Income Tax Law 2023 Pdf Law no 051 2023 of 05 09 2023 amending Law no 027 2022 of 20 10 2022 establishing taxes on income 141

The income tax is calculated for the calendar year which starts on 1st January and ends on 31st December unless otherwise provided by this law L imp t sur le revenu est calcul pour une ann e civile et d bute le 1er janvier et se termine au 31 d cembre sauf disposition contraire pr vue par la pr sente loi Commissioner General rules n 12 2012 of 23 02 2012 implementing the law N 24 2010 of 28 05 2010 modifying and complementing law No 16 2005 of 18 08 2005 on direct taxes on income 197 198 Directives du commissaire general No 12 2012 du 23 02 2012 portant mise en application de la loi N 24 2010 du 28 05 2010 modifiant et completant la loi n

Income Tax Law 2023 Pdf

Income Tax Law 2023 Pdf

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0b0525785350d621226e86e997fdd374/thumb_1200_1698.png

B Com 5th Semester Income Tax Law And Accounts Previous Year Question

https://studynotes.in/wp-content/uploads/2023/01/BCom-Qp.png

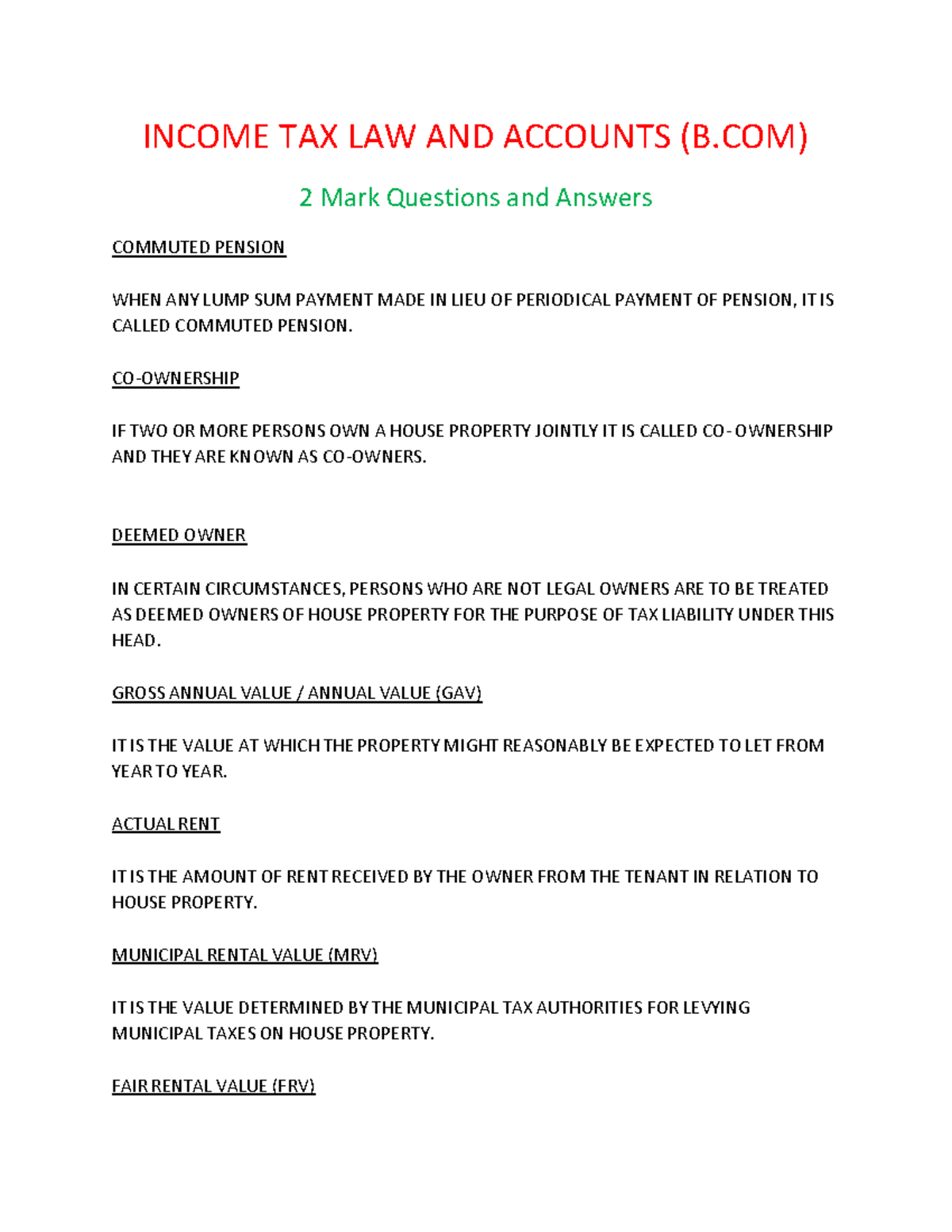

Income TAX LAW AND Accounts 4 INCOME TAX LAW AND ACCOUNTS B 2 Mark

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7506b9d788df7e2eae47ba3a9df4c840/thumb_1200_1553.png

The Government of Rwanda gazetted the Tax Procedures Law No 020 2023 TPL 2023 on 31 March 2023 governing tax procedures applicable to taxes on income value added tax VAT property tax on motor vehicles and boats tax on minerals and any other tax without a specific tax procedure Download Income Tax Law Notes PDF Books Syllabus for B COM BBA 2025 We provide complete income tax law pdf Income Tax Law study material includes income tax law notes income tax law book courses case study syllabus question paper MCQ questions and answers and available in income tax law pdf form

Focusing on Corporate Income Tax CIT Value Added Tax VAT and Excise Duty the tax reforms will reduce tax rates broaden the tax base improve tax compliance and curb tax evasion while ensuring that tax revenues increase by 1 of GDP by FY 2025 26 This study examines the fiscal and distributional effects of the personal income tax changes employing a newly created tax benefit microsimulation model for Rwanda Specifically we compare the reform to a business as usual scenario with the previous income tax regime

Download Income Tax Law 2023 Pdf

More picture related to Income Tax Law 2023 Pdf

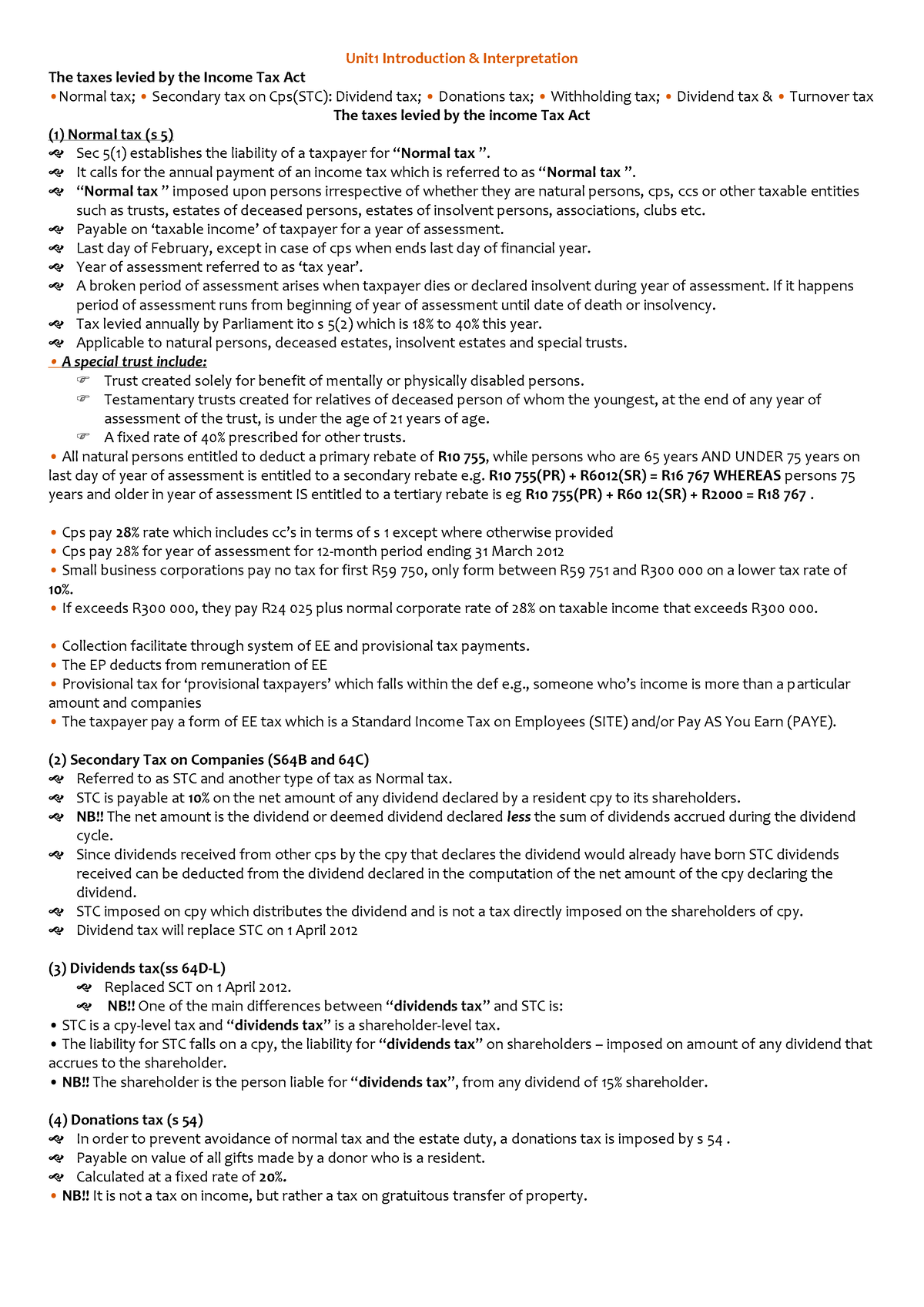

Tax Law 2012 Test 1 Notes Unit1 Introduction Interpretation The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/289bbb310751aecb839511cd0253f885/thumb_1200_1697.png

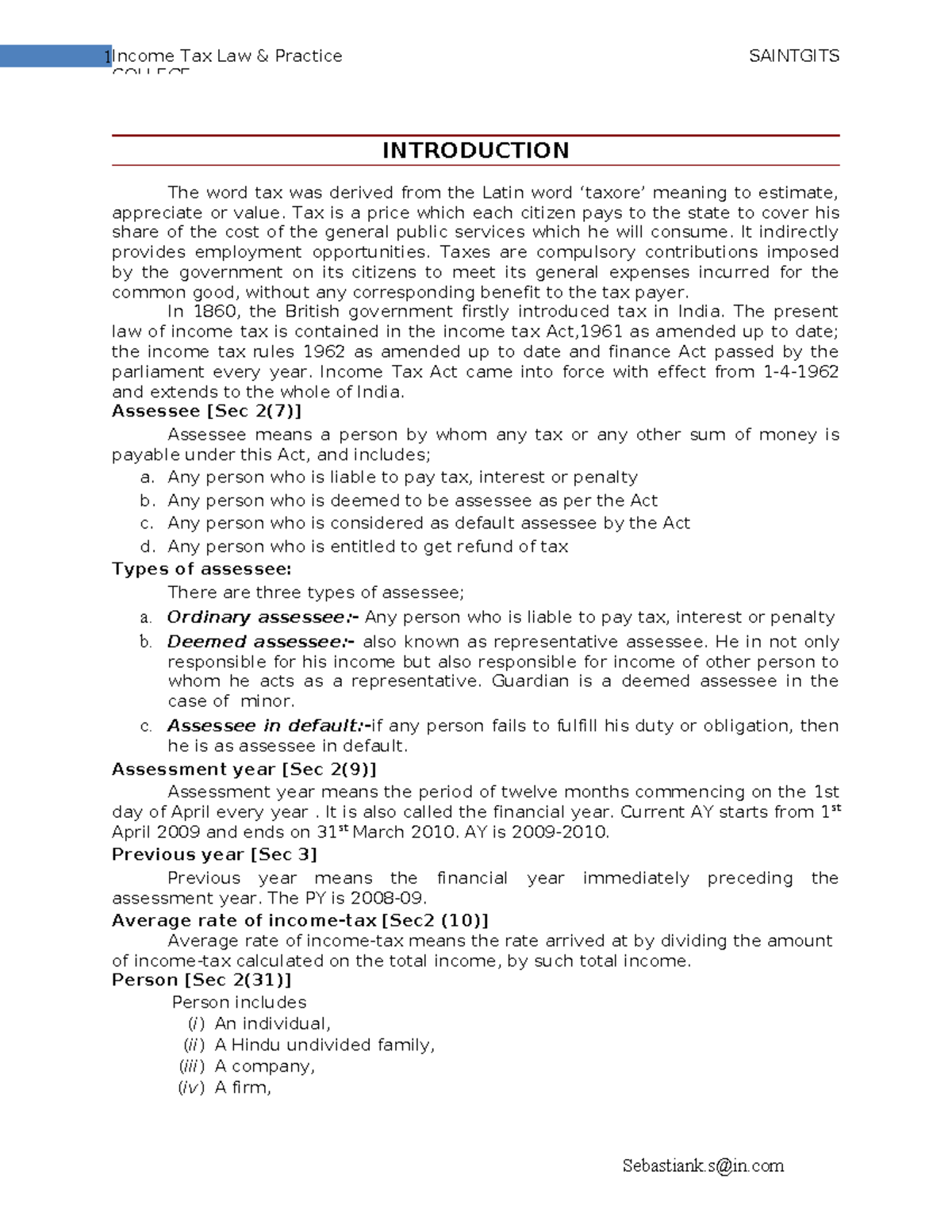

Income Tax Law English 3 COLLEGE INTRODUCTION The Word Tax Was

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/b9d06a931c3b9c53a74264faa24c5ba0/thumb_1200_1553.png

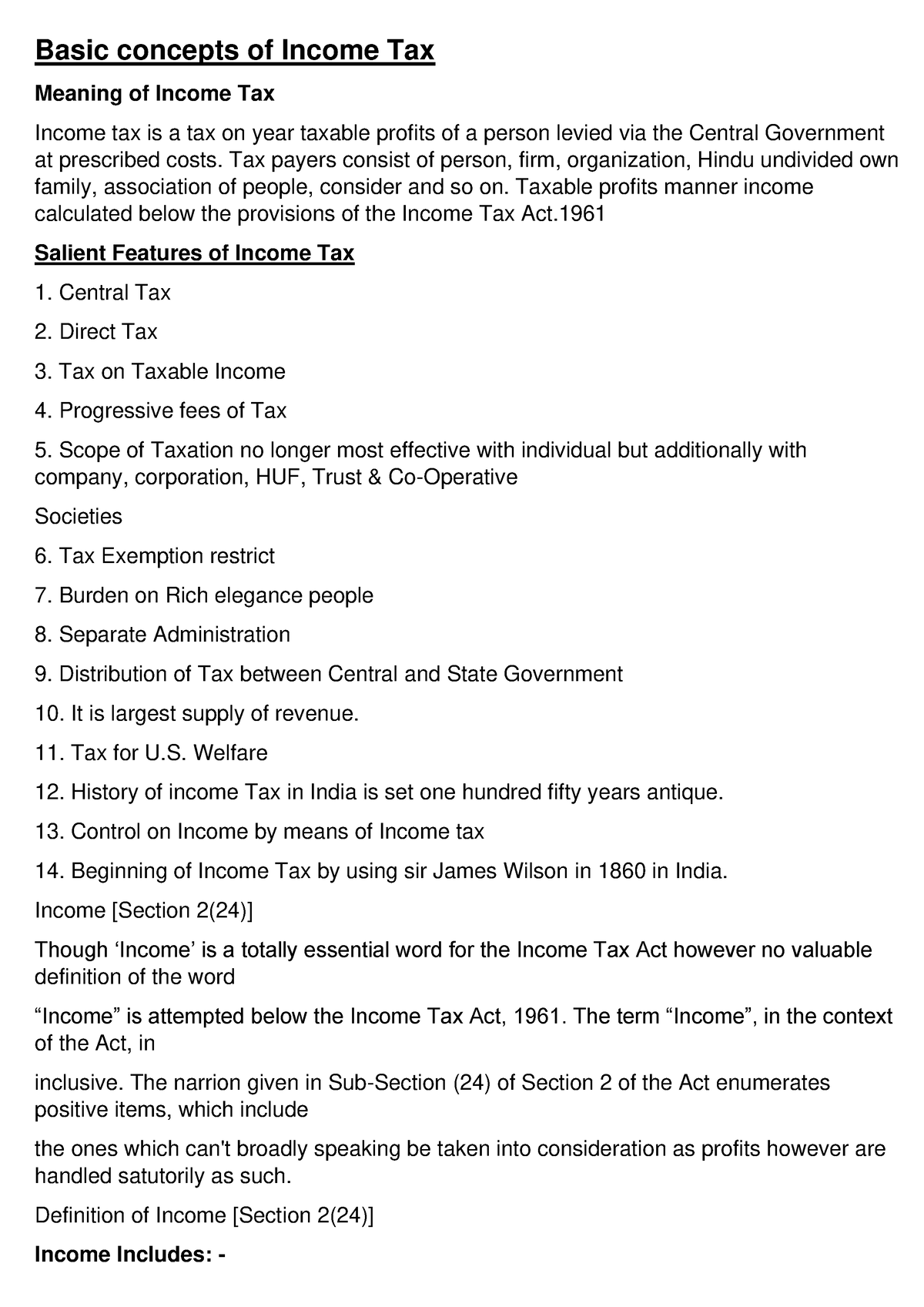

Basic Concepts Of Income Tax Basic Concepts Of Income Tax Meaning Of

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/89d98762071943e4120884e7ed614e4c/thumb_1200_1697.png

The new income tax law oficially known as the Law No 027 2022 of 20 10 2022 Establishing Taxes on Income was published in the oficial gazette on 28 October 2022 and came into force on the same day ULII aims to bridge the existing gap in public access to the law of Uganda Working with the AfricanLII and in collaboration with other partners such as the Free Access

[desc-10] [desc-11]

Income Tax Law And Accounting Under The TRAIN Law And The CREATE Law

https://ph-test-11.slatic.net/p/c84f2a0071cc231815facd2bb05de443.jpg

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

https://www.rra.gov.rw › fileadmin › user_upload › LAW...

Law no 051 2023 of 05 09 2023 amending Law no 027 2022 of 20 10 2022 establishing taxes on income 141

https://www.rra.gov.rw › fileadmin › user_upload

The income tax is calculated for the calendar year which starts on 1st January and ends on 31st December unless otherwise provided by this law L imp t sur le revenu est calcul pour une ann e civile et d bute le 1er janvier et se termine au 31 d cembre sauf disposition contraire pr vue par la pr sente loi

1 Income Tax Law And Accounts own CHAPTER 1 BASIC CONCEPTS OF

Income Tax Law And Accounting Under The TRAIN Law And The CREATE Law

VI Sem BCom Income Tax Law And Practise INCOME TAX LAW AND PRACTICE

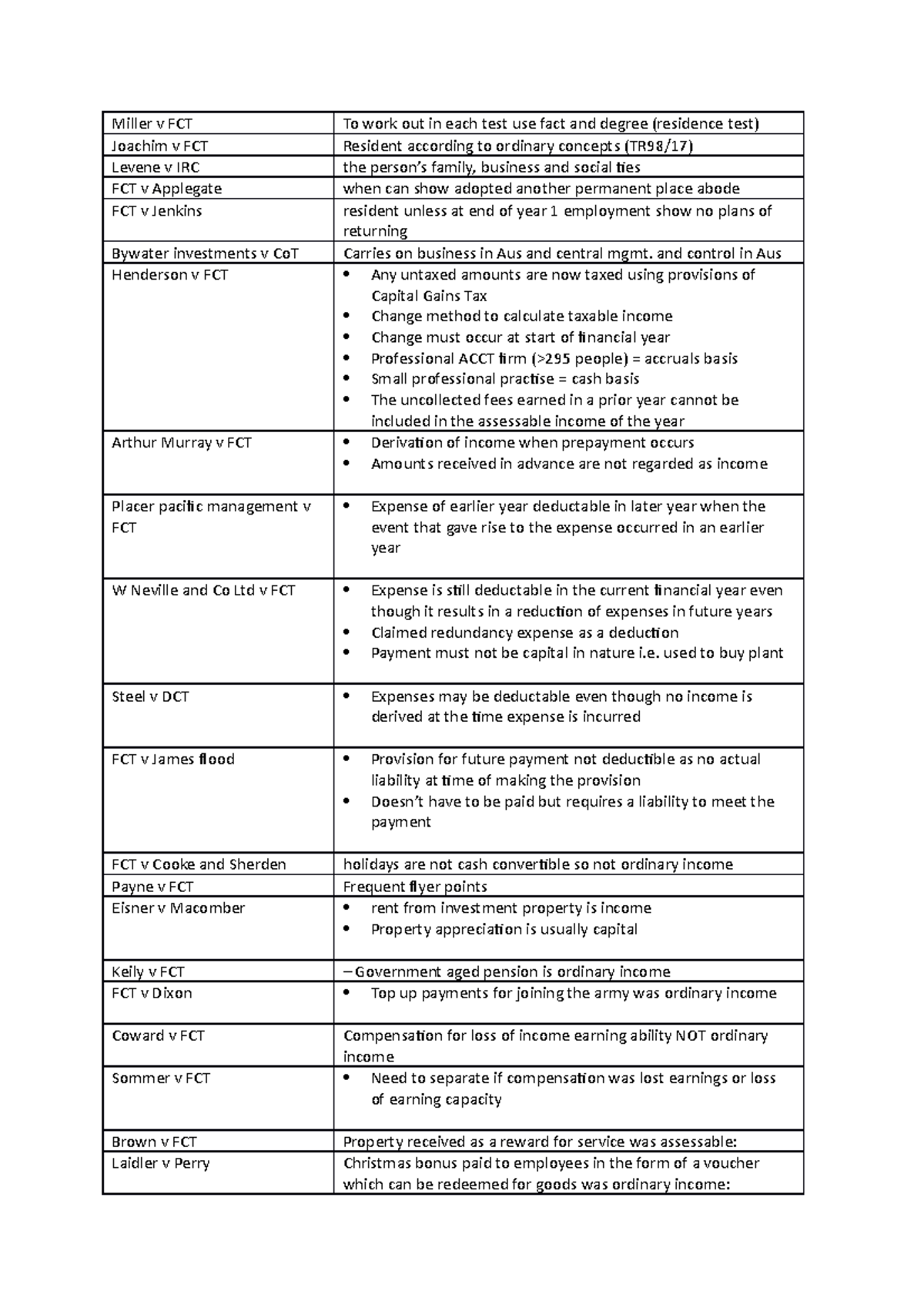

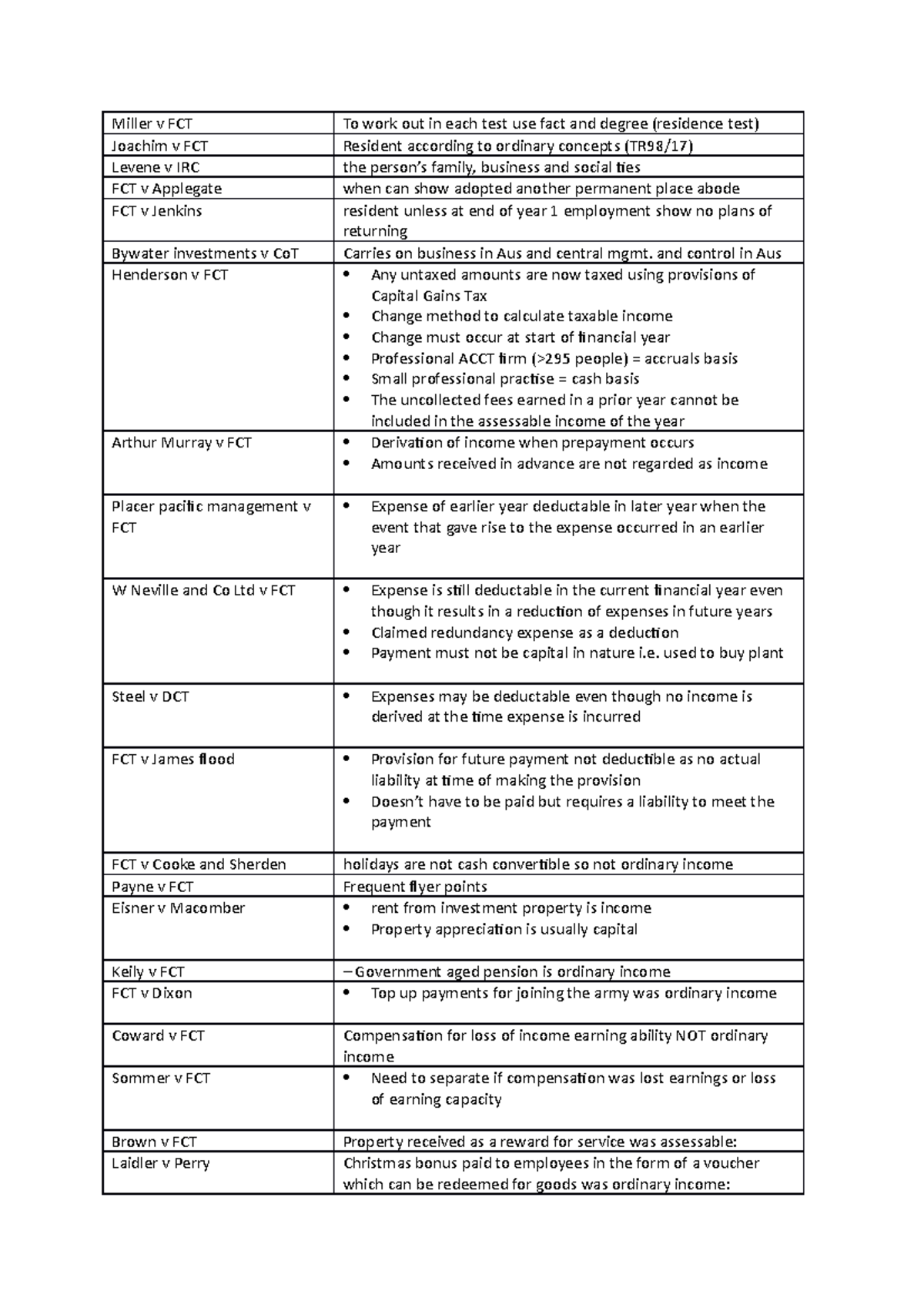

Tax Law Cases Part 1 Case Law Tax Law Cases Part CIR V Delfos 1933

Jason Full Income Tax Law Notes Table Of Contents Income Tax Law

Income TAX Accounting Article 22 INCOME TAX ACCOUNTING ARTICLE 22

Income TAX Accounting Article 22 INCOME TAX ACCOUNTING ARTICLE 22

Taxation Summary For Income Tax Law CHAPTER 5 SPECIFIC INCLUSIONS

Tax Law Assignment One DEPARTMENT OF MERCENTILE LAW INCOME TAX LAW

Income Tax Law Notes Income Tax Law Lecture 1 Tax Policy Criteria

Income Tax Law 2023 Pdf - [desc-12]