Income Tax Rebate On Home Loan Interest Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web 5 janv 2023 nbsp 0183 32 The mortgage interest deduction allows you to reduce your taxable income by the amount of money you ve paid in mortgage interest during the year So if you have a mortgage keep good records

Income Tax Rebate On Home Loan Interest

Income Tax Rebate On Home Loan Interest

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

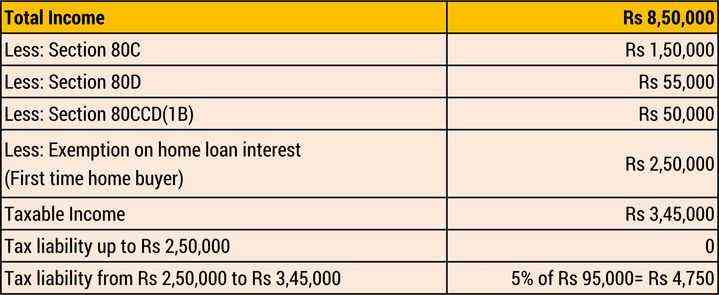

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less Web 24 ao 251 t 2023 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Download Income Tax Rebate On Home Loan Interest

More picture related to Income Tax Rebate On Home Loan Interest

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income Web Under Section 80 EEA the government has allowed first time homebuyers to deduct an extra Rs 1 5 lakhs from their taxable income if they pay interest on a house loan This

Web On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act If you are a first time homeowner additional Web 13 juin 2020 nbsp 0183 32 Hence to help the citizens income tax act provides deduction of interest paid on home loan under Section 24 Contents When the house is self occupied When

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

https://theviralnewslive.com/wp-content/uploads/2023/02/income-tax-rebate-home-loan-Savings_11zon.jpg

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Home Loan Interest Exemption In Income Tax Home Sweet Home

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Form 12BB New Form To Claim Income Tax Benefits Rebate

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

How To Claim Interest On Home Loan Deduction While Efiling ITR

Income Tax Rebate On Home Loan Interest - Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less