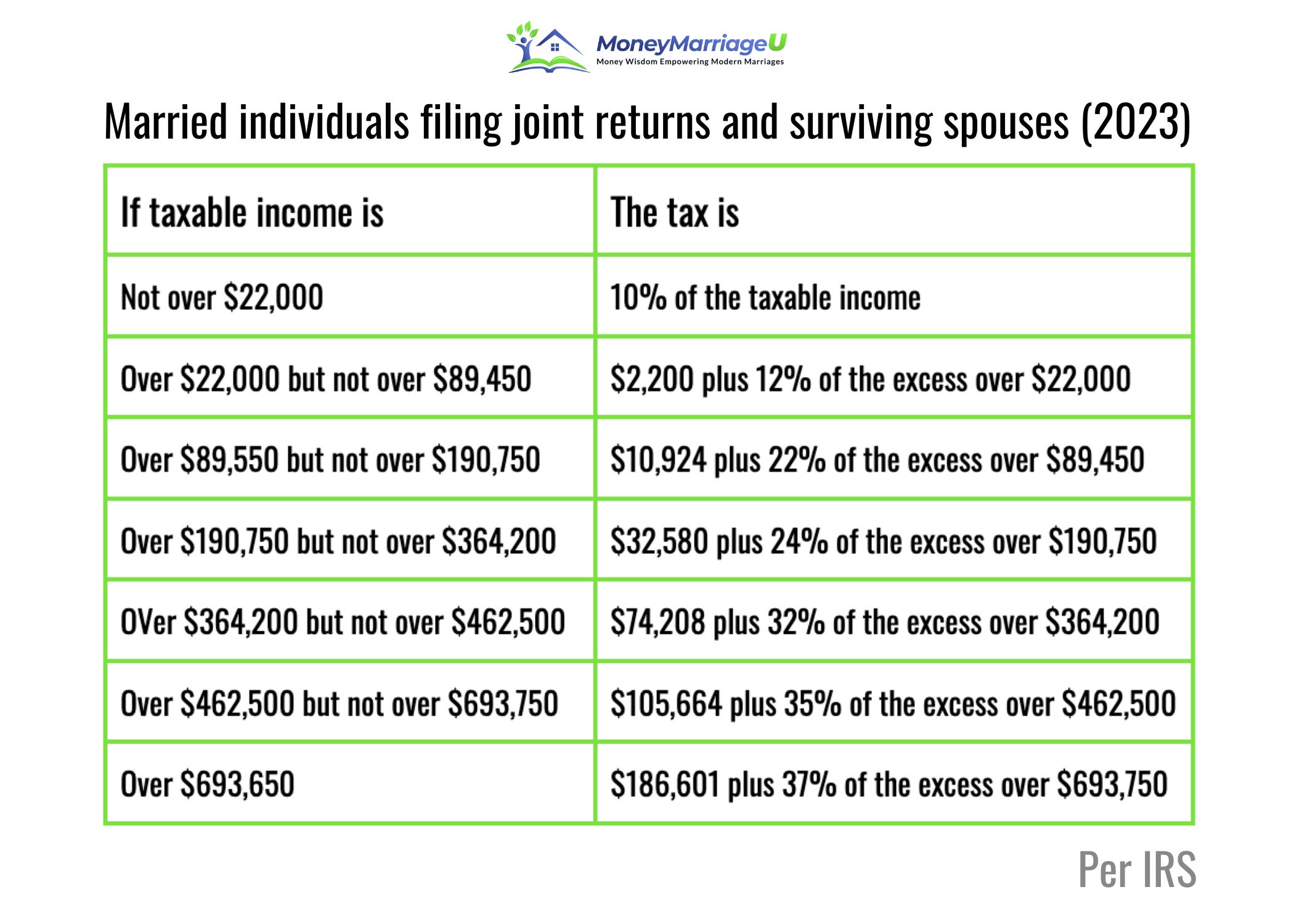

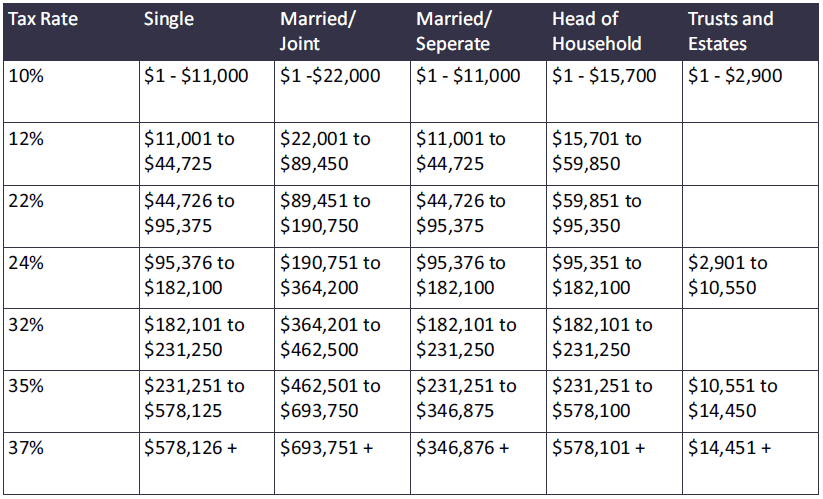

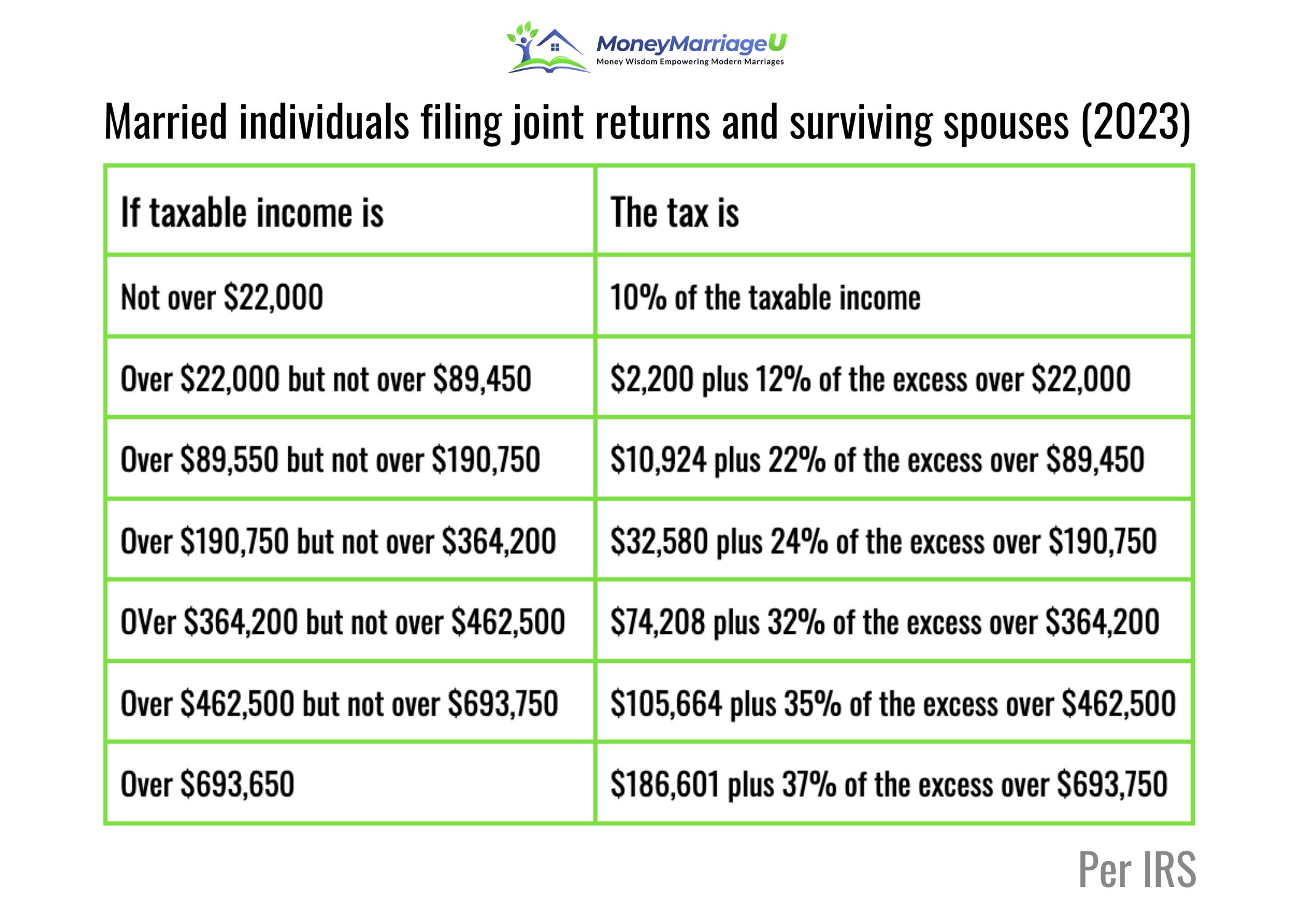

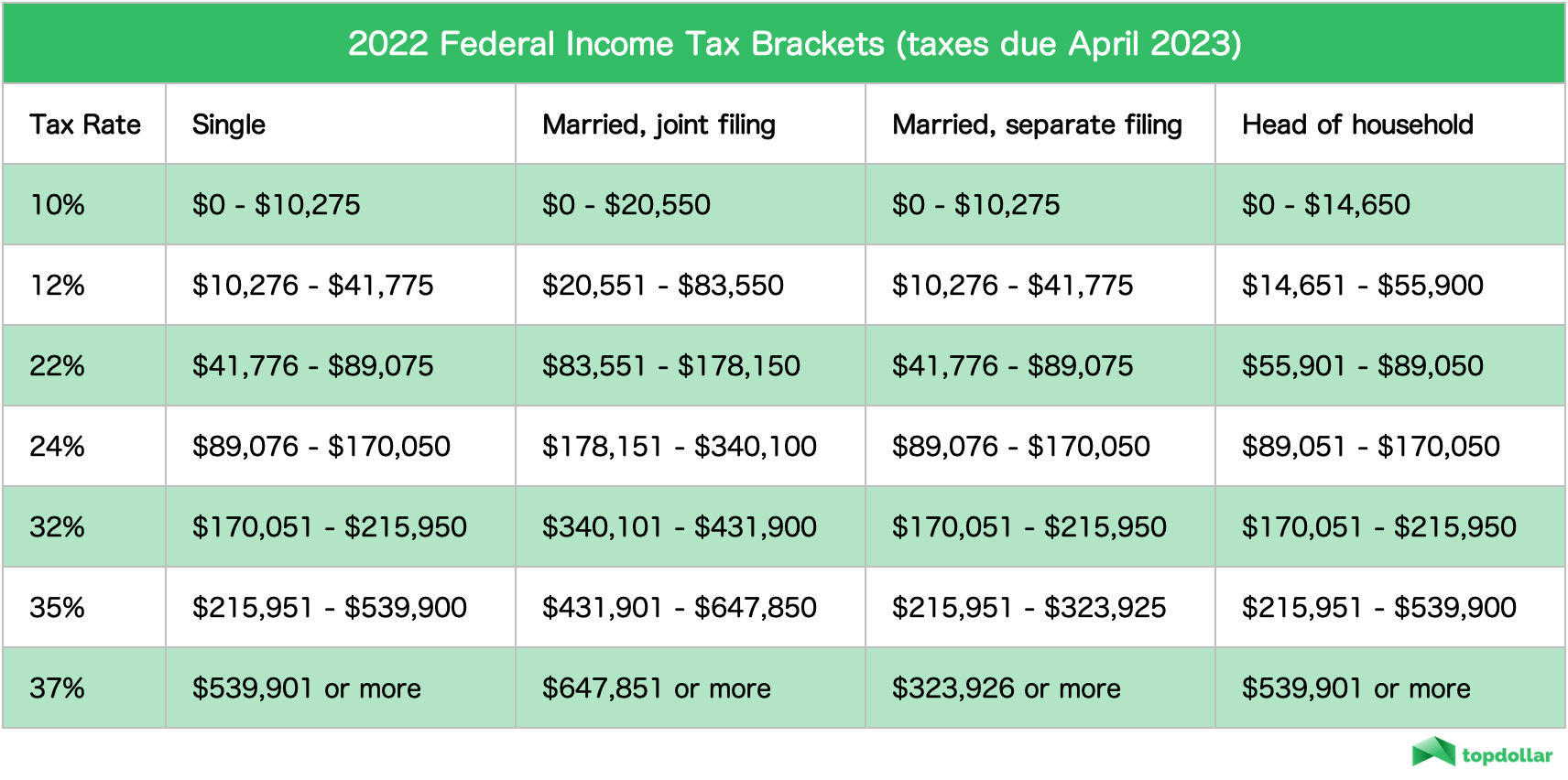

Income Tax Rates 2023 Federal 2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person with taxable income of 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing jointly or qualifying surviving spouse Married filing separately Head of household

The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37 Your filing For single taxpayers and married individuals filing separately the standard deduction rises to 13 850 for 2023 up 900 and for heads of households the standard deduction will be 20 800 for tax year 2023 up 1 400 from the amount for tax year 2022 Marginal Rates For tax year 2023 the top tax rate remains 37 for individual single

Income Tax Rates 2023 Federal

Income Tax Rates 2023 Federal

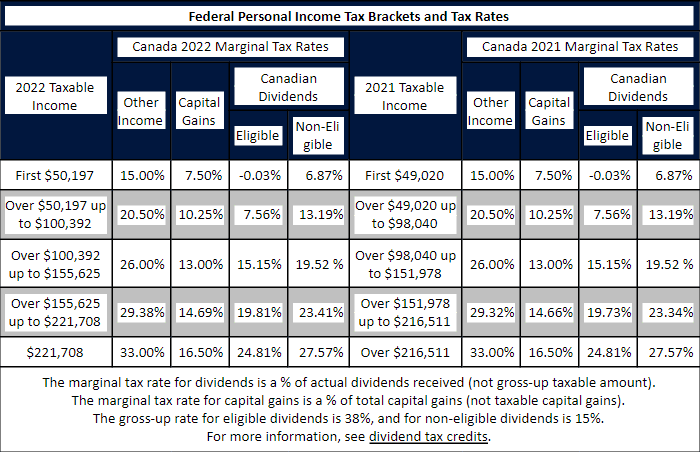

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

The 2023 Tax Brackets By Income Modern Husbands Free Nude Porn Photos

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

2021 Nc Standard Deduction Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

The seven federal income tax brackets for 2024 and 2025 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status The Internal Revenue Service adjusts federal income tax brackets annually to account for inflation and the new brackets can help you estimate your tax obligation based on your income and filing status for the year

In 2024 and 2025 the income tax rates for each of the seven brackets are the same 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent Federal income tax rates are divided into seven segments commonly known as income tax brackets You pay increasing income tax rates as your income rises If you re trying to determine your marginal tax rate or your highest federal tax bracket you ll need to know two things

Download Income Tax Rates 2023 Federal

More picture related to Income Tax Rates 2023 Federal

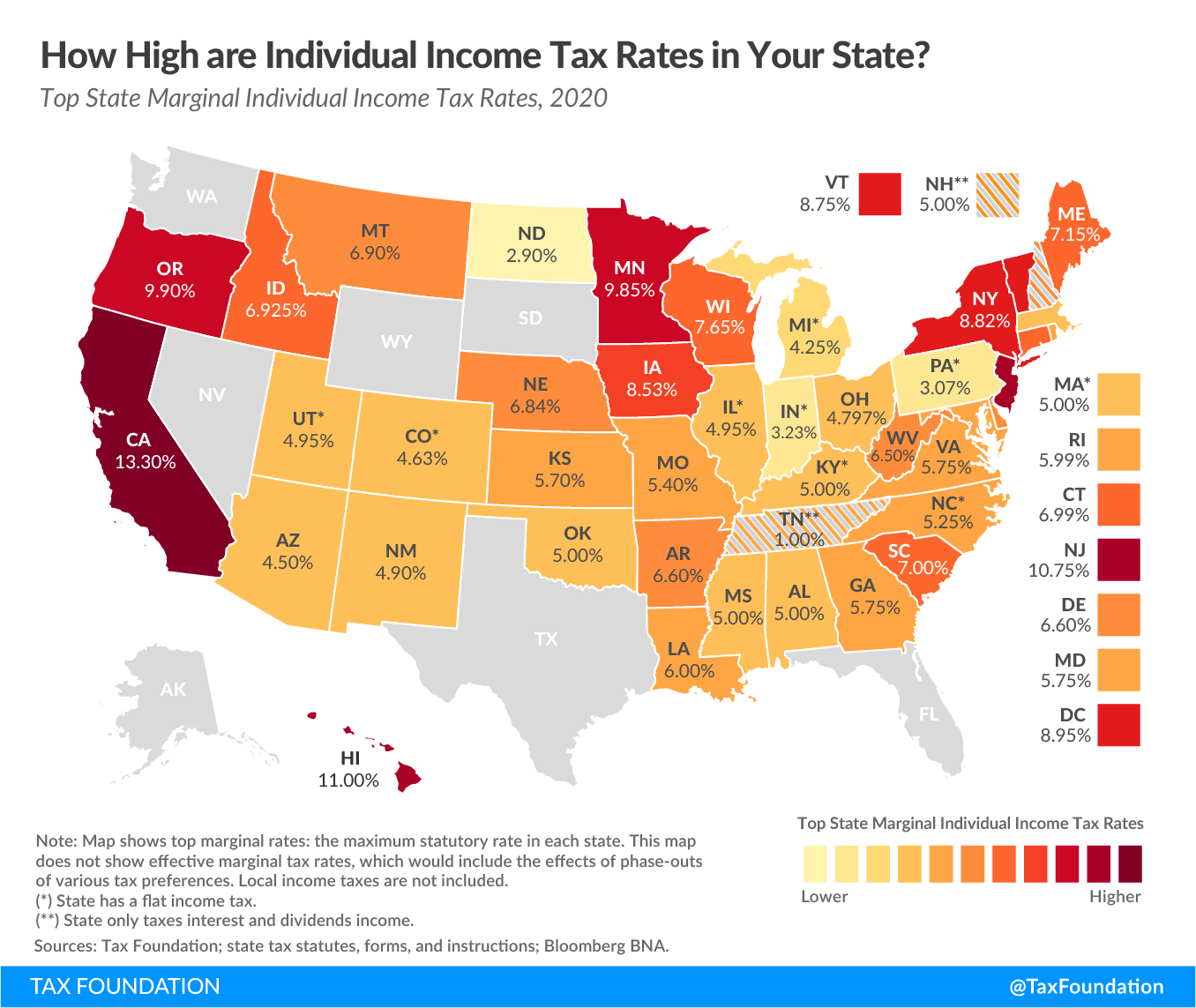

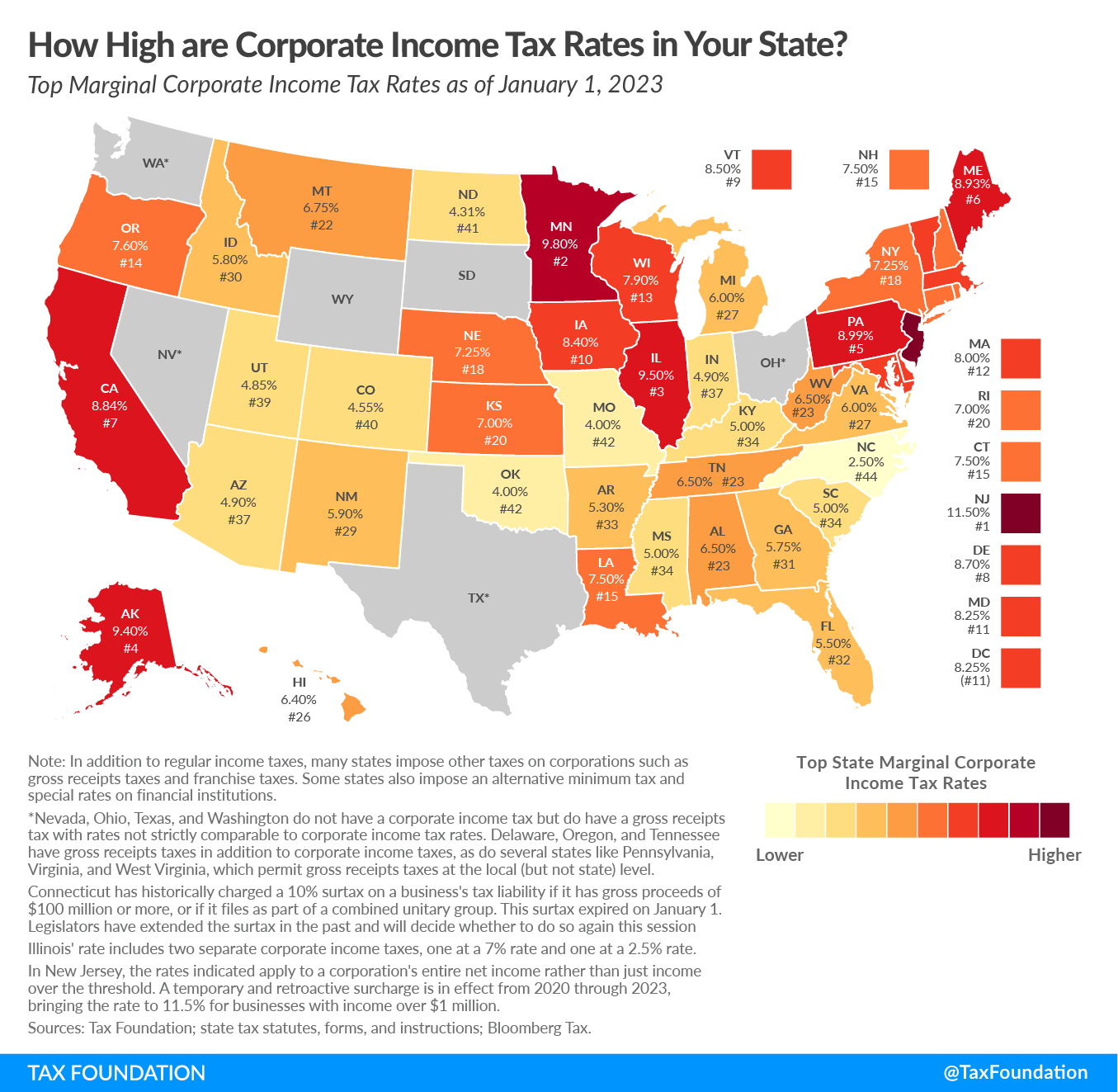

State Corporate Income Tax Rates 2023 American Legal Journal

https://files.taxfoundation.org/20230123172533/2023-state-corporate-income-tax-rates-and-brackets-see-state-corporate-tax-rates-by-state.png

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

https://files.taxfoundation.org/20220714115620/2022-CIT-rates-July-Update-FV2-01.png

Federal Corporate Income Tax Rate For 2023 Infoupdate

https://www.lbmc.com/wp-content/uploads/2023/01/2023-federal-income-tax-brackets-for-individuals-and-trusts.png

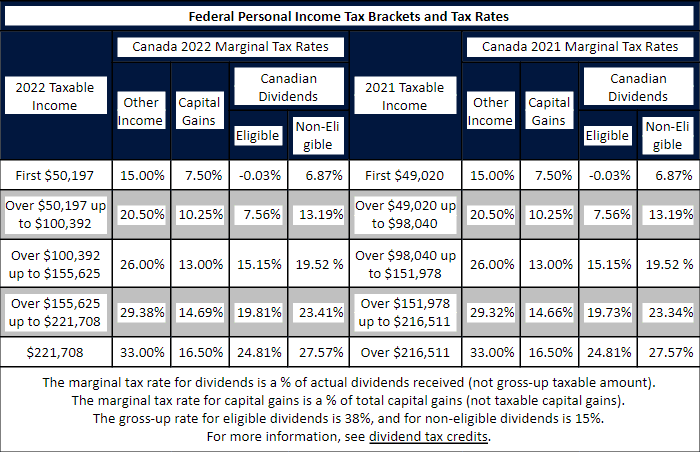

The IRS has released higher federal tax brackets for 2023 to adjust for inflation The standard deduction is increasing to 27 700 for married couples filing together and 13 850 for single 2024 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits available to you to reduce your total tax payable

The federal income tax system is progressive so the rate of taxation increases as income increases Marginal tax rates range from 10 to 37 Enter your financial details to calculate your taxes Federal Income Tax Rates and Brackets for 2023 The 2023 federal income tax rates will stay the same from 2022 What will change again are the income ranges for each 2023 federal income tax bracket which have already been adjusted for inflation

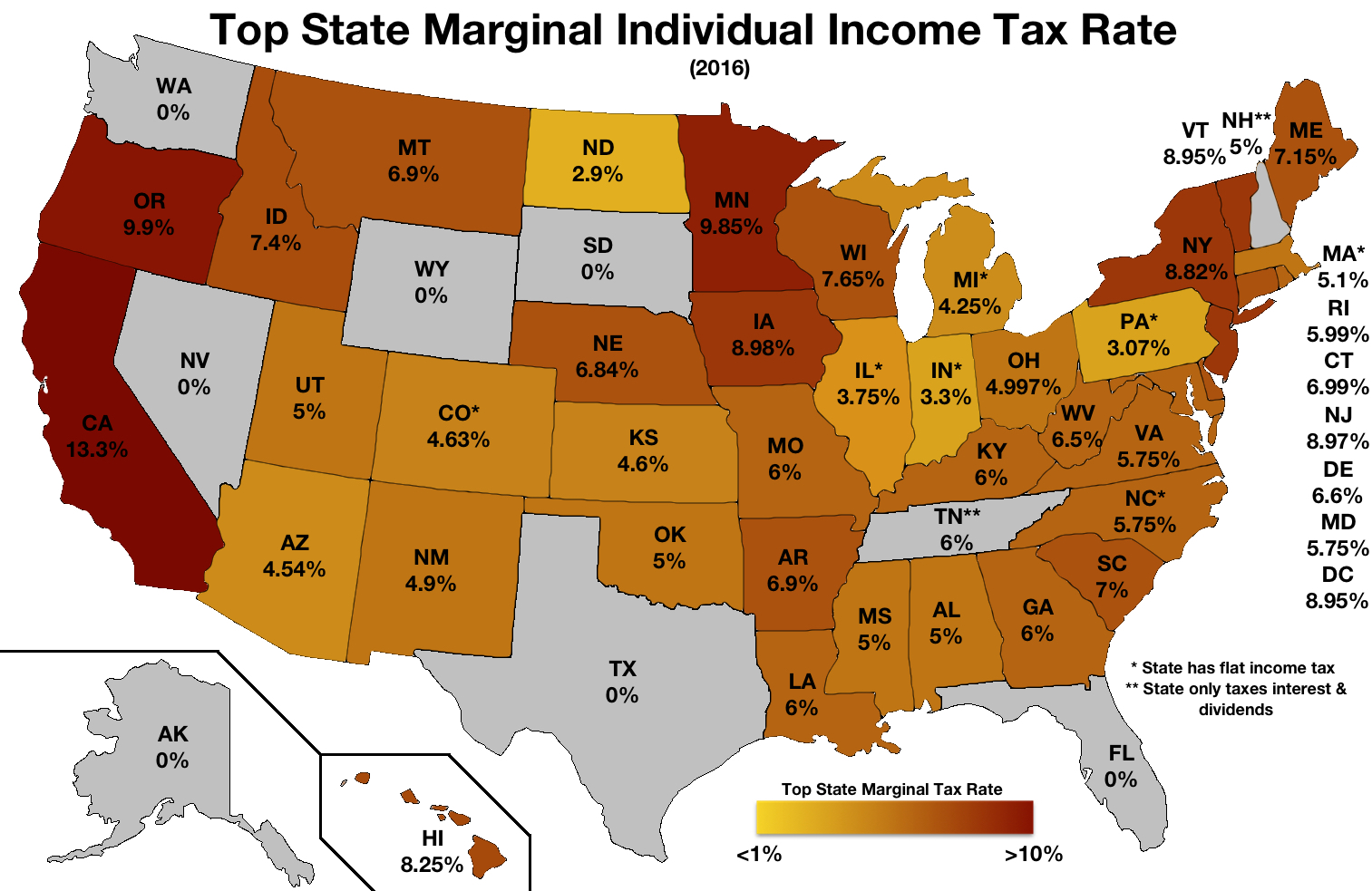

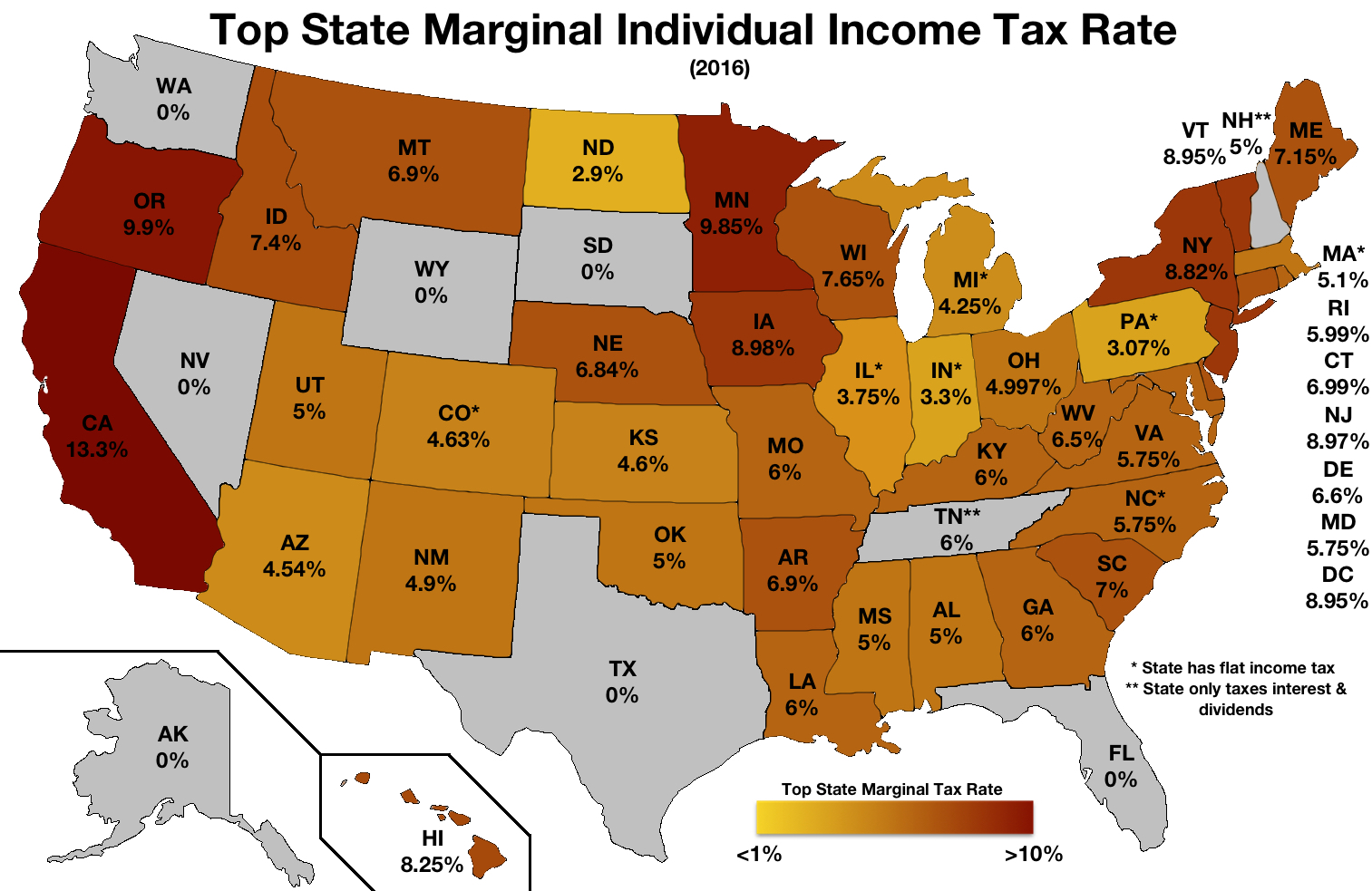

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

2022 Tax Brackets PersiaKiylah

https://www.kitces.com/wp-content/uploads/2021/09/01-Ordinary-Income-Tax-Rates-Under-The-Proposed-Legislation-1.png

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person with taxable income of 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing jointly or qualifying surviving spouse Married filing separately Head of household

https://www.forbes.com/advisor/taxes/taxes-federal

The 2023 tax year meaning the return you ll file in 2024 will have the same seven federal income tax brackets as the last few seasons 10 12 22 24 32 35 and 37 Your filing

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

The Union Role In Our Growing Taxocracy California Policy Center

Federal Income Tax Due Date 2022 Latest News Update

Irs Tax Brackets 2023 Chart Printable Forms Free Online

2023 Tax Bracket 2023

New Federal Tax Brackets For 2023

New Federal Tax Brackets For 2023

Oct 19 IRS Here Are The New Income Tax Brackets For 2023

Ca Tax Brackets Chart Jokeragri

2023 Tax Rates Federal Income Tax Brackets Top Dollar

Income Tax Rates 2023 Federal - The Internal Revenue Service adjusts federal income tax brackets annually to account for inflation and the new brackets can help you estimate your tax obligation based on your income and filing status for the year