Income Tax Hra Rebate Form Web 22 sept 2022 nbsp 0183 32 5 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces

Web DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent Web Calculate You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can

Income Tax Hra Rebate Form

Income Tax Hra Rebate Form

http://1.bp.blogspot.com/-ewd4gmFZDiM/Vr60xpZ2a2I/AAAAAAAARCw/IgWwp8ctHws/s1600/IMG-20160213-WA0009-788169.jpg

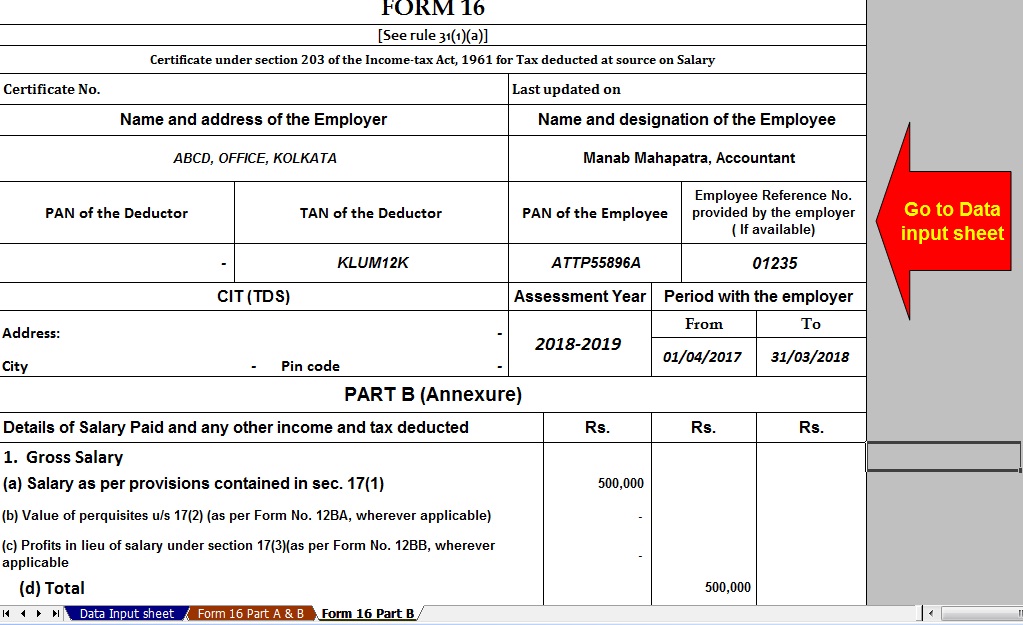

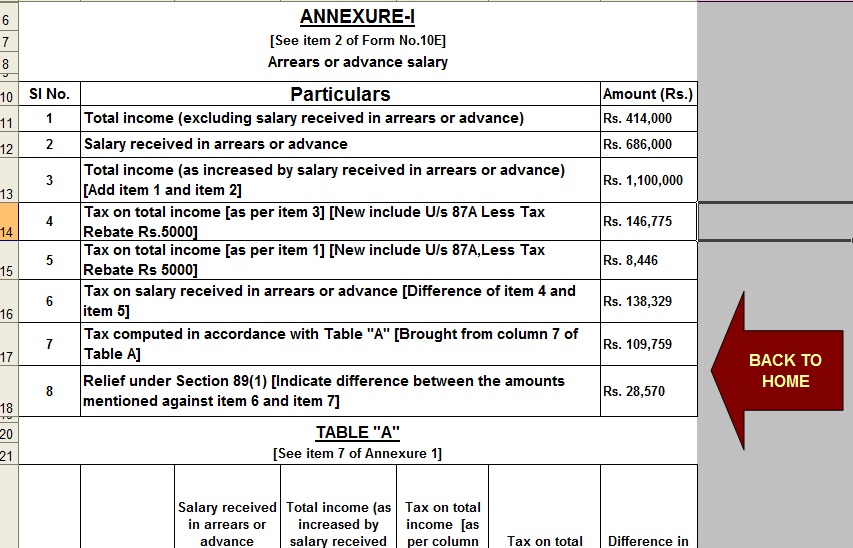

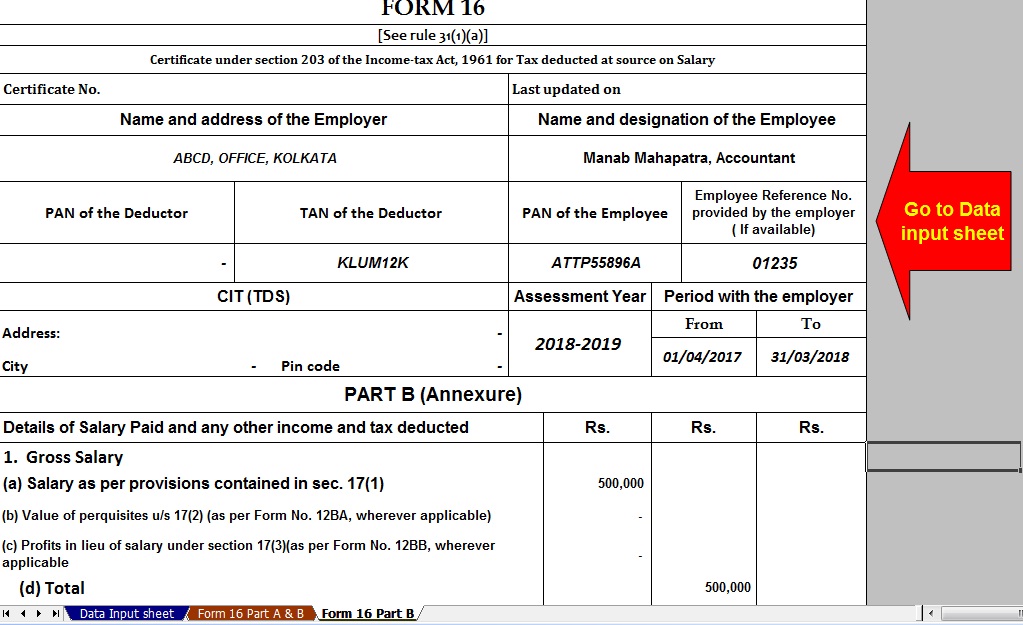

Download Automated Tax Computed Sheet HRA Calculation Arrears

https://4.bp.blogspot.com/-jcXR46JGbOw/WhOAD1L3J8I/AAAAAAAAF4A/ISuIxQnFWx4USLckHZYtmPvfE-NtuKIlwCLcBGAs/s1600/Form%2B16%2BPart%2BB.jpg

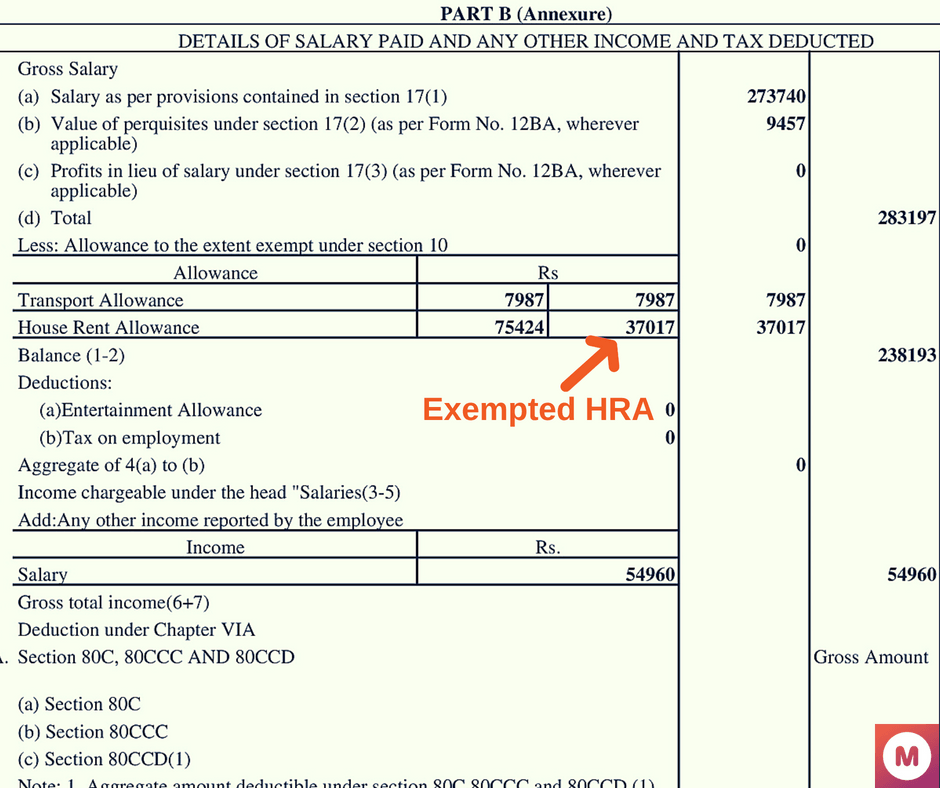

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

https://www.meteorio.com/wp-content/uploads/2018/05/Exempted-HRA-.png

Web 28 juil 2019 nbsp 0183 32 Form 16 is the official TDS certificate issued by an employer to its employees It contains the details of the TDS Tax deducted at Web 9 f 233 vr 2023 nbsp 0183 32 House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in

Web Conditions to be satisfied for claiming HRA deduction This deduction is allowed only when an employee actually pay rent for his residence purpose If no rent is paid for any period Web 5 sept 2023 nbsp 0183 32 The Guidance notes for form P87 PDF 267 KB 3 pages will help you to complete the form Tax agents submitting claims You must have an agent services

Download Income Tax Hra Rebate Form

More picture related to Income Tax Hra Rebate Form

Download Automated Tax Computed Sheet HRA Calculation Arrears

https://3.bp.blogspot.com/-m835-Ym3QK4/WhOAKOOxlxI/AAAAAAAAF4I/w08kTELbqAM-SkSwSZR0LPfc0PbdQ5I0ACLcBGAs/s1600/Arrears%2BRelief%2BPage%2B2.jpg

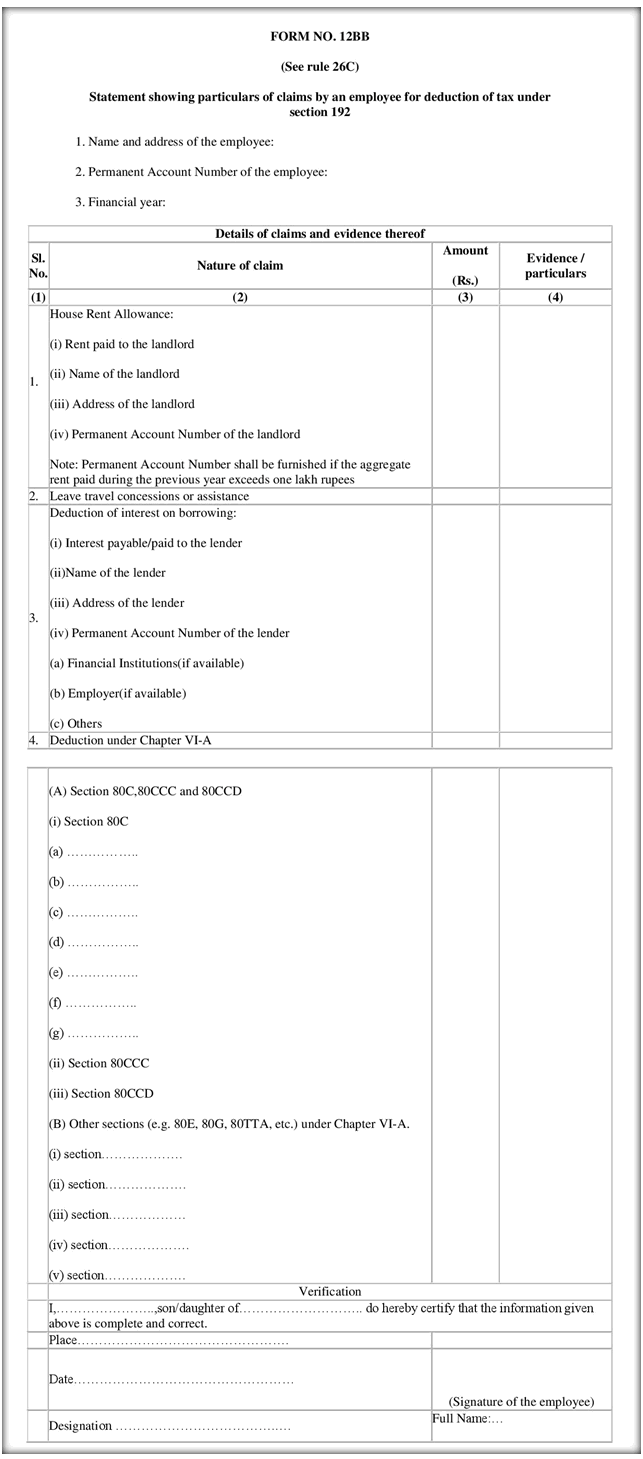

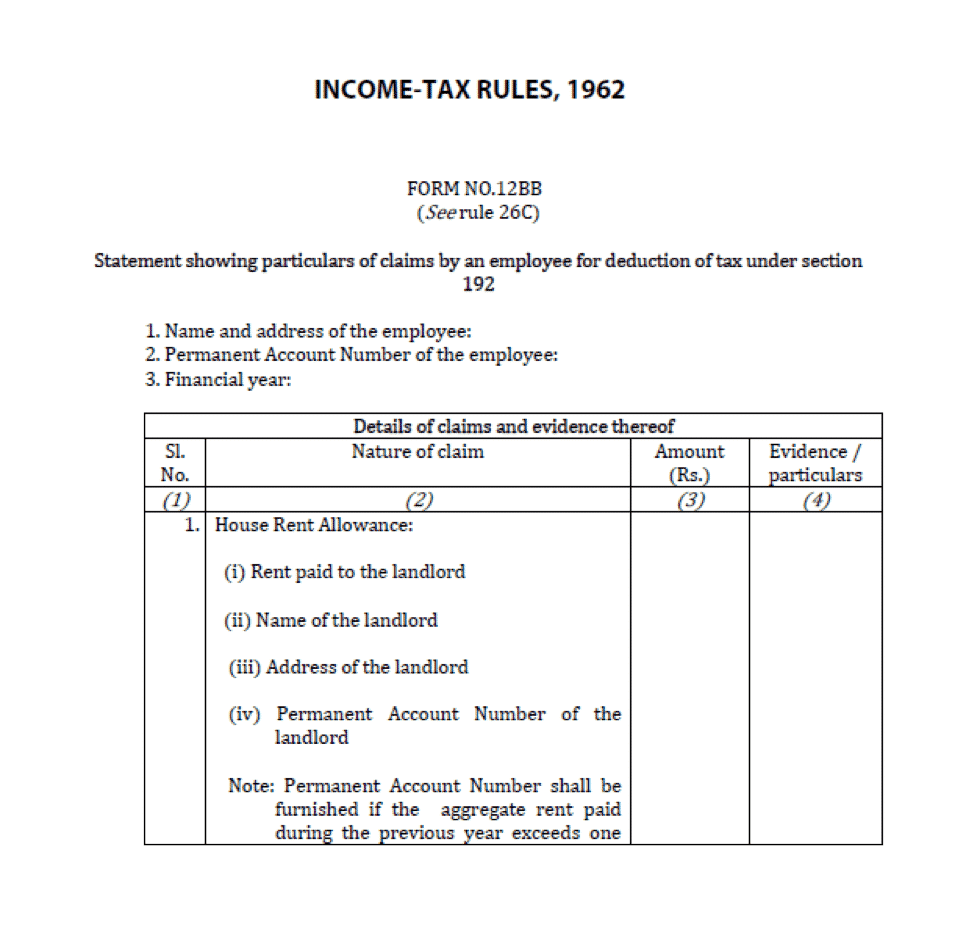

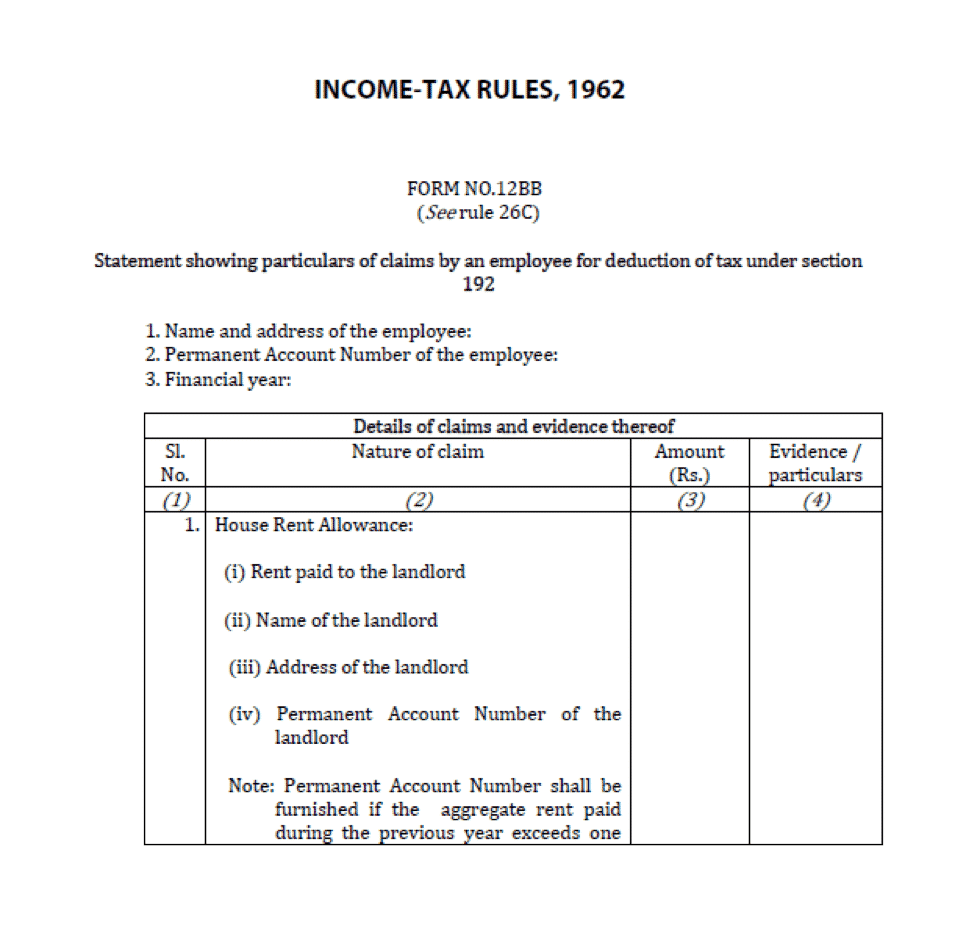

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

http://pmjandhanyojana.co.in/wp-content/uploads/2016/05/New-Form-12BB.png

HRA LTA Tax Deductions Can Be Claimed Using Form 12BB

https://www.jagoinvestor.com/wp-content/uploads/files/form-12BB.png

Web 7 sept 2023 nbsp 0183 32 Here are the rules that apply to HRA Exemption Calculation Your HRA cannot be more than 50 of your income 50 of your salary can be exempted from tax Web 10 f 233 vr 2023 nbsp 0183 32 HRA exemption limits The HRA exemption a salaried person is eligible to receive is the lowest of the following amounts according to Rule 2A of Income Tax

Web 30 juil 2022 nbsp 0183 32 Updated July 30 2022 14 01 IST Homeowners who are paying their home loan and receiving HRA as part of their salary can avail both the house property related Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the

How To Show HRA Not Accounted By The Employer In ITR

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

Exclusive Tax Receipt Template For Piano Lessons Great

https://2.bp.blogspot.com/-M1d2rNa_Ifw/XGAdyhaT33I/AAAAAAAAL4k/pYAkm3P2esUVhvx8I5XCQ5DRGfAdKmAHQCLcBGAs/s1600/IMG_20190210_181751.jpg

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 5 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces

https://incometaxindia.gov.in/Pages/tools/house-rent-allowance...

Web DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent

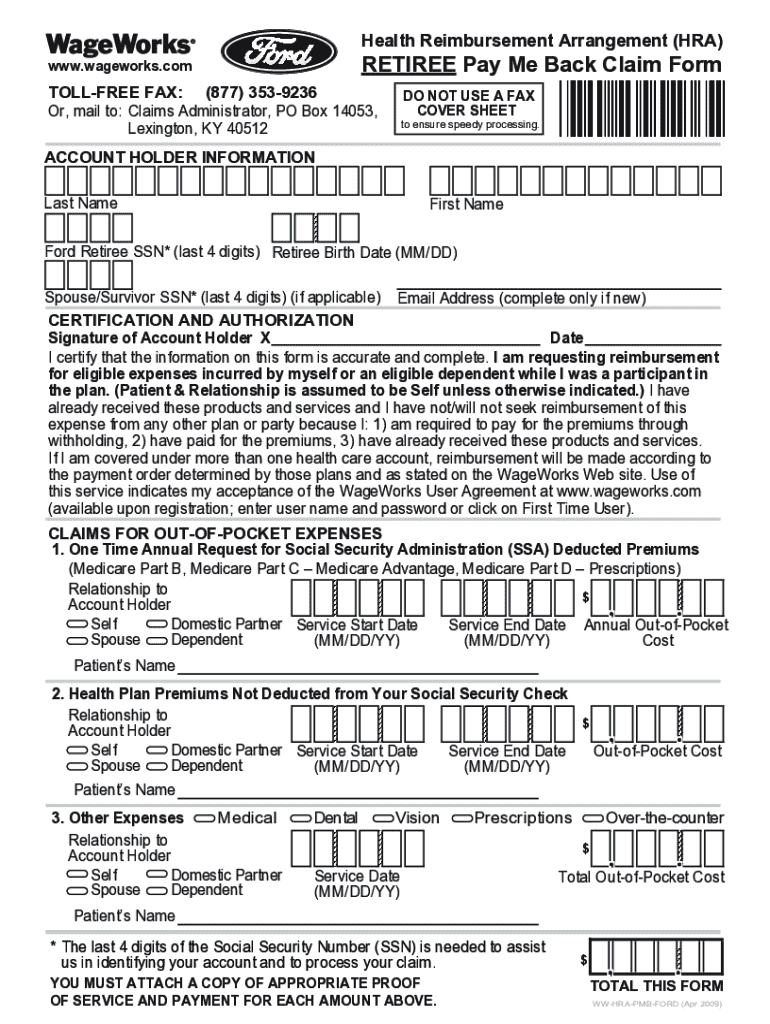

WW HRA PMB FORD 2009 2022 Fill And Sign Printable Template Online

How To Show HRA Not Accounted By The Employer In ITR

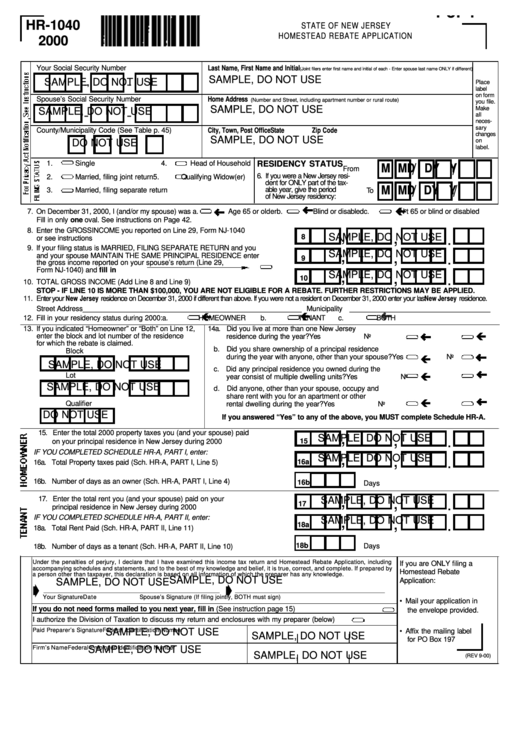

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Supplier Rebate Agreement Template

A Very Simple Guide To Form 12BB Download Format PDF

A Very Simple Guide To Form 12BB Download Format PDF

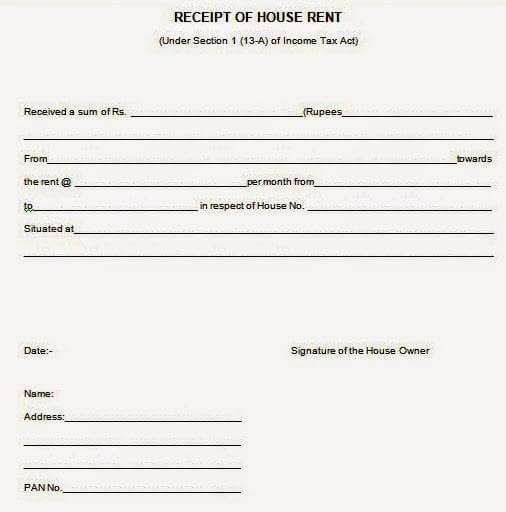

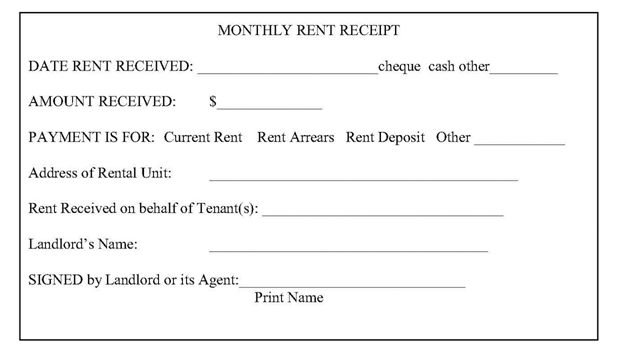

Guide On Rent Receipts How To Claim HRA Deduction Tax2win

How To Claim HRA With Rent Receipts E filing Of Income Tax Return

Rent Receipt Generate Online Claim HRA Benefits

Income Tax Hra Rebate Form - Web Therefore you will get Rs 1 32 lakh exemption from income tax You can claim HRA exemptions by submitting your monthly rent receipts However keep in mind that it is