Income Tax Rebate For Handicapped Child Web 1 nov 2022 nbsp 0183 32 The qualifying child you claim for the EITC can be any age if they Have a permanent and total disability and Have a valid Social Security number If the child gets

Web Less Parenthood Tax Rebate 1 040 Mr and Mrs Chen are sharing the PTR of 5 000 for their first child born in 2022 i e 2 500 per person Any unutilised amount of PTR will Web 7 d 233 c 2022 nbsp 0183 32 As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found in the IRS

Income Tax Rebate For Handicapped Child

Income Tax Rebate For Handicapped Child

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

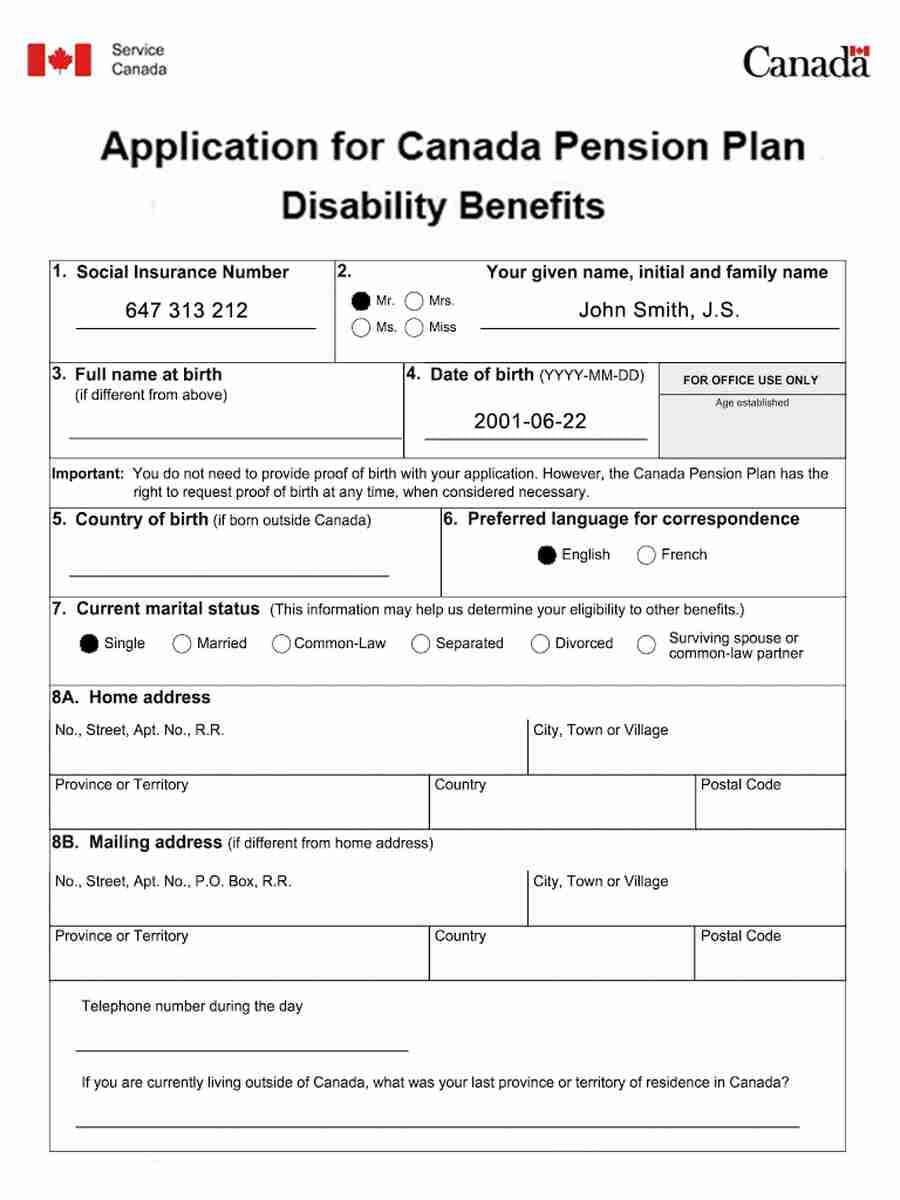

Cpp Disability Application Form Pdf Fill Out And Sign Printable Pdf

https://ekbasipym5m.exactdn.com/wp-content/uploads/CPP-Disability-form-1.jpg?strip=all&lossy=1&ssl=1

Income Tax Rebate For Handicapped U s 80 U 80 DD YouTube

https://i.ytimg.com/vi/Jrs4fApB7Fs/maxresdefault.jpg

Web 15 f 233 vr 2023 nbsp 0183 32 What tax credits are there if I have a child or a dependent with disabilities Depending on your child s age and income and your personal income you may be Web LIFECYCLESERIES This publication presents basic information about existing tax credits and benefits that may be available to qualifying taxpayers with disabilities parents of

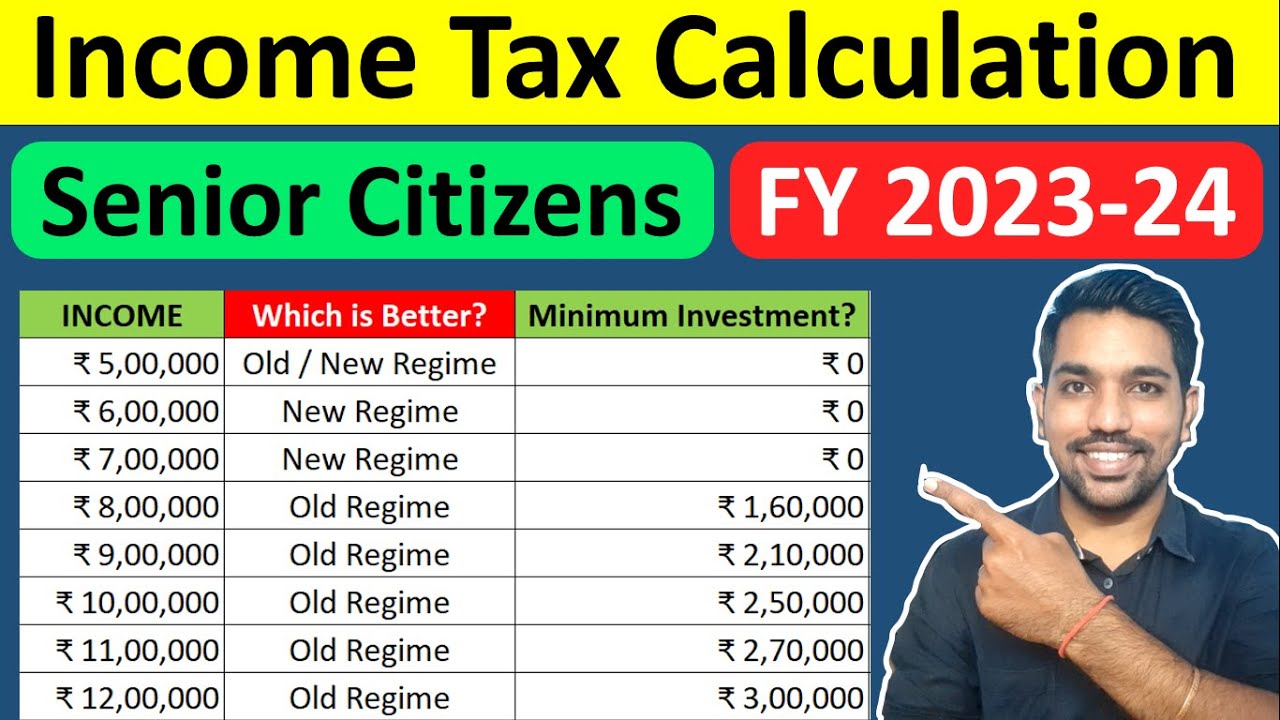

Web 23 mars 2023 nbsp 0183 32 What is Section 80DD of income tax Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled Web 20 juin 2023 nbsp 0183 32 A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions

Download Income Tax Rebate For Handicapped Child

More picture related to Income Tax Rebate For Handicapped Child

Handicapped Certificate In Mumbai Information About Guidelines To

https://taxguru.in/wp-content/uploads/2018/07/Deducation-Under-Section-80U-of-Income-Tax-Act-1961-For-Disable-Persons-1280x720.jpg

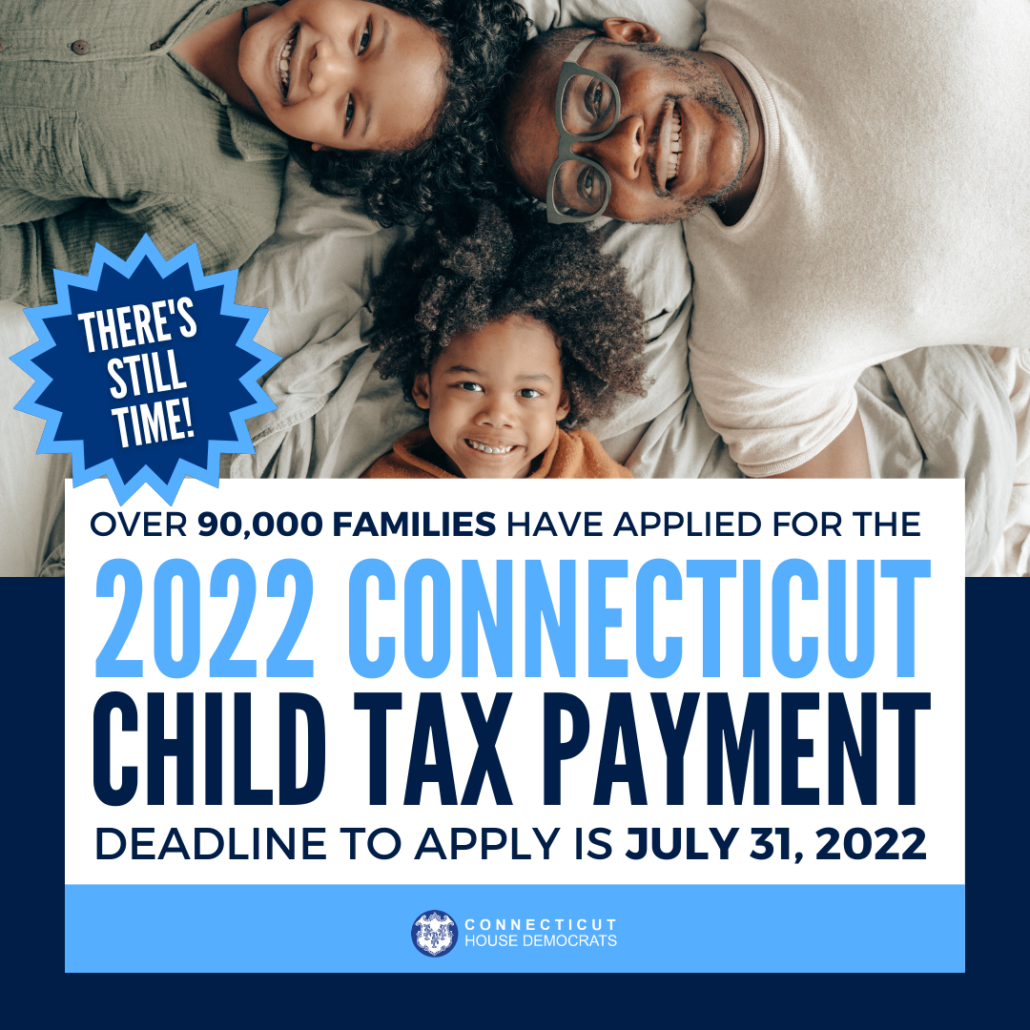

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022.png

Index Of wp content uploads 2022 03

https://www.theastuteparent.com/wp-content/uploads/2022/03/tax-savings.png

Web 6 sept 2023 nbsp 0183 32 Section 80U of the Income Tax Act of 1961 states the provisions for tax deductions or tax benefits for individual taxpayers who are suffering from a disability As Web 24 juil 2018 nbsp 0183 32 Government of India has in order to provide some relief to those who have a dependent with disability or sever disability provided some relief s from Income tax

Web Is this the first time you are claiming the relief Log in with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax Web 7 avr 2023 nbsp 0183 32 Child tax credit CTC Additional child tax ACTC Credit for other dependents ODC Child and dependent care credit Medical expense deduction

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

Child Care Rebate Income Tax Return 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/your-us-expat-tax-return-and-the-child-care-credit-when-abroad.png

https://www.irs.gov/credits-deductions/individuals/earned-income-tax...

Web 1 nov 2022 nbsp 0183 32 The qualifying child you claim for the EITC can be any age if they Have a permanent and total disability and Have a valid Social Security number If the child gets

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Web Less Parenthood Tax Rebate 1 040 Mr and Mrs Chen are sharing the PTR of 5 000 for their first child born in 2022 i e 2 500 per person Any unutilised amount of PTR will

Child Care Rebate Income Tax Return 2022 Carrebate

Pin On Tigri

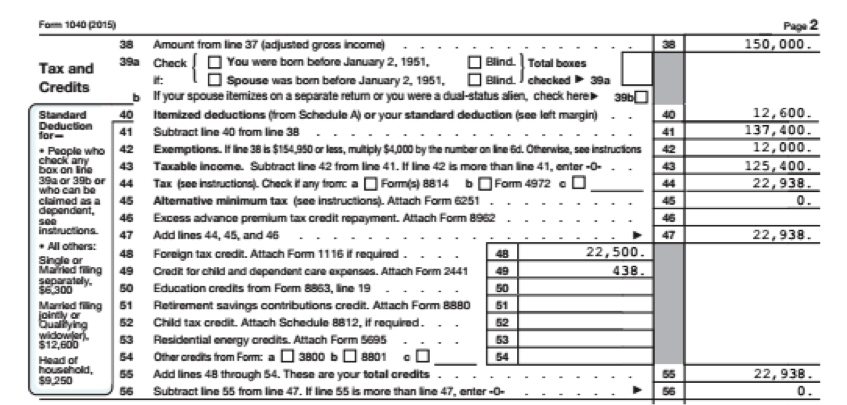

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Section 87A Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A

2022 Child Tax Rebate Stratford Crier

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate For Handicapped Child - Web LIFECYCLESERIES This publication presents basic information about existing tax credits and benefits that may be available to qualifying taxpayers with disabilities parents of