Income Tax Rebate On Child Education Fees Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

Web Thus including enough scholarship or fellowship grant in the student s income to report up to 4 000 in qualified education expenses for your American opportunity credit may Web 27 f 233 vr 2023 nbsp 0183 32 Further you can also make tax deduction claims on tuition fee payment of your child under section 80C of the Income Tax Act 1961 The IT Act allows claiming

Income Tax Rebate On Child Education Fees

Income Tax Rebate On Child Education Fees

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

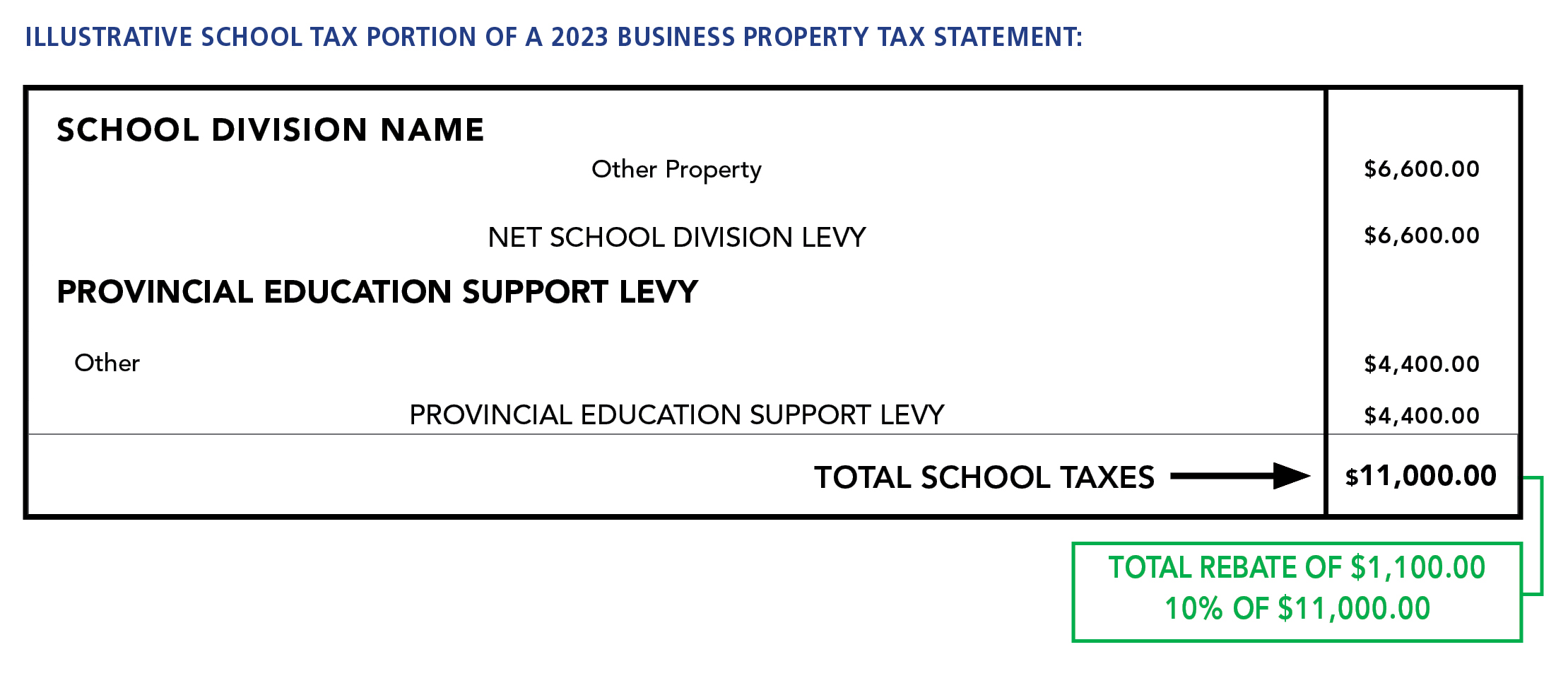

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Web 13 f 233 vr 2023 nbsp 0183 32 Feb 13 2023 at 9 36 a m Educational Tax Credits and Deductions If you re paying back student loans you may be able to deduct up to 2 500 in interest Getty Images College is Web 27 juin 2018 nbsp 0183 32 The Income Tax Act provides a direct deduction on account of fees paid for the education of dependent children The act also provides for deduction on account of

Web 17 f 233 vr 2017 nbsp 0183 32 Therefore if an individual opts for the new tax regime in current FY 2022 23 ending on March 31 2023 then s he will not be able to claim the commonly availed Web 3 juil 2023 nbsp 0183 32 Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student Who Must Pay Qualified education expenses

Download Income Tax Rebate On Child Education Fees

More picture related to Income Tax Rebate On Child Education Fees

Here s How You Calculate Your Adjusted Gross Income AGI

https://flyfin.tax/_next/image?url=https:%2F%2Fdem95u0op6keg.cloudfront.net%2Fflyfin-website%2Fself-employment-resources%2FThreeTaxBenefitsDesktop.png&w=2048&q=100

Education Rebate Income Tested

https://i2.wp.com/assets1.cleartax-cdn.com/s/img/2019/02/01163903/Budget-2019-middle-class-768x402.png

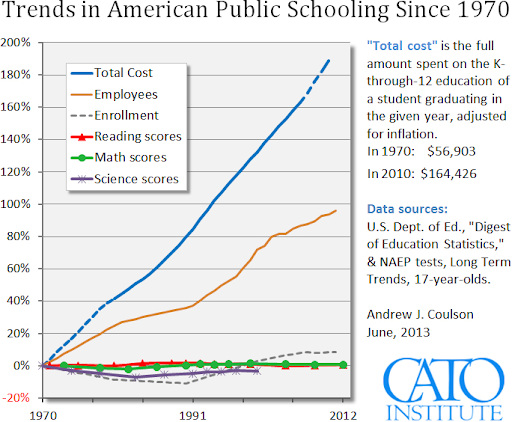

Contra Corner Rebate 165 000 In Taxes For Each Child And Let A Free

https://pbs.twimg.com/media/EeghFOZXgAEQooZ?format=png&name=small

Web If the children don t have any additional income or earnings they ll be able to use their personal tax allowance which stands at 163 12 570 per year for 2023 24 Assets like Web 5 janv 2023 nbsp 0183 32 The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction They

Web 7 janv 2020 nbsp 0183 32 Maximum Limit for Section 80C Deduction Deduction available on payment basis Section 80C Deduction not available for part time course Fees for Private tuition Coaching Classes not eligible for Web 16 f 233 vr 2022 nbsp 0183 32 Education tax credits for 2021 taxes American taxpayers can take advantage of one of two different college tax credits to essentially get back some of the

Tax Benefits On Child Education Fees

https://d3it91zw76pwp5.cloudfront.net/wp-content/uploads/2022/08/Tax-benefits-on-childs-education-fees.jpg

Rebate Checks Social Security Income Tax Cuts Plus New Taxes And Fees

https://assets3.cbsnewsstatic.com/hub/i/r/2022/11/14/9a44dcee-f1b3-4b2e-bab7-95ad1acd3c56/thumbnail/1200x630/9532cca100bebd4095f800e2d5c77a10/6p-vo-mn-trifecta-wcco2bhz.jpg?v=46148a329842187f630d57e5930d74c4

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

https://www.irs.gov/publications/p970

Web Thus including enough scholarship or fellowship grant in the student s income to report up to 4 000 in qualified education expenses for your American opportunity credit may

Are YOU Eligible For The CT Child Tax Rebate

Tax Benefits On Child Education Fees

High Income Child Benefit Charge Tax Rebates

Child Care Rebate Income Tax Return 2022 Carrebate

Education Loan Tax Deduction Benefits Tax Benefits On Educational Loans

Education Loan Tax Deduction Benefits Tax Benefits On Educational Loans

Tuition Fee Receipt School Forms

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

More Tax Credits More Rebates Education Magazine

Income Tax Rebate On Child Education Fees - Web 3 juil 2023 nbsp 0183 32 Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student Who Must Pay Qualified education expenses