Income Tax Rebate On Ex Gratia Web Ex gratia payment made voluntarily by an employer is not taxable as profits in lieu of salary Background Section 17 3 of the Income tax Act 1961 the

Web 28 oct 2020 nbsp 0183 32 Published October 28 2020 Updated December 27 2022 What is Ex Gratia Payment An ex gratia payment is a type of payment made by an organization to an Compensation payments are often made ex gratia if a government or organization is prepared to compensate victims of an event such as an accident or similar but not to admit liability to pay compensation or for causing the event A company conducting layoffs may make an ex gratia payment to the affected employees that is greater than the statutory payment required by the law perhaps if those employees had a long

Income Tax Rebate On Ex Gratia

Income Tax Rebate On Ex Gratia

https://static.toiimg.com/thumb/imgsize-23456,msid-83865749,width-600,resizemode-4/83865749.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

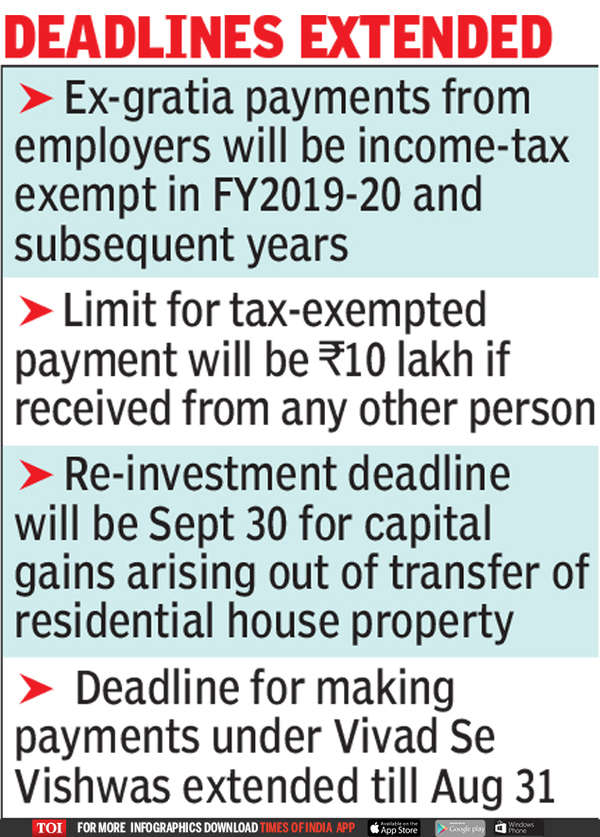

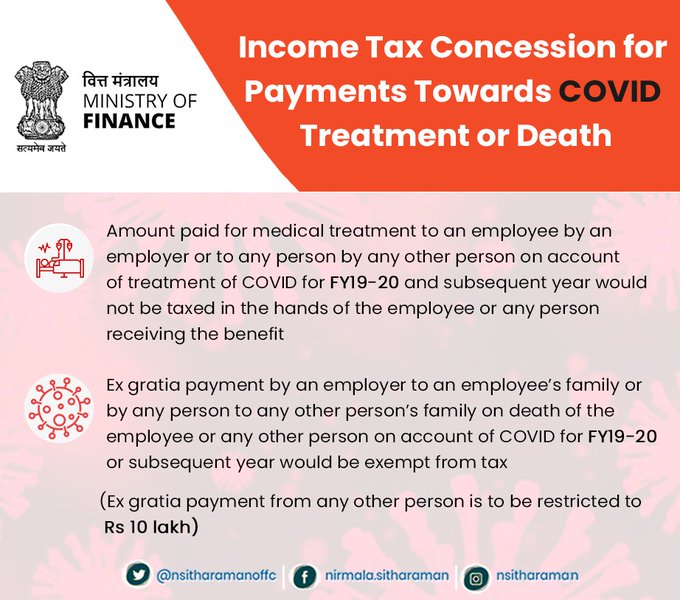

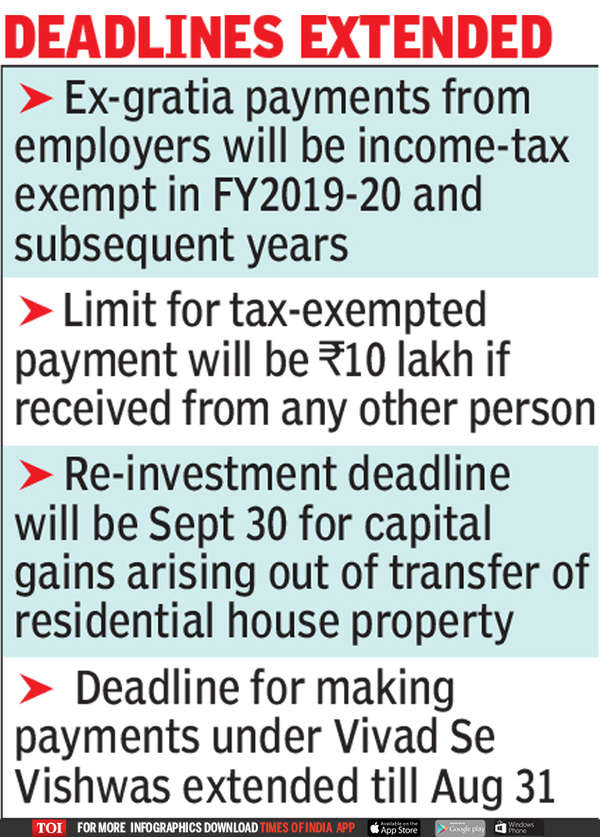

Web In order to provide relief to the family members of such taxpayer it has been decided to provide income tax exemption to ex gratia payment received by family members of a Web 19 d 233 c 2018 nbsp 0183 32 Guidance Ex gratia guidance Guidance on how ex gratia payments are managed and resolved and how actual and non financial losses are assessed by UK

Web 22 juin 2020 nbsp 0183 32 22 June 2020 Sometimes due to accidents and deaths people receive ex gratia from Government Is it taxable as per Income Tax Act If yes under what head Web 1 Gratuity payable to deceased s wife of Rs 12 5 Lakh is taxable in her own hands under the head quot Income from Other sources quot and exemption u s 10 10 is available to her upto

Download Income Tax Rebate On Ex Gratia

More picture related to Income Tax Rebate On Ex Gratia

Tax Exemption On Ex Gratia To Employees For COVID 19

https://1.bp.blogspot.com/-kIotAD-A5GE/YNvHq2LImhI/AAAAAAAADvM/i7iJcGFtSU8rS0bS35_e4CR7kwmIhMsFACLcBGAsYHQ/s680/tax-exemption-on-ex-gratia-to-employees-for-covid-19.jpg

Wages 1 5 Million Or Less RevenueSA

https://www.revenuesa.sa.gov.au/__data/assets/image/0019/203653/Image-$1.5m-wages-AR-rate-of-tax.png

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Web 6 oct 2021 nbsp 0183 32 Income tax rebate on ex gratia amount Anurag Jha 1 Points 05 October 2021 In FY 2020 21 I have been laid off and given ex gratia amount of INR 1200000 Web 16 ao 251 t 2023 nbsp 0183 32 You can efile income tax return on your income from salary house property capital gains business amp profession and income from other sources Further

Web Do I have to pay tax on ex gratia payments which are over 163 30 000 As above the first 163 30 000 of an ex gratia payment will be tax free Once you exceed the 163 30 000 tax free Web 2 f 233 vr 2022 nbsp 0183 32 Explained All about tax relief on COVID 19 treatment and ex gratia payment Budget 2022 has formalised the tax exemption to payment received from employers or

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

https://assets.kpmg.com/content/dam/kpmg/pdf/2016/02/KP…

Web Ex gratia payment made voluntarily by an employer is not taxable as profits in lieu of salary Background Section 17 3 of the Income tax Act 1961 the

https://corporatefinanceinstitute.com/.../ex-gratia-payment

Web 28 oct 2020 nbsp 0183 32 Published October 28 2020 Updated December 27 2022 What is Ex Gratia Payment An ex gratia payment is a type of payment made by an organization to an

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Electric Car 2023 Carrebate

How To Search Income Tax Rebate On Women YouTube

Income Tax Rebate Under Section 87A

Ex Gratia Payment Entry In Tally Chapter I Objectives Objectives Of

Ex Gratia Payment Entry In Tally Chapter I Objectives Objectives Of

GRATUITY OR EX GRATIA TO LEGAL HEIRS WHETHER TAXABLE Tax Planning For

Budget 2015 Personal Income Tax TODAY

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Income Tax Rebate On Ex Gratia - Web Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilit 233