Income Tax Rebate For Senior Citizens In India Web Income Tax slabs for Super Senior citizens 80 years and above in age New Personal Income Tax Regime 115BAC INCOME SLAB RATE OF INCOME TAX Upto Rs

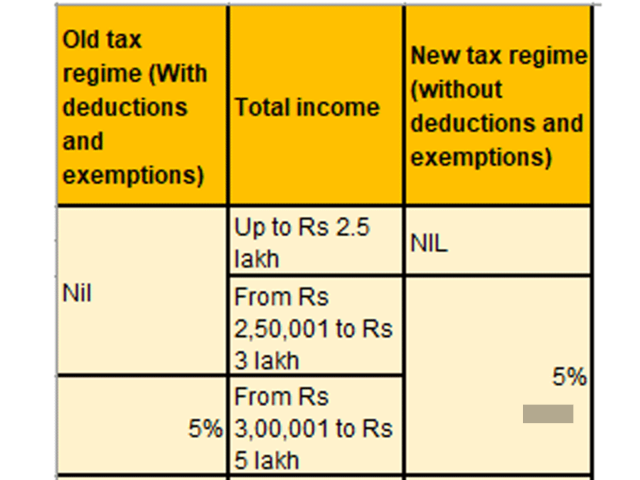

Web 11 janv 2023 nbsp 0183 32 If they are earning salary or pension income they can claim a deduction of Rs 50 000 from such income Tax rebate under Section 87A In case of senior citizens Web 22 avr 2023 nbsp 0183 32 Income Up to Rs 5 lakh to Rs 6 lakh Tax on income from Rs 5 lakh to Rs 6 lakh is 5 for FY 2023 24 However with the new tax rebate income up to Rs 7 lakh is

Income Tax Rebate For Senior Citizens In India

Income Tax Rebate For Senior Citizens In India

https://static.wixstatic.com/media/78f35a_bd55247cf7cc4428b1d9d1697f6e5542~mv2.png/v1/fill/w_600,h_237,al_c,usm_0.66_1.00_0.01/Tax Slabs2_FY 2019-20_PNG.png

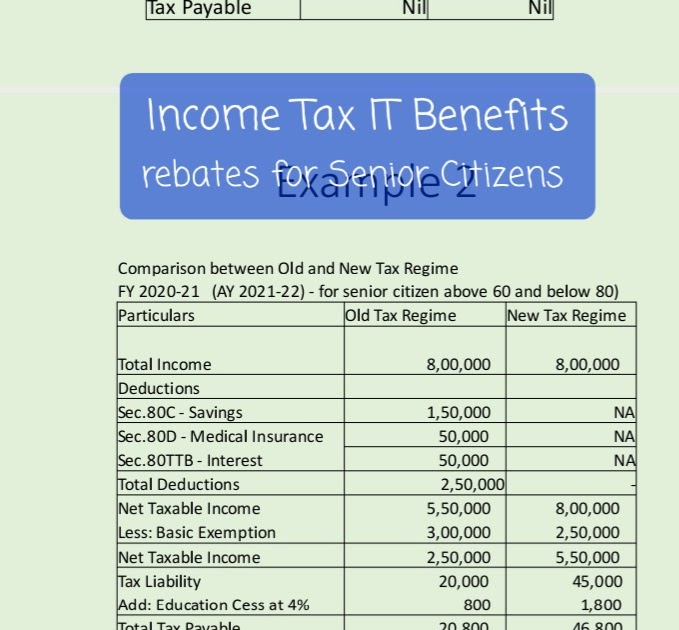

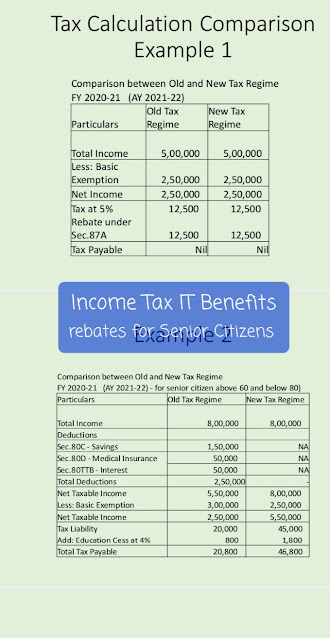

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

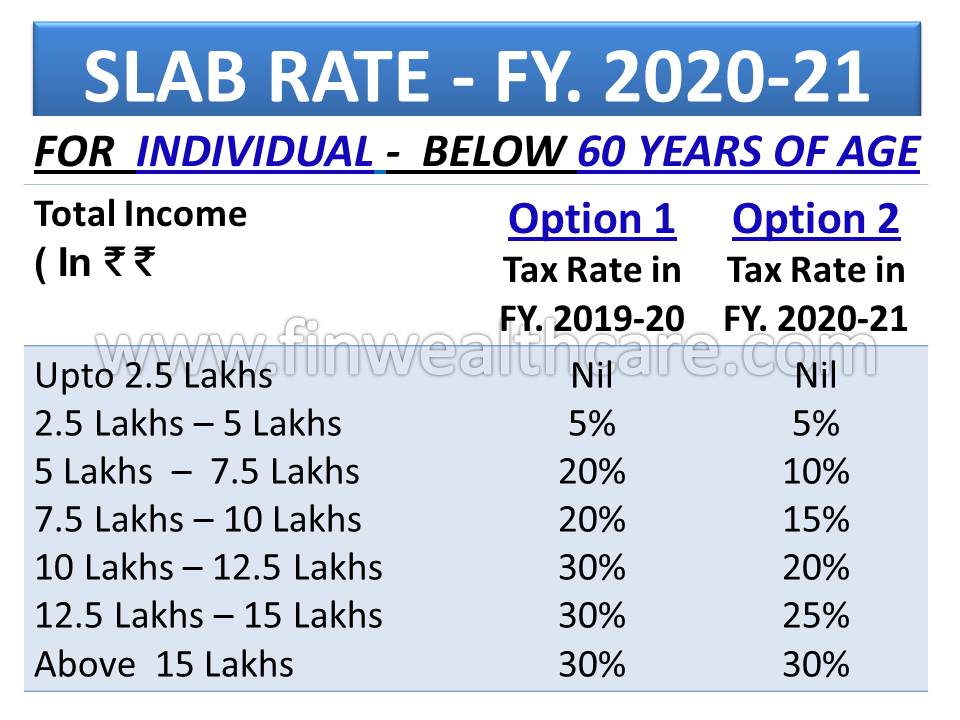

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

https://static.wixstatic.com/media/c43a2f_cb9ae79d3a48408f9bfea6c2295db169~mv2.jpg/v1/fill/w_626,h_230,al_c,q_90/c43a2f_cb9ae79d3a48408f9bfea6c2295db169~mv2.jpg

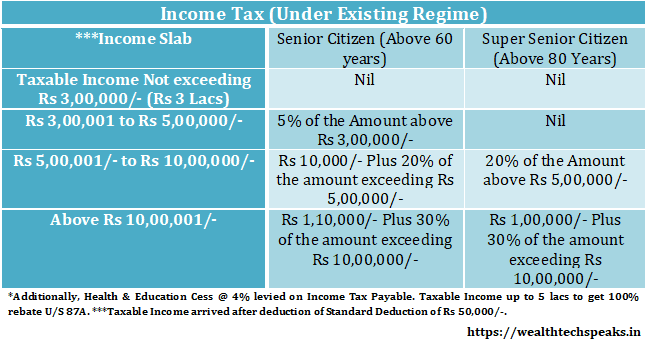

Web 30 juil 2021 nbsp 0183 32 Taxable Income Slab The taxable income slab for senior citizens between 60 and 80 years of age starts at Rs 3 lakh and that of super senior citizens starts at Rs 5 Web 30 juil 2023 nbsp 0183 32 Apply Basic Exemption Limit As per the income tax slab rates senior citizens are eligible for a higher basic exemption limit than non senior citizens The basic

Web TDS from Pension and Interest Income of specified Senior Citizen A resident individual is not required to file an income tax return where tax has been deducted under section Web 1 f 233 vr 2023 nbsp 0183 32 This will make him her eligible for a rebate of Rs 12 500 under section 87A in the old tax regime On the other hand if the same pensioner opts for a new tax regime then he she can claim the standard deduction

Download Income Tax Rebate For Senior Citizens In India

More picture related to Income Tax Rebate For Senior Citizens In India

Income Tax Slab 2020 21 Change ITR 4 Schema Version For AY 2020 21

https://1.bp.blogspot.com/-XWrNqxy2NuU/XsNXcy2mKeI/AAAAAAAAAYI/Nk2INOm42ek1bjAHZ_hursoGCNHhKY42wCLcBGAsYHQ/s1600/new-income-tax-slab-2020-21-india-vs-old-for-individuals.jpg

Latest Income Tax Slab Rates For FY 2022 23 FY 2021 22

https://img.etimg.com/thumb/width-640,height-480,imgsize-115679,resizemode-1,msid-92891924/wealth/web-stories/latest-income-tax-slab-rates-for-fy-2021-22-and-2022-23/income-tax-slabs-and-rates-for-senior-citizens.jpg

Income Tax Slabs Senior Citizen FY 2020 21 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2020/02/Existing-Senior-Citizen-Tax.png

Web 5 ao 251 t 2021 nbsp 0183 32 The maximum amount of income up to which the income tax department does not charge income tax is Rs 3 lakh for senior citizens and Rs 5 lakh for super senior Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of

Web 22 avr 2023 nbsp 0183 32 For Senior citizens the basic exemption limit is set Rs 3 Lakhs This means Senior citizens who are aged 80 years or more do not have to pay any tax up Web 11 f 233 vr 2022 nbsp 0183 32 Senior citizens are a part of individual taxpayers which means they also have to choose between the old and new income tax regime while filing annual tax returns

Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/09/Income-Tax-Slab-for-Senior-and-Super-Senior-Citizons-FY-2022-23-AY-2023-24.jpg

INCOME TAX SLAB 2019 20 TAX SLAB FOR INDIVIDUAL HUF NRI SENIOR CITIZEN

https://i.ytimg.com/vi/qa6xXBt40vM/maxresdefault.jpg

https://incometaxindia.gov.in/Booklets Pamphlets/Benefits-f…

Web Income Tax slabs for Super Senior citizens 80 years and above in age New Personal Income Tax Regime 115BAC INCOME SLAB RATE OF INCOME TAX Upto Rs

https://cleartax.in/s/income-tax-slab-for-senior-citizen

Web 11 janv 2023 nbsp 0183 32 If they are earning salary or pension income they can claim a deduction of Rs 50 000 from such income Tax rebate under Section 87A In case of senior citizens

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

New Income Tax Regime FY 2020 21 ELPHOS INVESTMENTS

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Here s What Changed For Senior Citizens After Budget 2020

Income Tax Slab For FY 2022 23 New Income Tax Rates Slabs In India

SENIOR CITIZEN INCOME TAX CALCULATION FY 2019 20 REBATE 87A TAX

Income Tax Rebate For Senior Citizens In India - Web 30 juil 2021 nbsp 0183 32 Taxable Income Slab The taxable income slab for senior citizens between 60 and 80 years of age starts at Rs 3 lakh and that of super senior citizens starts at Rs 5