Income Tax Rebate For Home Renovations Web 1 d 233 c 2022 nbsp 0183 32 Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and improvements to minimize your

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 20 sept 2021 nbsp 0183 32 Federal tax credits for renovations Substantial renovation tax rebate Home accessibility expenses tax credit Provincial tax credits for renovations British

Income Tax Rebate For Home Renovations

Income Tax Rebate For Home Renovations

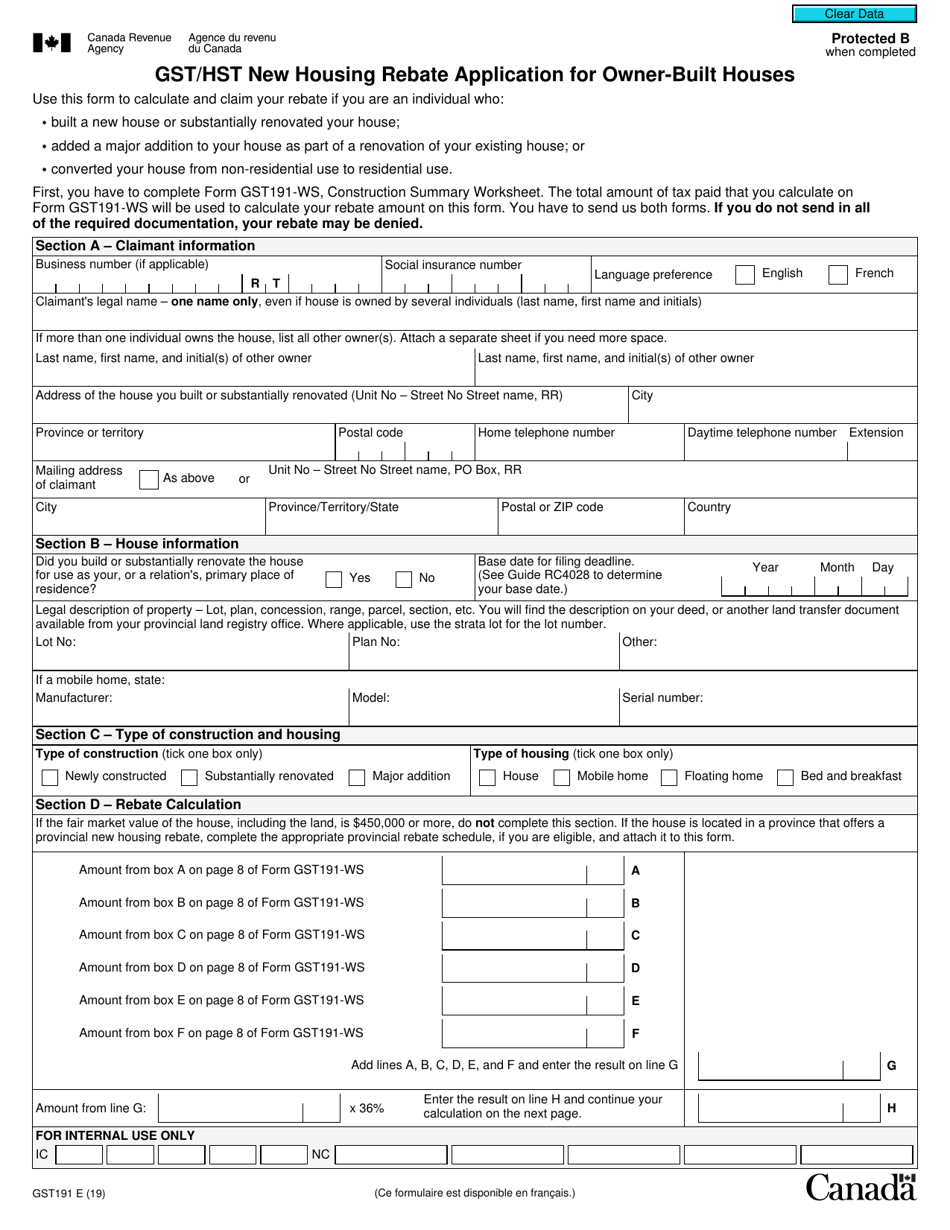

https://data.templateroller.com/pdf_docs_html/2030/20309/2030941/form-gst191-gst-hst-new-housing-rebate-application-for-owner-built-houses-canada_print_big.png

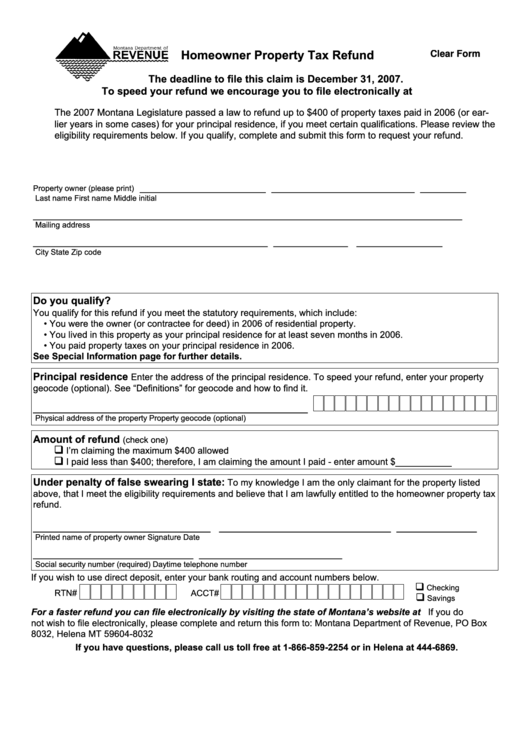

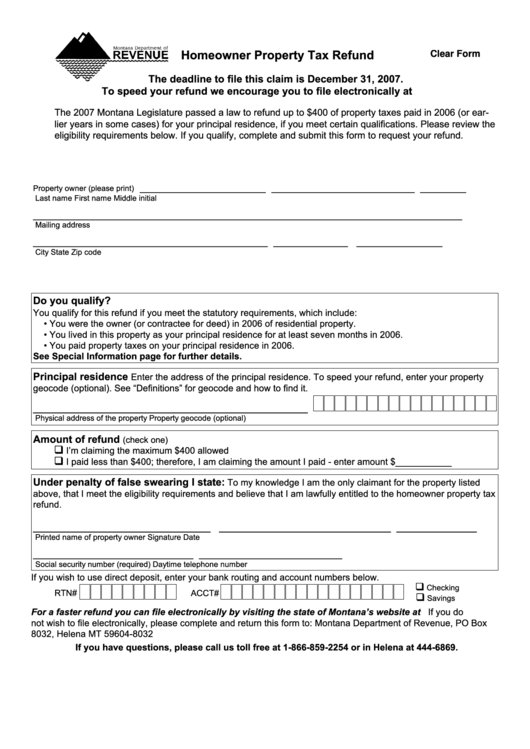

Fillable Homeowner Property Tax Refund Form Montana Department Of

https://data.formsbank.com/pdf_docs_html/177/1774/177484/page_1_thumb_big.png

Pin On Home Renovation Rebates

https://i.pinimg.com/736x/6f/b1/b3/6fb1b36225619470910b502e46aa736c.jpg

Web 9 sept 2022 nbsp 0183 32 The per household rebate is capped at 14 000 and households can t receive two rebates for the same upgrade For instance if they claim a HOMES Rebate Web 22 juin 2023 nbsp 0183 32 Tax refund You re probably familiar with this one already You ll get a refund if you pay more in taxes say through your paycheck withholdings than you actually

Web 1 ao 251 t 2023 nbsp 0183 32 Federal Tax Deductions for Home Renovation americantax August 1 2023 Deductions There are many strategies to use for house remodeling and upgrades to Web 9 ao 251 t 2023 nbsp 0183 32 IBD Personal Finance New Tax Rules Can Save You Thousands on Home Renovations Coming rebates for energy efficient upgrades can be combined with

Download Income Tax Rebate For Home Renovations

More picture related to Income Tax Rebate For Home Renovations

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

Ontario Home Renovation Rebates Which Are Right For You

https://www.gni.ca/uploads/upload/GNI-HER-Infographic.jpg

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Web 25 ao 251 t 2022 nbsp 0183 32 The Home Renovation Incentive HRI is a relief from Income Tax IT for homeowners and landlords You can claim the HRI Tax Credit for repairs renovations Web 12 oct 2022 nbsp 0183 32 The government will soon start reimbursing you for energy efficiency home improvements saving you money now and later Here s How You Can Get Up to 14 000 For Home Renovations CNET

Web Under Section 24 of the Indian Income Tax Act 1961 the interest that is payable on the home improvement loan is however tax deductible for up to Rs 30 000 p a This forms a Web 21 juin 2022 nbsp 0183 32 The tax credit previously provided 15 of up to 10 000 of eligible expenses but thanks to the new federal budget the limit will be increased to 20 000 for a total

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

https://i.pinimg.com/originals/02/f3/92/02f392640ab964797e6b4571b46692df.png

Top 6 Home Renovation Rebates And Tax Credits For 2021 2022

https://renco.ca/wp-content/uploads/2017/11/HST-ontario-home-renovation-rebate-program.jpg

https://turbotax.intuit.com/tax-tips/home-own…

Web 1 d 233 c 2022 nbsp 0183 32 Renovation of a home is not generally an expense that can be deducted from your federal taxes but there are a number of ways that you can use home renovations and improvements to minimize your

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

Solved Janice Morgan Age 24 Is Single And Has No Chegg

New Housing Tax Rebate Canada Home Tax Rebate

P55 Tax Rebate Form By State Printable Rebate Form

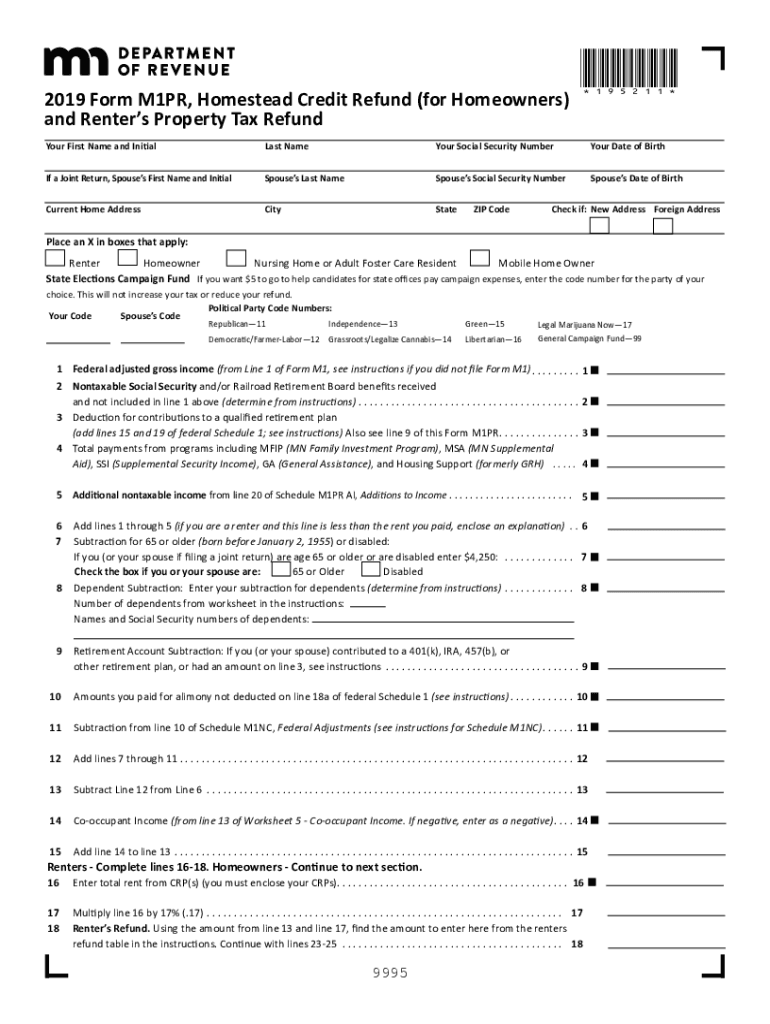

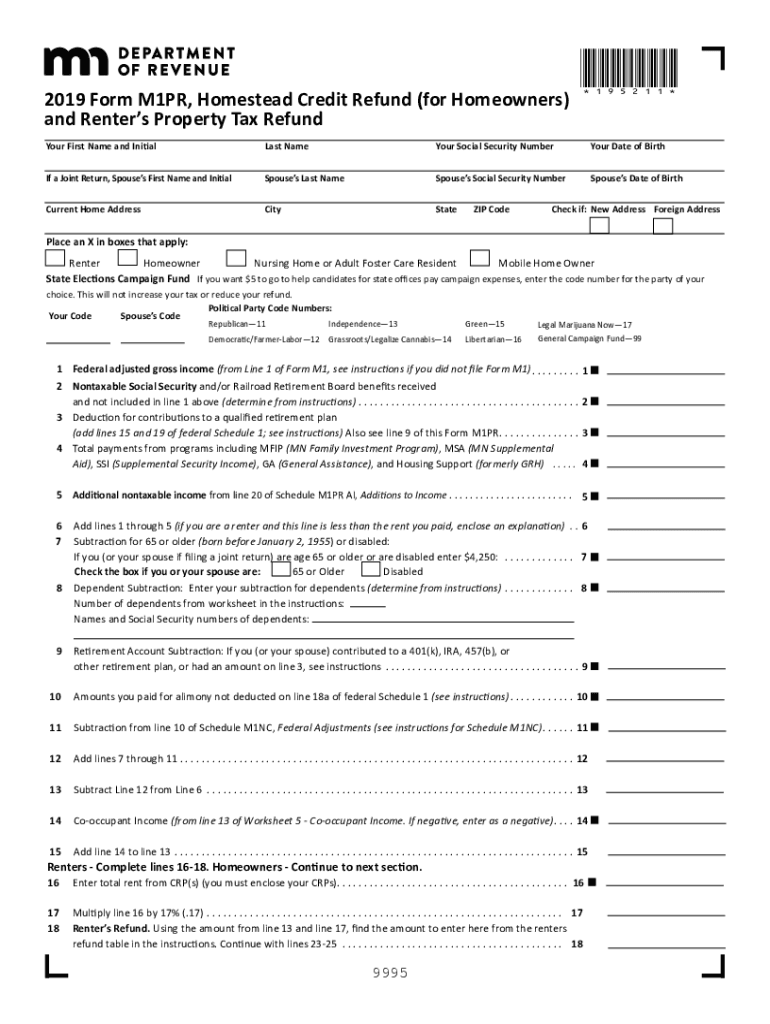

M1pr Form Fill Out Sign Online DocHub

M1pr Form Fill Out Sign Online DocHub

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Solved Janice Morgan Age 24 Is Single And Has No Chegg

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

Income Tax Rebate For Home Renovations - Web 9 ao 251 t 2023 nbsp 0183 32 IBD Personal Finance New Tax Rules Can Save You Thousands on Home Renovations Coming rebates for energy efficient upgrades can be combined with