Can Hra Be Claimed In Itr You can now easily claim HRA by attesting a copy of Form 16 with your ITR 1 However if you prefer to do it the other way you can also submit the rent related documents such as rent agreement or receipts in order

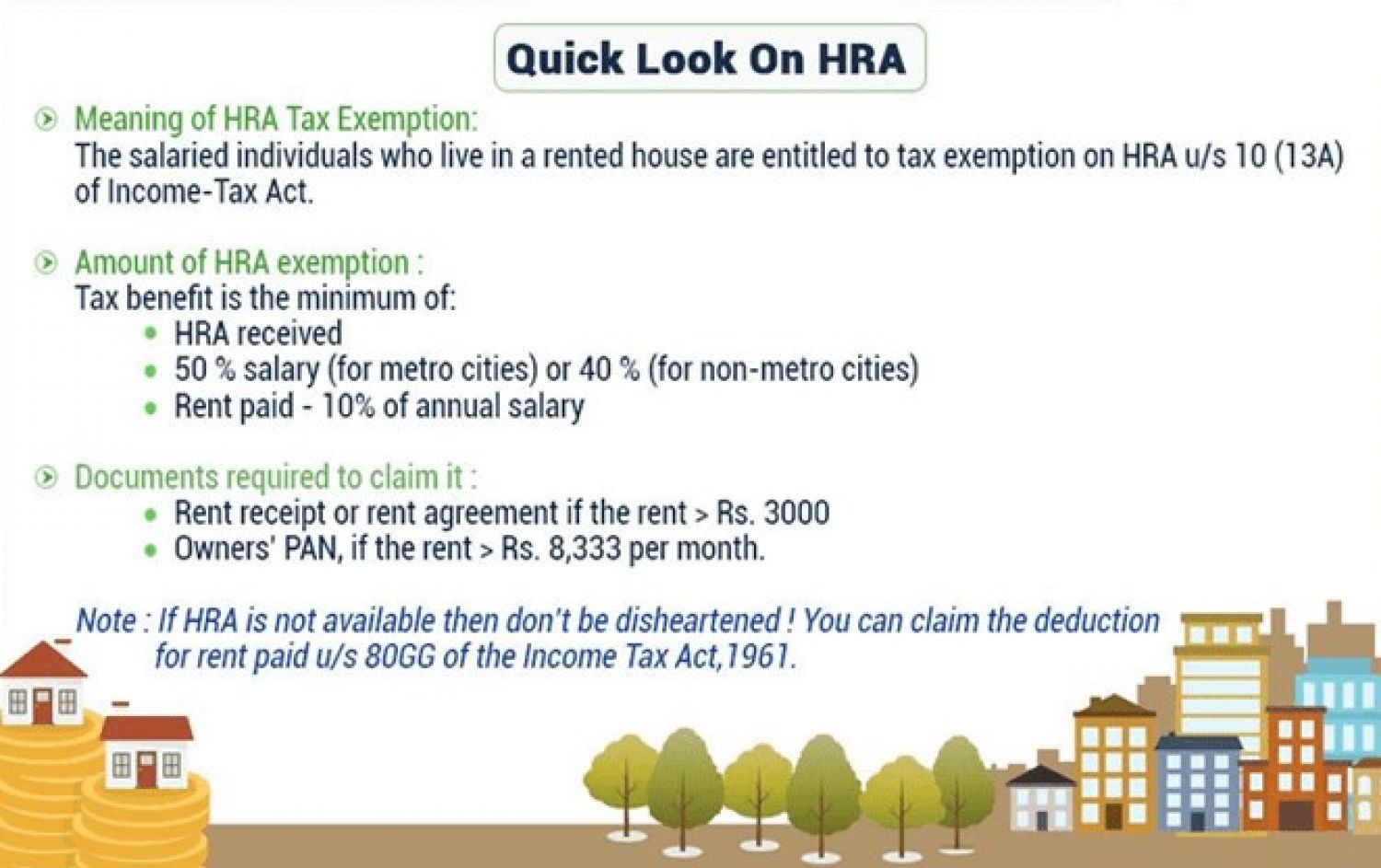

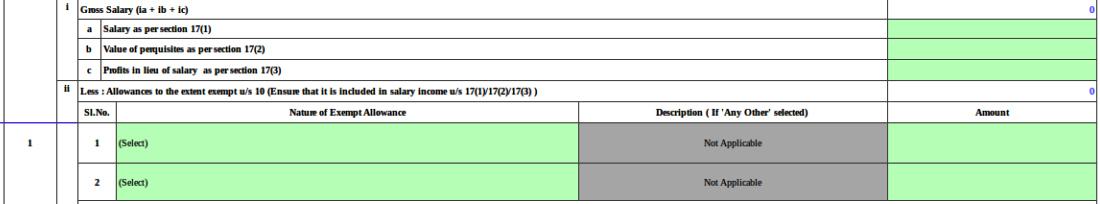

The tax exemption on HRA can be claimed while filing ITR even though you have forgotten to submit rent proofs to the employer An individual can save tax on the HRA amount received from employer if they have lived in rented accommodation during the previous financial year i e FY 2022 23 Salaried individuals living in a rented house can claim HRA exemption under Section 10 13A of the Income Tax Act One can claim the lowest amount among HRA received rent paid minus 10 of salary or a fixed percentage based on your city

Can Hra Be Claimed In Itr

Can Hra Be Claimed In Itr

https://static.tnn.in/thumb/msid-92839548,imgsize-100,width-1280,height-720,resizemode-75/92839548.jpg

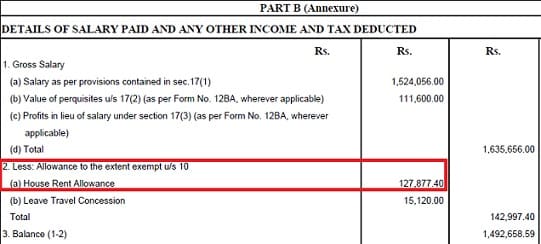

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

How To Show HRA Not Accounted By The Employer In ITR

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

House Rent Allowance HRA is one of the most commonly received allowances by the salaried class If you are paying rent for accommodation to a landlord who can also be your parents then you are eligible to claim tax exemption on the rent paid According to Section 10 13A of the Income Tax Act 1961 salaried individuals in India can claim an exemption on their House Rent Allowance HRA This exemption is calculated

If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim a deduction under section 80GG towards the rent that you pay Can I claim both the HRA and the Home loan interest deduction Yes a taxpayer can claim both HRA and home loan interest simultaneously subject to the genuineness of the conditions Also a deduction for principal repayment can be claimed under Section 80C

Download Can Hra Be Claimed In Itr

More picture related to Can Hra Be Claimed In Itr

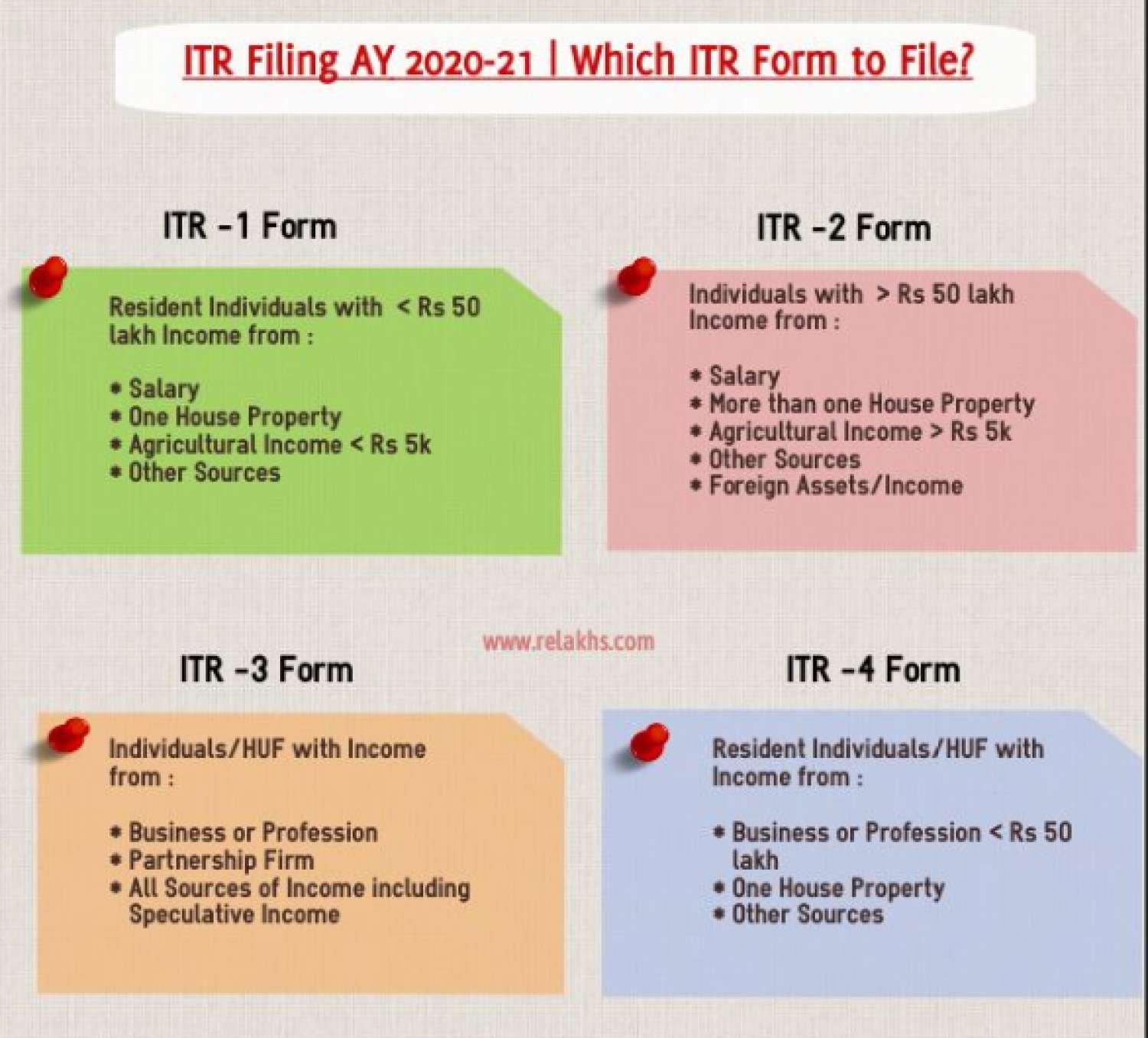

ITR Forms ITR 5 ITR 6 ITR 1 File ITR Online For Free ITR E filing

https://carajput.com/art_imgs/small/latest-update-on-income-tax-return-forms-for-fy-2020-21-new-itr-form.jpg

Claiming HRA Deduction Don t Make These Common Mistakes To Ensure Your

https://akm-img-a-in.tosshub.com/businesstoday/images/story/202301/house-rent-1-sixteen_nine.jpg?size=948:533

ITR Filing How To Claim HRA Exemption India Today

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202206/money-2724248_960_720_1200x768.jpeg?VersionId=E2ML18PpAvl.mllwDvGRIAznU8E_PQuk

Ans From AY 2024 25 new tax regime has become the default tax regime where claiming of HRA u s 10 13A is not allowed as per the provision of section 115BAC of the Income Tax Act In case Taxpayer wants to claim HRA taxpayer must choose Old Tax Regime by selecting Yes in ITR 1 HRA benefit can be claimed for the rented house and deduction of home loan interest and principal payments towards the self occupied property

Thus you can claim the actual amount of HRA in the ITR as income computed in Form 16 is on an estimated basis When HRA deduction is claimed while filing ITR the excess taxes that This article aims to provide a comprehensive explanation of various scenarios and the permissible amounts that can be claimed for both HRA exemption and home loan interest deduction under the provisions of the Act

Break It If You Can Online Hra Zdarma Superhry cz

https://www.superhry.cz/sys_img/di/9905/510/break-it-if-you-can.jpg

Avoid Mistakes While Claiming HRA On The ITR Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/06/Things-to-avoid-when-claiming-HRA-on-your-ITR-1.jpg

https://blog.saginfotech.com/claim-hra-filing-income-tax-return

You can now easily claim HRA by attesting a copy of Form 16 with your ITR 1 However if you prefer to do it the other way you can also submit the rent related documents such as rent agreement or receipts in order

https://economictimes.indiatimes.com/wealth/tax/...

The tax exemption on HRA can be claimed while filing ITR even though you have forgotten to submit rent proofs to the employer An individual can save tax on the HRA amount received from employer if they have lived in rented accommodation during the previous financial year i e FY 2022 23

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

Break It If You Can Online Hra Zdarma Superhry cz

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

HRA Calculation Formula On Salary Change How HRA Exemption Is

Can HRA Exemption Be Claimed While Paying Rent To Relatives YouTube

Can HRA Exemption Be Claimed While Paying Rent To Relatives YouTube

ITR Of AY 2022 23 Identified Under RISK MANAGEMENT PROCESS Claimed Ded

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Can Pg Rent Be Claimed As HRA

Can Hra Be Claimed In Itr - HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION