Indiana Tax Rebate 2024 Eligibility Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

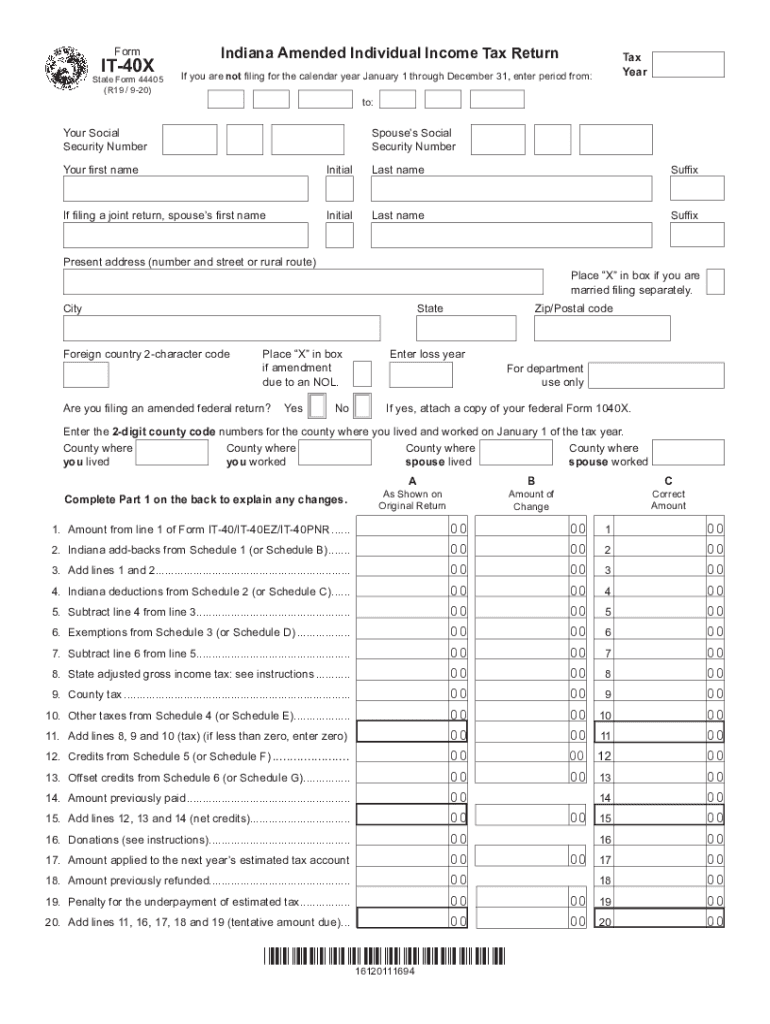

The Indiana Department of Revenue DOR officially launches the 2024 individual income tax filing season following the Internal Revenue Service s schedule Commencing on January 29 2024 Hoosiers are encouraged to embrace electronic filing online payment and direct deposit for accurate and expedited tax returns and refunds Photo from Google You are eligible to claim the Automatic Taxpayer Refund ATR 200 refundable tax credit only if ALL the following statements are true You are a full year Indiana resident You did NOT receive the 325 ATR or 650 ATR for married fling jointly You received Social Security benefts in 2022

Indiana Tax Rebate 2024 Eligibility

Indiana Tax Rebate 2024 Eligibility

https://www.pdffiller.com/preview/536/231/536231109/large.png

Nebraska Tax Rebate 2024 Eligibility Application Deadline Status PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

Who Is Eligible For The Council Tax Rebate Eligibility For The 150 Support And Payment

https://worldcitieschess.com/wp-content/uploads/2022/08/Who-is-eligible-for-the-council-tax-rebate-Eligibility-for-1024x683.jpg

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief DOR Individual Income Taxes Filing My Taxes Tax Credits Learn what tax credits you can claim on your Indiana individual income tax return You can find all available credits listed below including a brief description which forms and schedules to use and who is eligible To learn more about each credit simply click on the credit name below

The rebates may become available to Hoosiers as early as mid to late 2024 However this is subject to change based on receiving federal approval In the meantime consumers may be eligible for federal tax credits should a replacement be required before program implementation 4 My current energy equipment is old about to die Friday afternoon the Indiana House voted 93 2 on House Bill 1001 to send those relief checks to nearly every adult in the state All residents who file a tax return would automatically be eligible to receive the 225 450 for married couples filing jointly

Download Indiana Tax Rebate 2024 Eligibility

More picture related to Indiana Tax Rebate 2024 Eligibility

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

Get Up To 1 300 In Tax Rebates Eligibility Criteria

https://www.lamansiondelasideas.com/wp-content/uploads/2023/08/August-2023-1300-Tax-Rebate.jpg

On May 4 2023 Indiana Governor Eric Holcomb signed into law HB 1001 which starting in 2024 accelerates the personal income tax cuts passed in 2022 under HB 1002 and eliminates the contingency of meeting state budget thresholds for those tax cuts to apply Current law HB 1002 enacted in 2022 lowered the personal income tax rate from 3 23 to 3 15 for tax years 2023 and 2024 The individual income tax rate has been reduced from 3 15 percent to 3 05 percent in 2024 with further reductions to 3 0 percent in 2025 2 95 percent in 2026 and 2 9 percent in 2027 and

INDIANAPOLIS AP Indiana lawmakers on Thursday approved expanding the number of people eligible for anticipated 125 payments this spring under the state s automatic taxpayer refund law Those payments are being made because of a big jump in state tax collections helped by federal COVID 19 relief funding That revenue jump pushed up the state government cash reserves to a record 3 9 The Indiana Department of Revenue notes the eligibility requirements for the two refunds are different Although all who were eligible for the initial 125 payment qualify for the subsequent

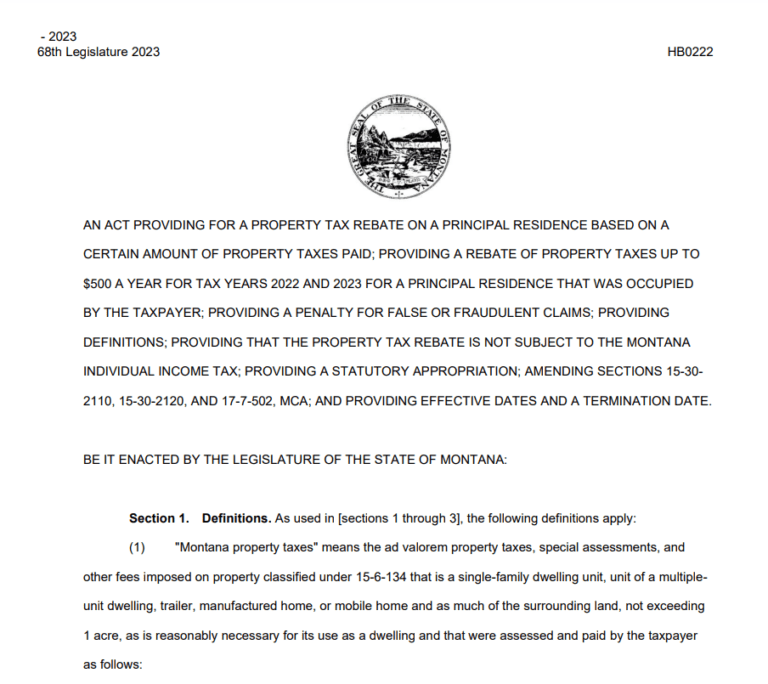

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Montana-Tax-Rebate-2023-768x684.png

GSTV U Save And S CC Rebates 950 000 Eligible Households To Receive Payouts Starting April

https://humanresourcesonline-assets.b-cdn.net/images/hr-sg/content-images/priya_apr_2023_mofsingapore_gstusave_gstscc_payouts_mofsingaporefb.jpg?auto_optimize=medium

https://www.kiplinger.com/taxes/state-stimulus-checks

Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

https://omdnews.com/2024/01/22/indiana-department-of-revenue-opens-2024-tax-filing-season/

The Indiana Department of Revenue DOR officially launches the 2024 individual income tax filing season following the Internal Revenue Service s schedule Commencing on January 29 2024 Hoosiers are encouraged to embrace electronic filing online payment and direct deposit for accurate and expedited tax returns and refunds Photo from Google

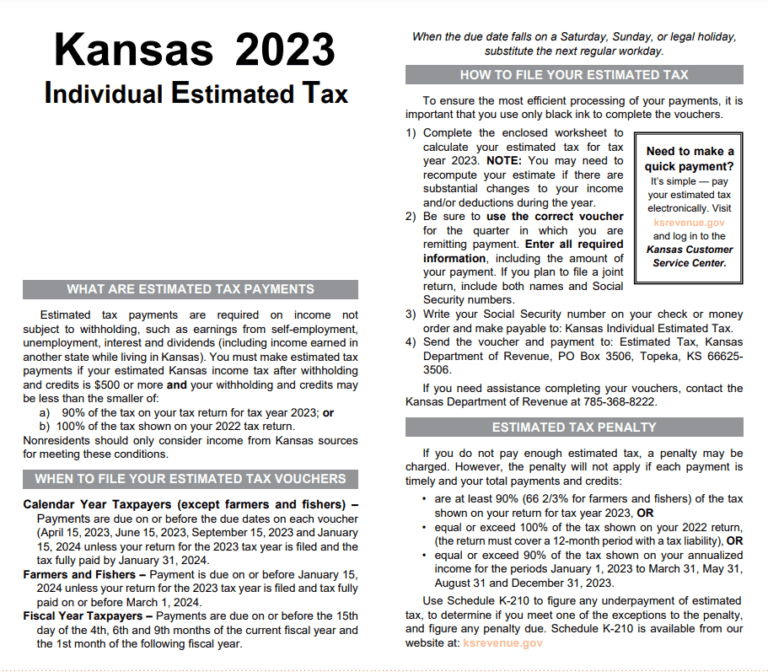

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

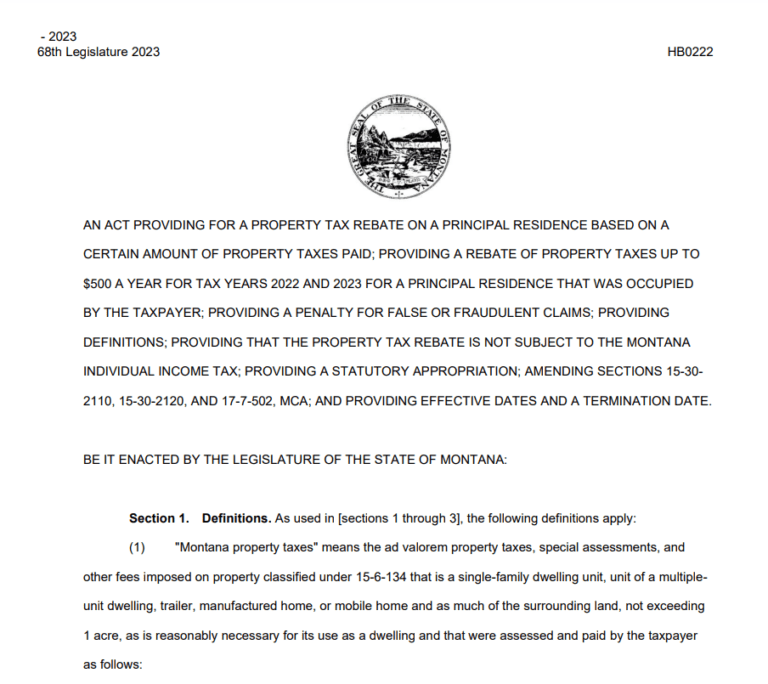

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Eligibility For Homeowners Tax Rebate YouTube

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Indiana Tax Cap Proposal Would Help Homeowners But Hurt School Corporations Indiana Capital

Indiana Tax Cap Proposal Would Help Homeowners But Hurt School Corporations Indiana Capital

Income Tax Rebate Under Section 87A Eligibility Tax Deductions Exemptions Rebate Amount

Property Tax Rebate Pennsylvania LatestRebate

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained Rebate2022

Indiana Tax Rebate 2024 Eligibility - Currently 1 600 of the 2 000 credit per child is refundable The credit s phaseout threshold is 400 000 for married earners filing jointly and 200 000 for head or single households At the