Income Tax Rebate In Budget Web The rebate under the Income Tax law has been increased from Rs 5 Lakh to Rs 7 Lakh so as to benefit income taxpayers Further the tax slabs have been reduced to 5 under

Web 1 f 233 vr 2023 nbsp 0183 32 5 income tax rule changes announced in Budget 2023 4 min read 01 Feb 2023 12 56 PM IST Sangeeta Ojha Budget 2023 Nirmala Sitharaman on Wednesday Web 1 f 233 vr 2023 nbsp 0183 32 In her Budget 2023 speech Finance Minister Nirmala Sitharaman announced no income tax will be levied on those who earn up to Rs 7 lakh under new tax regime

Income Tax Rebate In Budget

Income Tax Rebate In Budget

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

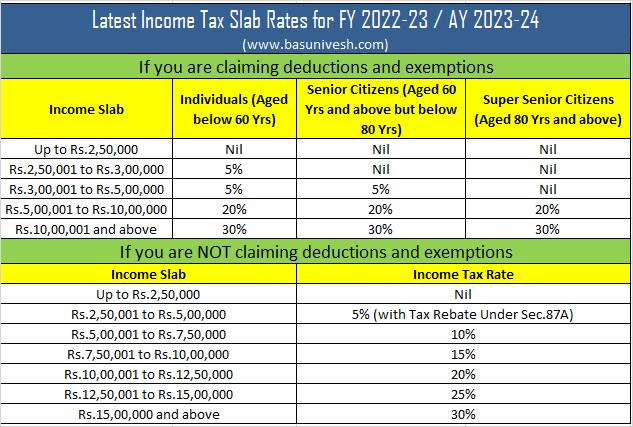

Corporate Tax Rebate Budget 2022 Rebate2022

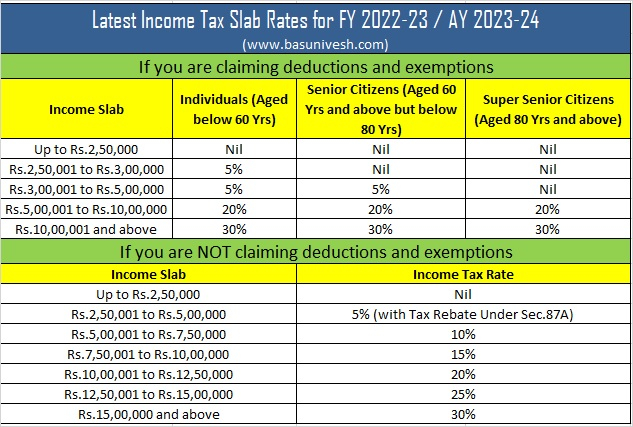

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

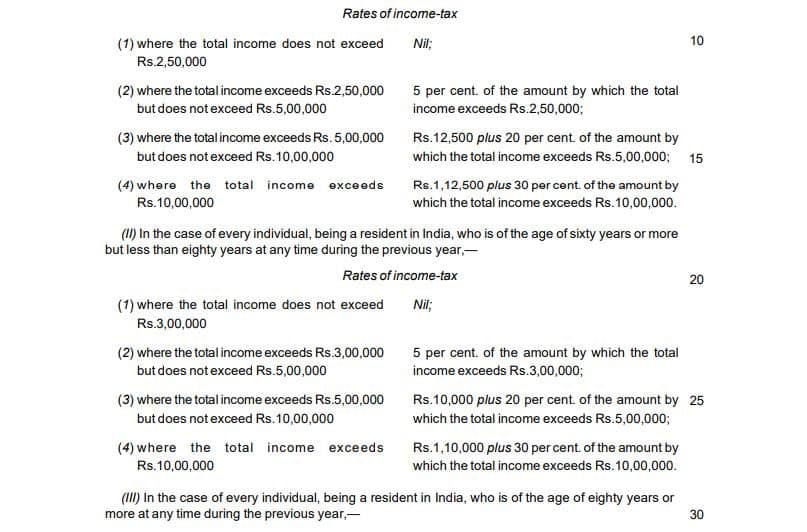

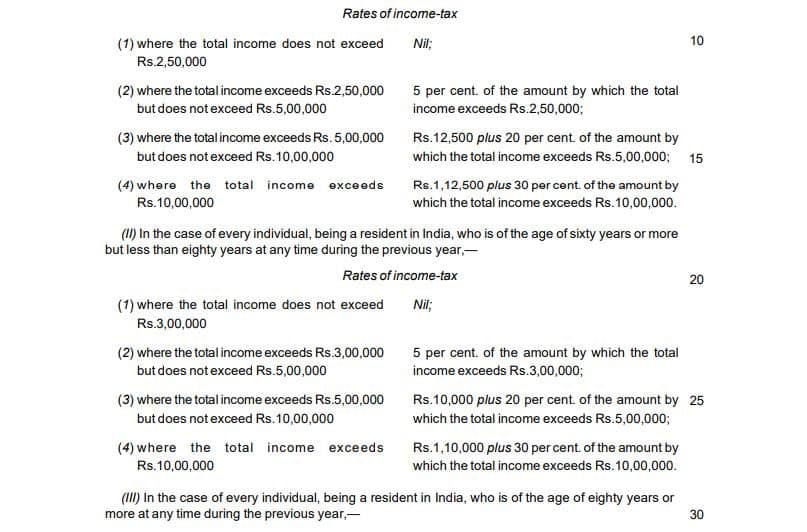

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 What is Rebate in Income Tax Explained YouTube Finance Minister Nirmala Sitharaman in the Union Budget 2023 24 presented on Feb 1 tweaked the slabs to Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up

Web 1 f 233 vr 2023 nbsp 0183 32 The Government proposes to increase the income tax rebate limit from 5 lakh to 7 lakh in the new tax regime A person earning 9 lakh a year will now be Web 31 janv 2023 nbsp 0183 32 This is because a rebate of Rs 12 500 under section 87A is available under both regimes This effectively means that individuals with taxable income up to Rs 5 lakh

Download Income Tax Rebate In Budget

More picture related to Income Tax Rebate In Budget

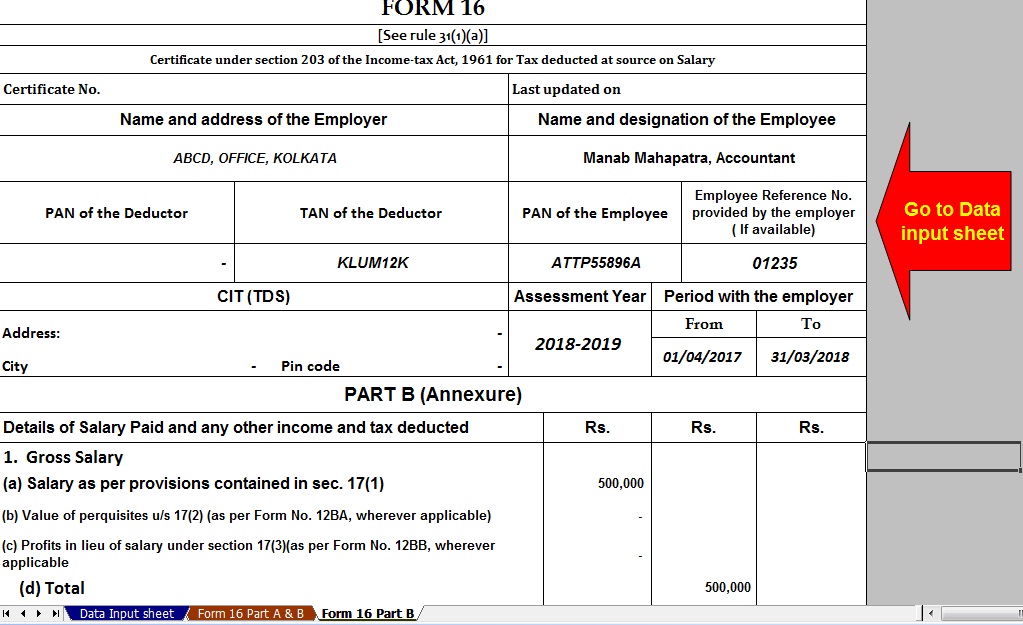

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

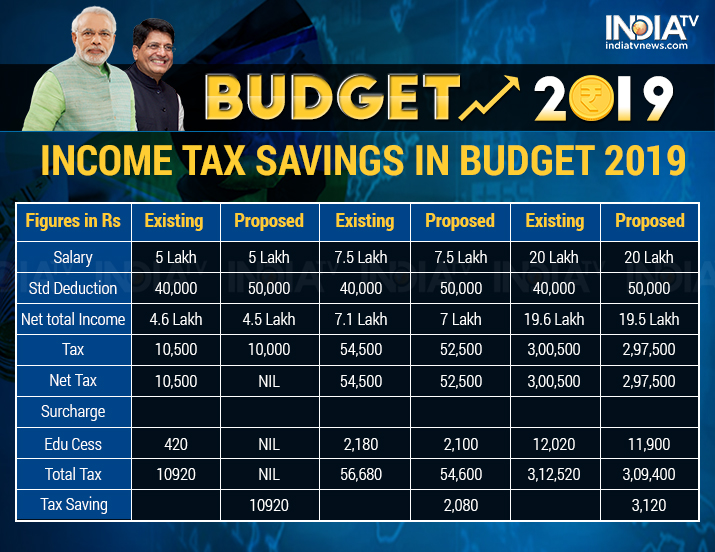

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2019/02/income-tax-savings-in-budget-2019-1549027494.jpg

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

Web 9 sept 2023 nbsp 0183 32 The 2023 budget proposal includes about 1 05 billion in proposed tax reductions most of which will come from one time tax rebates to eligible Virginians Web 9 sept 2023 nbsp 0183 32 The 2023 budget proposal includes about 1 05 billion in proposed tax reductions most of which will come from one time tax rebates to eligible Virginians

Web 1 f 233 vr 2023 nbsp 0183 32 major announcements in personal income tax to substantially benefit the middle class persons with income up to rs 7 lakh will not pay income tax in new tax Web PTI A look at the income tax slabs under the new versus old regime Here are the five major announcements 1 The first proposal was related to the rebate on personal

Income Tax Rebate In Interim Budget 2019 Comes With A Big Rider India

https://english.cdn.zeenews.com/sites/default/files/Finance-Bill.jpg

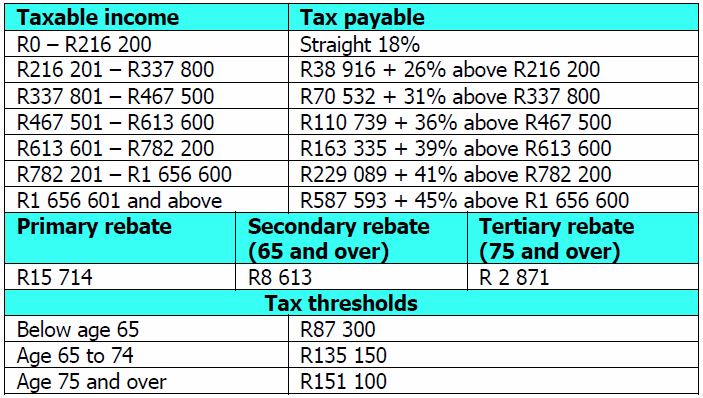

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

https://www.financialexpress.com/budget/budget-2023-income-tax-slab...

Web The rebate under the Income Tax law has been increased from Rs 5 Lakh to Rs 7 Lakh so as to benefit income taxpayers Further the tax slabs have been reduced to 5 under

https://www.livemint.com/money/personal-finance/5-income-tax-rule...

Web 1 f 233 vr 2023 nbsp 0183 32 5 income tax rule changes announced in Budget 2023 4 min read 01 Feb 2023 12 56 PM IST Sangeeta Ojha Budget 2023 Nirmala Sitharaman on Wednesday

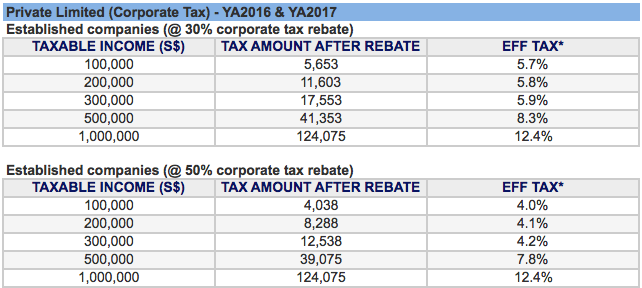

Corporate Tax Rate 2019 Phil Bower

Income Tax Rebate In Interim Budget 2019 Comes With A Big Rider India

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Budget 2023 Explained In FM Nirmala Sitharaman s Budget Focus On

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

Income Tax Rebate In Budget - Web 1 f 233 vr 2023 nbsp 0183 32 Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up