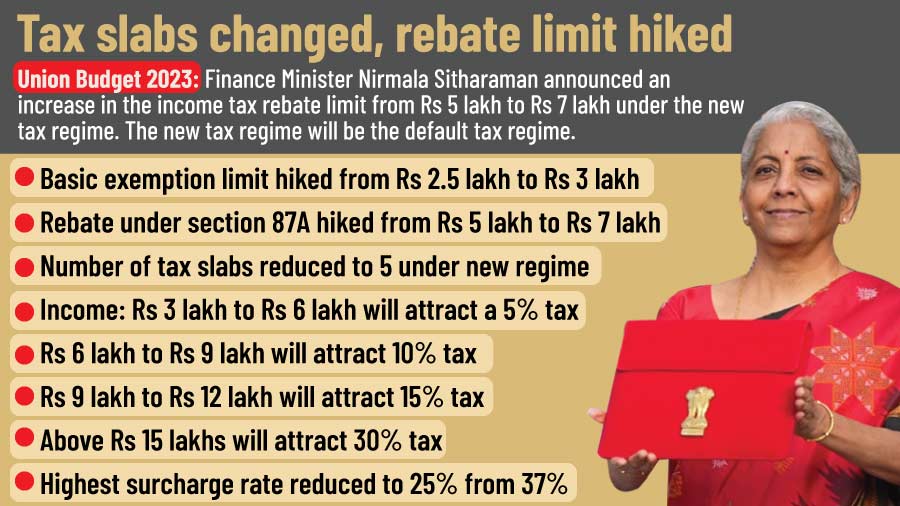

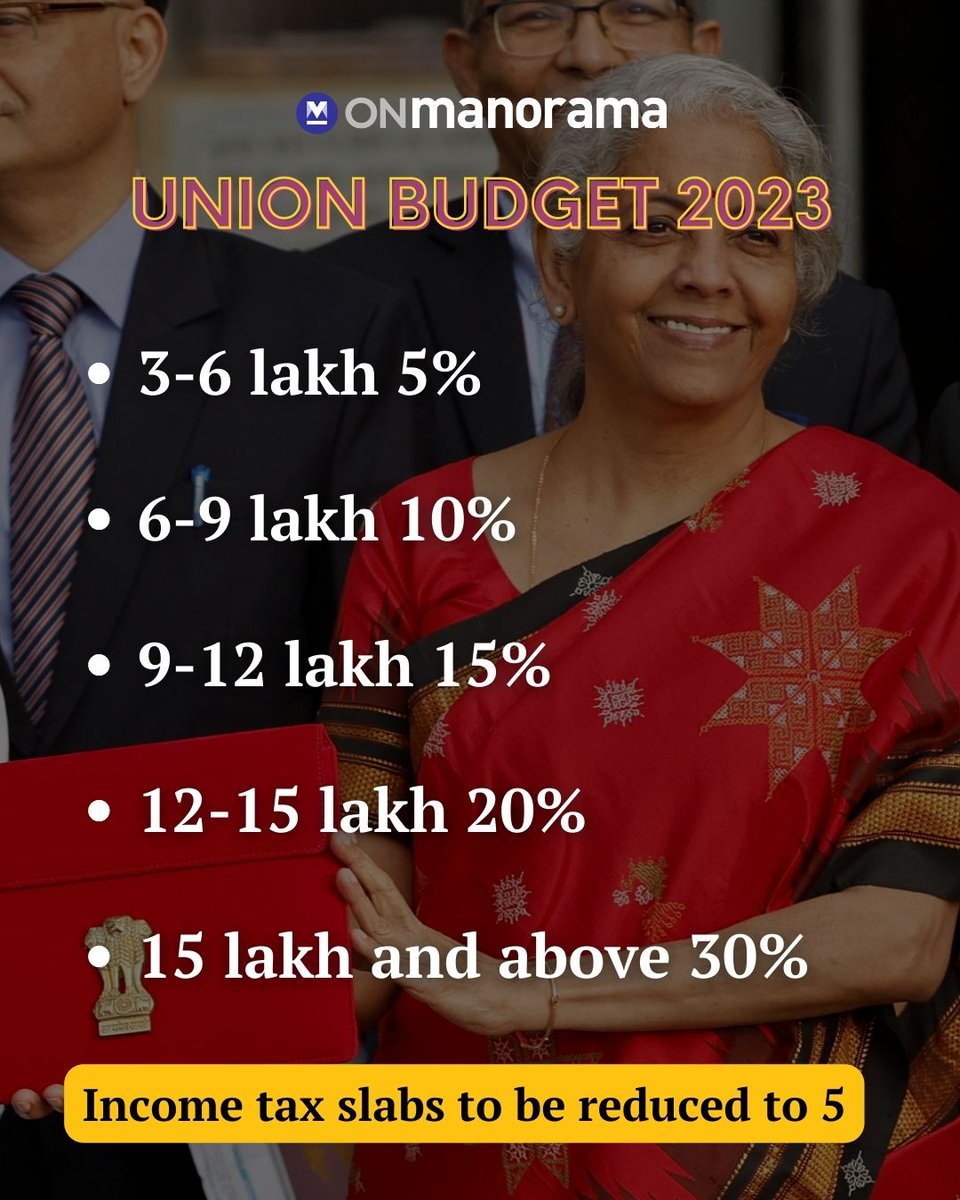

Income Tax Rebate For Womens In India Web Income Tax Rebate for Women The Union Budget 2023 announced tax relief for the new tax regime under Section 87A of the Income Tax Act 1961 for individual taxpayers

Web Income Tax Rebate for Women Under Section 87A individual taxpayers including women are eligible to avail of full tax rebates on a certain limit of income for both old Web 24 janv 2023 nbsp 0183 32 Smriti Jain TIMESOFINDIA COM Updated Jan 24 2023 08 12 IST Share AA Follow us Budget 2023 for women Finance Act 2012 abolished the differential tax slabs that were in vogue for women

Income Tax Rebate For Womens In India

Income Tax Rebate For Womens In India

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Standard Deduction For 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19.png

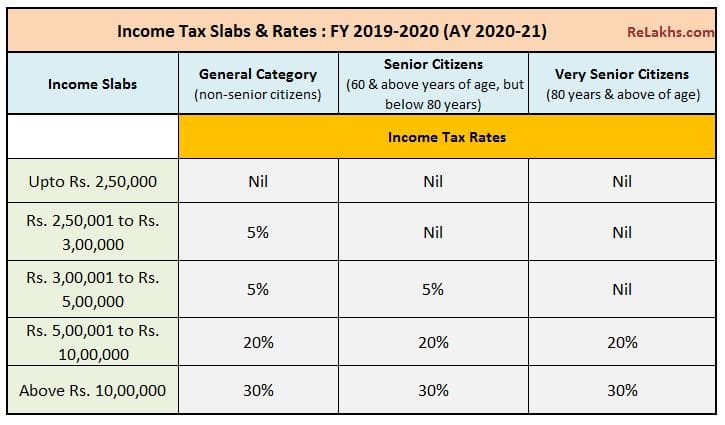

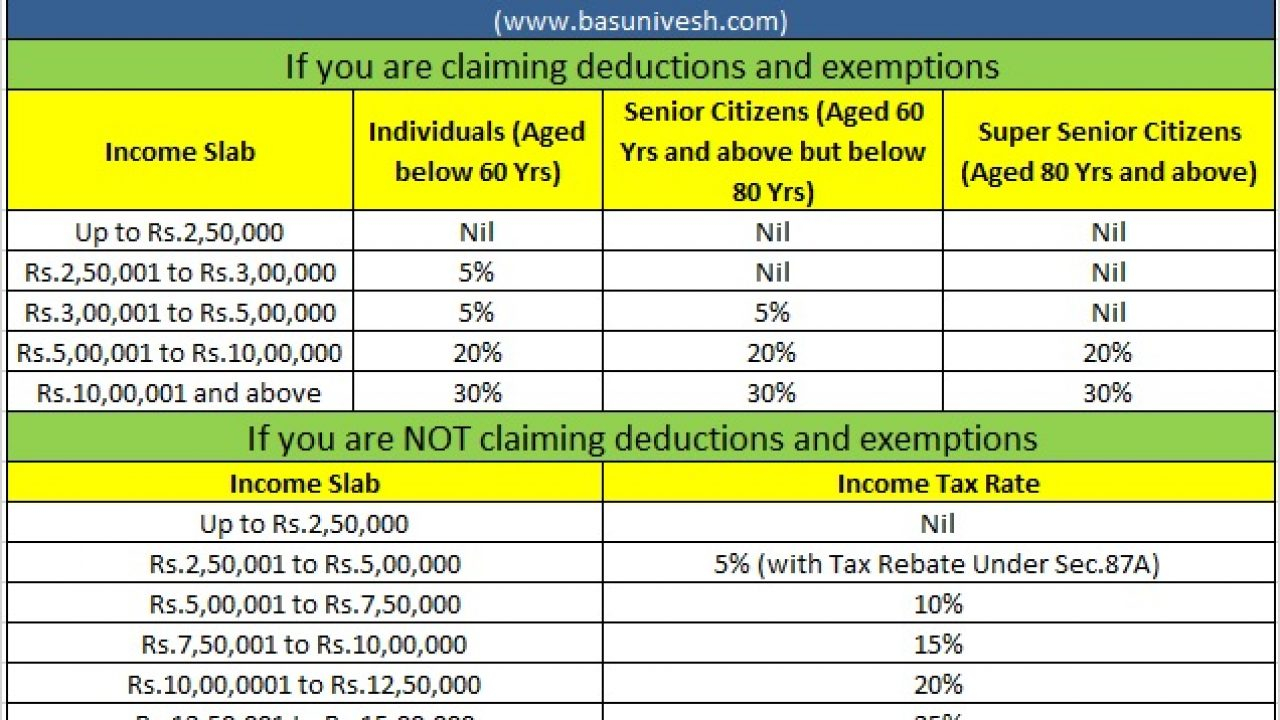

Web 29 ao 251 t 2021 nbsp 0183 32 As a parent legal guardian they can deposit up to Rs 1 50 000 and earn a fixed return of 7 6 interest rate for the quarter ending 31 st March 2022 till the Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the new income tax regime the amount of

Web 6 juil 2023 nbsp 0183 32 Income Tax Slab for Women Tax Rebate and Exemptions 23 24 Author TATA AIG Team Published on 06 07 2023 Every individual in India who earns an Web 13 ao 251 t 2020 nbsp 0183 32 Presently there is no specific income tax exemption for women Those having a total income of up to Rs 5 Lakh are eligible for a tax rebate of up to Rs 12 500 on their taxes The Tax Slab Applicable

Download Income Tax Rebate For Womens In India

More picture related to Income Tax Rebate For Womens In India

Nirmala Sitharaman Union Budget 2023 24 Income Tax Rebate Limit

https://assets.telegraphindia.com/telegraph/2023/Feb/1675241971_card.jpg

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

What Is The Income Tax Slab For Women In India

https://www.careinsurance.com/upload_master/media/posts/August2020/G2gxS9ZGRHdgPl9FDkui.jpg

Web 14 f 233 vr 2023 nbsp 0183 32 Society amp Culture Union Budget 2023 4 Key Points That Women Must Take Note Of Finance Minister Nirmala Sitharaman has announced the Union Budget for 2023 24 The biggest highlight was the Web 26 d 233 c 2018 nbsp 0183 32 8941 1 Image Source http pili pro bono highlights from 2016 law firm pro bono roundtable 2 In this article Divya Jakhar discusses income tax benefits for women under the Indian law

Web 2 ao 251 t 2023 nbsp 0183 32 Aug 2 2023 3 004 5 mins read This is a complete guide for the income tax slab for women And it also explains women s benefits from income tax Income tax is Web 1 f 233 vr 2023 nbsp 0183 32 Photo PTI Listen to this article 00 00 1x 1 5x 1 8x In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate

Income Tax Rebate 10 7 Slab 2 5

https://www.valueresearchonline.com/content-assets/images/47951_20220601-tax_slabs-old_and_new__w1000__.png

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

https://images.moneycontrol.com/static-mcnews/2023/02/Budget-2023-I-T-slabs-tweaked-2.jpg

https://www.godigit.com/income-tax/income-tax-slab-for-women

Web Income Tax Rebate for Women The Union Budget 2023 announced tax relief for the new tax regime under Section 87A of the Income Tax Act 1961 for individual taxpayers

https://www.policybazaar.com/income-tax/income-tax-slab-for-women

Web Income Tax Rebate for Women Under Section 87A individual taxpayers including women are eligible to avail of full tax rebates on a certain limit of income for both old

Onmanorama On Twitter Income Tax Rebate Raised To 7 Lakhs In The New

Income Tax Rebate 10 7 Slab 2 5

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Rebate Under Section 87A

Tax Rebate For Individual Deductions For Individuals reliefs

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate For Womens In India - Web You can claim tax deductions of up to Rs 1 5 lakhs from your total income under Section 80C from any of the following National Savings Certificate Equity Linked Savings