Can We Claim Hra Deduction In Itr Here s How an ITR Filer can Claim HRA in their Return Unlike before the tax department has now decided to sync ITR 1 with the Form 16 making it easier for people to claim eligible employee benefits in their IT returns

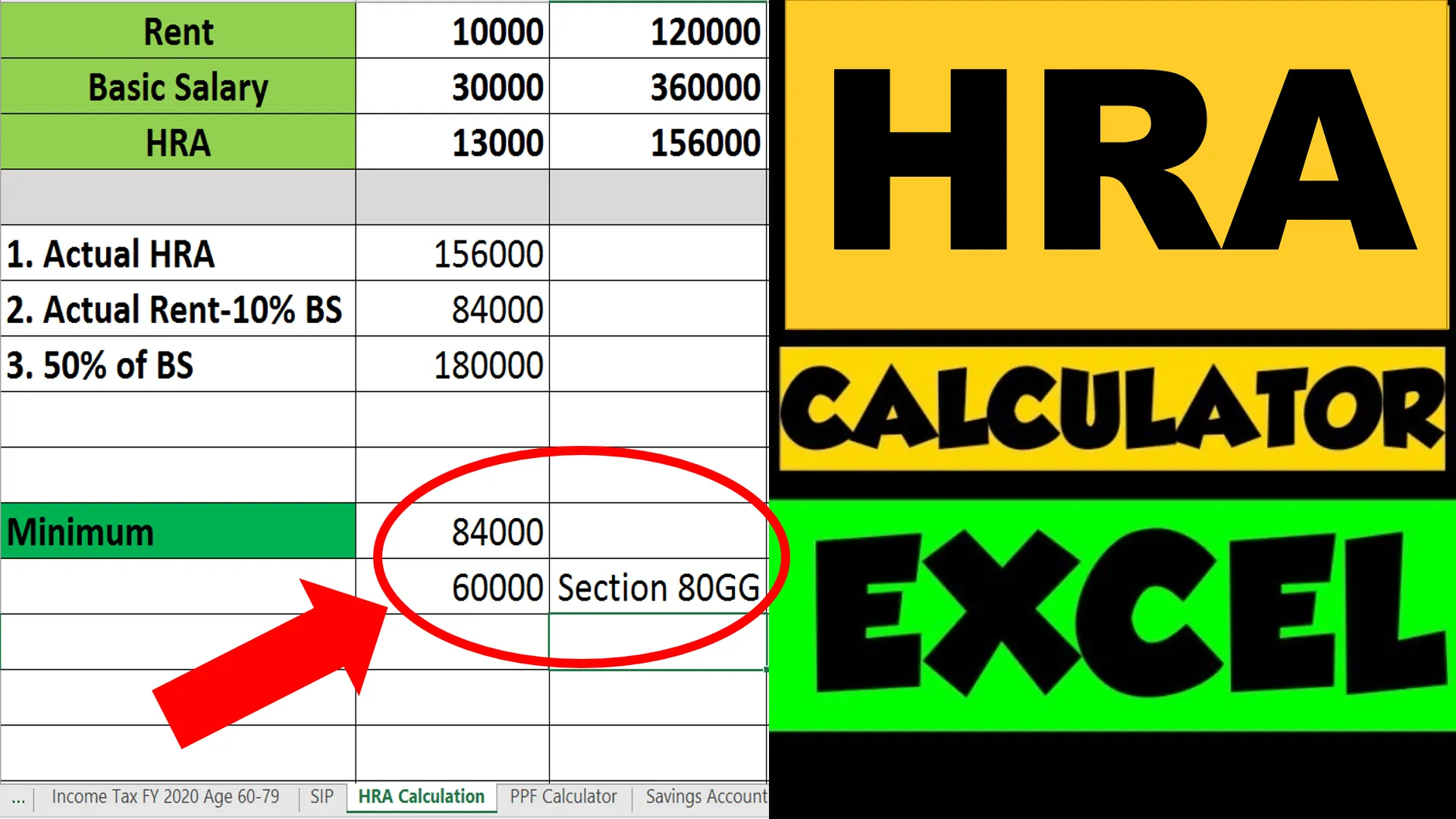

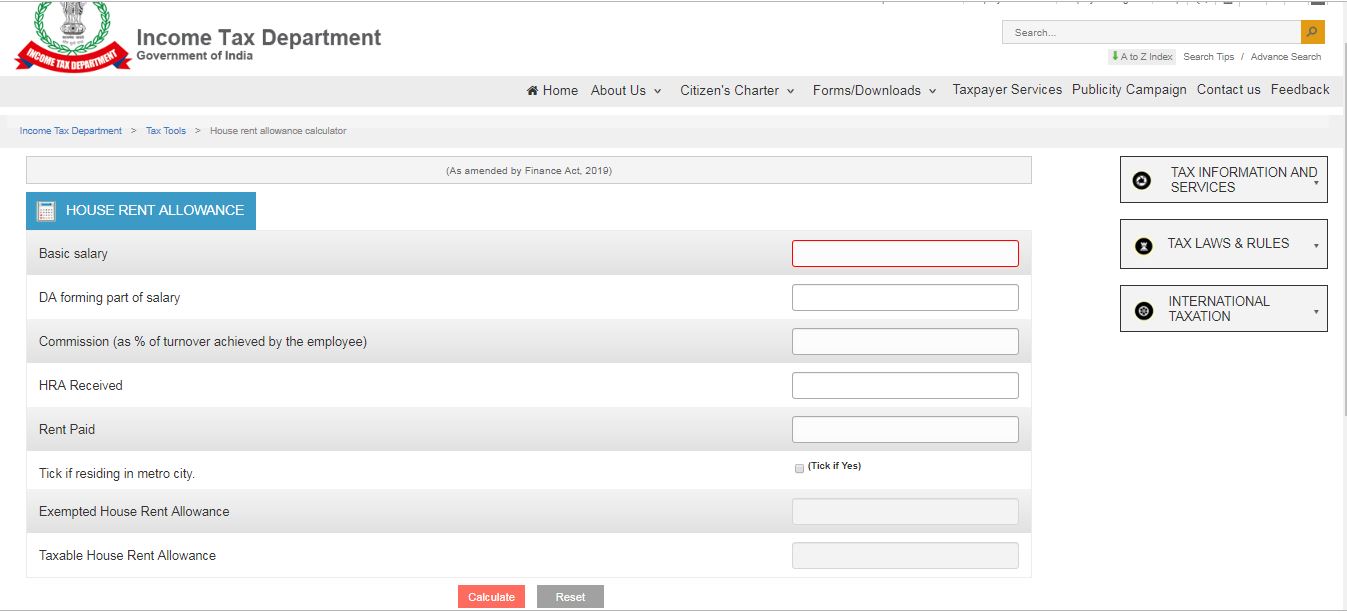

The tax exemption on HRA can be claimed while filing ITR even though you have forgotten to submit rent proofs to the employer An individual can save tax on the HRA amount received from employer if they have lived in rented accommodation during the previous financial year i e FY 2022 23 One can claim the lowest amount among HRA received rent paid minus 10 of salary or a fixed percentage based on your city This article gives complete information regarding the HRA exemption eligibility criteria documents required how to

Can We Claim Hra Deduction In Itr

Can We Claim Hra Deduction In Itr

https://carajput.com/art_imgs/can-hra-and-home-loan-benefits-be-claimed-when-itr-is-filing.jpg

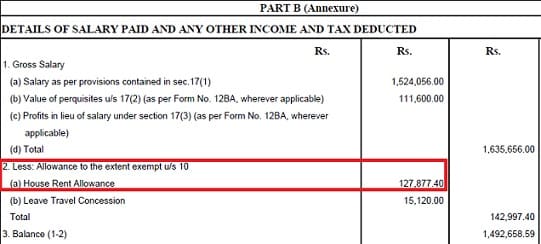

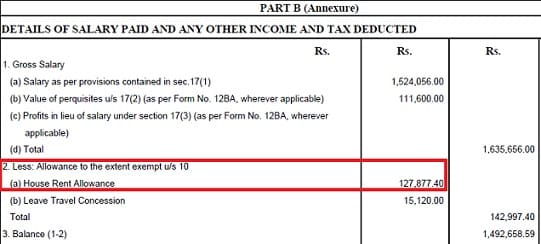

How To Show HRA Not Accounted By The Employer In ITR

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

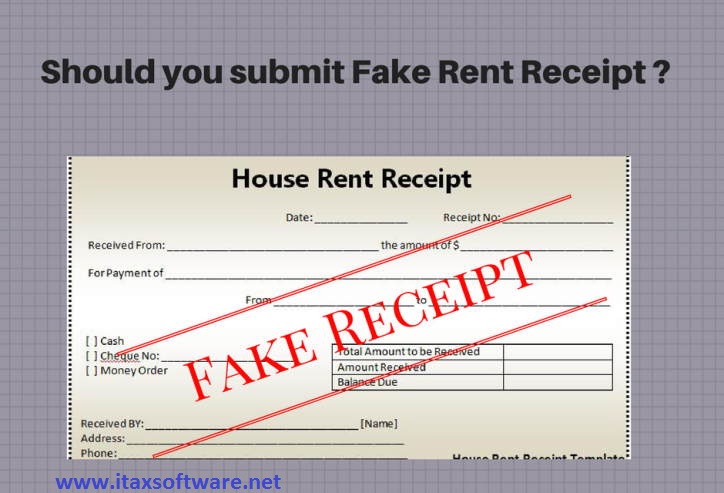

Be Aware Before Submit Fake Rent Receipts At Your Office To Claim HRA

https://4.bp.blogspot.com/-8OthH2RBWqQ/WfQj6x_bZfI/AAAAAAAAFsk/eAYaok4XSiU0MbR5qoPDsyV-hFlHryTfACLcBGAs/s1600/HRA%2BRENT%2BRECEIPT.jpg

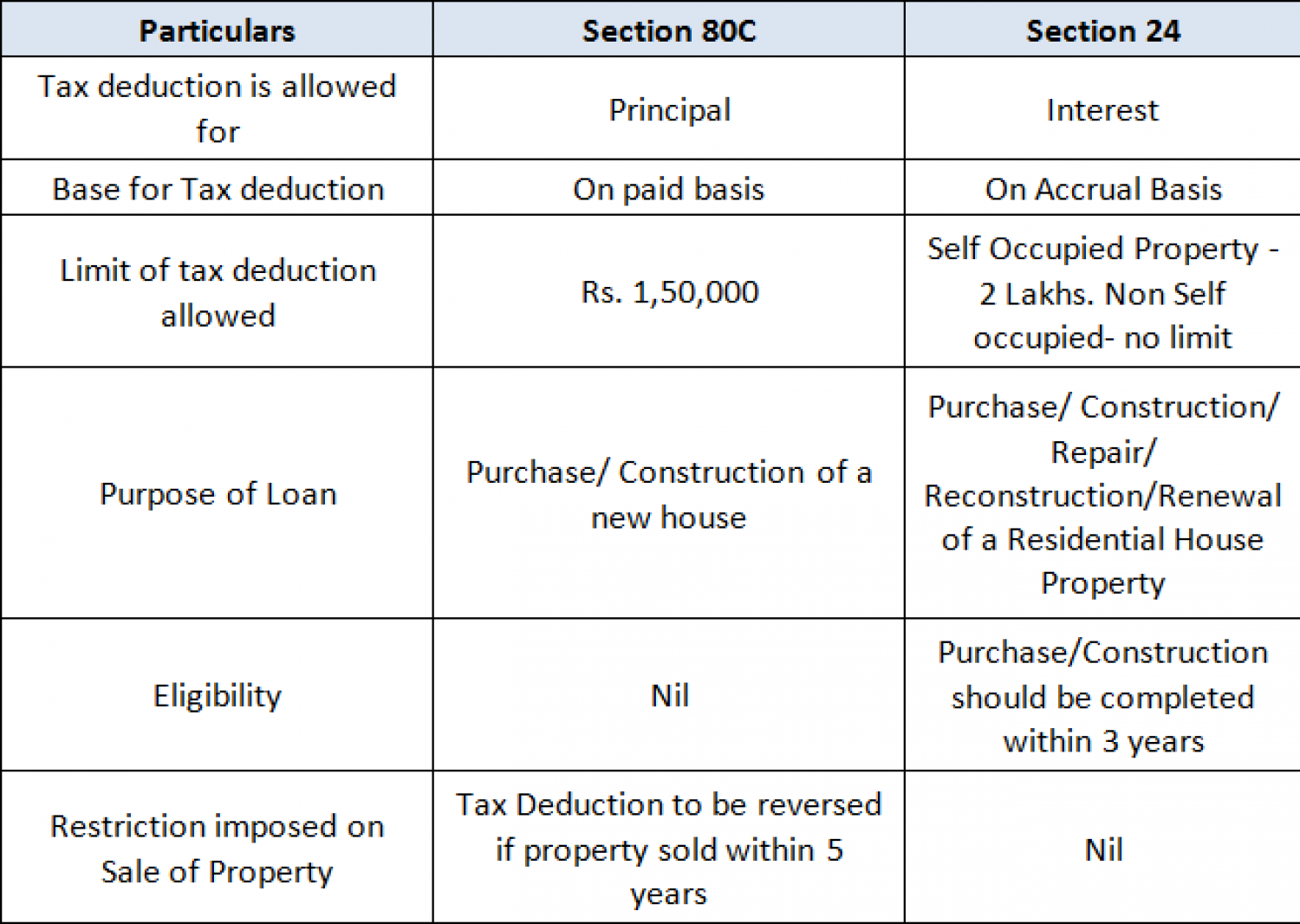

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section Yes you can still claim the HRA exemption while filing your Income Tax Return ITR even if your Form 16 doesn t show it You ll need to have the rent receipts and proof of PAN payment to your landlord

When HRA deduction is claimed while filing ITR the excess taxes that the employer would have deducted will either be refunded or it will automatically be adjusted against other income HRA exemption and tax deduction To claim an exemption for HRA you must meet these requirements Live in rented accommodation This means you can t claim HRA if you re living on self owned

Download Can We Claim Hra Deduction In Itr

More picture related to Can We Claim Hra Deduction In Itr

HRA House Rent Allowances Claim HRA Benefits Without Landlord s PAN

https://i.ytimg.com/vi/LLp_IybyHfM/maxresdefault.jpg

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

https://blog.saginfotech.com/wp-content/uploads/2019/07/hra-itr-filing.jpg

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

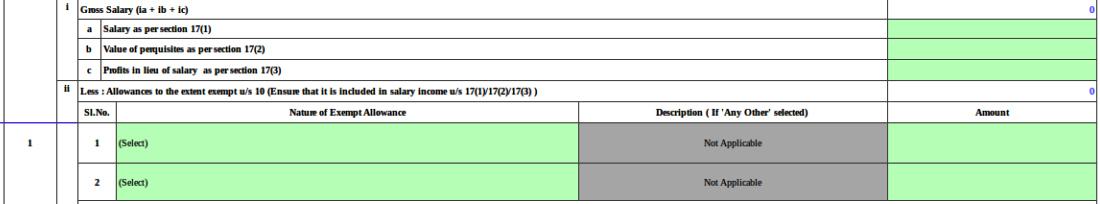

Yes if you do not receive HRA as a part of a salary component the Rent paid can be claimed as deduction under section 80GG However the maximum amount of deduction allowed is Rs 60 000 per annum What is 80GG in income tax HRA exemption can be claimed by mentioning the amount in the declaration form provided to you by your employer at the start of a financial year In case the employee is unable to claim the same through the employer you can claim

How to Claim HRA in ITR for Maximum Benefits Discover the eligibility criteria necessary documents and key considerations to ensure a smooth and successful HRA claim in your ITR Maximize your tax benefits with this valuable resource on claiming HRA in your income tax return Regime and VIA deductions cannot be claimed except deduction u s 80CCD 2 80CCH 80JJAA as per the provision of Section 115BAC of the Income Tax Act 1961 In case taxpayer wants to claim any deductions as applicable then taxpayer need to choose for old tax regime by selecting Yes option in ITR 1 ITR 2 or Yes within due date optio

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

https://blog.saginfotech.com/claim-hra-filing-income-tax-return

Here s How an ITR Filer can Claim HRA in their Return Unlike before the tax department has now decided to sync ITR 1 with the Form 16 making it easier for people to claim eligible employee benefits in their IT returns

https://economictimes.indiatimes.com/wealth/tax/...

The tax exemption on HRA can be claimed while filing ITR even though you have forgotten to submit rent proofs to the employer An individual can save tax on the HRA amount received from employer if they have lived in rented accommodation during the previous financial year i e FY 2022 23

Material Requirement Form Hra Exemption Calculator 201920

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

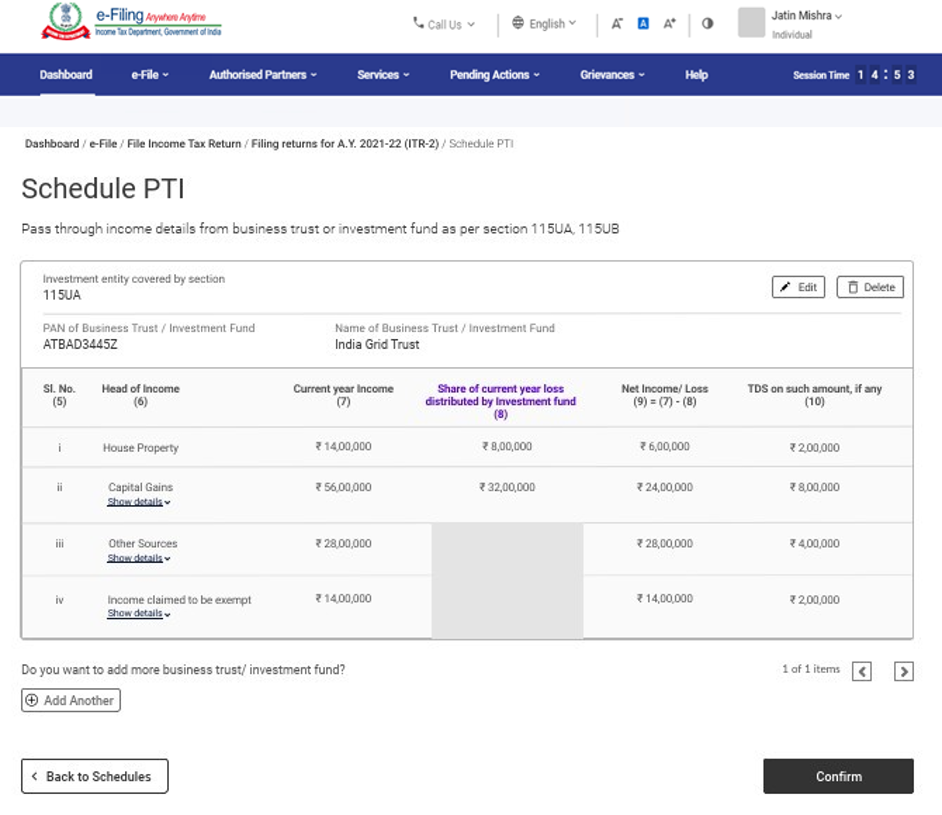

2 Income Tax Department

House Rent Allowance How To Claim Exemption HRA Tax Benefit Illustration

House Rent Allowance How To Claim Exemption HRA Tax Benefit Illustration

Claim Tax Deduction On HRA For Two House Vakilsearch Blog

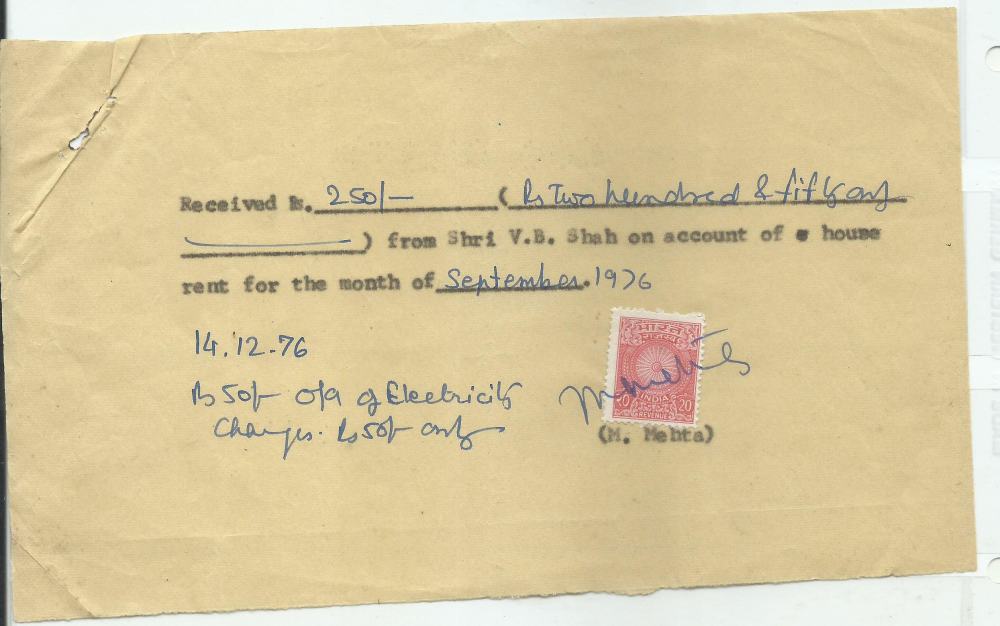

Rent Receipts With Revenue Stamps Its Role In Claiming HRA Tax Benefits

House Rent Allowance

Can We Claim Hra Deduction In Itr - HRA exemption and tax deduction To claim an exemption for HRA you must meet these requirements Live in rented accommodation This means you can t claim HRA if you re living on self owned