Should Rebates Be Recorded As Revenue Web If receipt of the rebate is not probable or the amount cannot be measured reliably then the inventory should be recorded at its gross amount Again this assessment should be

Web 30 oct 2015 nbsp 0183 32 I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them Should I Web 29 nov 2018 nbsp 0183 32 The Financial Accounting Standards Board has ruled that rebates and other sales discounts must be recorded in a contra account that reduces gross sales

Should Rebates Be Recorded As Revenue

Should Rebates Be Recorded As Revenue

https://images.sampletemplates.com/wp-content/uploads/2016/04/25122800/Rent-Rebate-Form-Free.jpg

The New Revenue Recognition Standard The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2016.86.1.014.t006.jpg

Solved The Total Of Deposits As Per The Balance Sheet Will Chegg

https://media.cheggcdn.com/study/bf4/bf436ab3-e529-4e68-9011-10ae9075943d/image

Web may arise as a result of discounts rebates refunds credits concessions incentives performance bonuses penalties and contingent payments variable consideration is only Web 5 sept 2012 nbsp 0183 32 Revenue the gross inflow of economic benefits cash receivables other assets arising from the ordinary operating activities of an entity such as sales of goods

Web Expenses and revenues must be matched in the same accounting period Everything from purchasing and rebate agreements to sales depends on financial periods If a mistake is made in terms of when a rebate is Web ElectronicsCo should account for the rebate in the same manner as if it were paid directly to the Retailer Payments to a customer s customer within the distribution chain are

Download Should Rebates Be Recorded As Revenue

More picture related to Should Rebates Be Recorded As Revenue

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

![]()

Building Energy Retrofit Accelerator City Of Edmonton

https://coe-edmonton.prod.opwebops.dev/sites/default/files/public-files/BERA-Rebate-Tracker.jpg?cb=1667961490

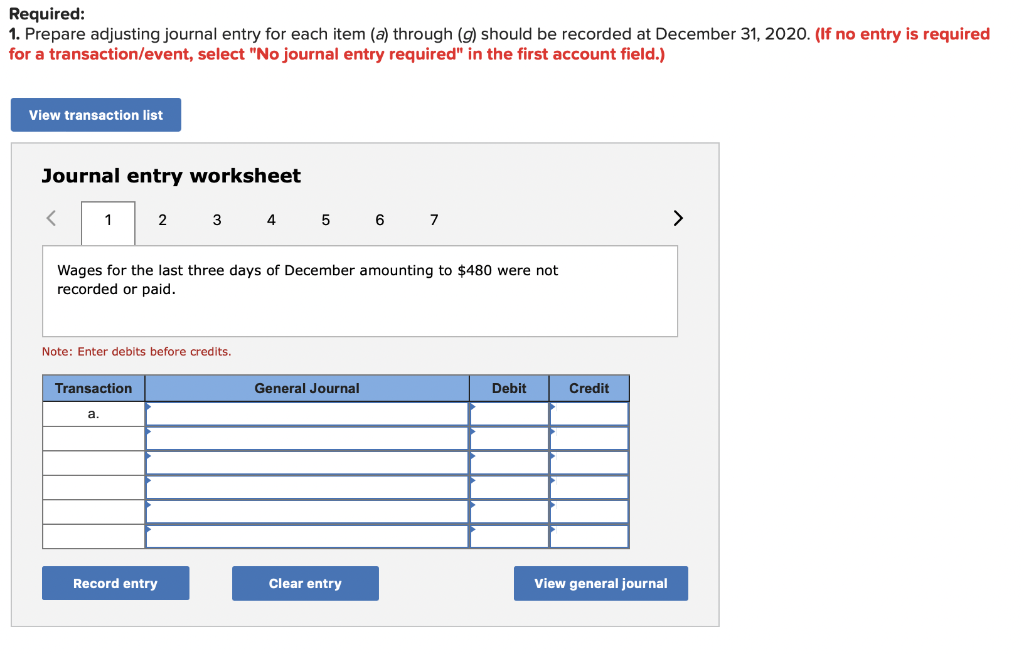

Solved The Following Transactions Are Typical Op SolutionInn

https://s3.amazonaws.com/si.experts.images/questions/2023/02/63fc61959fb12_1677484436891.png

Web The key to getting your rebate accounting right is to ensure you understand both the contractual form and commercial substance of your rebates and the appropriate Web New model Current US GAAP Current IFRS Revenue should not be recognised for goods expected to be returned and a liability should be recognised for expected refunds to

Web 4 d 233 c 2018 nbsp 0183 32 If your company is on the receiving end of a rebate for installing energy efficient equipment it should be recorded as revenue Although the rebate is from a Web A business should match expenses and revenues in the same accounting period to show the full effect of a transaction in that period Financial periods are vital as the majority of

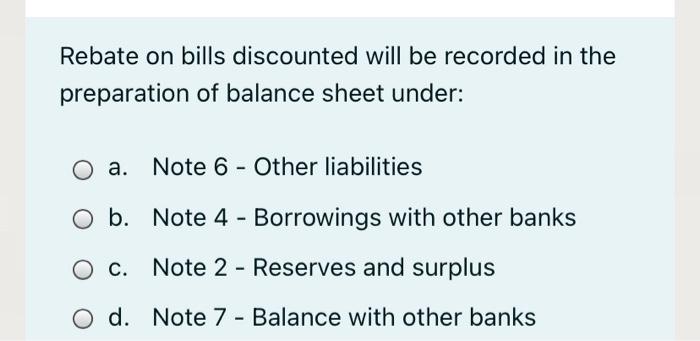

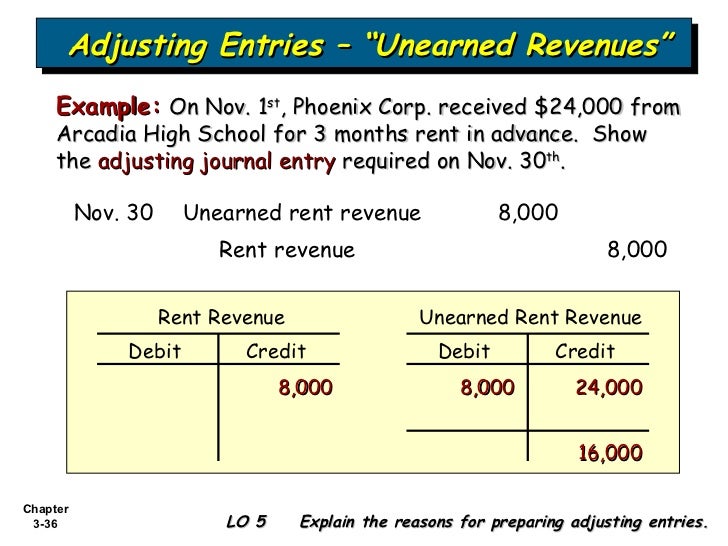

Bab 3 The Accounting Information System

https://image.slidesharecdn.com/bab3-theaccountinginformationsystem-120101011232-phpapp01/95/bab-3-the-accounting-information-system-36-728.jpg?cb=1325381323

Solved On December 31 2020 Dyer Inc Completed Its First Chegg

https://media.cheggcdn.com/media/12b/12b898a7-4085-46c2-9d8e-2312e504a49b/phpw3JZb3

https://www.grantthornton.global/globalassets/1.-member-fir…

Web If receipt of the rebate is not probable or the amount cannot be measured reliably then the inventory should be recorded at its gross amount Again this assessment should be

https://www.proformative.com/questions/accounting-for-vendor-rebates

Web 30 oct 2015 nbsp 0183 32 I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them Should I

Fiscal Revenue Excluding Subsidies And Tax Rebates Increased By 5 1 In

Bab 3 The Accounting Information System

6 A Construction Company Decides To Take A New Job The Estimated

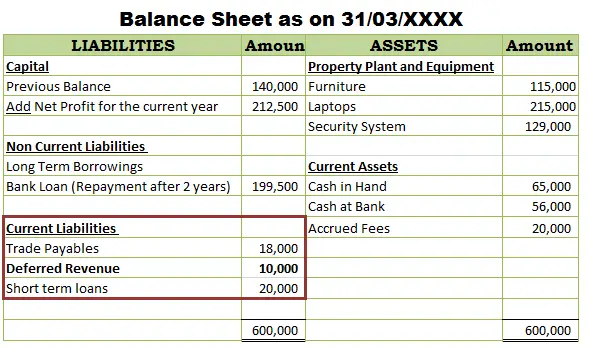

Is Deferred Revenue A Liability Accounting Capital

Rebates Discounts And Rent Incentives Re Leased

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

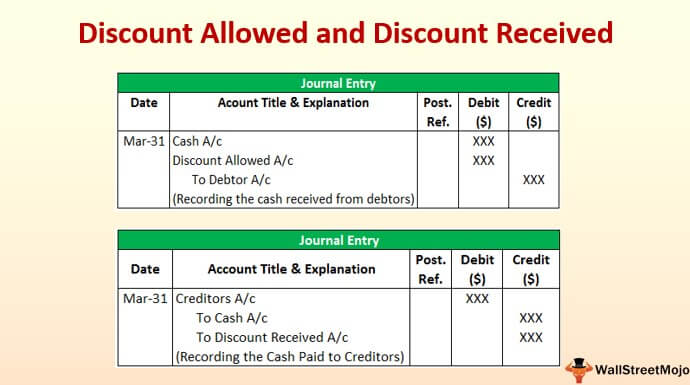

Discount Allowed And Discount Received Journal Entries With Examples

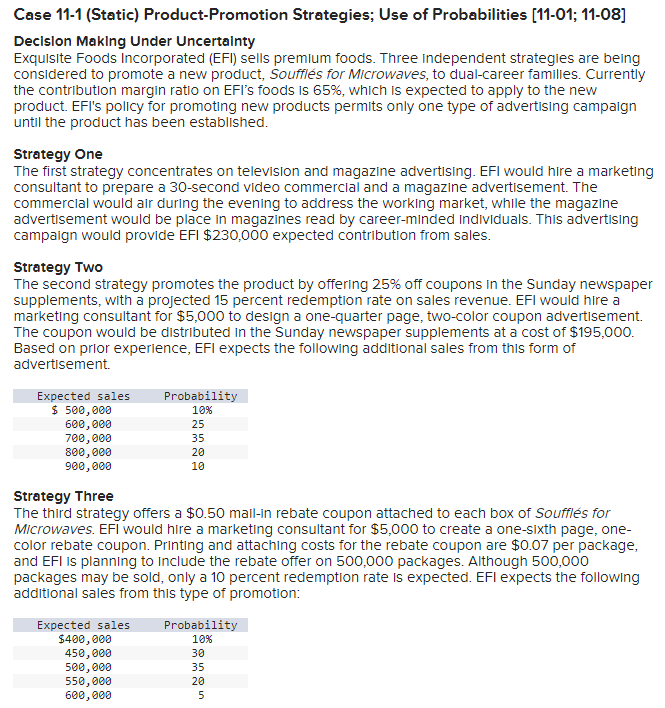

Solved Case 11 1 Static Product Promotion Strategies Use Chegg

Turning Supply Chain Chaos Into Revenue With Rebates Enable

Should Rebates Be Recorded As Revenue - Web The following are examples of when a receipt should be treated as an expense reduction Refunds or rebates from a vendor for goods or services purchased from the vendor