Income Tax Rebate For New Furnace Web 1 janv 2023 nbsp 0183 32 If you make home improvements for energy efficiency you may qualify for an annual tax credit up to 3 200 If you make qualified energy efficient improvements to

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat Web 13 avr 2023 nbsp 0183 32 How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax

Income Tax Rebate For New Furnace

Income Tax Rebate For New Furnace

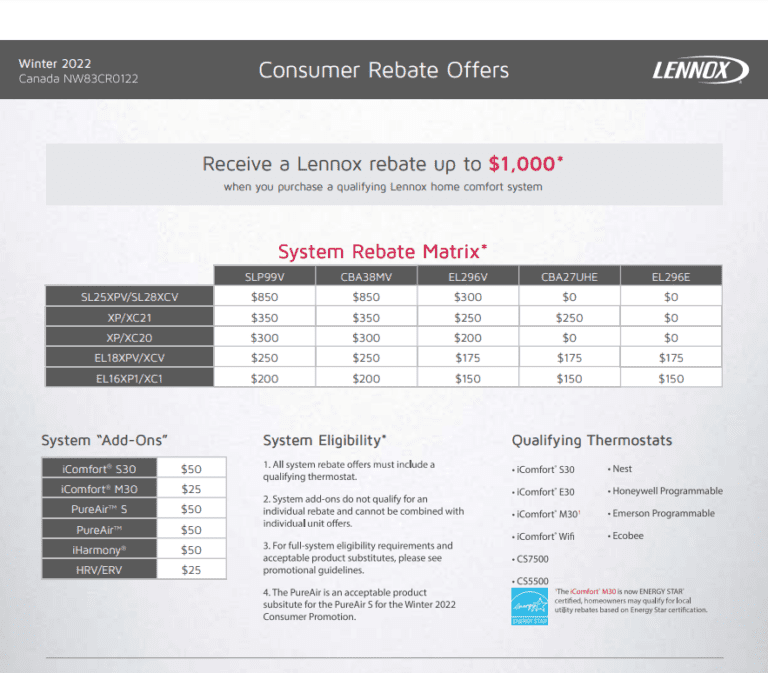

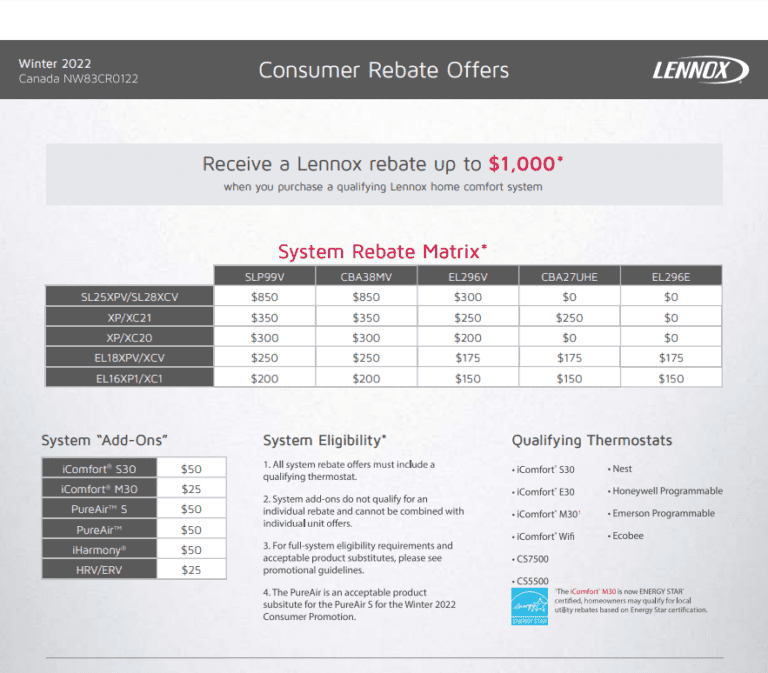

https://printablerebateform.net/wp-content/uploads/2022/11/Lennox-Rebate-Form-768x673.png

Government Rebate For Furnaces Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Government-Rebate-for-Furnaces-2022.png

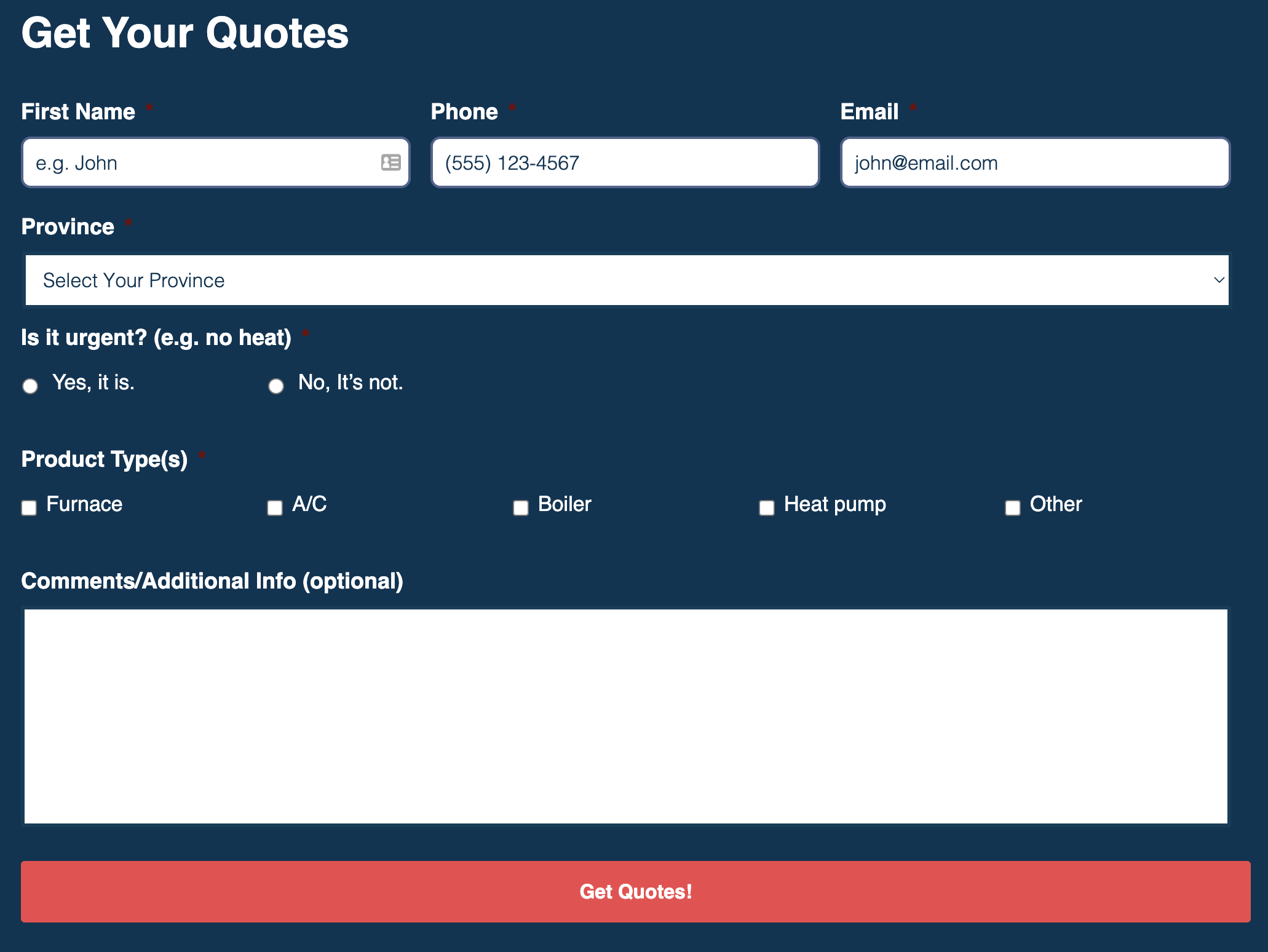

Rebate For New Furnace 2022 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/fortis-rebates-for-furnaces-2020-tek-climate-heating-and-air-conditioning.jpg

Web 16 janv 2023 nbsp 0183 32 What Tax Credits are Available for All Homeowners Houston residents have access to tax credits equal to up to 30 of the cost of installing new HVAC Web 9 sept 2022 nbsp 0183 32 The per household rebate is capped at 14 000 and households can t receive two rebates for the same upgrade For instance if they claim a HOMES Rebate

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

Download Income Tax Rebate For New Furnace

More picture related to Income Tax Rebate For New Furnace

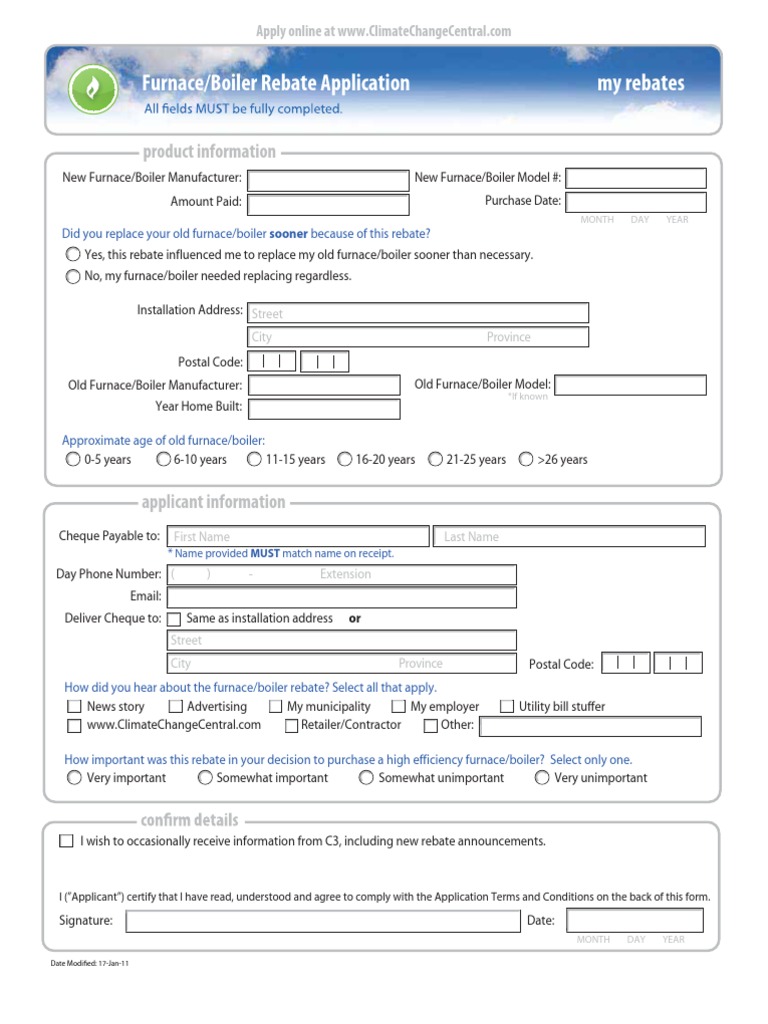

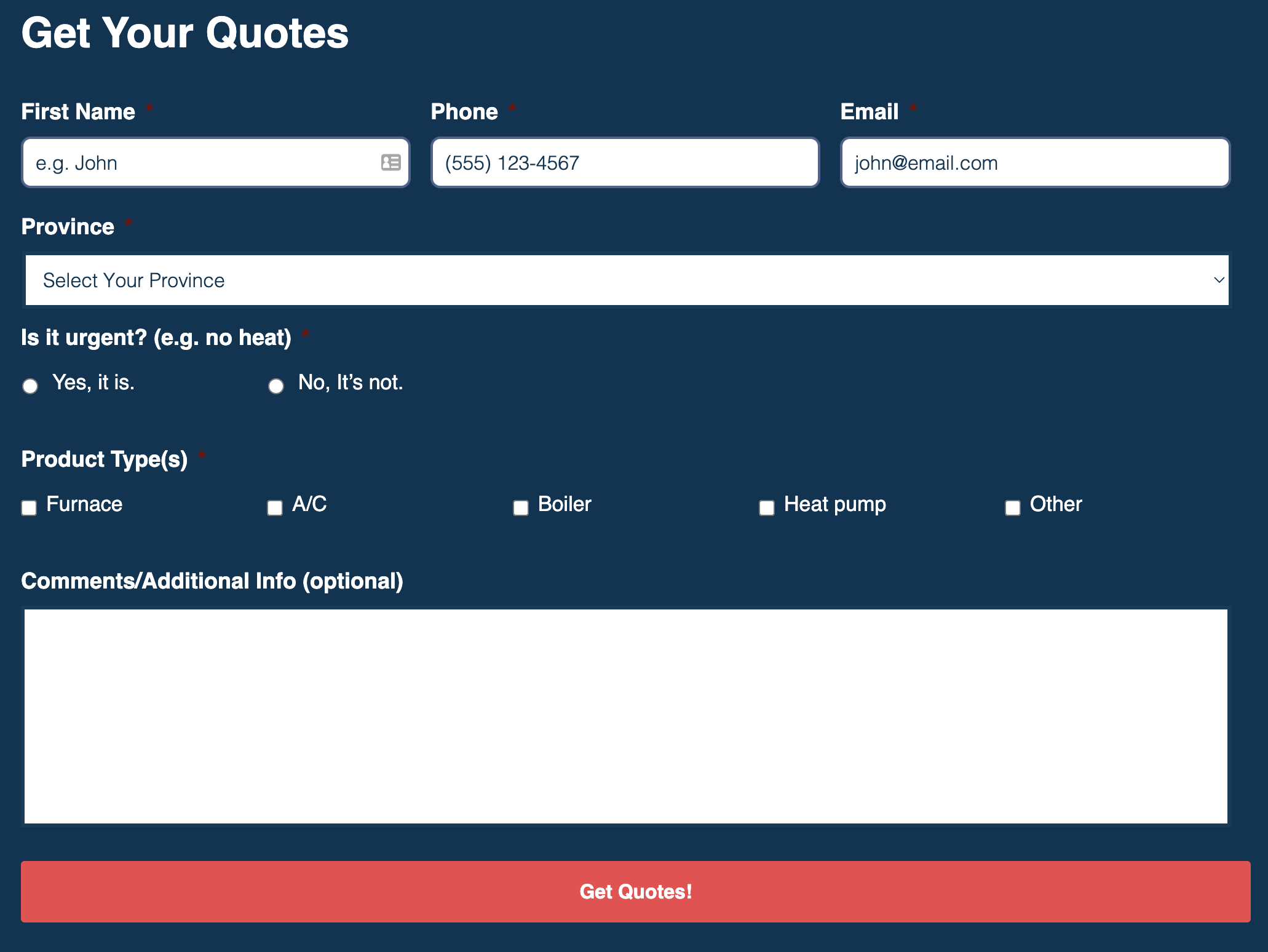

Furnace Boiler Rebate Application My Rebates Product Information

https://imgv2-1-f.scribdassets.com/img/document/62124828/original/f72eceff81/1591130690?v=1

Tds Slab Rate For Ay 2019 20

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

INCOME TAX REBATES FOR FY 20 21

http://www.plannprogress.com/uploads/4/1/7/0/41706423/published/590533831_1.jpg?1598940645

Web 13 f 233 vr 2023 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 The limit includes a maximum credit of 1 200 for any combination of home energy Web 7 f 233 vr 2023 nbsp 0183 32 The IRA Also Created 2 New Energy Rebate Programs In addition to the makeover of the 2 federal energy tax credit programs the Inflation Reduction Act also created 2 completely new energy rebate

Web Beginning in 2023 you could be eligible for a tax credit of up to 2 000 for qualifying heat pumps and heat pump water heaters under the new tax guidelines included in the Inflation Reduction Act This annual credit is Web 26 juil 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take

Rebates Incentives Advanced Technology Heating Cooling Systems

https://advancedtechnologyheatingandcooling.com/files/2020/08/NYS-Clean-Heat-Statewide-Heat-Pump-Program_page-0001.jpg?&a=t

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make home improvements for energy efficiency you may qualify for an annual tax credit up to 3 200 If you make qualified energy efficient improvements to

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Rebates Incentives Advanced Technology Heating Cooling Systems

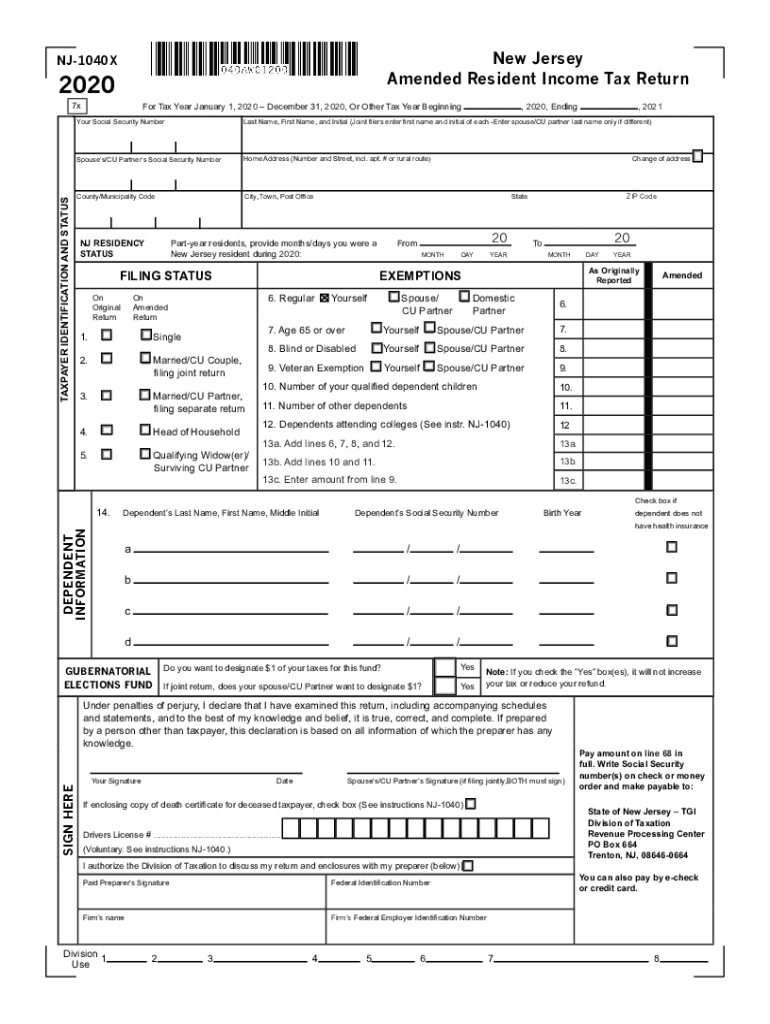

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

Solved Janice Morgan Age 24 Is Single And Has No Chegg

P55 Tax Rebate Form Business Printable Rebate Form

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

What To Know About Montana s New Income And Property Tax Rebates

Pin On Tigri

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate For New Furnace - Web 16 janv 2023 nbsp 0183 32 What Tax Credits are Available for All Homeowners Houston residents have access to tax credits equal to up to 30 of the cost of installing new HVAC