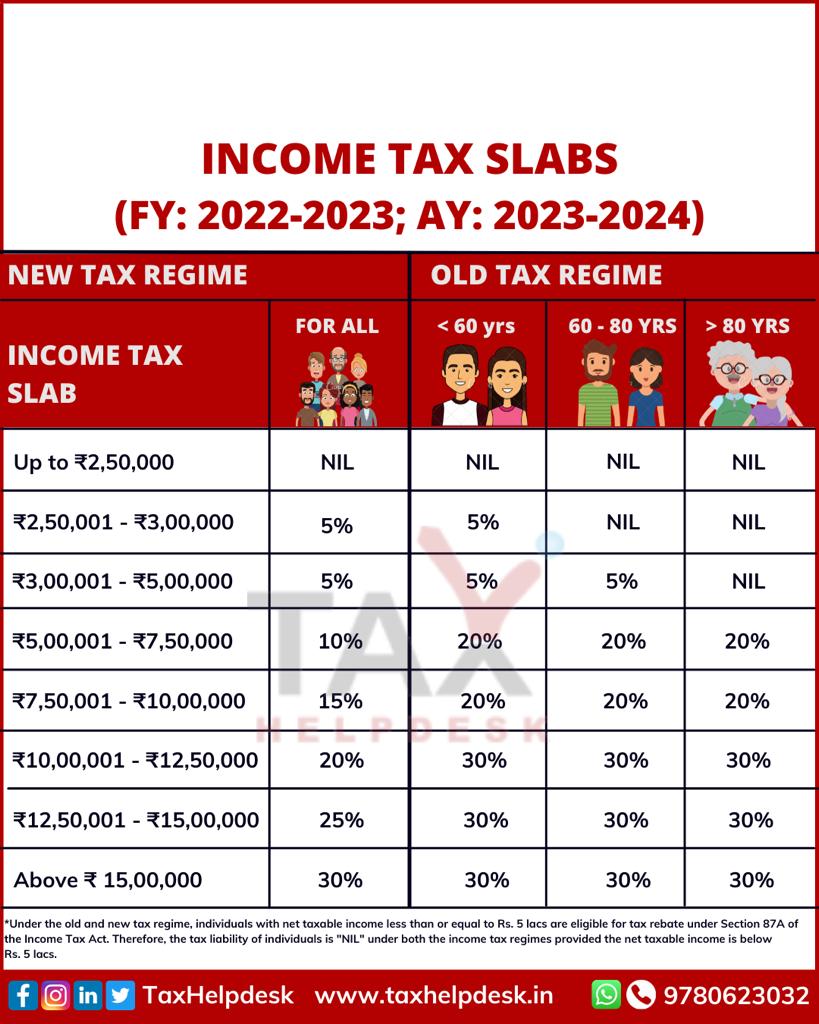

Income Tax Rates For Assessment Year 2022 23 Income Tax Slabs Tax Rate Tax Amount Income up to Rs 2 50 000 No tax Income from Rs 2 50 000 Rs 5 00 000 5 Rs 5 00 000 Rs 2 50 000 Rs 12 500 Income from

This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having This handy calculator will show you how much income tax and National Insurance you ll pay in the 2023 24 2022 23 and 2021 22 tax years as well as how

Income Tax Rates For Assessment Year 2022 23

Income Tax Rates For Assessment Year 2022 23

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1200/dpr_auto,f_auto/website-images/netlify/rates_income-tax-rates-and-bands_2022-23.png

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Income Tax Rates for Assessment Year 2022 2023 Last updated February 27th 2023 04 17 pm The present article covers the income tax slab rates as applicable for the Assessment Year 2021 Income Tax Rates for A Y 2023 24 and A Y 2022 23 Taxmann 01 Feb 2022 Income Tax Rates for A Y 2023 24 and A Y 2022 23 Income Tax News 890 Views

Guidance Income Tax rates and allowances for current and previous tax years Updated 15 January 2024 This publication is licensed under the terms of the Open Government The highest surcharge rate on tax due for capital gains or dividend income specified in Section 112 will be 15 as of Assessment Year 2023 2024 Additionally an

Download Income Tax Rates For Assessment Year 2022 23

More picture related to Income Tax Rates For Assessment Year 2022 23

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

https://wealthtechspeaks.in/wp-content/uploads/2022/03/Income-Tax-Calculation-Financial-Year-2022-23.png

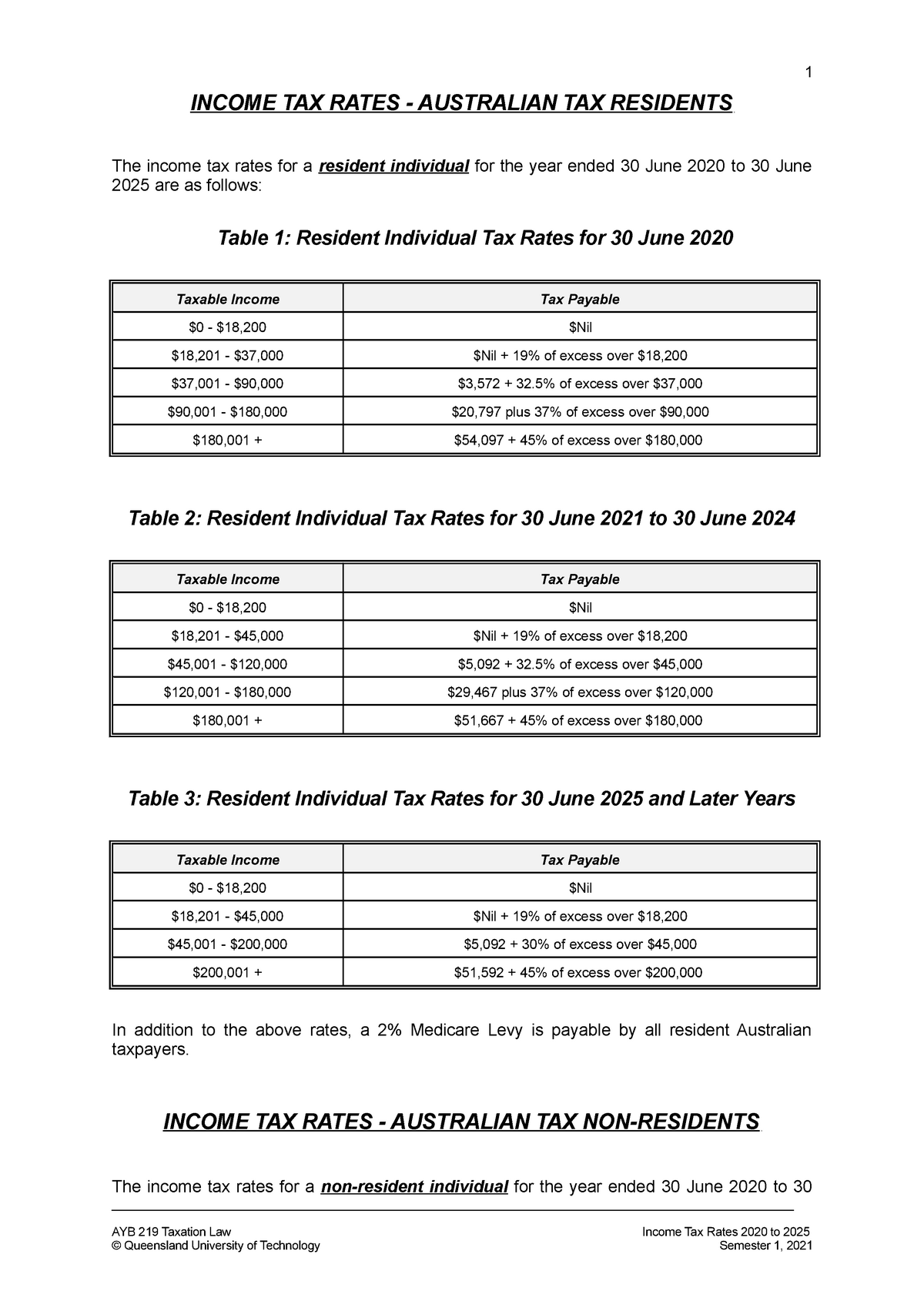

Income Tax Rates 2020 To 2025 INCOME TAX RATES AUSTRALIAN TAX

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/56ce636814d7cc999e8963637b9144bd/thumb_1200_1698.png

Irs Withholding Rates 2021 Federal Withholding Tables 2021 Free Nude

https://federalwithholdingtables.net/wp-content/uploads/2021/07/tax-season-2021-new-income-tax-rates-brackets-and-the-1.png

Income Tax Return ITR filing for the assessment year 2022 23 is now available on e filing portal the income tax department said on Wednesday Check your Dividend allowance The rules are different for dividends before 6 April 2016 Working out tax on dividends How much tax you pay on dividends above the dividend allowance

63 FAQs on Income tax Returns for Assessment Year 2022 23 Taxmann 19 Jul 2022 2022 140 taxmann 378 Article Income Tax Opinion 4705 Views Facebook Rates of Income Tax for Assessment Year 2022 23 2023 24 Direct and Indirect Taxes with Tax Ready Reckoner Income Tax Concept Knowledge Base Tax

Legislation Could Cut Income Tax Rates For Good The Daily Courier

https://westernnews.media.clients.ellingtoncms.com/img/photos/2020/02/28/mesnard02_YMpGeCr.jpg

INCOME TAX SLAB FOR FY 2022 23 BBNC

https://www.bbnc.in/blog/wp-content/uploads/2022/10/2-2048x1152.png

https://cleartax.in/s/income-tax-slabs

Income Tax Slabs Tax Rate Tax Amount Income up to Rs 2 50 000 No tax Income from Rs 2 50 000 Rs 5 00 000 5 Rs 5 00 000 Rs 2 50 000 Rs 12 500 Income from

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having

2022 Tax Brackets Lashell Ahern

Legislation Could Cut Income Tax Rates For Good The Daily Courier

California Individual Tax Rate Table 2021 20 Brokeasshome

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

Migration Of Personal Incomes Between States According To The Tax

Migration Of Personal Incomes Between States According To The Tax

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

Income Tax Slabs For FY 2022 23 FY 2021 22

Income Tax Rates For Senior Citizens For Assessment Year Page My XXX

Income Tax Rates For Assessment Year 2022 23 - Rates of Income tax for FY 2022 23 assessment year 2023 24 CACube By Jupiter June 10 2022 A Income tax Rates for Individual HUF who