Income Tax Rate In Bangladesh 2020 21 Pdf You have to know the updated TDS rates 2020 21 to deduct or collect tax at the time of payment or collection of money to comply with Income Tax Law of Bangladesh TDS Rates Chart FY 2021 22 I have

Major sources of income subject to deduction 14 or collection of tax advance payment of tax and presumptive tax Rates applicable for Financial Year 2021 2022 363 rows01 11 2023 Report on Tax Expenditure in the Direct tax of Bangladesh FY

Income Tax Rate In Bangladesh 2020 21 Pdf

Income Tax Rate In Bangladesh 2020 21 Pdf

https://i.ytimg.com/vi/yEFoIIuLDIo/maxresdefault.jpg

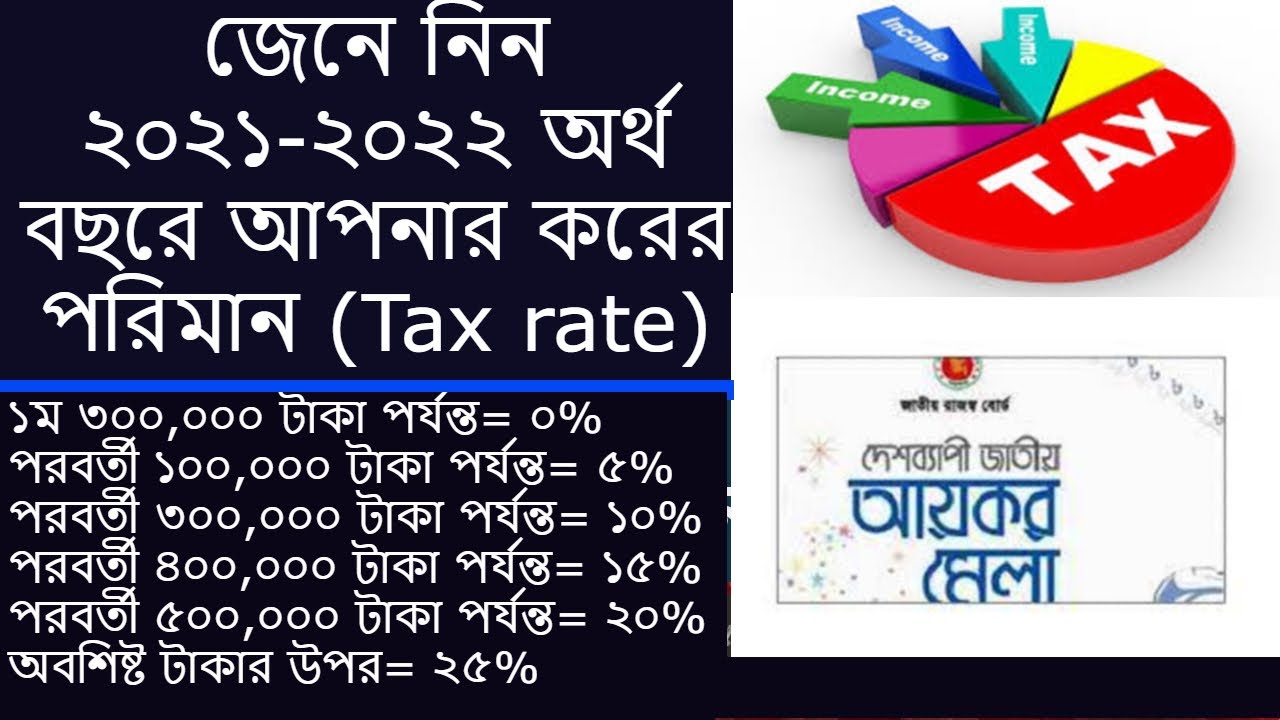

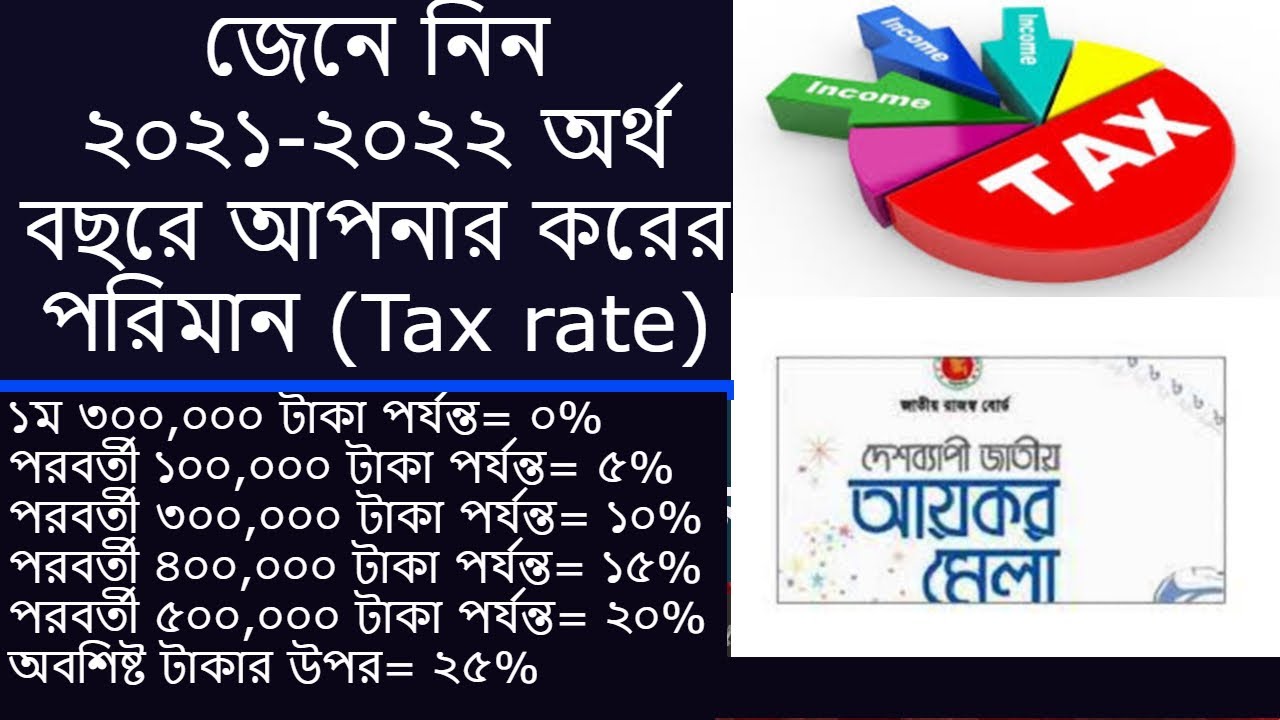

Personal Income Tax Rate In Bangladesh 2021 2022 YouTube

https://i.ytimg.com/vi/vZv_C0-xW_E/maxresdefault.jpg

Income Tax Rate In Bangladesh 2020 21 Income TAX YouTube

https://i.ytimg.com/vi/oDLmdA1R44I/maxresdefault.jpg

Income Tax and VAT changes by Finance Act 2021 Government of Bangladesh passed the Finance Act 2021 which introduced various changes in the tax legislations KPMG Income tax is targeting for FY 2022 23 is Taka 121 020 crore which is only 0 87 percent increase over that of revised budget for FY 2021 22 The amount of income tax target in

PDF 1 5 1145 0 obj Linearized 1 L 2826717 H 1336 2764 O 1147 E 1023907 N 463 T 2803688 endobj xref 1145 39 0000000017 00000 n 0000001255 00000 n The income tax GDP ratio was 3 11 percent in revised budget of FY2020 21 and it is expected to be 3 04 percent in FY2021 22 overall tax GDP ratio expected to be 10 01 in

Download Income Tax Rate In Bangladesh 2020 21 Pdf

More picture related to Income Tax Rate In Bangladesh 2020 21 Pdf

VAT Rates Chart FY 2021 22 In Bangladesh With H S Code

http://www.jasimrasel.com/wp-content/uploads/2021/08/VAT-Rates-Chart-FY-2021-22-Bangladesh.jpg

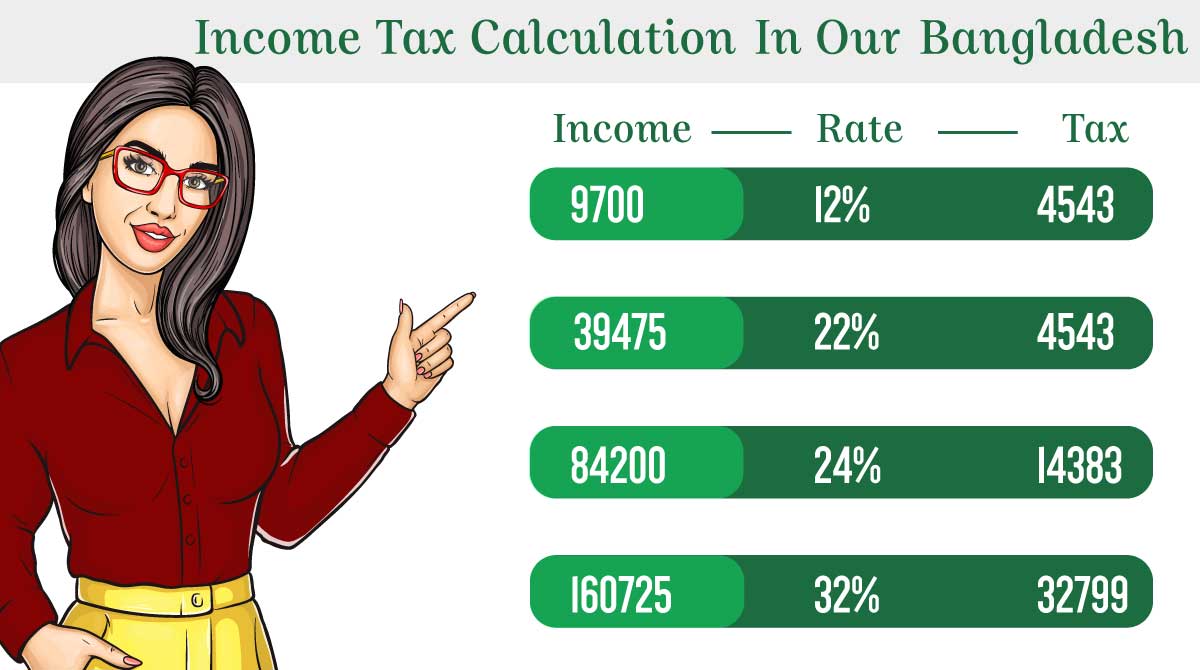

Income Tax Calculate And Submit Returns In Bangladesh

https://www.payroll.com.bd/wp-content/uploads/2022/10/Tax-1.jpg

VAT Rates Chart FY 2021 22 In Bangladesh With H S Code

http://www.jasimrasel.com/wp-content/uploads/2021/08/Corporate-Tax-Book-Bangladesh-1024x512.jpg

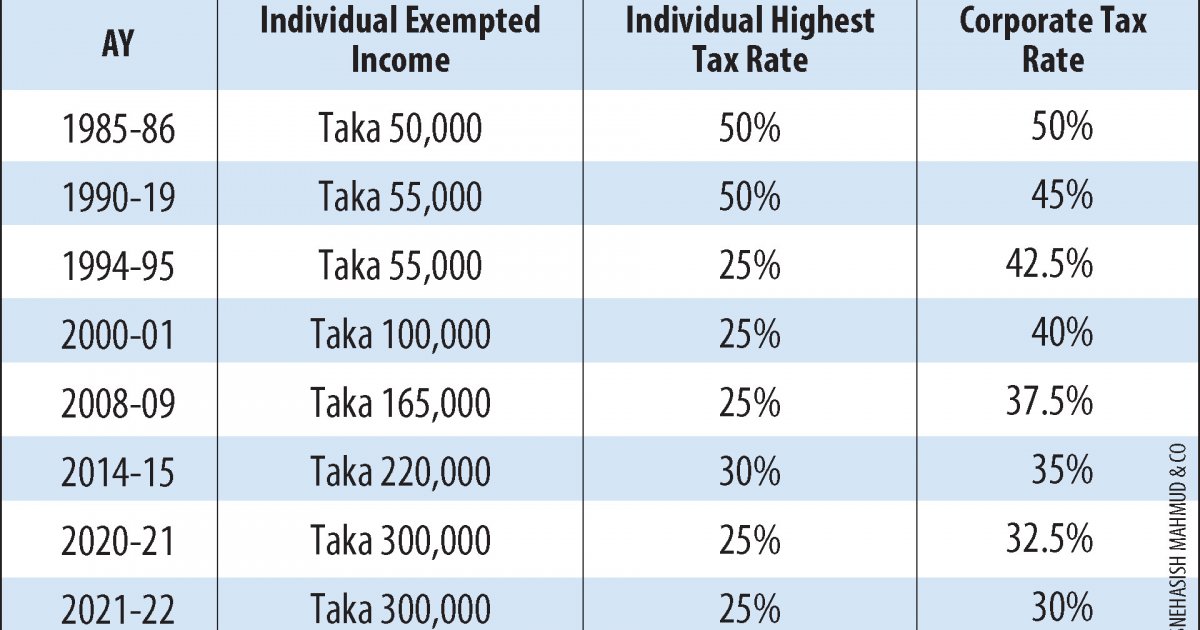

Download The Personal Income Tax Rate in Bangladesh stands at 25 percent Personal Income Tax Rate in Bangladesh averaged 26 84 percent from 2004 until 2022 reaching an all time high of 30 00 percent in 2014 Circular Income Tax 2012 13 Amendment of Income Tax Ordinance Section 19 Some Amendment of Definition of 1984 Section 2

The Income tax rates and personal allowances in Bangladesh are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below Major sources of income subject to deduction or collection of tax advance payment of tax and presumptive tax Rates applicable for Financial Year 2021 2022 Sl No

TDS Rates 2020 21 With Section References In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2020/06/TDS-Rates-2020-21.jpg

Withholding Tax Rate In Bangladesh 2022 24 BDesheba Com

https://bdesheba.com/wp-content/uploads/2023/04/Withholding-Tax-Rate-in-Bangladesh.jpg

https://www.jasimrasel.com/tds-rates-20…

You have to know the updated TDS rates 2020 21 to deduct or collect tax at the time of payment or collection of money to comply with Income Tax Law of Bangladesh TDS Rates Chart FY 2021 22 I have

https://nbr.gov.bd/.../2021_Paripatra_draft_final.pdf

Major sources of income subject to deduction 14 or collection of tax advance payment of tax and presumptive tax Rates applicable for Financial Year 2021 2022

Tax Return Submission In Bangladesh Lowest Among South Asian Countries

TDS Rates 2020 21 With Section References In Income Tax Of Bangladesh

FY24 Minimum Income Tax Rate Reducing

Corporate Income Tax Rate In Bangladesh In 2023 Hire The Most

Corporate Tax Rate In Bangladesh 2020 21 YouTube

Income Tax Rate In Bangladesh FY 2019 20 AY 2020 21 L Learn

Income Tax Rate In Bangladesh FY 2019 20 AY 2020 21 L Learn

Tax Rate In Bangladesh In 2023 Choose The Actionable Way Of Dealing

BongoBIX

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Income Tax Rate In Bangladesh 2020 21 Pdf - The amount of tax expenditures in Bangladesh is 2 52 per cent of GDP and 31 25 per cent of total revenue in FY05 0 28 per cent of GDP in the direct taxes and 2 24 per cent of