Income Tax Rebate Limit Web 16 mars 2017 nbsp 0183 32 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified A resident individual with taxable income up to Rs 7 00 000 will receive a Rs 25 000 tax relief The former tax regime remains the same i e 12 500 for income up to Rs 5 00 000

Web This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Total Income up to 50 lakh and having income from Business or Profession which is computed on a presumptive basis u s 44AD 44ADA 44AE and income from any of Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount of tax rebate of Rs 12 500 will be given in both old as well as new tax regimes Having said that people cannot claim tax rebates for all types of incomes For instance tax

Income Tax Rebate Limit

Income Tax Rebate Limit

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

https://shabiba.eu-central-1.linodeobjects.com/2023/02/1675237419-1675237419-ominottsnayo-700x400.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

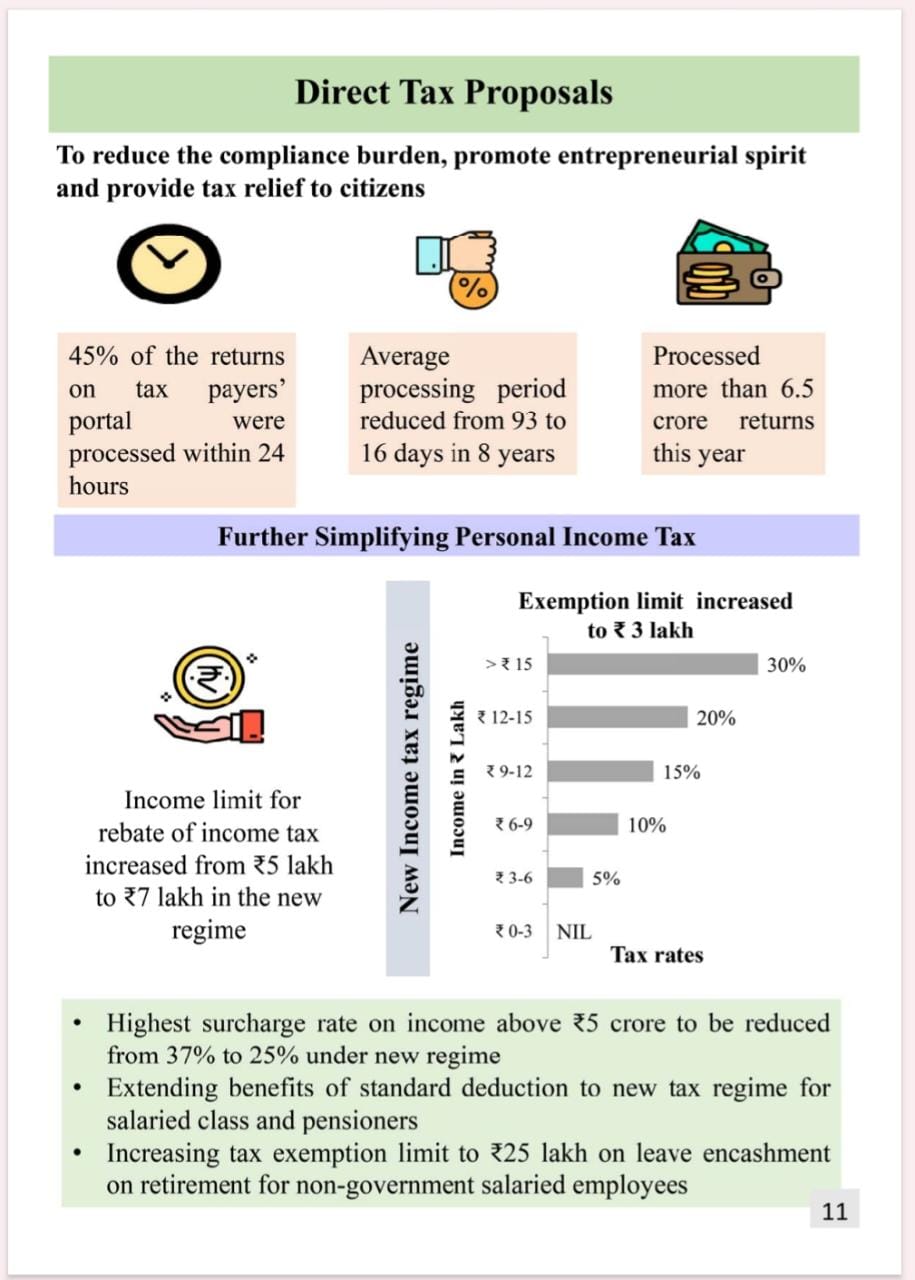

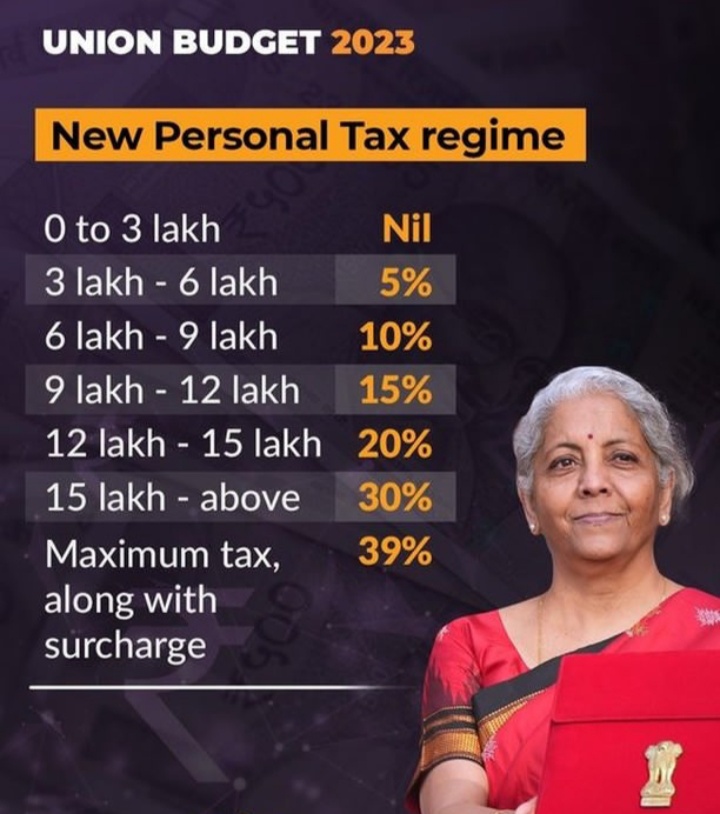

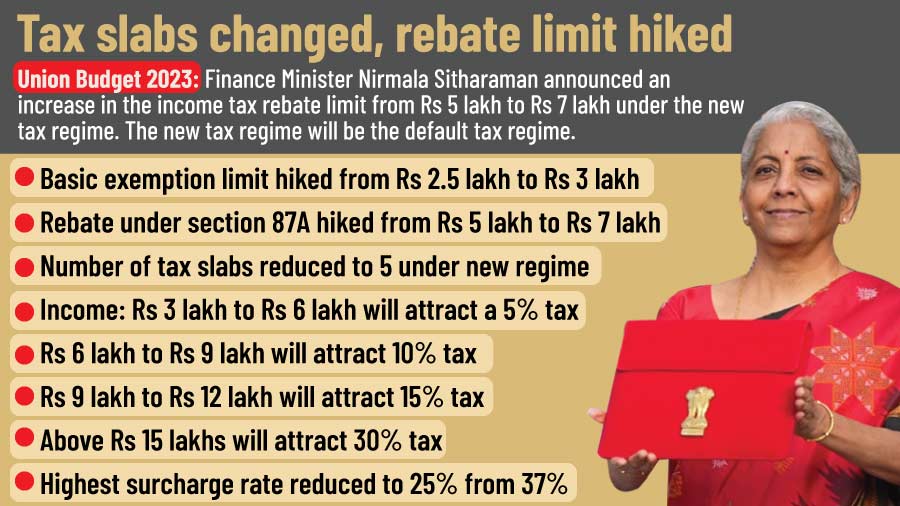

Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the income tax rebate has been extended on income up to 7 lakh under the new tax regime up from 5 lakh so far The FM also announced there will not be any new tax for income up to Web 18 juil 2023 nbsp 0183 32 Section 80C is one of the most popular and favourite sections amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or incurring eligible expenses It allows a maximum deduction of Rs 1 5 lakh every year from the taxpayers total income The benefit of this deduction can be availed by Individuals

Web 1 f 233 vr 2023 nbsp 0183 32 The Government proposes to increase the income tax rebate limit from 5 lakh to 7 lakh in the new tax regime The highest tax rate in our country is 42 74 it is among the highest in the Web 16 ao 251 t 2023 nbsp 0183 32 Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be NIL in both New and old existing tax regimes In Budget 2023 rebate under new regime has been increased and therefore income upto Rs 7 lakh will be tax free from FY 2023 24

Download Income Tax Rebate Limit

More picture related to Income Tax Rebate Limit

Budget 2023 Summary Of Direct Tax Proposals

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

Budget 2023 Key Updates Income Tax Rebate Limit Increased From Rs 5

https://www.topnewsenglish.com/wp-content/uploads/2023/02/income-tax-rebate-limit.jpg

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

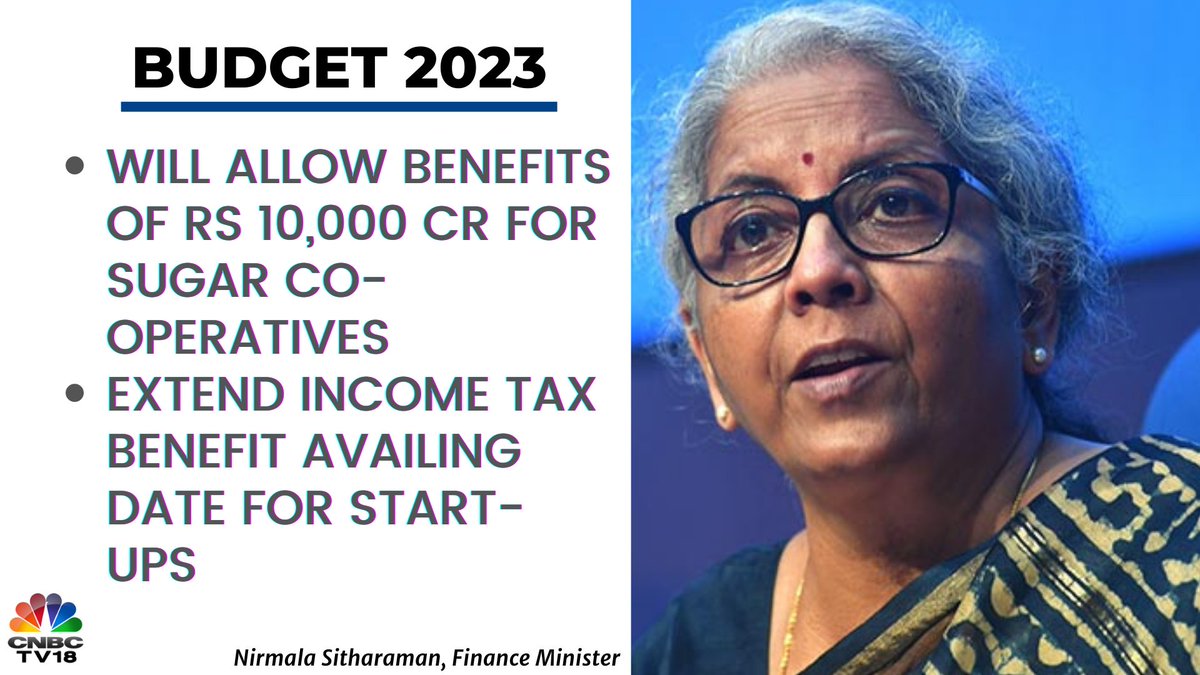

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5 lakh The highest surcharge rate has been reduced to 25 percent from 37 percent in the new slab FM said Web 22 sept 2021 nbsp 0183 32 Les tranches marginales d imposition du bar 232 me de l imp 244 t sur le revenu vont 234 tre relev 233 es de 1 4 en 2022 soit au niveau de l inflation hors tabac pr 233 vue pour 2021 L entr 233 e dans

Web 1 f 233 vr 2023 nbsp 0183 32 New Delhi February 1 Union Finance Minister Nirmala Sitharaman hiked capital expenditure by a massive 33 per cent to Rs 10 lakh crore and provided direct tax concessions worth Rs 35 000 crore Web 3 ao 251 t 2023 nbsp 0183 32 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000 The change is effective from 1st April 2023 Contents Rebate u s 87A for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24

Budget 2023 Income Tax Rebate Limit Increased From 5 Lakh To 7

https://s1.dmcdn.net/v/UdHRt1ZslpkeS085X/x720

Credit Karma Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/credit-karma-tax-income-limit-taxw.png?fit=972%2C890&ssl=1

https://cleartax.in/s/income-tax-rebate-us-87a

Web 16 mars 2017 nbsp 0183 32 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified A resident individual with taxable income up to Rs 7 00 000 will receive a Rs 25 000 tax relief The former tax regime remains the same i e 12 500 for income up to Rs 5 00 000

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Total Income up to 50 lakh and having income from Business or Profession which is computed on a presumptive basis u s 44AD 44ADA 44AE and income from any of

Retirement Income Tax Rebate Calculator Greater Good SA

Budget 2023 Income Tax Rebate Limit Increased From 5 Lakh To 7

CNBC TV18 On Twitter Budget2023 Highlights FM NirmalaSitharaman

Income Tax Rebate 2023 Illinois LatestRebate

Fortune India Business News Strategy Finance And Corporate Insight

Carbon Tax Rebate 2022 Printable Rebate Form

Carbon Tax Rebate 2022 Printable Rebate Form

Union Budget 2023 Live Income Tax Rebate Limit Increased To Rs 7 Lakh

Union Budget 2023 24 Live Income Tax Rebate Limit Increased To Rs 7

Nirmala Sitharaman Union Budget 2023 24 Income Tax Rebate Limit

Income Tax Rebate Limit - Web 1 f 233 vr 2023 nbsp 0183 32 The Government proposes to increase the income tax rebate limit from 5 lakh to 7 lakh in the new tax regime The highest tax rate in our country is 42 74 it is among the highest in the