Income Tax Rebate For Donation Web 28 sept 2021 nbsp 0183 32 The law now permits taxpayers to claim a limited deduction on their 2021 federal income tax returns for cash contributions they made to certain qualifying

Web Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief The tax goes to you or the charity How this works depends Web 25 nov 2017 nbsp 0183 32 Are charitable donations tax deductible Yes In general you can deduct up to 60 of your adjusted gross income via charitable donations but you may be limited

Income Tax Rebate For Donation

Income Tax Rebate For Donation

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Income Tax Rebate Under Section 87A For FY 2020 21

https://thepipl.com/wp-content/uploads/2022/07/tax-rebate.png

Web 25 nov 2020 nbsp 0183 32 WASHINGTON The Internal Revenue Service today reminded taxpayers of a special new provision that will allow more people to easily deduct up to 300 in Web 5 juil 2021 nbsp 0183 32 Donation up to Rs 2 000 can be made in cash but any amount above that must be made through cheque bank transfer etc Limits A deduction of 50 or 100 of

Web The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t Web 10 avr 2022 nbsp 0183 32 A married couple taking the standard deduction is allowed to claim up to 600 for cash contributions made to qualifying charities in 2021 if filing a joint return It s a temporary break which

Download Income Tax Rebate For Donation

More picture related to Income Tax Rebate For Donation

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

https://janjagritisewasamiti.org/wp-content/uploads/2016/12/jjss7.jpg

List Of LHDN s Income Tax Relief For E Filing 2021 YA 2020

https://img.iproperty.com.my/angel/750x1000-fit/wp-content/uploads/sites/2/2021/01/LHDN-income-tax-YA-2020.jpg

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

https://janjagritisewasamiti.org/wp-content/uploads/2016/12/jjss2.jpg

Web 10 of the Income is allowed to be donated to Charity and claimed as a tax deduction Donations more than 10 can also be made provided they are made to certain Web Donations with 50 Deduction Without any qualifying limit Donations made towards trusts like Prime Minister s Drought Relief Fund National Children s Fund Indira Gandhi

Web Income tax relief You can pay less income tax by deducting the value of your donation from your overall taxable income You can do this by adding the amount you re claiming Web Reclaim tax If you receive income with tax deducted for example donations you can claim Gift Aid on you can claim it back online using the Charities Online service

Union Budget 2020 How Income Tax Rebate Tax Exemption And Tax

https://imgeng.jagran.com/images/2020/jan/29_08_2019-income_tax_195287911580362220002.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://www.irs.gov/newsroom/expanded-tax-benefits-help-individuals...

Web 28 sept 2021 nbsp 0183 32 The law now permits taxpayers to claim a limited deduction on their 2021 federal income tax returns for cash contributions they made to certain qualifying

https://www.gov.uk/donating-to-charity

Web Donations by individuals to charity or to community amateur sports clubs CASCs are tax free This is called tax relief The tax goes to you or the charity How this works depends

LHDN IRB Personal Income Tax Rebate 2022

Union Budget 2020 How Income Tax Rebate Tax Exemption And Tax

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Rebate U s 87A Income Tax Applicability Eligibility IndiaFilings

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

Tax Deduction Rebate On Donation Jan Jagriti Sewa Samiti

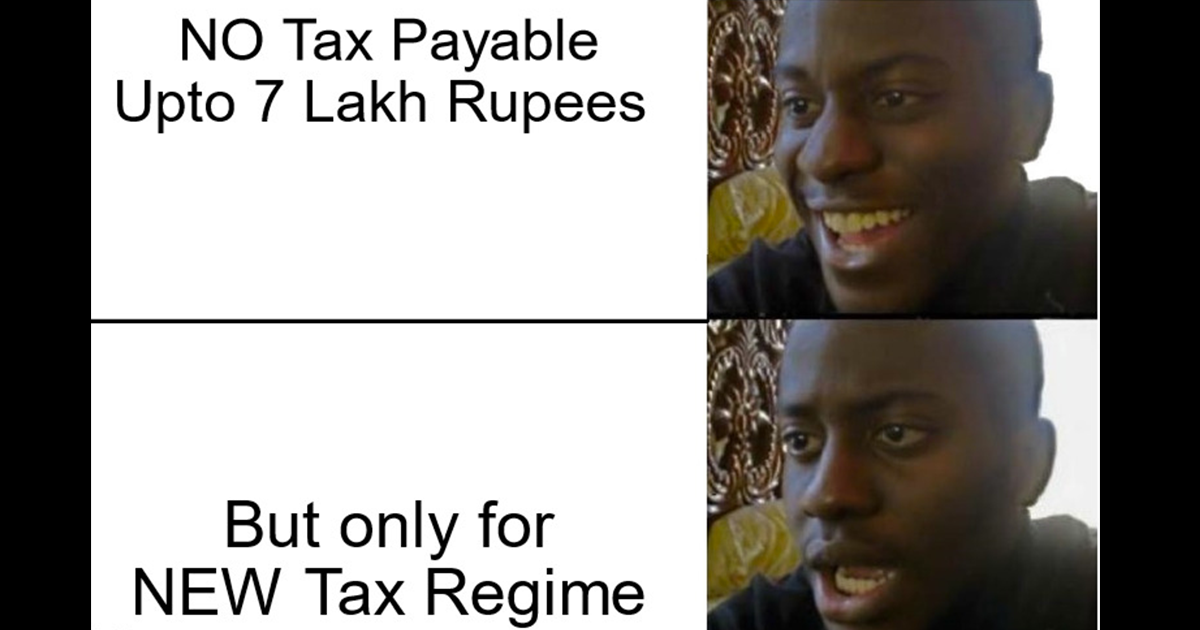

Budget 2023 Increase In Income Tax Rebate For The New Regime Has

Georgia Income Tax Rebate 2023 Printable Rebate Form

Reducing Your Income Tax Parents Edition Tax Reliefs Rebate For

Income Tax Rebate For Donation - Web Each taxpayer belongs to a designated tax bracket but it s a tiered system For example a portion of your income is taxed at 12 the next portion is taxed at 22 and so on This