Tax Rebate On Medical Treatment Web 12 juin 2020 nbsp 0183 32 Tax on medical reimbursement received amp expenses paid SRIKANT AGARWAL Income Tax Articles Download PDF 12 Jun 2020 426 991 Views 86 comments All about taxability of medical

Web 16 ao 251 t 2023 nbsp 0183 32 You can claim tax relief on Doctor and consultant fees Maintenance or treatment in a hospital treatment facility such as a clinic or a nursing home Transport Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner RM8000

Tax Rebate On Medical Treatment

Tax Rebate On Medical Treatment

https://www.caaccess.org/wp-content/uploads/2022/06/Screen-Shot-2022-06-07-at-2.18.42-PM.png

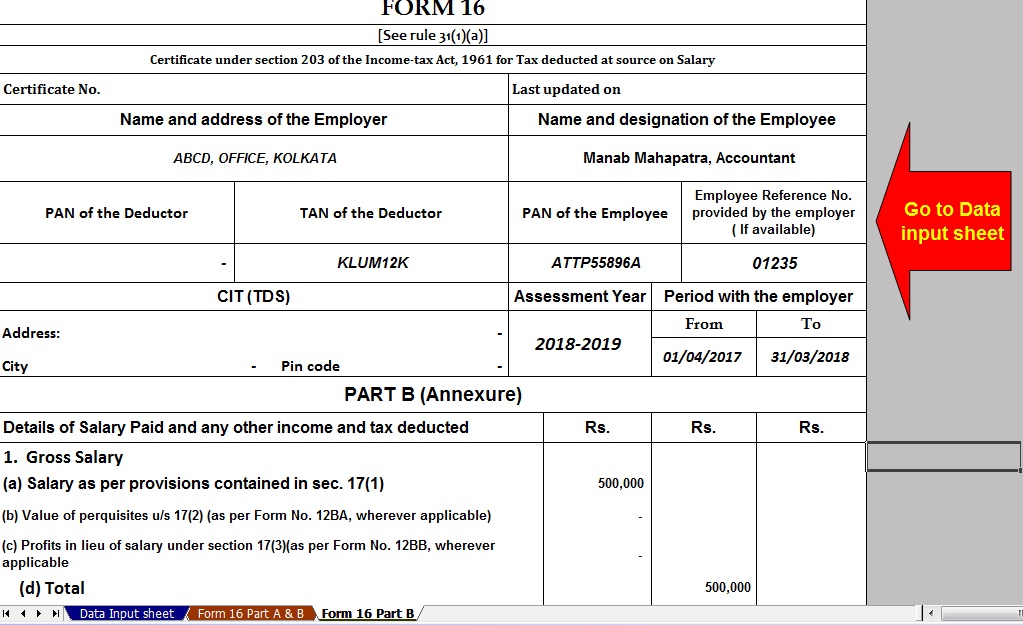

Income Tax Deduction For Medical Treatment With Automated TDS On

https://tdstax.files.wordpress.com/2018/01/1a1d4-form2b162bpart2bb.jpg

REBATES FOR MEDICAL AND ALLIED HEALTH THERAPIES

https://s3.studylib.net/store/data/008447136_1-856556770ed22f5955a5a1f85590b51e-768x994.png

Web 8 mars 2022 nbsp 0183 32 Since you have to earn over 163 150 000 for the first 45 rate to apply most doctors will pay tax on their salary at the basic rate of 20 for the first chunk of income Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions

Web 13 f 233 vr 2019 nbsp 0183 32 The deduction under this section is available only for expenditures incurred for medical treatment of specified diseases All specified diseases for which this deduction can be claimed are Web 26 nov 2020 nbsp 0183 32 Deduction in respect of expenses towards medical treatment Section 80DDB allows tax deduction on expenses incurred by an individual on himself or a dependent

Download Tax Rebate On Medical Treatment

More picture related to Tax Rebate On Medical Treatment

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

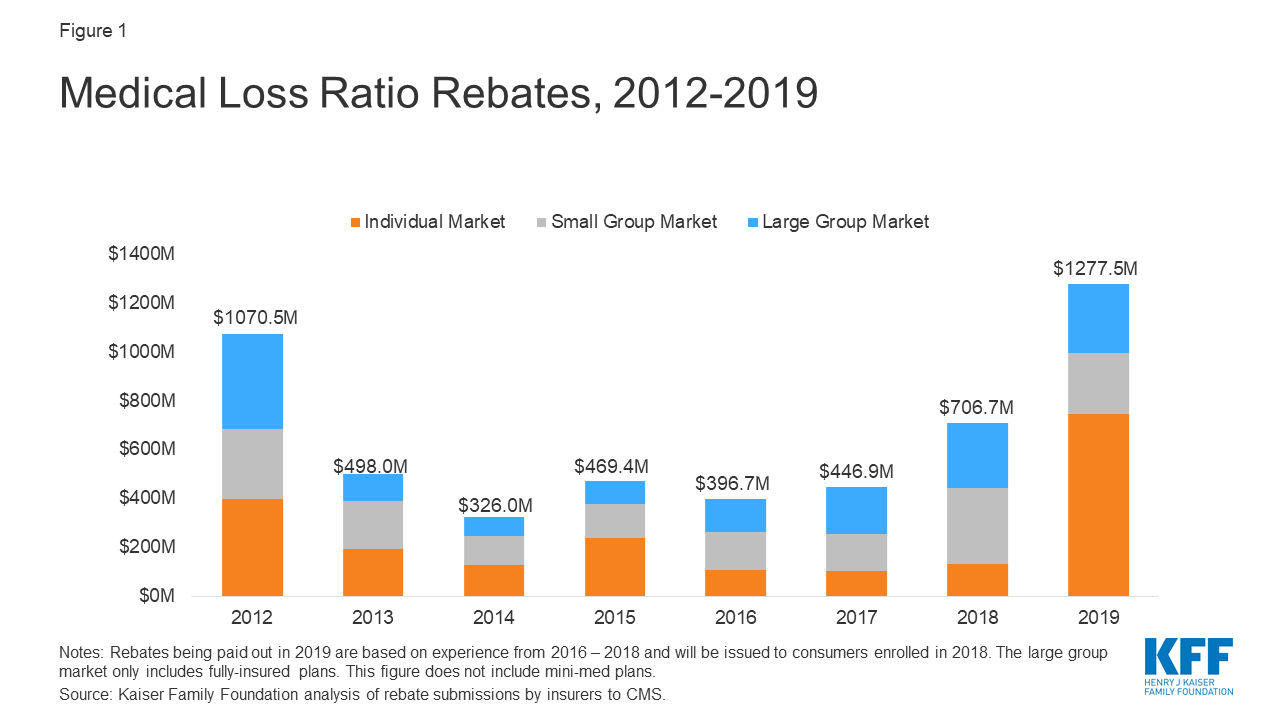

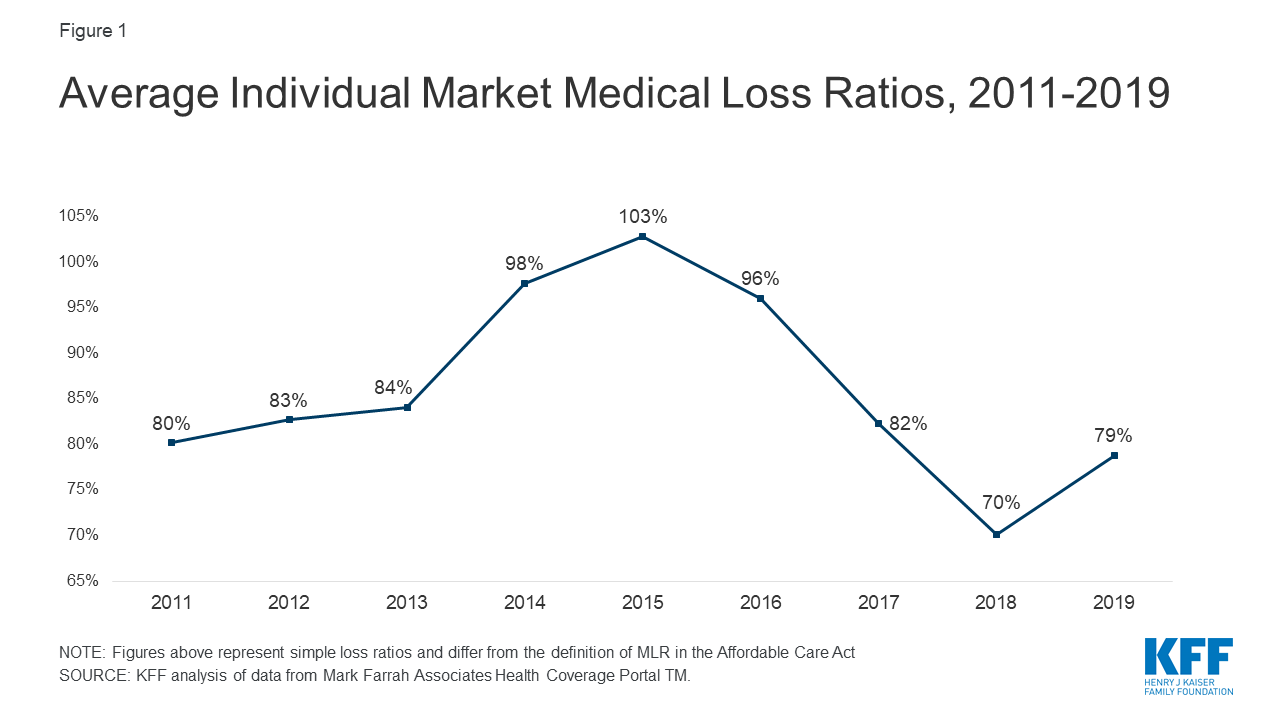

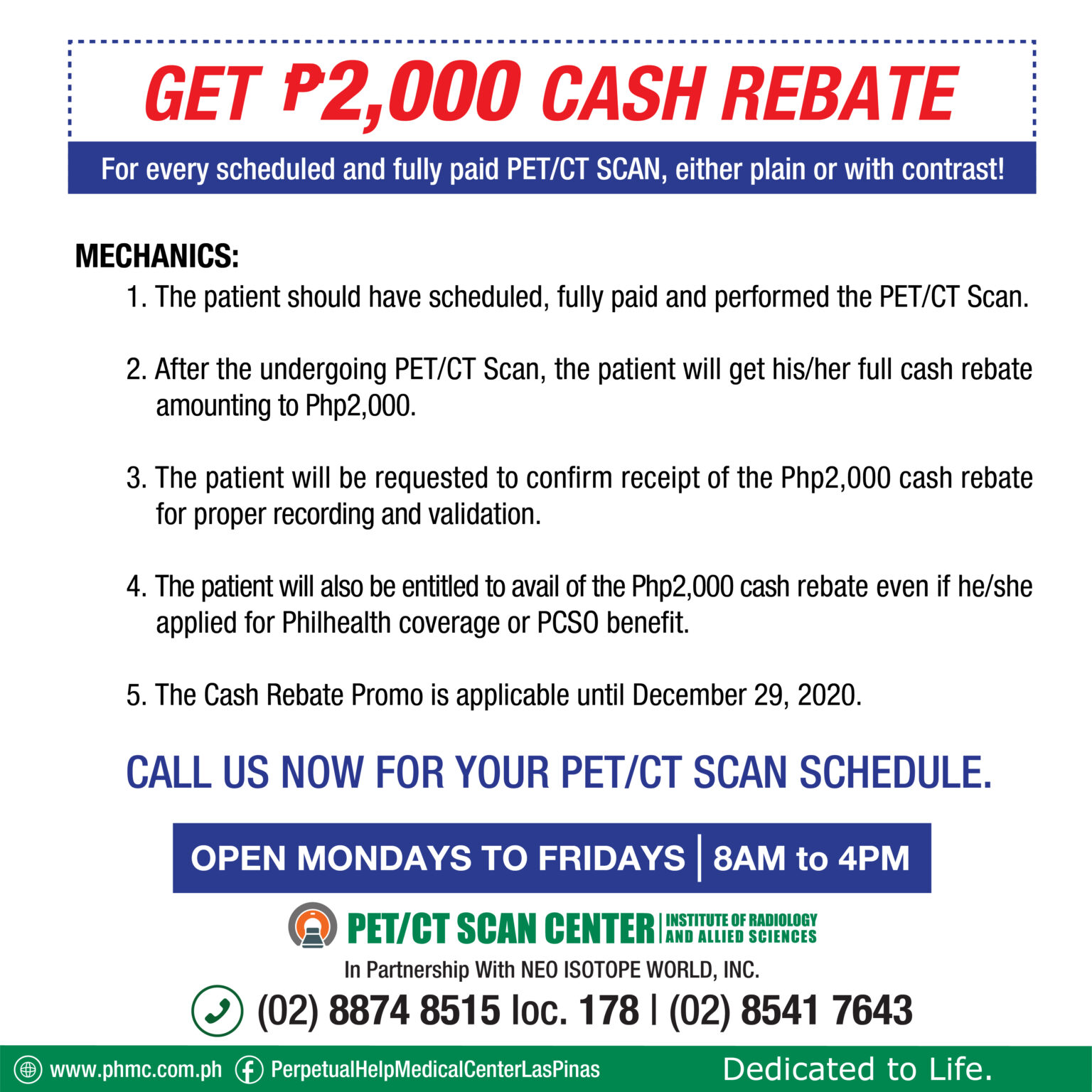

How The Medical Loss Ratio Impacts Mississippi Center For Mississippi

https://mshealthpolicy.com/wp-content/uploads/2019/09/9346-Figure-1.png

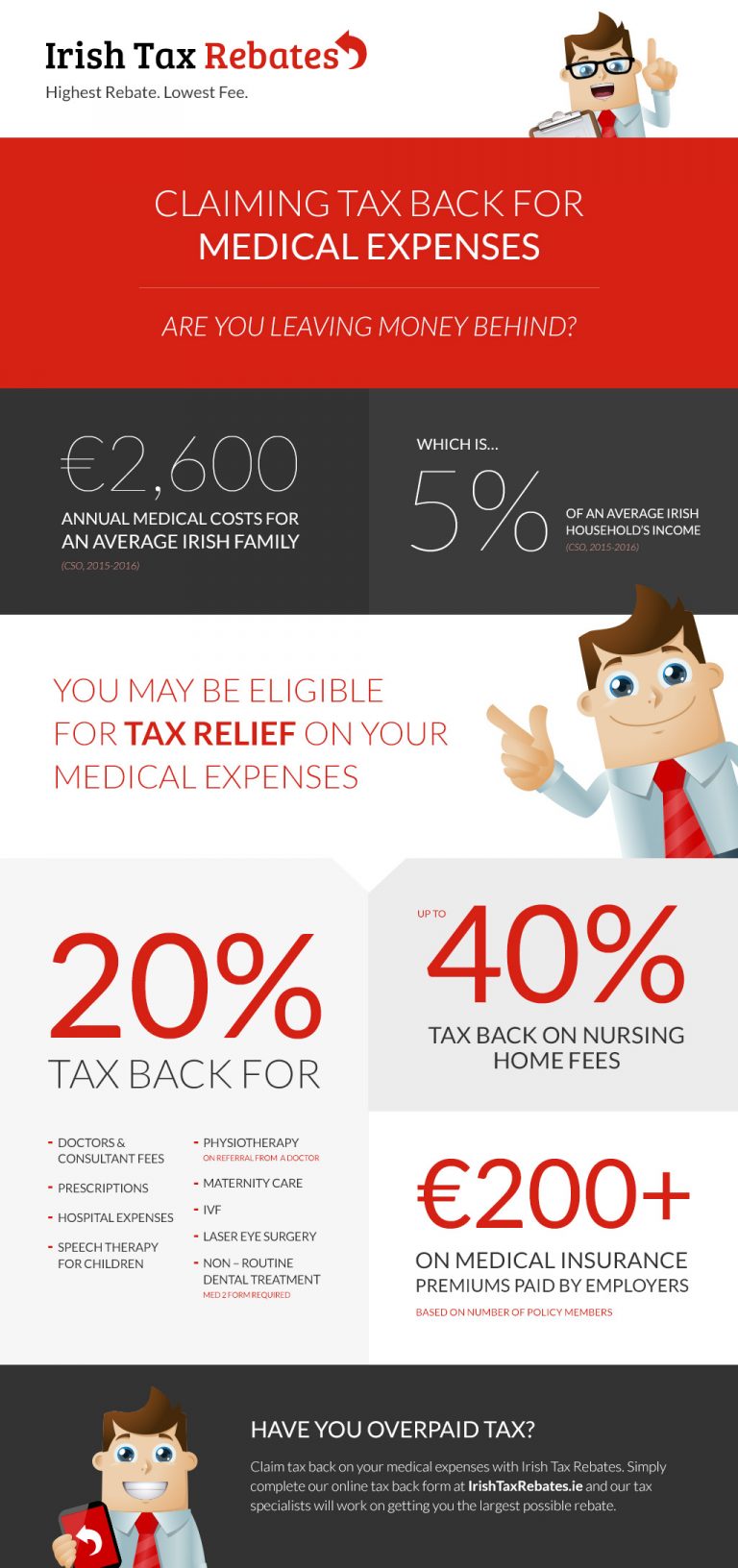

Tax Back On Medical Expenses Infographic Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1-768x1632.jpg

Web 2 nov 2015 nbsp 0183 32 Section 80DDB Income tax Act 1961 2015 Medical Treatment Income Tax Rebate under section 80DDB provides rebate in respect of Medical Treatment Web 19 avr 2021 nbsp 0183 32 You can claim your tax refund for the following medical expenses Visits to the doctor On average it costs around 30 to 65 for a single visit to the GP It includes fees

Web 4 mai 2018 nbsp 0183 32 You get tax relief for health expenses at your standard rate of tax at 20 and nursing home expenses at your highest rate of tax up to 40 For example this amounts Web 23 avr 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act

Data Note 2020 Medical Loss Ratio Rebates KFF

https://www.kff.org/wp-content/uploads/2020/04/9346-02-Figure-1.png?resize=215

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

https://taxguru.in/income-tax/taxability-medic…

Web 12 juin 2020 nbsp 0183 32 Tax on medical reimbursement received amp expenses paid SRIKANT AGARWAL Income Tax Articles Download PDF 12 Jun 2020 426 991 Views 86 comments All about taxability of medical

https://www.citizensinformation.ie/en/money-and-tax/tax/income-tax...

Web 16 ao 251 t 2023 nbsp 0183 32 You can claim tax relief on Doctor and consultant fees Maintenance or treatment in a hospital treatment facility such as a clinic or a nursing home Transport

Why Is Medicare

Data Note 2020 Medical Loss Ratio Rebates KFF

In SA Tax Credits For Medical Aid Contributions eBiz Money

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

Private Health Insurance Rebate Navy Health

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

Claiming The Medical Offset Tax Rebate

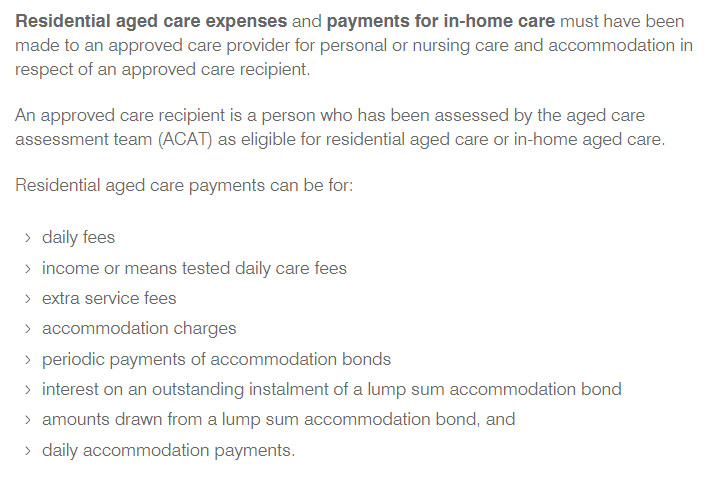

PET CT SCAN P2 000 CASH REBATE PROMO Perpetual Help Medical Center

Can I Claim Ppi Back From My Catalogue

Tax Rebate On Medical Treatment - Web 26 nov 2020 nbsp 0183 32 Deduction in respect of expenses towards medical treatment Section 80DDB allows tax deduction on expenses incurred by an individual on himself or a dependent