Income Tax Rebate 2022 23 Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their taxable income does not exceed Rs 5 lakh in a financial year

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24

Income Tax Rebate 2022 23

Income Tax Rebate 2022 23

https://i.ytimg.com/vi/OaeaGHgkz-k/maxresdefault.jpg

Income Tax 2022 23 Numerical ON Income Tax Tax Rates Rebate BBA

https://i.ytimg.com/vi/s6RjxXjuWz0/maxresdefault.jpg

Want To Track Your 2022 Tax Rebate Check Out This Tool From The Idaho

https://idahocapitalsun.com/wp-content/uploads/2022/04/income-tax-491626_1920-768x512.jpg

Income Tax On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down To see tax rates from 2014 5 see the Archive Tax Rates webpage An individual is eligible for a tax rebate under section 87A of the Income Tax Act 1961 if their taxable income is below Rs 5 lakh in FY 2022 23 AY 2023 24 Rs 12 500 is the maximum amount of income tax rebate that is available in both the tax regimes

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime People with taxable incomes under Rs 5 lakhs are eligible for a tax rebate under Section 87A of the Income Tax Act of 1961 in the financial year 2022 23 Both the previous and the new tax regimes would offer a maximum tax rebate of Rs 12 500

Download Income Tax Rebate 2022 23

More picture related to Income Tax Rebate 2022 23

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Here s How You Can Claim The 2022 Council Tax Rebate Holeys

https://holeys.co.uk/wp-content/uploads/2022/02/Blog-image-24.2.22.jpg

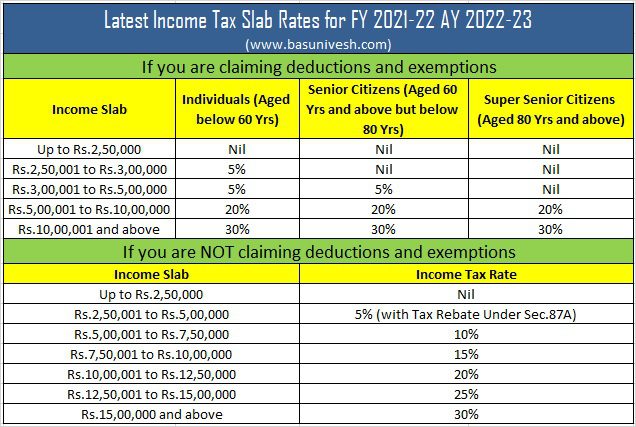

ITR Forms AY 2022 23 FY 2021 22 Which Form To Use BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2021/02/Latest-Income-Tax-Slab-Rates-for-FY-2021-22-AY-2022-23.jpg?lossy=1&strip=1&webp=1

The tax offset reduces by 0 125 for every dollar your rebate income exceeds the relevant shading out threshold amount We round up the amount to the nearest whole dollar Example single with rebate income above the threshold Between 2018 19 and 2021 22 you may have been eligible to receive one or both of the low income tax offset if you earn up to 66 667 low and middle income tax offset if you earn up to 126 000 LMITO ended on 30 June 2022 The last year you can receive it is the 2021 22 income year

Income Tax Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on This SARS tax pocket guide provides a synopsis of the most important tax duty and levy related information for 2022 23 INCOME TAX INDIVIDUALS AND TRUSTS Tax rates from 1 March 2022 to 28 February 2023 Individuals and special trusts Trusts other than special trusts rate of tax 45 Rebates Primary R16 425

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

https://economictimes.indiatimes.com › wealth › tax › ...

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their taxable income does not exceed Rs 5 lakh in a financial year

https://tax2win.in › guide

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

Income Tax 2022 23 Slab Bed Frames Ideas

Income Tax 2022 23 Tax Rates Rebate Rate Of Surcharge Cess

Council Tax Rebate 2022 Council Issues THIRD Date To Pay 150

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Irs Form Release Date 2023 Printable Forms Free Online

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

Wisconsin Form 1 Es 2023 Printable Printable Forms Free Online

Income Tax Rebate 2022 23 - This article summarizes Tax Rates Surcharge Health Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident Non Resident Hindu undivided family Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical persons for income liable to tax in