Income Tax Rebate On Donation To Charitable Trust Web 1 mars 2021 nbsp 0183 32 Cash A trust s or estate s cash donations to charity can be deducted to the extent of the lesser of the taxable income for the year or the amount of the contribution

Web 27 avr 2018 nbsp 0183 32 As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions from your total income to arrive at your Web 5 nov 2014 nbsp 0183 32 You can claim Income Tax relief by deducting the value of your donation from your total taxable income for the tax year 6 April to 5 April in which you made the

Income Tax Rebate On Donation To Charitable Trust

Income Tax Rebate On Donation To Charitable Trust

https://i0.wp.com/www.transparenthands.org/wp-content/uploads/2018/10/How-to-Get-maximum-Tax-rebate-on-Donation-in-USA.jpg?fit=770%2C385&ssl=1

Tax Rebate Digital Tax Filing Taxes Tax Services

https://i.pinimg.com/originals/d1/08/d6/d108d680f501d43a50b64f8f43eae623.png

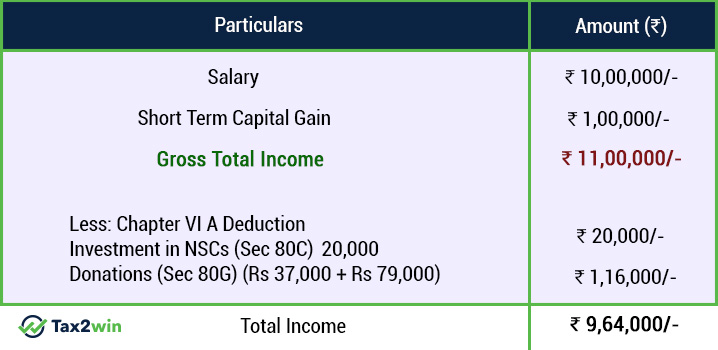

Chapter VI A 80G Deduction For Donation To Charitable Institution

https://blog.tax2win.in/wp-content/uploads/2018/07/DEDUCTION-us-80G-Infographic-4.jpg

Web 3 ao 251 t 2023 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals Web 28 mars 2023 nbsp 0183 32 Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax

Web 23 juin 2023 nbsp 0183 32 Charitable Trusts A charitable trust de 173 scribed in Internal Revenue Code section 4947 a 1 is a trust that is not tax exempt all of the unexpired interests of Web C Donations U s 80G to the following are eligible for 100 Deduction subject to Qualifying Limit Donation to Government or any approved local authority institution or association

Download Income Tax Rebate On Donation To Charitable Trust

More picture related to Income Tax Rebate On Donation To Charitable Trust

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

https://www.careindia.org/wp-content/uploads/2022/05/Secton80g-1024x768.jpg

Taxation Of Charitable Religious Trust

http://taxguru.in/wp-content/uploads/2014/07/trust2.jpg

Charitable Donation Receipt Template Template Business

https://nationalgriefawarenessday.com/wp-content/uploads/2018/01/charitable-donation-receipt-template-donation-receipt-tax-form.jpg

Web 20 avr 2022 nbsp 0183 32 Income Tax on Charitable Trusts and NGOs The following income tax rules are applicable to various categories of incomes of charitable institutions and trusts Web 28 juil 2023 nbsp 0183 32 Types of Charitable Remainder Trusts Taxes on Income Payments From a Charitable Remainder Trust Charitable Deductions for Contributions to a Charitable

Web If you donate to a charity or a community amateur sports club CASCs through Gift Aid they can claim an extra 25p for every 163 1 donated if they have registered with HMRC to Web 16 mai 2021 nbsp 0183 32 The Finance Act 2017 amended section 11 of the Income tax Act 1961 Act with effect from the A Y 2018 19 by adding explanation 2 to section 11 1 of the

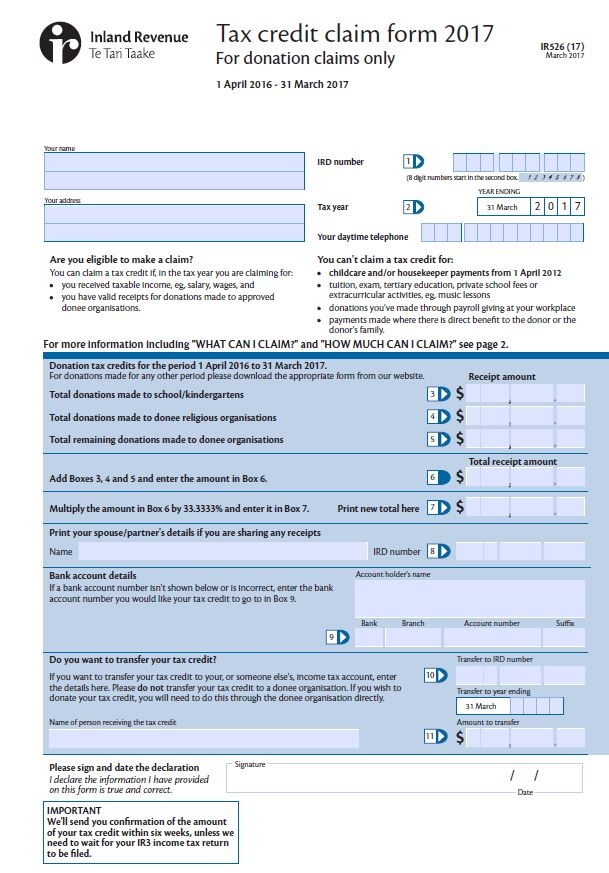

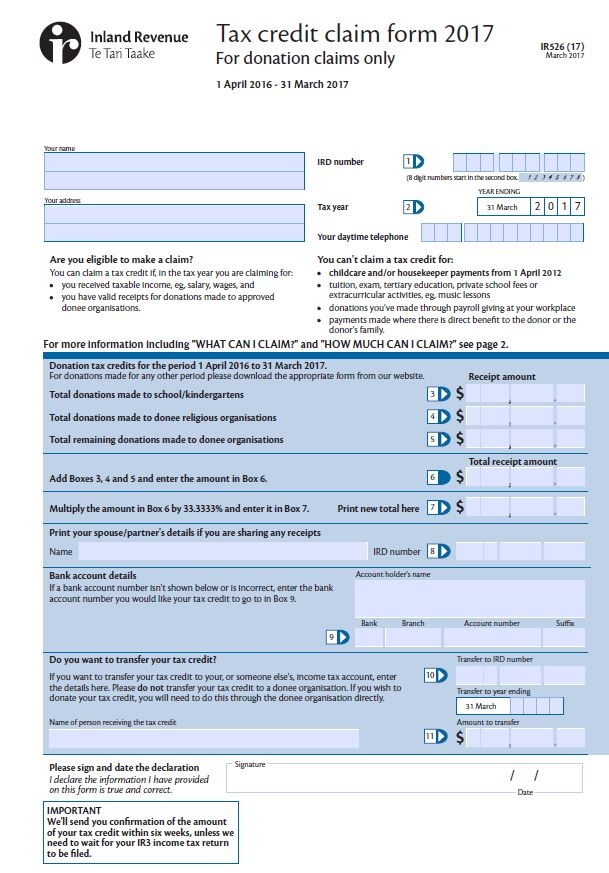

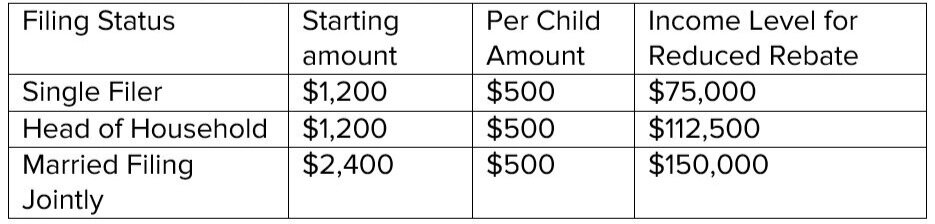

Emigrate Or Immigrate Ir526 Form

https://www.taxback.com/resources/blogimages/20180502135506.1525258506704.09c19926c5abdbcf91642f39647.jpg

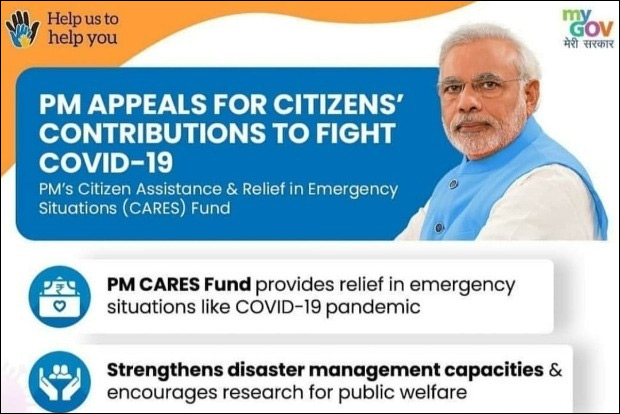

Pm Cares Fund Income Tax Rebate 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/donations-made-to-pm-cares-fund-eligible-for-100-tax-deduction.jpg

https://www.thetaxadviser.com/issues/2021/mar/charitable-income-tax...

Web 1 mars 2021 nbsp 0183 32 Cash A trust s or estate s cash donations to charity can be deducted to the extent of the lesser of the taxable income for the year or the amount of the contribution

https://cleartax.in/s/charitable-trusts-ngo-income-tax-benefits

Web 27 avr 2018 nbsp 0183 32 As per 80G you can deduct your donations to Central and State Relief Funds NGOs and other charitable institutions from your total income to arrive at your

Sample Official Donation Receipts Canada ca Receipts Charitable

Emigrate Or Immigrate Ir526 Form

Explore Our Printable Furniture Donation Receipt Template Receipt

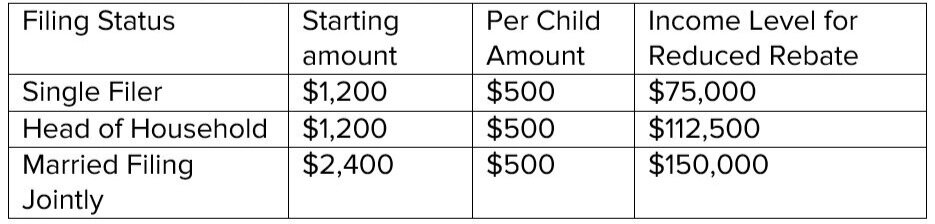

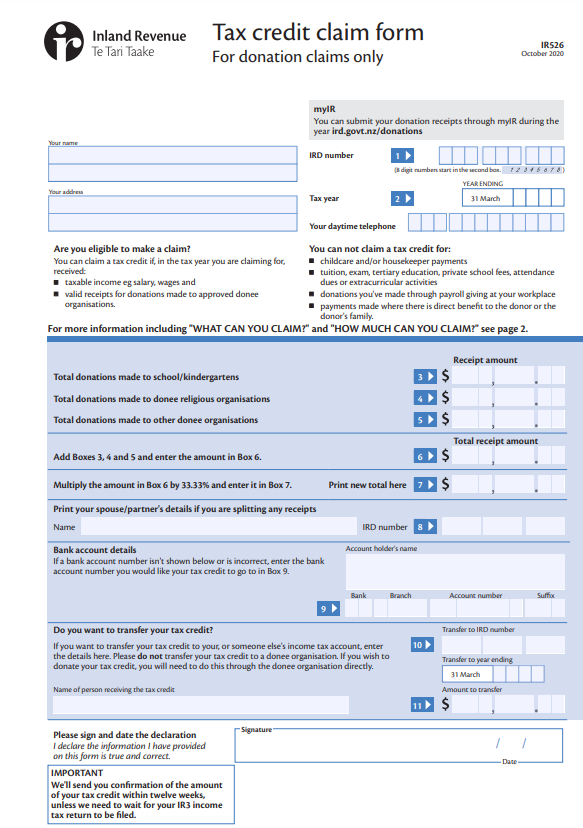

Individual Income Tax Rebate

Irs Rules For Church Donations Hobi Akuarium

CARES Act Q A About Recovery Rebates Student Loans Health Care

CARES Act Q A About Recovery Rebates Student Loans Health Care

Donate Your Tax Return To UNICEF NZ

Random Thoughts Does Donating Money Actually Save You More Money From

Income Tax Rebate Under Section 87A

Income Tax Rebate On Donation To Charitable Trust - Web C Donations U s 80G to the following are eligible for 100 Deduction subject to Qualifying Limit Donation to Government or any approved local authority institution or association