Income Tax Rebate On Child Education Expenses Web 29 mars 2022 nbsp 0183 32 IR 2022 70 March 29 2022 WASHINGTON The Internal Revenue Service today reminded teachers and other educators planning ahead for 2022 that

Web 3 juil 2023 nbsp 0183 32 Child Tax Credit Earned Income Tax Credit Businesses and Self Employed Clean Vehicle Credits Qualified education expenses are amounts paid for tuition fees Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

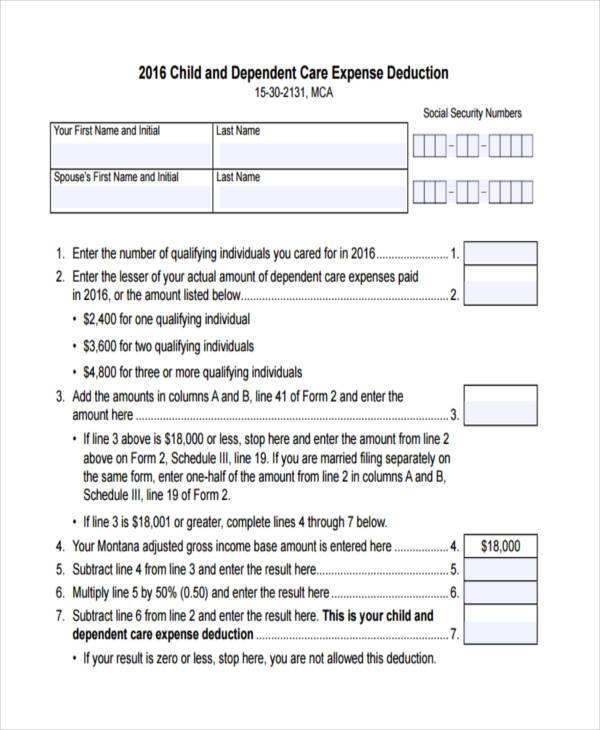

Income Tax Rebate On Child Education Expenses

Income Tax Rebate On Child Education Expenses

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

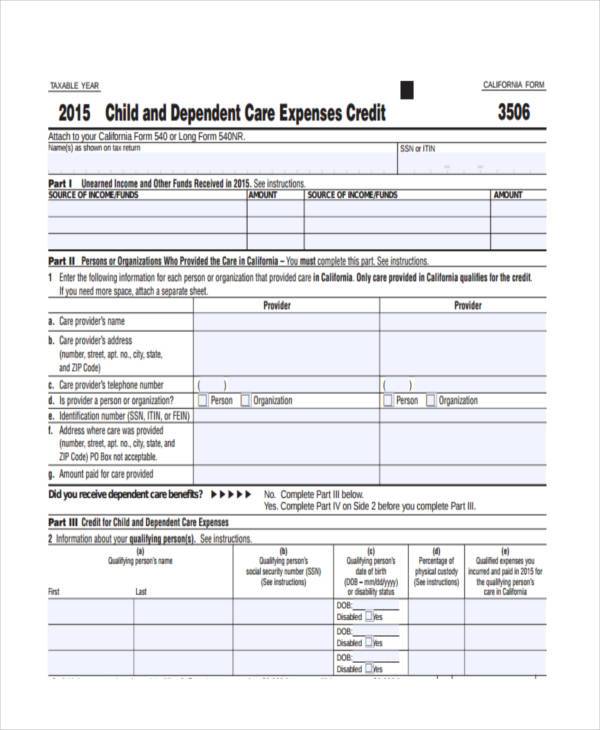

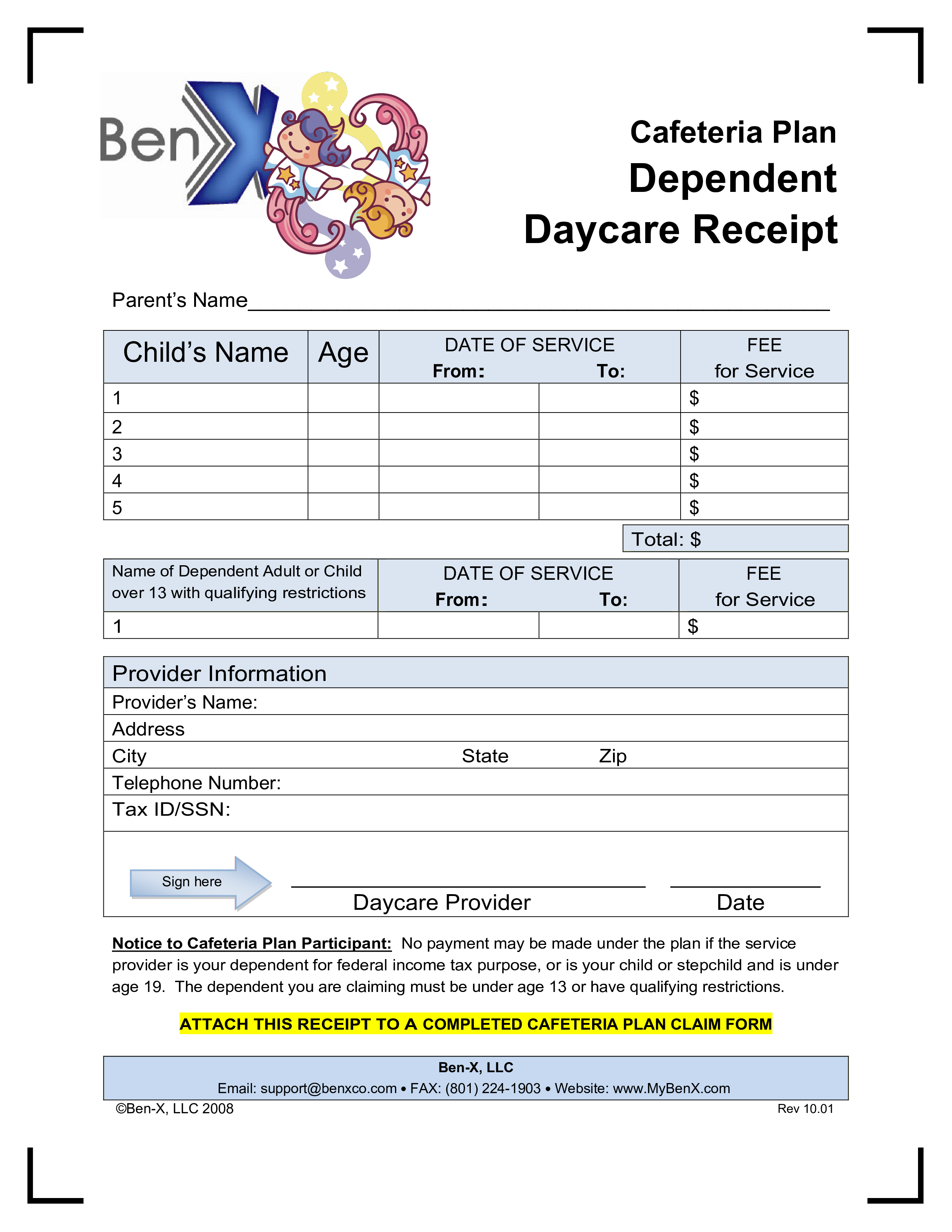

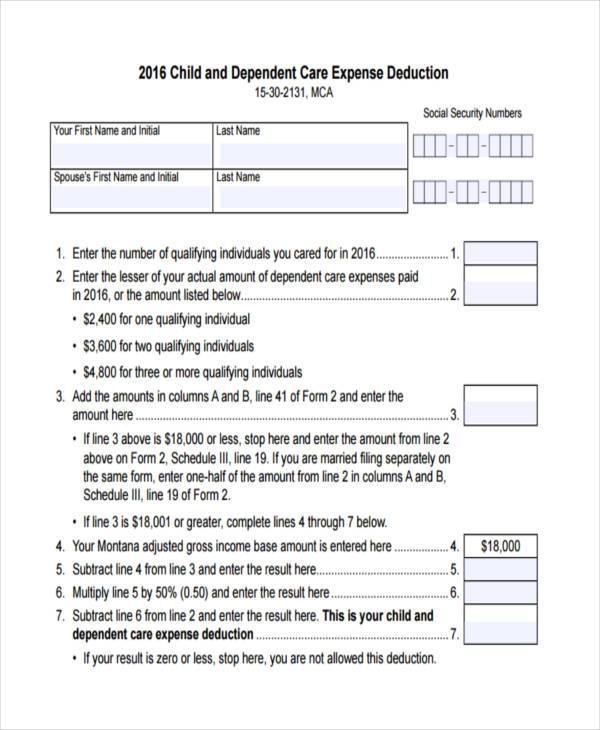

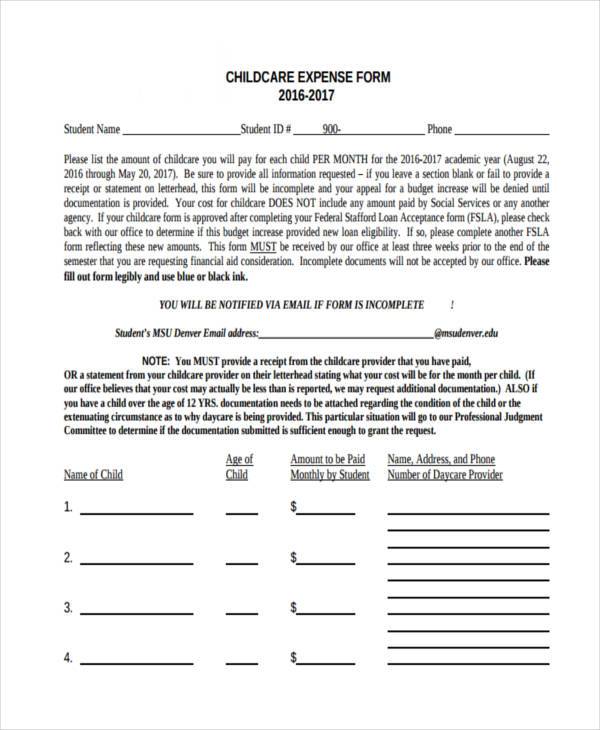

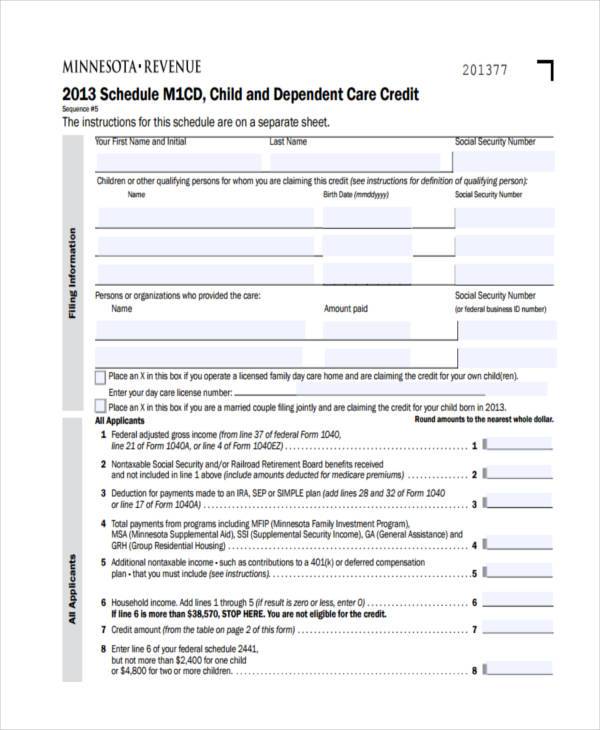

FREE 8 Sample Child Care Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/02/Child-Care-Expenses-Deduction-Form.jpg

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-expenses-tax-credit-colorado-d1.png

Web 13 f 233 vr 2023 nbsp 0183 32 You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of continuing education Web A refund of qualified education expenses may reduce adjusted qualified education expenses for the tax year or require repayment recapture of a credit claimed in an earlier year Some tax free educational assistance

Web 22 juil 2023 nbsp 0183 32 The expenses would need to qualify as deductible medical expenses that are reduced by 7 5 of your adjusted gross income AGI Otherwise you won t have a significant opportunity to claim tax savings Web 29 ao 251 t 2023 nbsp 0183 32 You can use the IRS s Interactive Tax Assistant tool to help determine if you re eligible for educational credits or deductions including the American Opportunity

Download Income Tax Rebate On Child Education Expenses

More picture related to Income Tax Rebate On Child Education Expenses

Child Care Rebate Income Tax Return 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/daycare-business-income-and-expense-sheet-to-file-your-daycare-business-1.jpg

FREE 8 Sample Child Care Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/02/Child-Care-Expense-Tax-Form.jpg

Education Rebate Income Tested

https://i2.wp.com/assets1.cleartax-cdn.com/s/img/2019/02/01163903/Budget-2019-middle-class-768x402.png

Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction They Web 7 janv 2020 nbsp 0183 32 07 Jan 2020 2 721 597 Views 589 comments This article will cover in depth details regarding deduction under section 80C with respect of tuition or school fees paid for education of children alongwith some

Web 27 juin 2018 nbsp 0183 32 The deduction on payments made towards tuition fee can be claimed up to Rs 150 000 Rs 1 00 000 upto A Y 2014 15 together with deduction in respect of Web 27 f 233 vr 2023 nbsp 0183 32 Children Education Allowance Fixed education allowance received from the employer is tax exempt upto Rs 100 per month per child upto a maximum of 2

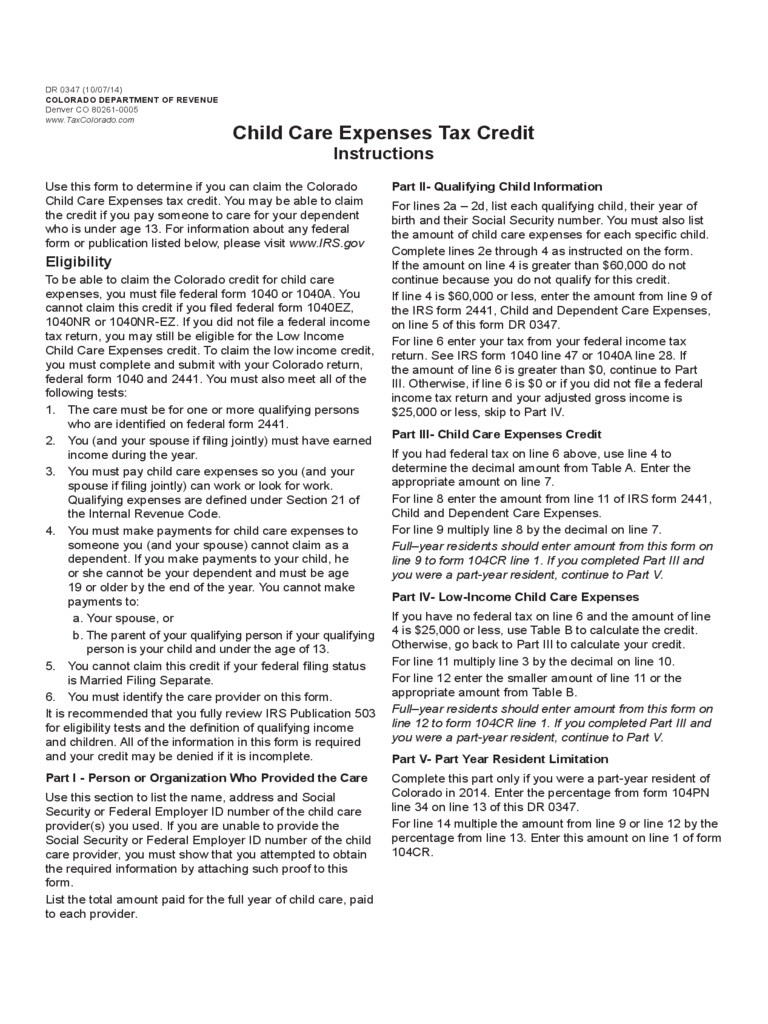

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l3.png

Daycare Tax Receipt Template Master Template

https://www.allbusinesstemplates.com/thumbs/d89f1e6f-988f-45c5-80f0-b007f1b9679b_1.png

https://www.irs.gov/newsroom/for-the-first-time-maximum-educator...

Web 29 mars 2022 nbsp 0183 32 IR 2022 70 March 29 2022 WASHINGTON The Internal Revenue Service today reminded teachers and other educators planning ahead for 2022 that

https://www.irs.gov/credits-deductions/individuals/qualified-ed-expenses

Web 3 juil 2023 nbsp 0183 32 Child Tax Credit Earned Income Tax Credit Businesses and Self Employed Clean Vehicle Credits Qualified education expenses are amounts paid for tuition fees

FREE 8 Sample Child Care Expense Forms In PDF MS Word

Child Care Expenses Tax Credit Colorado Free Download

FREE 8 Sample Child Care Expense Forms In PDF MS Word

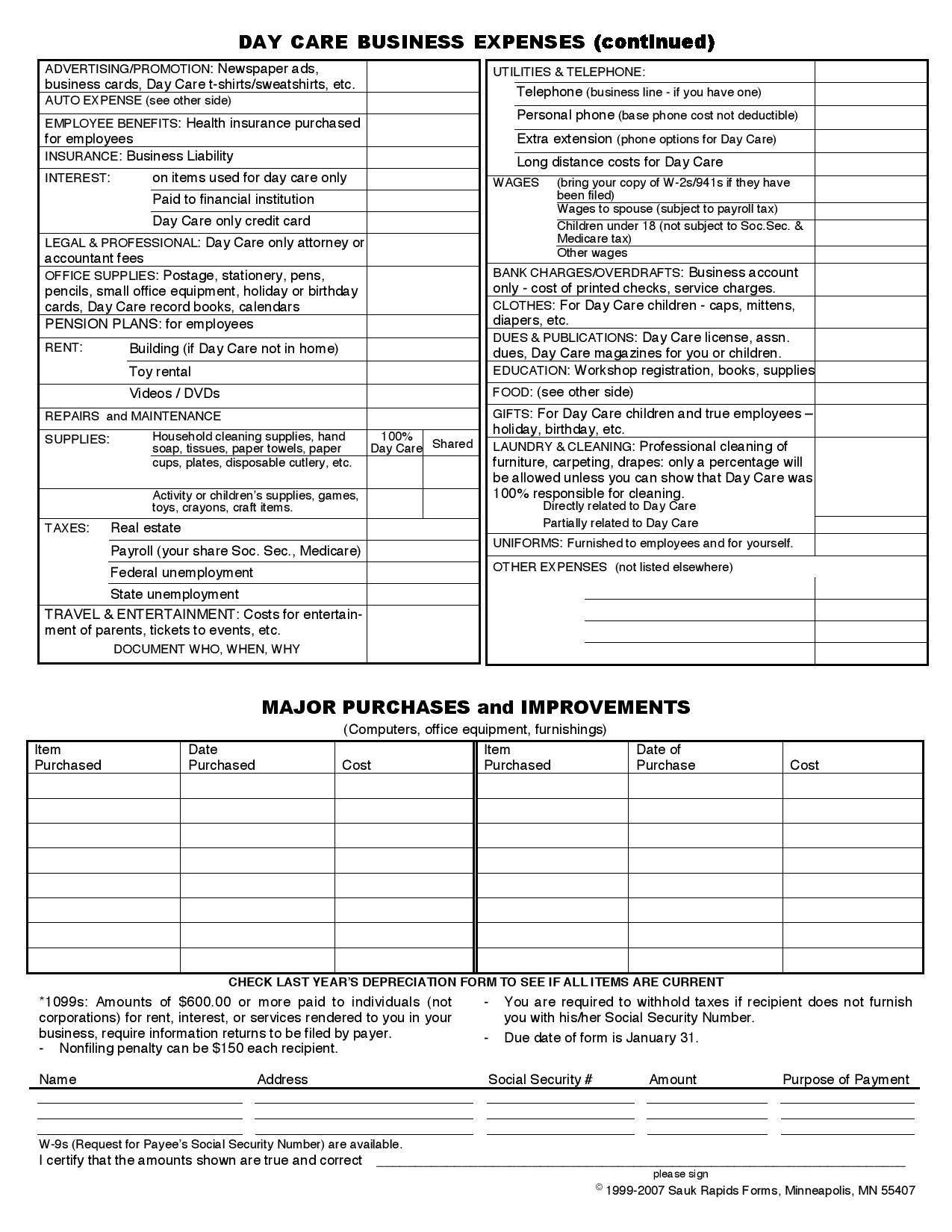

Printable Daycare Income And Expense Worksheet Printable Word Searches

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Child Care Rebate Income Tax Return 2022 Carrebate

Child Care Rebate Income Tax Return 2022 Carrebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Co Parenting Child Custody Parenting Plans

Here s How You Calculate Your Adjusted Gross Income AGI

Income Tax Rebate On Child Education Expenses - Web A refund of qualified education expenses may reduce adjusted qualified education expenses for the tax year or require repayment recapture of a credit claimed in an earlier year Some tax free educational assistance