Irs Ev Fed Tax Rebate Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you Web 17 avr 2023 nbsp 0183 32 Release Date 4 19 2023 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023 Vehicle Model Year

Irs Ev Fed Tax Rebate

Irs Ev Fed Tax Rebate

https://cdn.osvehicle.com/does_ev_tax_credit_carry_over.png

Tesla Model 3 US Federal EV Tax Credit Update CleanTechnica

https://cleantechnica.com/files/2018/07/IRS-Federal-EV-tax-credit-form-8936.png

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

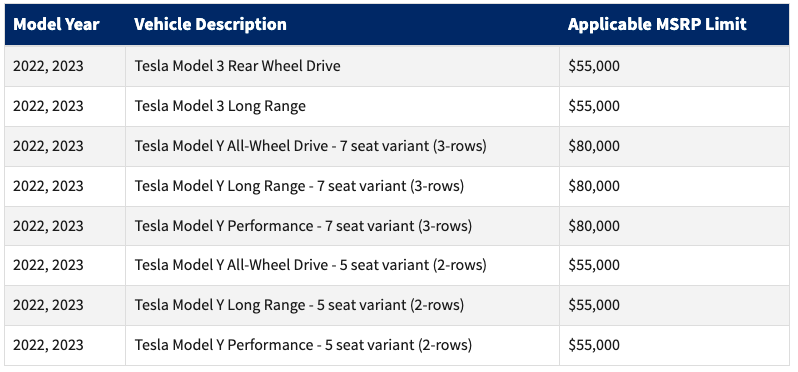

Web The information on this page should not be viewed as an official or legally binding document Other requirements or exceptions may apply For more detailed information please Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit Bestselling Chevy Bolts and Tesla Model 3s and Model Ys are

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal

Download Irs Ev Fed Tax Rebate

More picture related to Irs Ev Fed Tax Rebate

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

https://evadoption.com/wp-content/uploads/2017/07/Screen-Shot-2017-07-22-at-1.03.16-AM.png

UPDATE Here Are All The EVs Eligible Now For The 7 500 Federal Tax Credit

https://cdn.motor1.com/images/custom/tesla-models-eligible-for-federal-tax-credit.jpg

Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to Web The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric drive motor

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web 17 avr 2023 nbsp 0183 32 CNN The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than in

EV Rebates Valley Clean Energy

https://valleycleanenergy.org/wp-content/uploads/EV-rebate-infographic-english-scaled.jpeg

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

EV Rebates Valley Clean Energy

El IRS Invita A Los Consumidores A Comentar Sobre La Elegibilidad Del

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

IRS Says California Most State Tax Rebates Aren t Taxable Income

How The IRS Ignored The Inflation Reduction Act And Rejected The Most

How The IRS Ignored The Inflation Reduction Act And Rejected The Most

2018 Form IRS 8862 Fill Online Printable Fillable Blank PdfFiller

How Do I Claim The Recovery Rebate Credit On My Ta

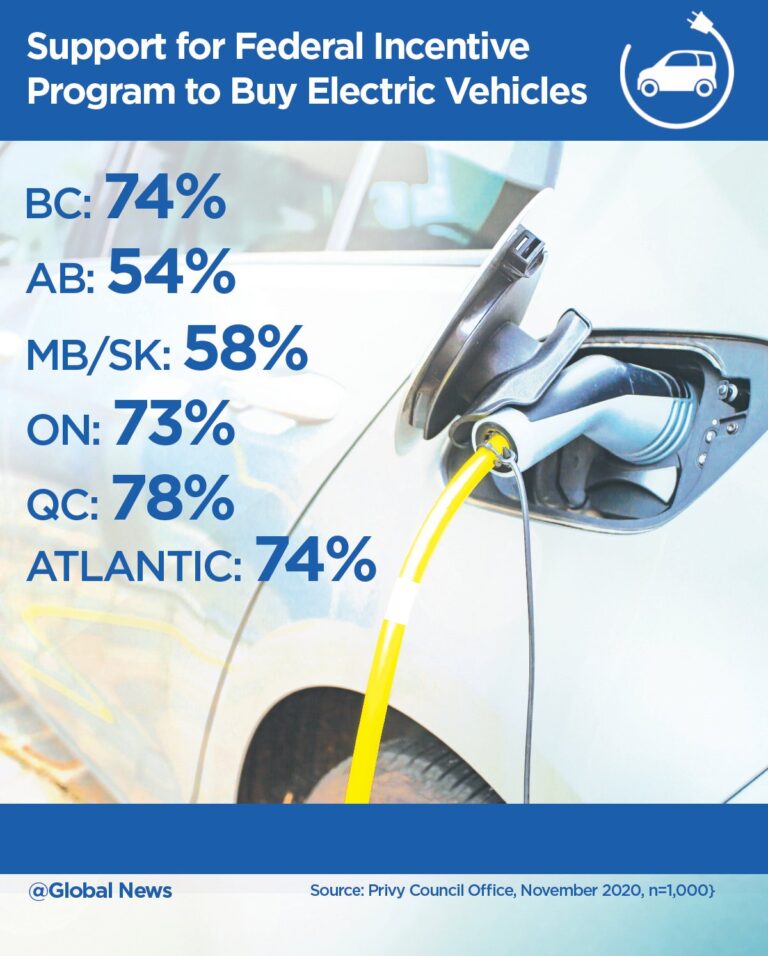

Canadians Support Federal EV Rebates Shows Internal Govt Poll

Irs Ev Fed Tax Rebate - Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of