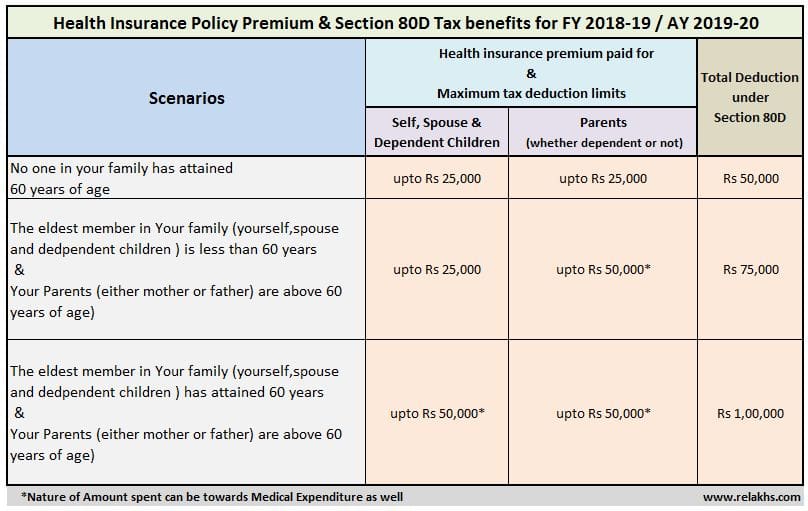

Income Tax Rebate For Medical Treatment Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner RM8000

Web 18 mai 2021 nbsp 0183 32 IR 2021 115 May 18 2021 WASHINGTON The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for Web 12 juin 2020 nbsp 0183 32 There are primarily three ways of funding your medical expenses 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried

Income Tax Rebate For Medical Treatment

Income Tax Rebate For Medical Treatment

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

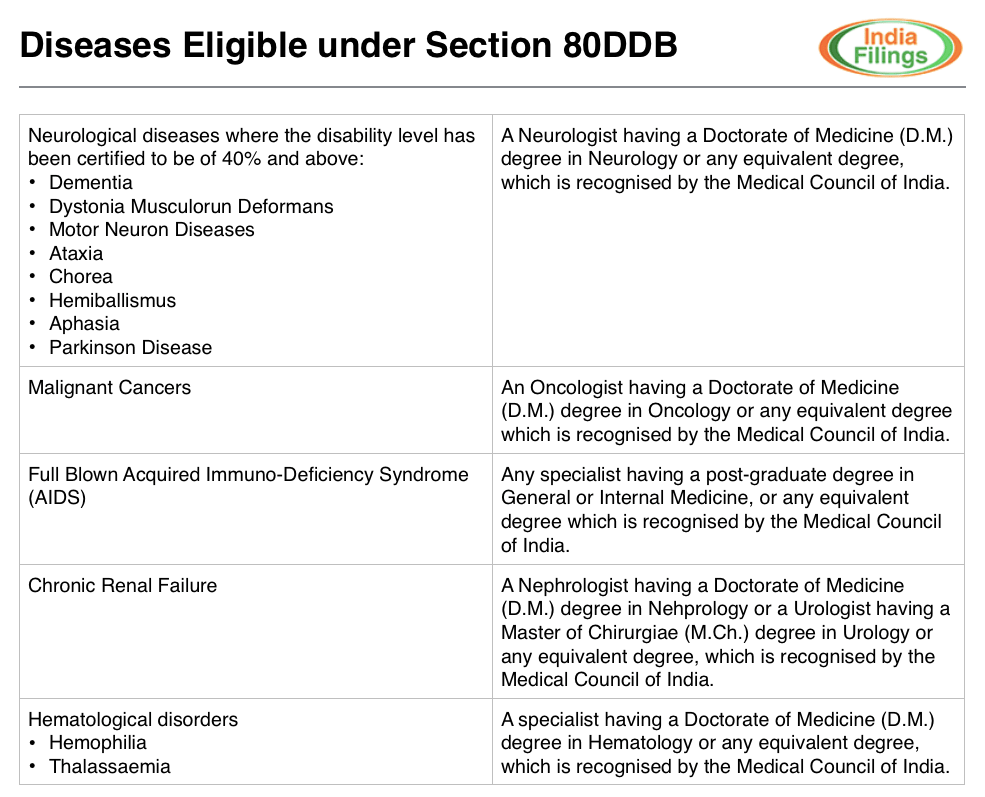

Income Tax Deduction For Medical Treatment IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2017/10/Diseases-Eligible-for-Deduction-under-Section-80DDB.png

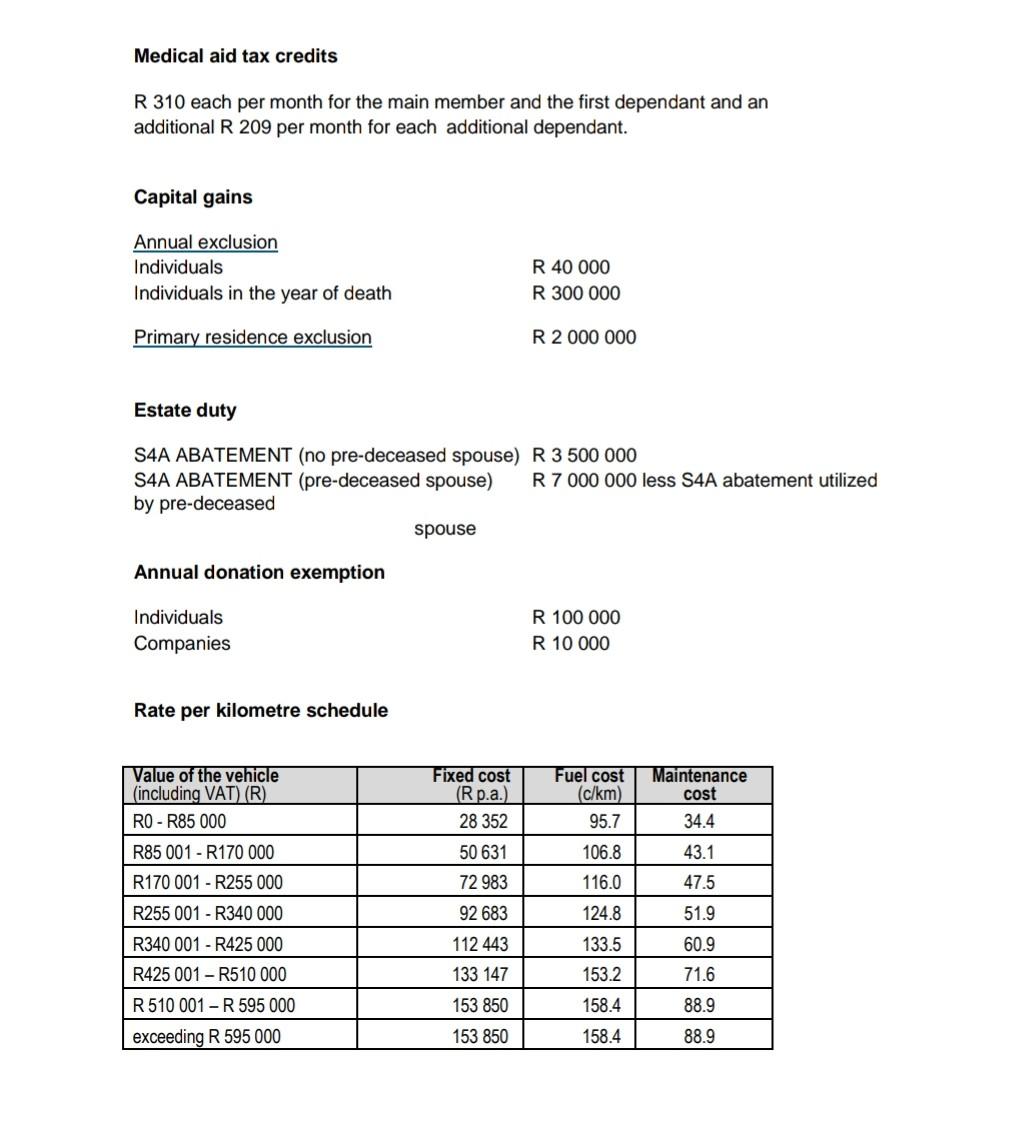

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

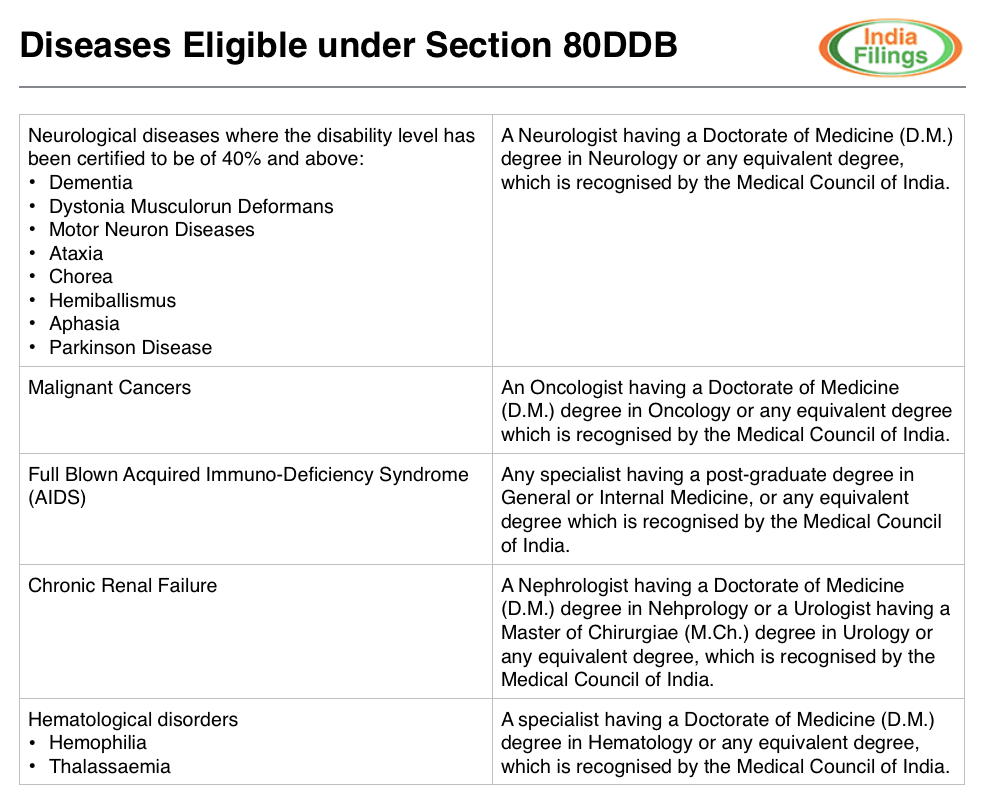

Web The taxpayer is eligible for tax deduction of Rs 40 000 or the actual amount paid for medical treatment whichever is lower Senior citizens between the ages of 60 years and Web 18 nov 2021 nbsp 0183 32 Updated on 12 Jul 2023 Section 80DDB of the Income Tax Act 1961 has gained its popularity in recent years You can claim a tax deduction against the

Web 55 Deduction in respect of medical treatment etc 80DDB Where an assessee who is resident in India has during the previous year actually paid any amount for the medical Web 26 nov 2020 nbsp 0183 32 Deduction for medical treatment of a dependent who is a person with disability Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a

Download Income Tax Rebate For Medical Treatment

More picture related to Income Tax Rebate For Medical Treatment

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

https://3.bp.blogspot.com/-4Id9T3np6TI/W7YTc5WnDBI/AAAAAAAASjk/QbYRDVMQcsQoXHoU4geurcLL1b1We92VgCLcBGAs/s1600/DEDUCTION%2BFOR%2BMEDICAL%2BINSURANCE%2BPREMIUM-PREVENTIVE%2BHEALTH%2BCHECK%2BUP%2B-MEDICAL%2BTREATMENT%2BSECTION%2B80D.png

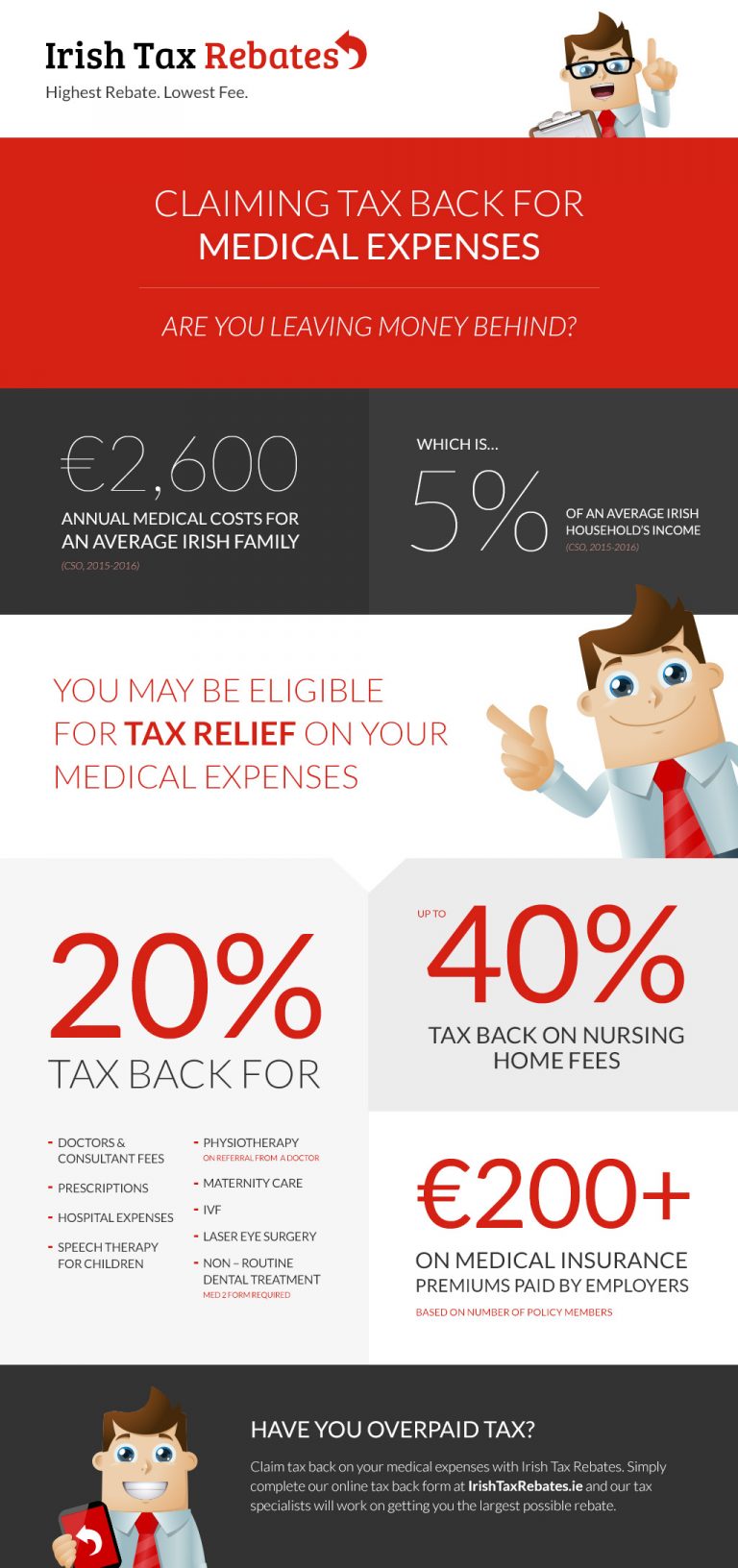

Tax Back On Medical Expenses Infographic Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1-768x1632.jpg

Solved QUESTION TWO 30 MARKS The Following Information Is Chegg

https://media.cheggcdn.com/study/ae2/ae2e3510-2d3b-40ee-8f9c-99f39b17ccc4/image

Web 26 d 233 c 2022 nbsp 0183 32 Taxpayers would be required to pay income tax on expenses that surpass Rs 15 000 if they exceed that amount For reimbursement of medical expenses up to Rs 15 000 the employer will Web 2 nov 2015 nbsp 0183 32 Section 80DDB Income tax Act 1961 2015 Medical Treatment Income Tax Rebate under section 80DDB provides rebate in respect of Medical Treatment

Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s Web 13 f 233 vr 2020 nbsp 0183 32 Any money paid by an employee for obtaining medical treatment for him or her or family upto a maximum of Rs 15 000 will be tax free Also the expenses incurred

National Budget Speech 2022 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/tax-rate-tables.png

T20 0262 Additional 2020 Recovery Rebates For Individuals In The

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0262_0.gif

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner RM8000

https://www.irs.gov/newsroom/irs-provides-guidance-on-premium...

Web 18 mai 2021 nbsp 0183 32 IR 2021 115 May 18 2021 WASHINGTON The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

National Budget Speech 2022 SimplePay Blog

Epf Contribution Table For Age Above 60 2019 Frank Lyman

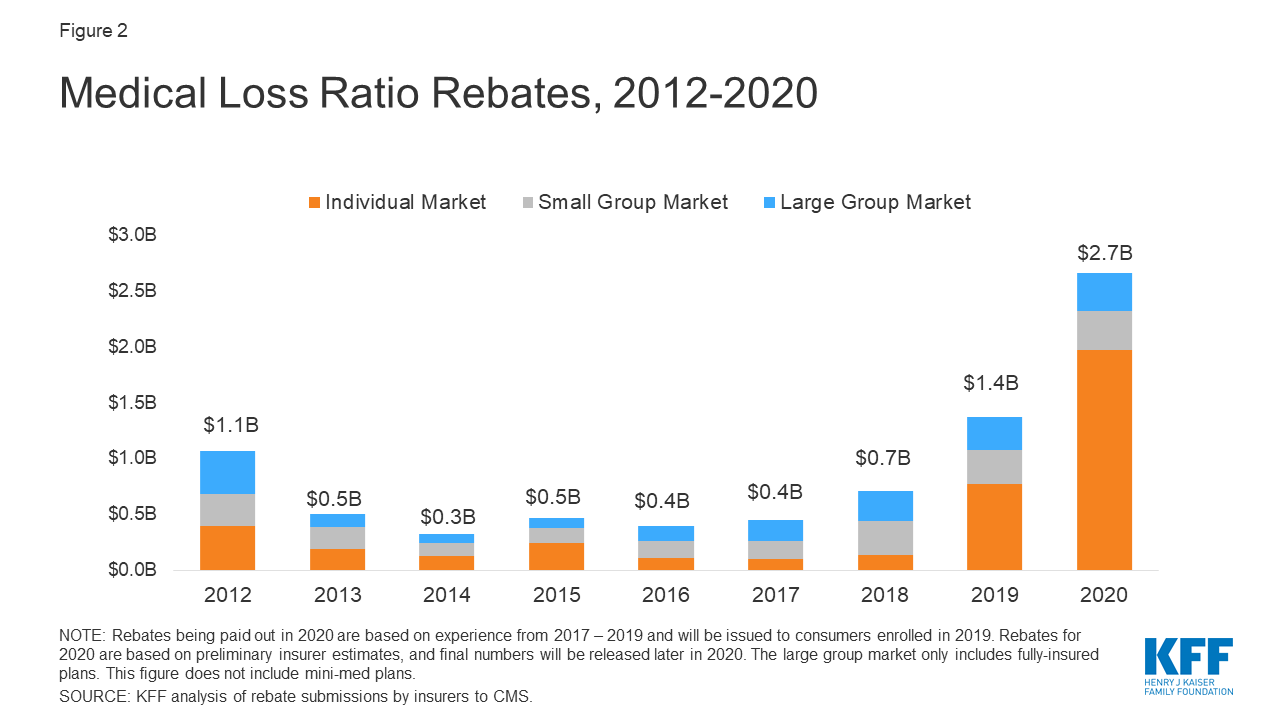

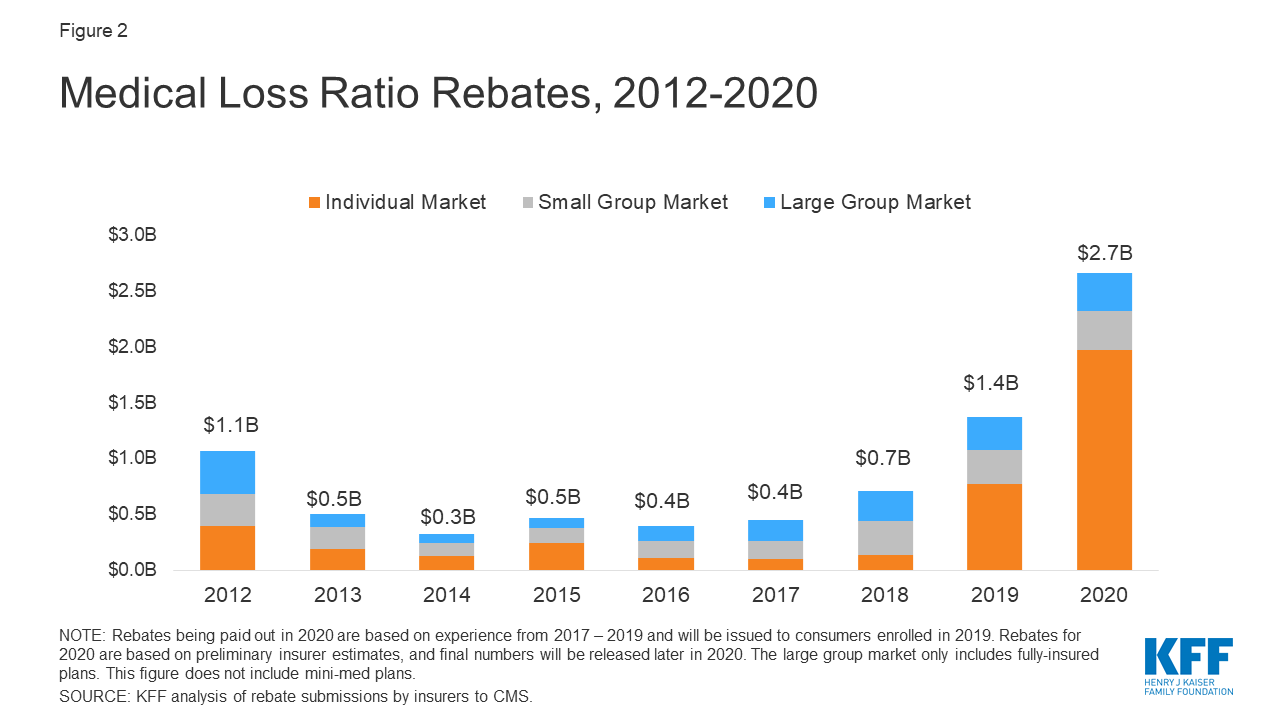

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

In SA Tax Credits For Medical Aid Contributions eBiz Money

Data Note 2020 Medical Loss Ratio Rebates KFF

Data Note 2020 Medical Loss Ratio Rebates KFF

How To Calculate Tax Rebate On Home Loan Grizzbye

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate For Medical Treatment - Web 18 nov 2021 nbsp 0183 32 Updated on 12 Jul 2023 Section 80DDB of the Income Tax Act 1961 has gained its popularity in recent years You can claim a tax deduction against the