Income Tax On Savings Bank Interest Uk Guidance and forms for tax on savings and investments Including savings interest savings for children tax on shares and dividends and ISAs

The personal savings allowance allows you to earn up to 1 000 of interest tax free on top of the starting rate for savers The allowance varies depending on your income tax bracket Basic rate taxpayers 1 000 Higher rate taxpayers 500 Additional rate taxpayers 0 Savings income is defined at section 18 of the Income Tax Act 2007 ITA and includes interest from savings accounts held with banks building societies NS I and credit unions as well as

Income Tax On Savings Bank Interest Uk

Income Tax On Savings Bank Interest Uk

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/f82d51f886204e5746759dc357690e4f/thumb_1200_1698.png

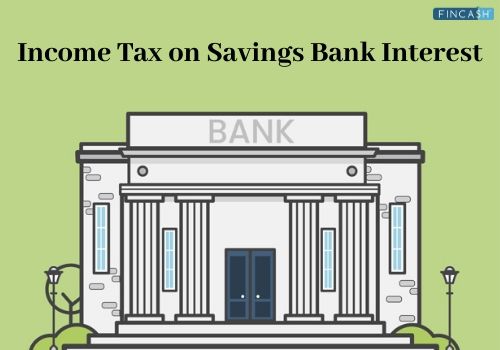

3 2 Tax On Corporations INCOME TAX ON CORPORATIONS An Overview Of

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/164a2eaa7543d649f098623199ada815/thumb_1200_1886.png

How To Get Highest Savings Account Interest Rate Investdunia Free

https://investdunia.com/wp-content/uploads/2017/11/Savings-account-interest-rate-Dec-2020.png

How to pay the tax you owe on savings interest If you ve used up your personal savings allowance you may need to pay tax on the savings interest you ve earned You pay tax at your usual income tax rate based on your income tax band Your personal savings allowance PSA is a tax free allowance that lets you earn interest on your savings without paying tax on that interest The allowance you get depends on what rate of income tax you pay Basic rate 20 taxpayers can earn 1 000 in savings interest per year with no tax

Assuming you earn over 17 500 a year your tax free savings allowance is given below any savings earnt above this allowance outside of ISAs is taxed as income tax If you earn less than 18 570 a year from earned income and savings combined then all your interest from those savings could be tax free This is primarily due to what s called the starting rate for savings which you get on top of your Personal Savings Allowance

Download Income Tax On Savings Bank Interest Uk

More picture related to Income Tax On Savings Bank Interest Uk

TAX Income Tax On Estates And Trust INCOME TAX ON ESTATES AND TRUSTS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7364fb57dd83ad933e94a7b0f24defee/thumb_1200_1553.png

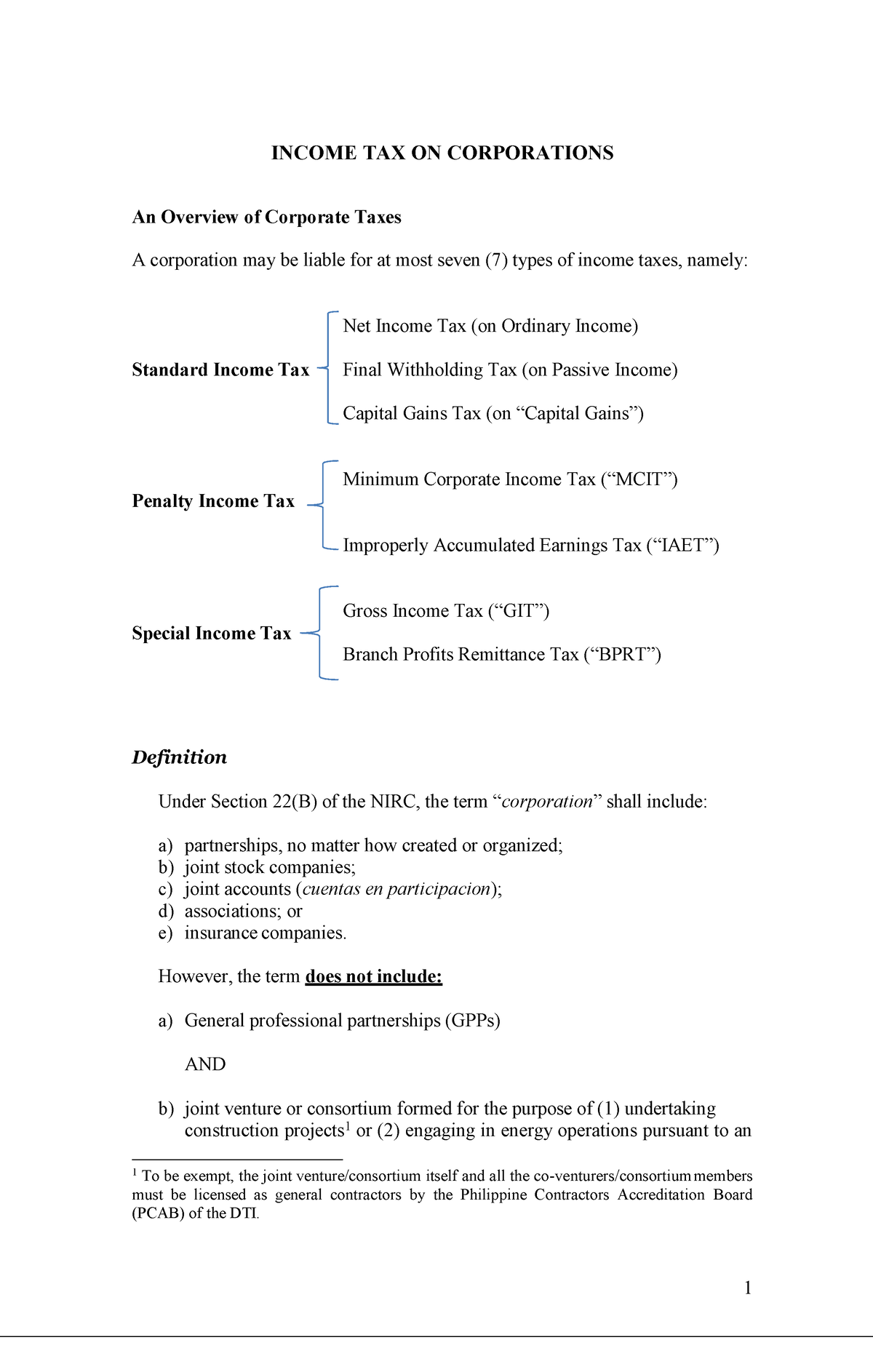

03 Income Tax On Individuals MODULE 3 INCOME TAX ON INDIVIDUALS 1

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/484c6abf969bbcfee1c51978a83afca3/thumb_1200_1553.png

TIN NSDL You Cannot Use Accounts With These Banks To Pay Income Tax On

https://teambuildit.com/3ad5d7a4/https/7e34f5/img.etimg.com/thumb/width-1200,height-900,imgsize-51564,resizemode-1,msid-95505715/wealth/tax/you-cannot-use-accounts-with-these-banks-to-pay-income-tax-on-tin-nsdl-website-anymore.jpg

If tax is payable on savings interest it s charged at your usual rate of income tax 0 20 40 or 45 What types of savings interest are taxed Interest from the following places would usually be taxable bank building society and credit union accounts open ended investment companies OEICs investment trusts and unit trusts Tax on savings interest calculator UK Use our personal savings allowance calculator to find out whether you have to pay tax on your savings Savings interest rates can quickly change and while high interest rates are great for building your rainy day fund you might pay tax on interest

Many savers with relatively modest sums in bank and building society accounts are likely to be caught up paying tax on savings as higher interest rates increase income Find out how tax on savings interest works You must pay tax on savings interest earned over your allowance at your normal rate of Income Tax So someone that earns 25 000 a year that generated 1 500 in savings interest would be allowed to keep 1 000 tax free but would have to pay 20 tax on the 500 above their Personal Savings Allowance threshold

Income TAX ON Individuals INCOME TAX ON INDIVIDUALS Income Tax Is A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fd52bed5866978576d8660aa1b4b3310/thumb_1200_1553.png

Income Tax On Savings Bank Interest Saving Account FD RD Fincash

https://d28wu8o6itv89t.cloudfront.net/images/IncomeTaxOnSavingsBankInterest-1580984799675.jpeg

https://www.gov.uk/government/collections/tax-on...

Guidance and forms for tax on savings and investments Including savings interest savings for children tax on shares and dividends and ISAs

https://www.which.co.uk/money/tax/income-tax/income...

The personal savings allowance allows you to earn up to 1 000 of interest tax free on top of the starting rate for savers The allowance varies depending on your income tax bracket Basic rate taxpayers 1 000 Higher rate taxpayers 500 Additional rate taxpayers 0

TAXATION Income Tax On Corporations Batas Pambansa Bilang 68

Income TAX ON Individuals INCOME TAX ON INDIVIDUALS Income Tax Is A

10 Banks Which Pay High Interest Rates On Savings Accounts YouTube

Singaporean Talks Money Savings Plan Yes Or No

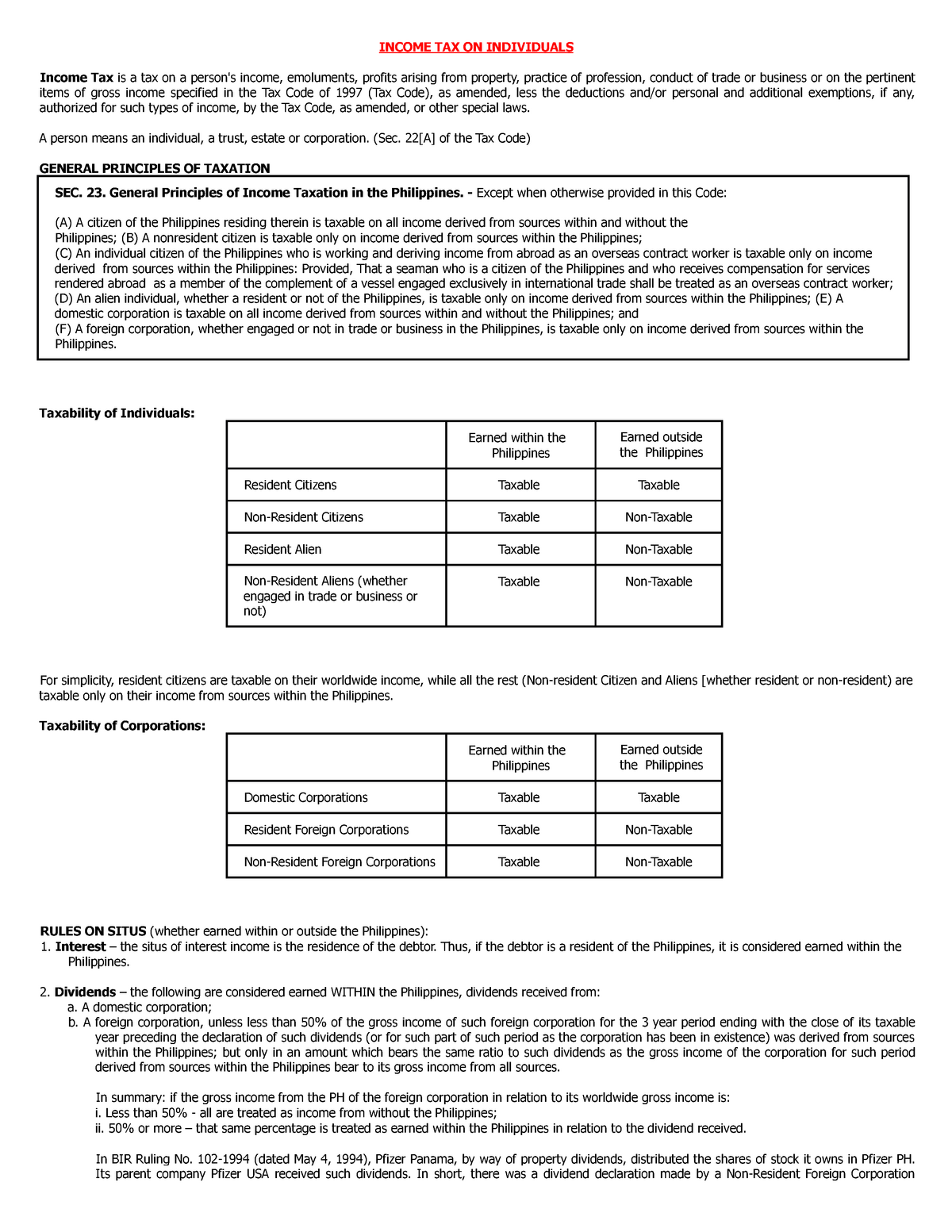

SOLVED In A Certain Country The Tax On Incomes Less Than Or Equal To

Bank Liable To Pay Income Tax On Interest On Sticky Loans NPAs On

Bank Liable To Pay Income Tax On Interest On Sticky Loans NPAs On

TAX Income Tax On Individuals INCOME TAX ON INDIVIDUALS Income Tax

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

Pay Less Tax On Savings Income GBM Accounts

Income Tax On Savings Bank Interest Uk - Our 2 step calculator will help you understand if you may have to pay tax on any savings interest you earn All you need are the details for your savings accounts including interest rate and balance and your total annual non savings taxable income e g salary bonus payments pensions