Income Tax Rebate For Senior Citizens Web Abattement sp 233 cifique pour les plus de 65 ans ainsi que les personnes handicap 233 es L abattement sur les revenus pour les personnes 226 g 233 es de plus de 65 ans tout

Web Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for Web 26 mars 2021 nbsp 0183 32 C est un avantage fiscal qui permet de r 233 duire le montant de l imp 244 t sur le revenu des seniors Pour l ann 233 e 2022 l abattement d imp 244 t pour les personnes 226 g 233 es

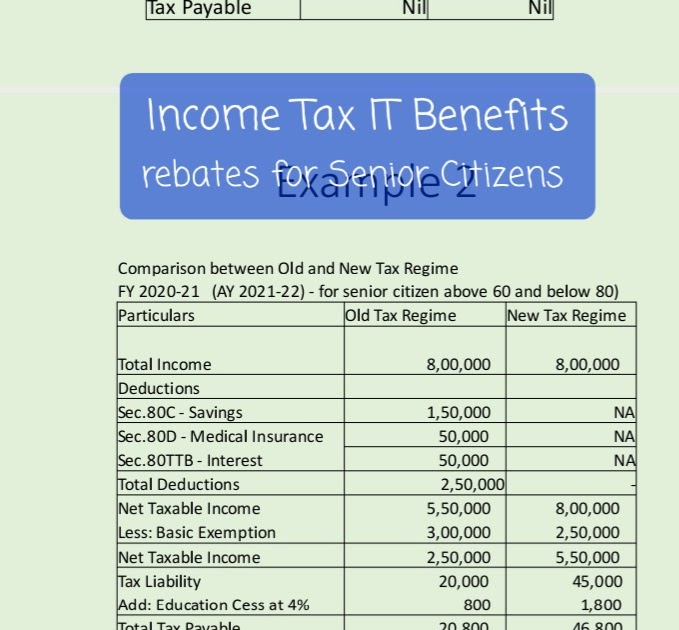

Income Tax Rebate For Senior Citizens

Income Tax Rebate For Senior Citizens

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

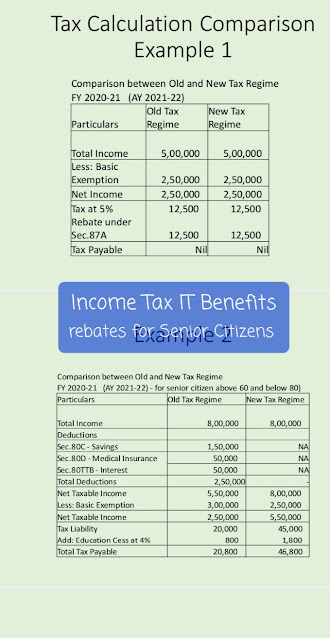

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w330-h640/Screenshot_20210713-082223_WPS%2BOffice.jpg

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

Web 14 avr 2023 nbsp 0183 32 Pour les revenus d 233 clar 233 s au printemps 2023 l abattement fiscal d une personne 226 g 233 e est 233 gal 224 2 620 quand ce revenu est inf 233 rieur 224 16 410 1 310 Web Les seniors qui travaillent devront s acquitter d une nouvelle taxe institu 233 e par l accord sur l assurance ch 244 mage du 22 mars dernier Il s agit d une contribution sp 233 cifique de

Web How much income tax should I be paying We all have a personal tax free allowance representing the amount of income you can receive before paying tax This tax free Web English Espa 241 ol A credit for taxpayers aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted

Download Income Tax Rebate For Senior Citizens

More picture related to Income Tax Rebate For Senior Citizens

SENIOR CITIZEN INCOME TAX CALCULATION FY 2019 20 REBATE 87A TAX

https://i.ytimg.com/vi/bfFXjqmPROE/maxresdefault.jpg

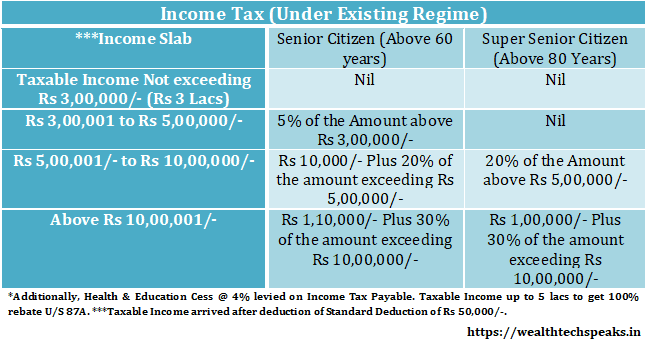

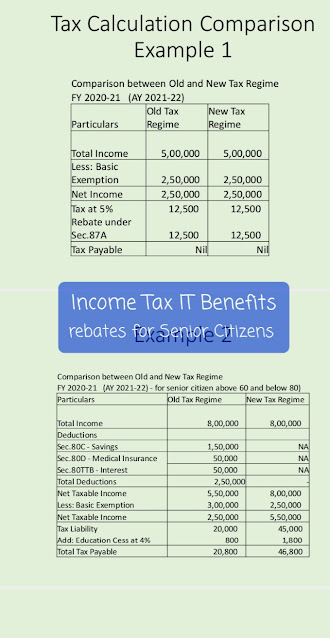

Tax Calculation Income Tax Slab For Fy 2020 21 New Income Tax Rates

https://wealthtechspeaks.in/wp-content/uploads/2020/02/Existing-Senior-Citizen-Tax.png

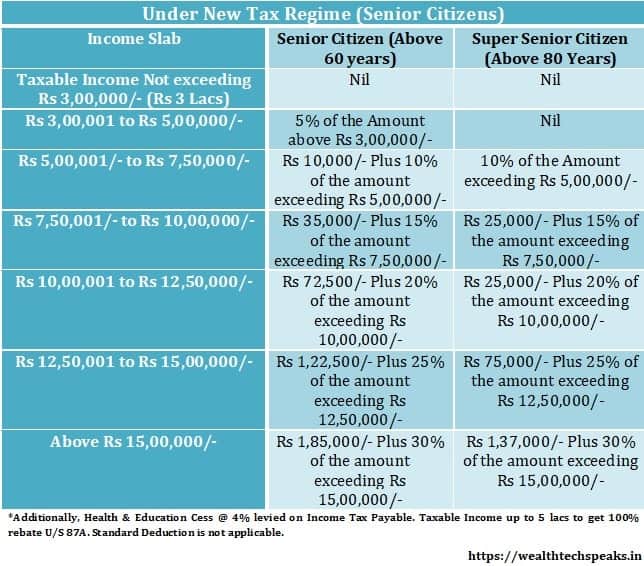

Senior Citizen Under New Tax Regime FY 2020 21 WealthTech Speaks

https://wealthtechspeaks.in/wp-content/uploads/2020/02/Senior-Citizen-Under-New-Tax-Regime-min.jpg

Web 17 ao 251 t 2023 nbsp 0183 32 Tax information for seniors and retirees including typical sources of income in retirement and special tax rules Older adults have special tax situations and benefits Web 5 avr 2021 nbsp 0183 32 Qualifying widow er age 65 or older with at least 25 700 in gross income In the 2019 tax year the IRS introduced Form 1040 SR US Tax Return for Seniors This

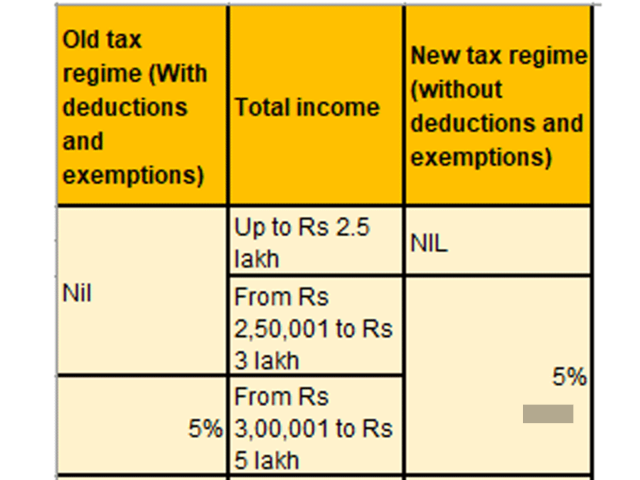

Web 30 juil 2021 nbsp 0183 32 The taxable income slab for senior citizens between 60 and 80 years of age starts at Rs 3 lakh and that of super senior citizens starts at Rs 5 lakh while the taxable Web Income Tax slabs for Super Senior citizens 80 years and above in age New Personal Income Tax Regime 115BAC INCOME SLAB RATE OF INCOME TAX Upto Rs

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

https://i.ytimg.com/vi/GHq5DhLzRhQ/maxresdefault.jpg

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

https://i.ytimg.com/vi/rfW84weCMCs/maxresdefault.jpg

https://www.francetransactions.com/impots/abattement-impot-2021-plus...

Web Abattement sp 233 cifique pour les plus de 65 ans ainsi que les personnes handicap 233 es L abattement sur les revenus pour les personnes 226 g 233 es de plus de 65 ans tout

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-2

Web Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for

Latest Income Tax Slab Rates For FY 2022 23 FY 2021 22

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

Chart A For Senior Citizen

Income Tax Benefits For Senior Citizens 2020 Income Tax Rebate For

Standard Deduction For Ay 2020 21 For Senior Citizens Standard

INCOME TAX SLAB FY 2019 20 AY20 21 FOR INDIVIDUAL SENIOR CITIZEN HUF

INCOME TAX SLAB FY 2019 20 AY20 21 FOR INDIVIDUAL SENIOR CITIZEN HUF

Method Of Calculating Income Tax For Senior Citizen Pensioners

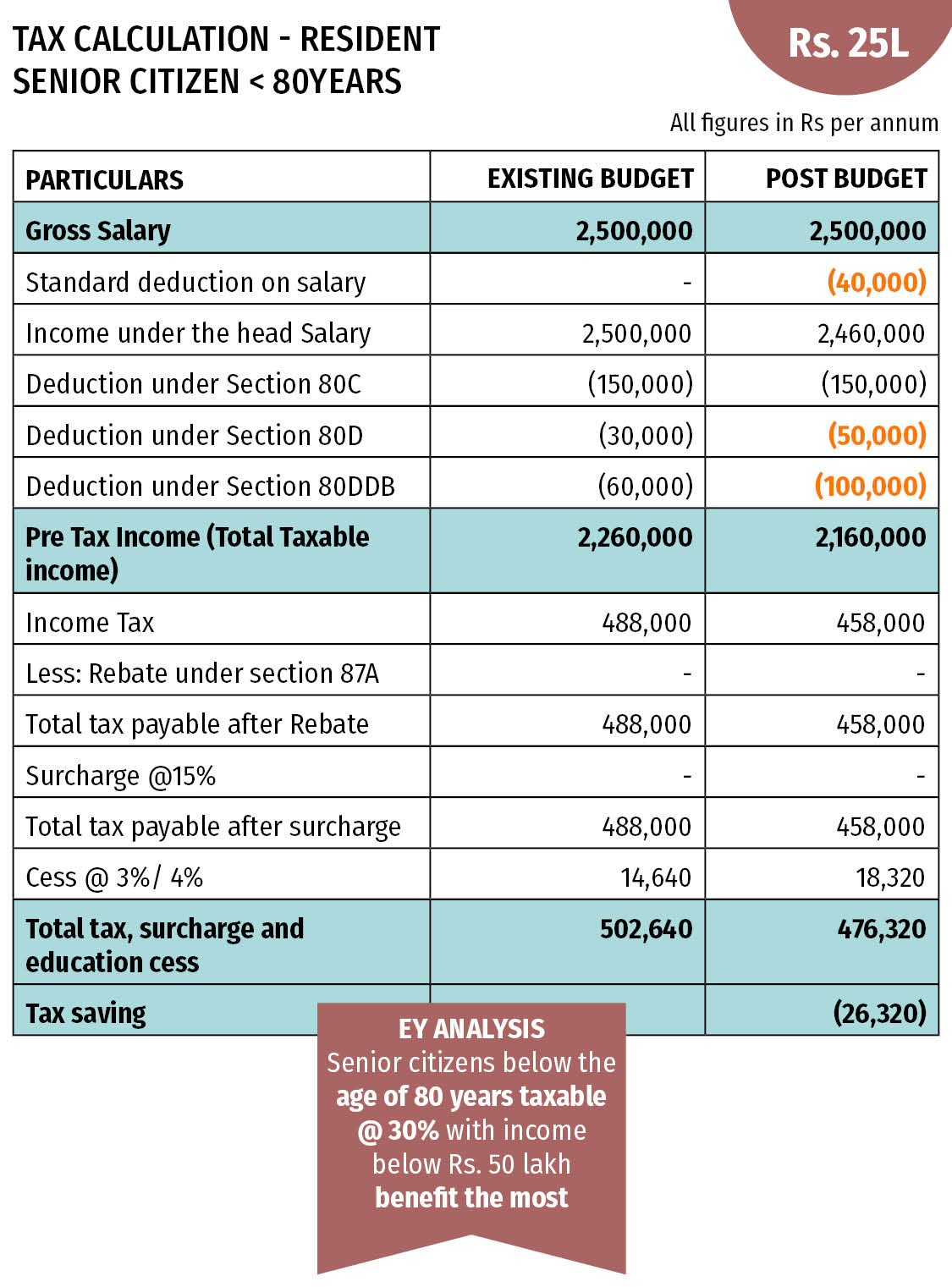

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

Income Tax Rebate For Senior Citizens - Web 6 sept 2023 nbsp 0183 32 If you are a senior citizen then your tax liability will be calculated separately The tax slabs are different for different assessee For the senior citizens 60 80 age