Income Tax Rebate On Interest Of Saving Account Web 26 avr 2023 nbsp 0183 32 Interest from a savings account is taxed at your earned income tax rate for the year As of the 2022 tax year those rates ranged from 10 to 37 If your net investment income NII or

Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return Claim a refund of Income Tax deducted Web 10 mars 2022 nbsp 0183 32 Savings account interest will be taxed at the same marginal income tax rate as the rest of your earned income Here s a look at the tax rates for the 2022 tax year

Income Tax Rebate On Interest Of Saving Account

Income Tax Rebate On Interest Of Saving Account

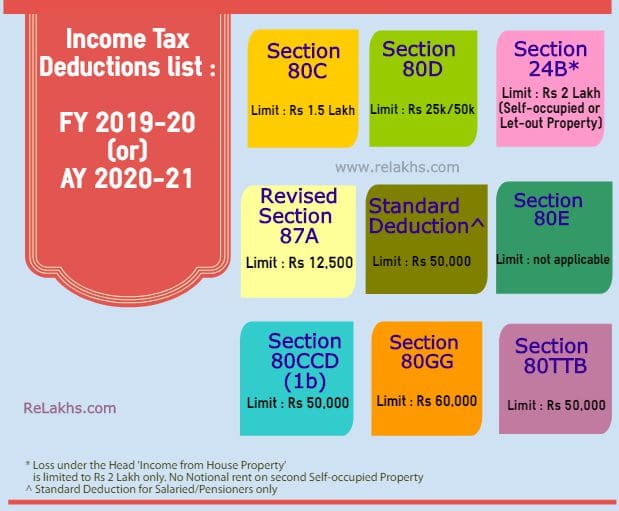

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Bank Savings Account Interest Rate

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/07/Savings-Account-Interest-Rates-of-Small-Finance-Banks-August-2020.png?fit=1316%2C874&ssl=1

Web You earn 163 16 000 of wages and get 163 200 interest on your savings Your Personal Allowance is 163 12 570 It s used up by the first 163 12 570 of your wages The remaining 163 3 430 of your Web 3 ao 251 t 2023 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is applicable for interest on savings accounts held by individuals or

Web 6 avr 2023 nbsp 0183 32 You may need to claim a repayment of tax if any of your savings income should only have been subject to the starting rate of tax for savings 0 in 2023 24 or should not have been taxed at all for Web 26 juil 2022 nbsp 0183 32 ITR filing Here s how to claim tax deduction of Rs 10 000 on savings account Income tax return ITR filing How savings bank interest is taxed and can

Download Income Tax Rebate On Interest Of Saving Account

More picture related to Income Tax Rebate On Interest Of Saving Account

Latest Savings Account Interest Rates Of Major Banks Yadnya

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/09/Savings-Account-Interest-Rates-of-Major-Banks-Sept-2020_3.png?resize=640%2C496&ssl=1

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web Published 9 December 2015 Who is likely to be affected Individuals who receive savings income such as interest on bank or building society accounts Banks building societies Web 2 d 233 c 2021 nbsp 0183 32 HMRC requires UK banks and building societies to annually submit information about interest paid or credited to reportable persons This information is

Web 6 avr 2023 nbsp 0183 32 You earn 163 60 000 a year and get 163 250 in account interest you won t pay any tax because it s less than your 163 500 allowance You earn 163 60 000 a year and get 163 1 100 in account interest you won t pay tax Web The PSA will apply a new 0 rate for up to 163 1000 of savings income received by a basic rate 20 taxpayer or up to 163 500 of savings income received by a higher rate 40

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Which Banks Are Offering The Best Interest Rates

https://i.pinimg.com/originals/ff/64/b6/ff64b6abd4a77af50d6e670ed63a49b8.png

https://www.investopedia.com/ask/answers/05…

Web 26 avr 2023 nbsp 0183 32 Interest from a savings account is taxed at your earned income tax rate for the year As of the 2022 tax year those rates ranged from 10 to 37 If your net investment income NII or

https://www.gov.uk/guidance/claim-a-refund-of-income-tax-deducted-from...

Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return Claim a refund of Income Tax deducted

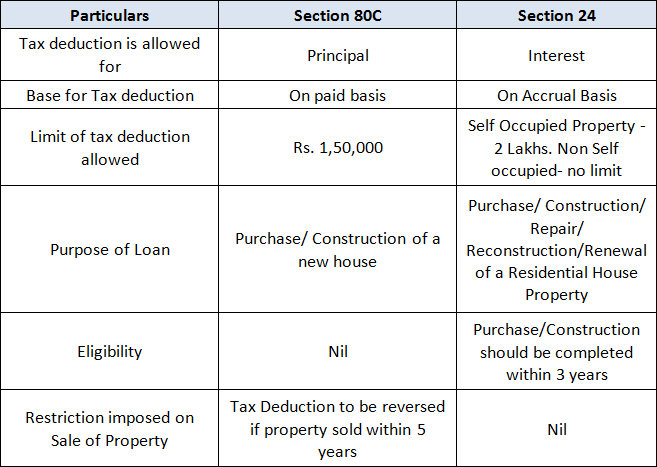

House Loan Interest Tax Deduction Home Sweet Home Insurance

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Under Section 87A

Pin On Tigri

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

Go Banking Rates Study Top 100 U S Cities With The Best Savings

P55 Tax Rebate Form By State Printable Rebate Form

Income Tax Rebate On Interest Of Saving Account - Web You earn 163 16 000 of wages and get 163 200 interest on your savings Your Personal Allowance is 163 12 570 It s used up by the first 163 12 570 of your wages The remaining 163 3 430 of your