Income Tax Rate Equation Key Takeaways The effective tax rate represents the percentage of taxable income paid in taxes it typically refers only to federal income tax The effective tax rate can be

The effective tax rate can be defined as the average rate of tax payable by an organization or person It is the actual amount of federal income tax payable on a person s income The effective tax rate can be calculated for historical periods by dividing the taxes paid by the pre tax income or earnings before tax EBT The formula used to calculate the

Income Tax Rate Equation

Income Tax Rate Equation

https://www.paulhypepage.co.id/wp-content/uploads/2017/12/Corporate-Tax-Rates-in-Indonesia.svg

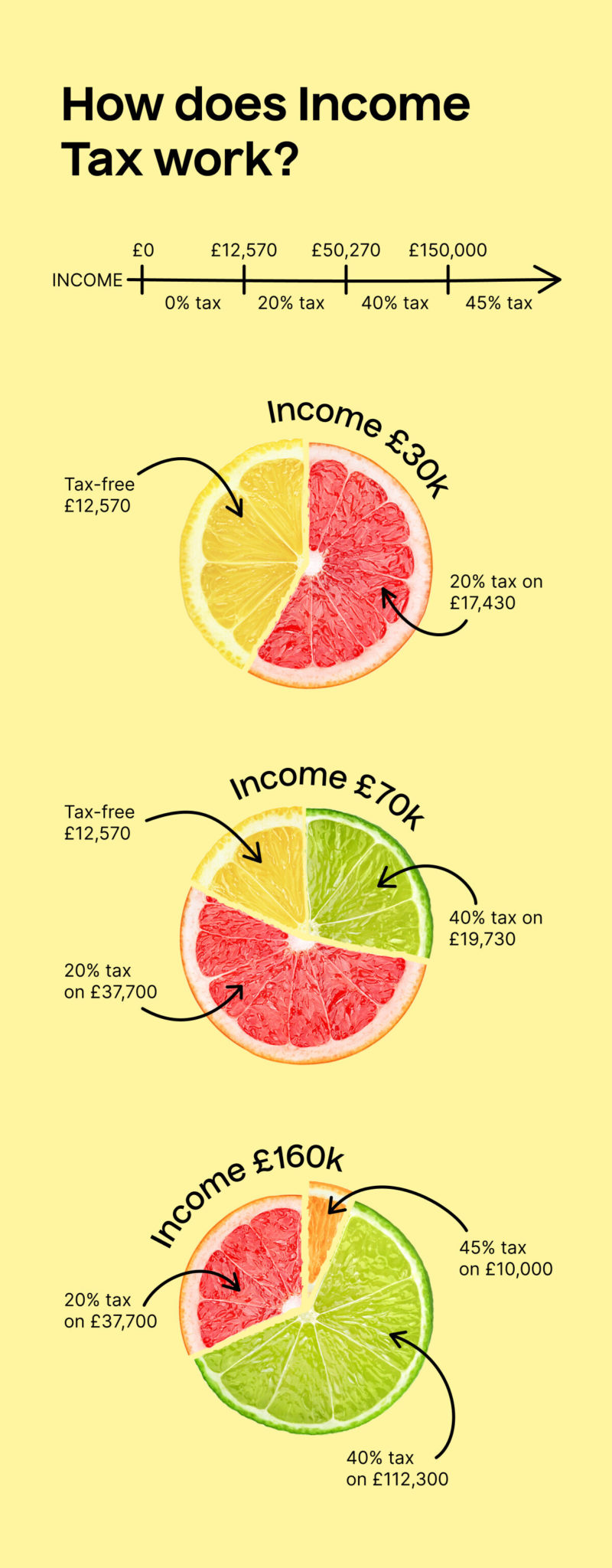

Income Tax Rates In The UK TaxScouts

https://taxscouts.com/wp-content/uploads/Infographic-1-800x2048.jpg

Income Tax Malaysia 2022 Who Pays And How Much

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_comparehero/income-tax-how-much-featured-image.png#keepProtocol

To calculate your effective tax rate find your total tax on your income tax return and divide it by your taxable income Your effective tax rate is What is Effective Tax Rate Effective Tax Rate refers to the average taxation rate for an individual or a corporation wherein for an individual it is calculated by dividing total tax expense by the total taxable income

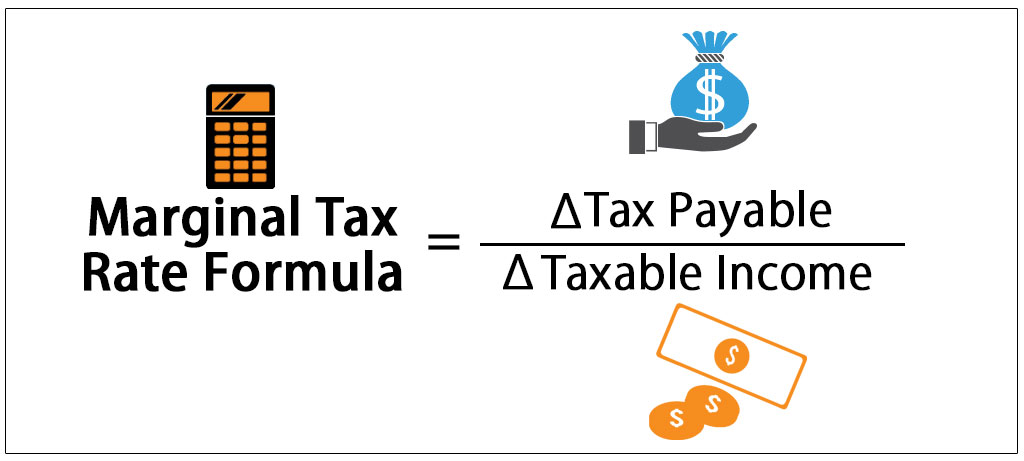

Key Takeaways The marginal tax rate is the tax rate paid on the highest dollar of income Under the progressive income tax method used for federal income tax in the U S the marginal tax rate To calculate your marginal tax rate apply the percentage of tax charged to the amount of income in each bracket according to your filing status and add up the totals

Download Income Tax Rate Equation

More picture related to Income Tax Rate Equation

PDF The Personal Income Tax Equation Rate Structure And Tax Base

https://i1.rgstatic.net/publication/228153303_The_Personal_Income_Tax_Equation_Rate_Structure_and_Tax_Base/links/562ffe7c08aefac54d8f0449/largepreview.png

Income Tax Rates Free Creative Commons Images From Picserver

https://www.picserver.org/assets/library/2020-10-29/originals/income_tax_rates.jpg

Income Tax Rates Free Of Charge Creative Commons Typewriter Image

https://www.thebluediamondgallery.com/typewriter/images/income-tax-rates.jpg

The marginal tax rate determines the percentage of taxes owed for each additional dollar that falls within progressing tiers of tax rates An effective tax rate is the percentage of The effective tax rate represents the average tax rate that an individual or a corporation pays on their taxable income It is calculated by dividing the total tax paid by the taxable

Marginal tax rate is the rate at which an additional dollar of taxable income would be taxed It is part of a progressive tax system which applies different tax rates to different levels of income As income rises it is Your effective tax rate is the average rate you pay on all your taxable income It s a helpful way to understand the taxes you pay in relation to your marginal tax rate

Exploring Financial Havens The World s Lowest Tax Rate Countries

https://flashlearners.com/wp-content/uploads/2023/09/tax-rate-1536x1536.jpg

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

https://www.gconnect.in/gc22/wp-content/uploads/2022/06/Tax1.jpg

https://www.investopedia.com › ... › effectiv…

Key Takeaways The effective tax rate represents the percentage of taxable income paid in taxes it typically refers only to federal income tax The effective tax rate can be

https://corporatefinanceinstitute.com › resources › ...

The effective tax rate can be defined as the average rate of tax payable by an organization or person It is the actual amount of federal income tax payable on a person s income

Income Tax Rates Free Of Charge Creative Commons Suspension File Image

Exploring Financial Havens The World s Lowest Tax Rate Countries

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

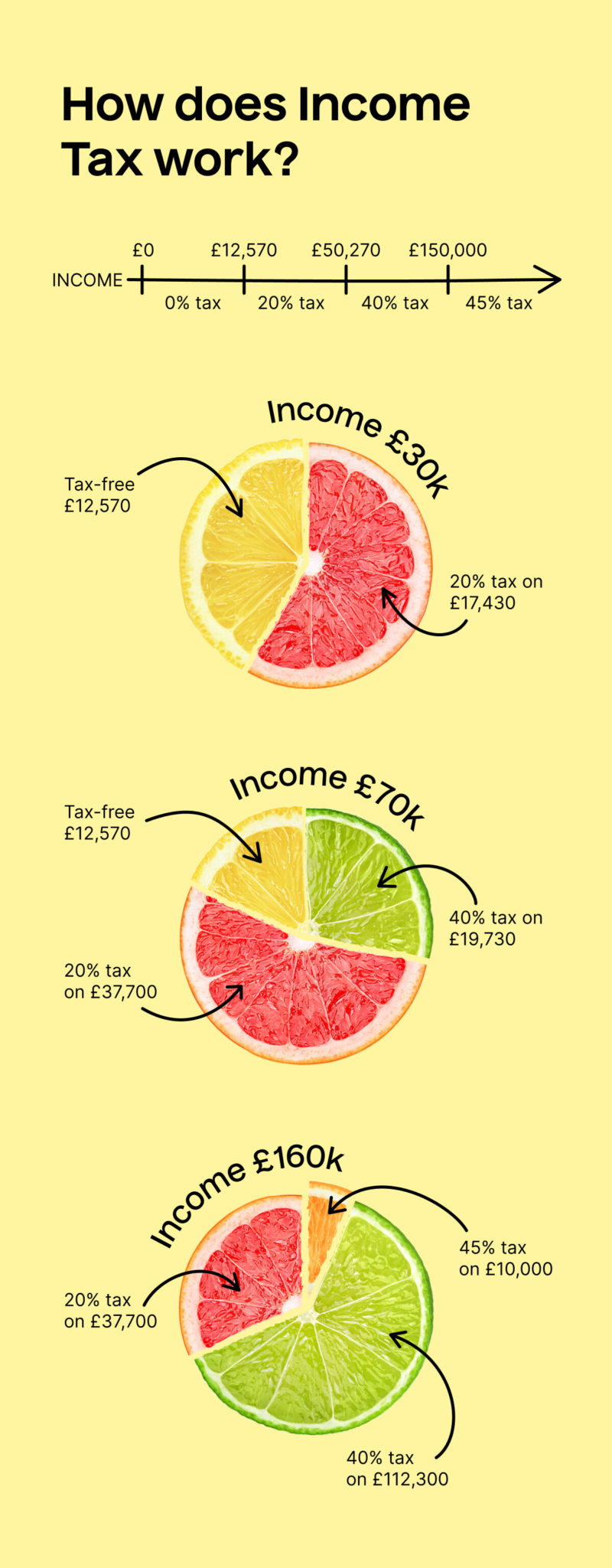

Tax Information CHANNELVIEW ISD BOND

About Income Tax In Hindi Seekhoaccounting

Lesson 1 Notes Individual Income Tax Rate Structures Tax Structures

Lesson 1 Notes Individual Income Tax Rate Structures Tax Structures

Different Types Of Income Tax Assessments Under The Income Tax Act

Marginal Tax Rate Definition Formula How To Calculate

Income Tax Rate In Nepal For The Fiscal Year 2078 79

Income Tax Rate Equation - To calculate your marginal tax rate apply the percentage of tax charged to the amount of income in each bracket according to your filing status and add up the totals