Tax Benefit On Medical Expenses General information How to claim medical expenses Credits or deductions related to medical expenses Certain medical expenses require a certification Common medical

Tax Benefit to Employee on Medical Reimbursement of up to Rs 15 000 Updated on Sep 5th 2023 8 min read CONTENTS Show This benefit has been Ask Mint Money Can I claim tax benefit on medical costs 2 min read 21 Jan 2024 10 21 PM IST Join us Neeraj Agarwala In accordance with the provisions of

Tax Benefit On Medical Expenses

Tax Benefit On Medical Expenses

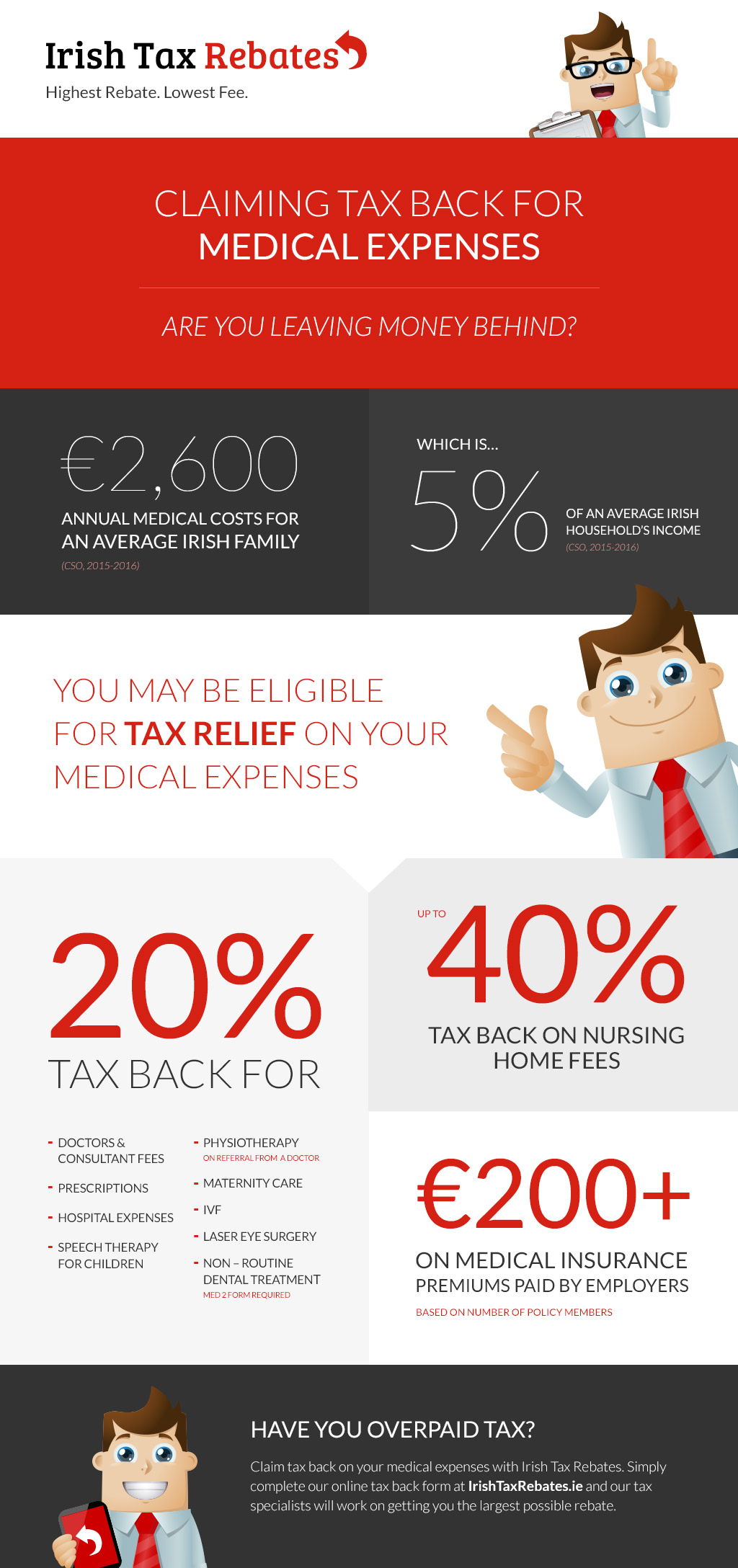

http://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1.jpg

How To Get The Most Out Of Your Medical Expenses Elite Tax

http://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

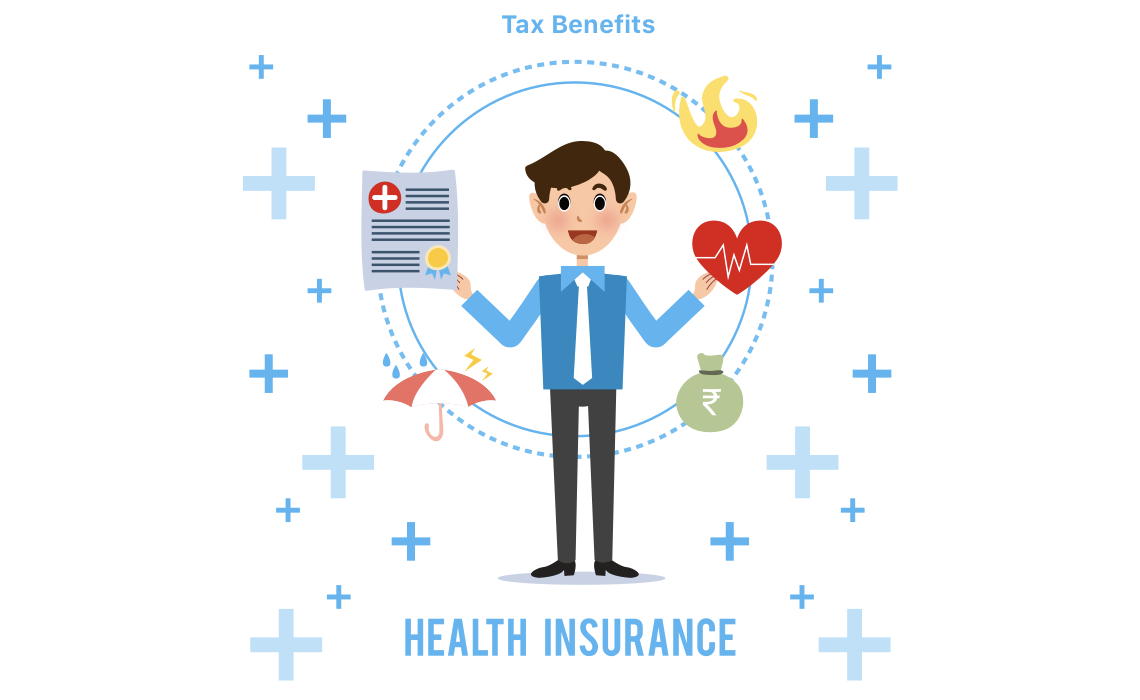

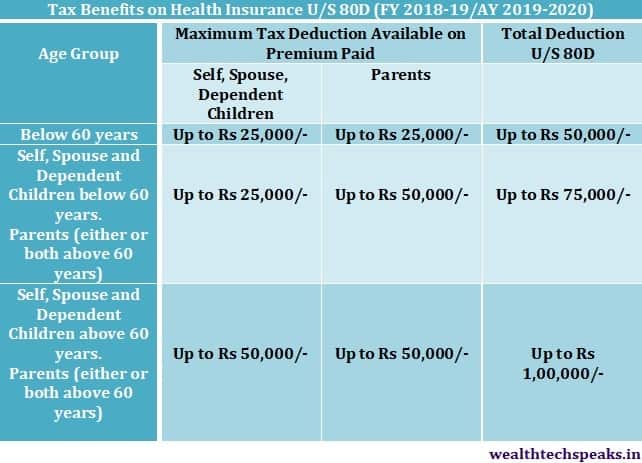

Tax Benefit On Health Insurance U s 80D updated For FY 2018 19

https://www.apnaplan.com/wp-content/uploads/2018/05/Tax-Benefit-on-Medical-Insurance-under-Section-80D.png

Can You Claim Medical Expenses on Your Taxes While many out of pocket medical bills are deductible you have two hurdles to overcome before you can If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to 07 Dec 2023 Allowances and reimbursements to employees have become prevalent in the corporate world Among such assistance from the employers employees also enjoy

Download Tax Benefit On Medical Expenses

More picture related to Tax Benefit On Medical Expenses

Tax Refund Claim Your Tax Refund On Medical Expenses Today

https://yourmoneyback.ie/wp-content/uploads/2017/11/Medical.jpg

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

Frequently Asked Questions PHSP HSA Smartin Benefits

https://www.smartinbenefits.com/images/faq/data-claim-medical-expenses-personal-tax.png

Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

To receive a tax benefit you have to itemize deductions on Schedule A and your total itemized deductions deductible medical expenses state and local Taxpayers can deduct medical expenses by itemizing them on their taxes However these deductions may be out of your reach as the current standard deduction

How To Save On Medical Expenses Small Steps With Big Results Hosbeg

https://hosbeg.com/wp-content/uploads/2019/07/f34999a9e347487d34cd4e79041efc25-1024x682.jpeg

What Can You Claim For Tax Relief Under Medical Expenses

https://static.imoney.my/articles/wp-content/uploads/2022/03/26220201/medical-check-up.jpg

https://www.canada.ca/en/revenue-agency/services...

General information How to claim medical expenses Credits or deductions related to medical expenses Certain medical expenses require a certification Common medical

https://cleartax.in/s/income-tax-benefit-employee...

Tax Benefit to Employee on Medical Reimbursement of up to Rs 15 000 Updated on Sep 5th 2023 8 min read CONTENTS Show This benefit has been

Medical Expenses You Can Claim Back From Tax Multiply Blog

How To Save On Medical Expenses Small Steps With Big Results Hosbeg

Tax Benefits Of Health Insurance Policies Piggy Blog

Tax Benefits With Health Insurance

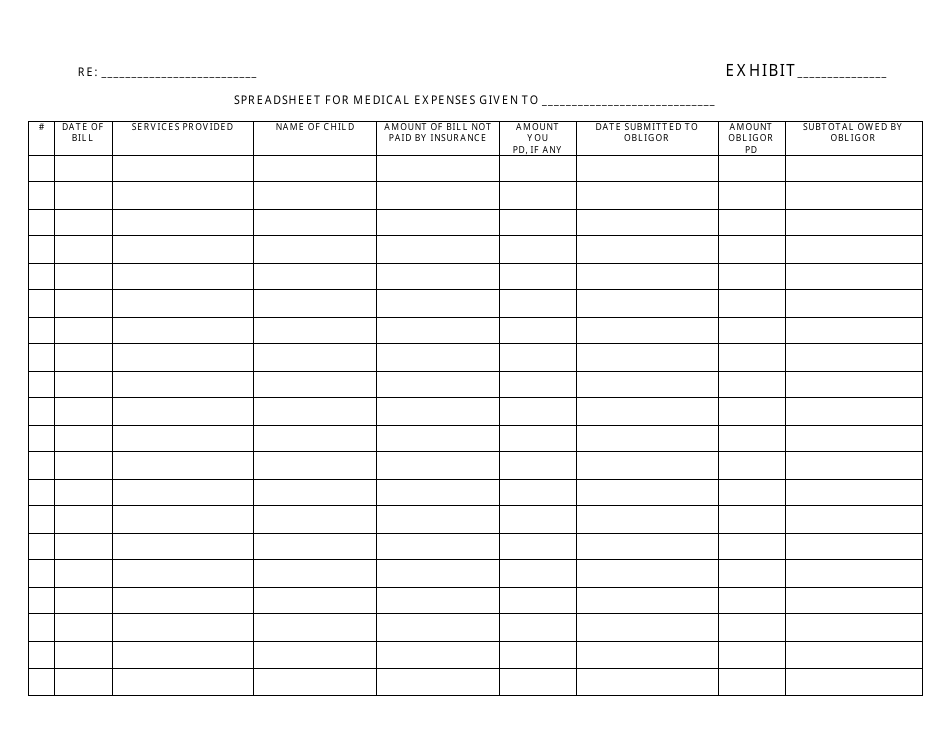

Spreadsheet Template For Medical Expenses Download Printable PDF

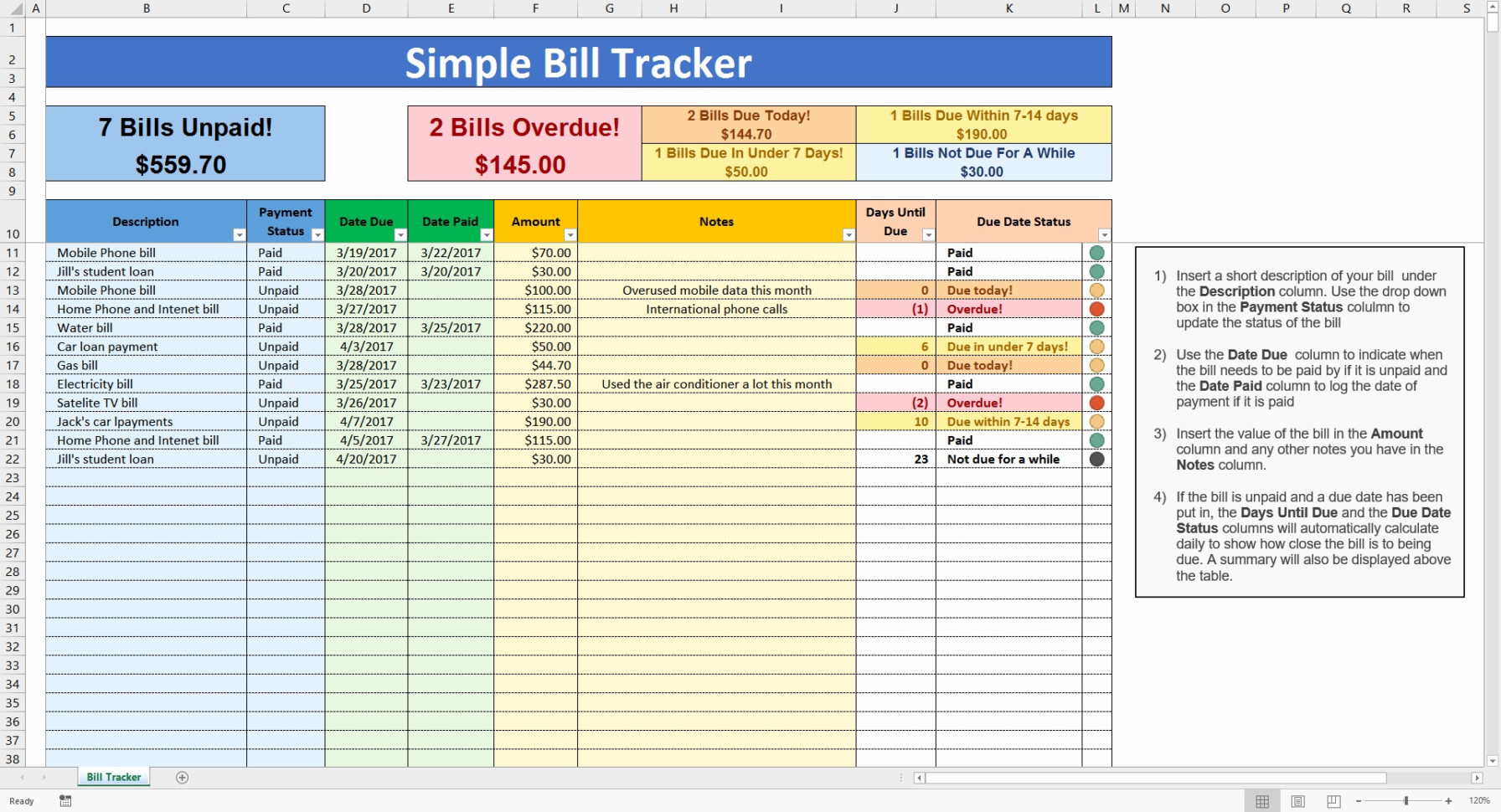

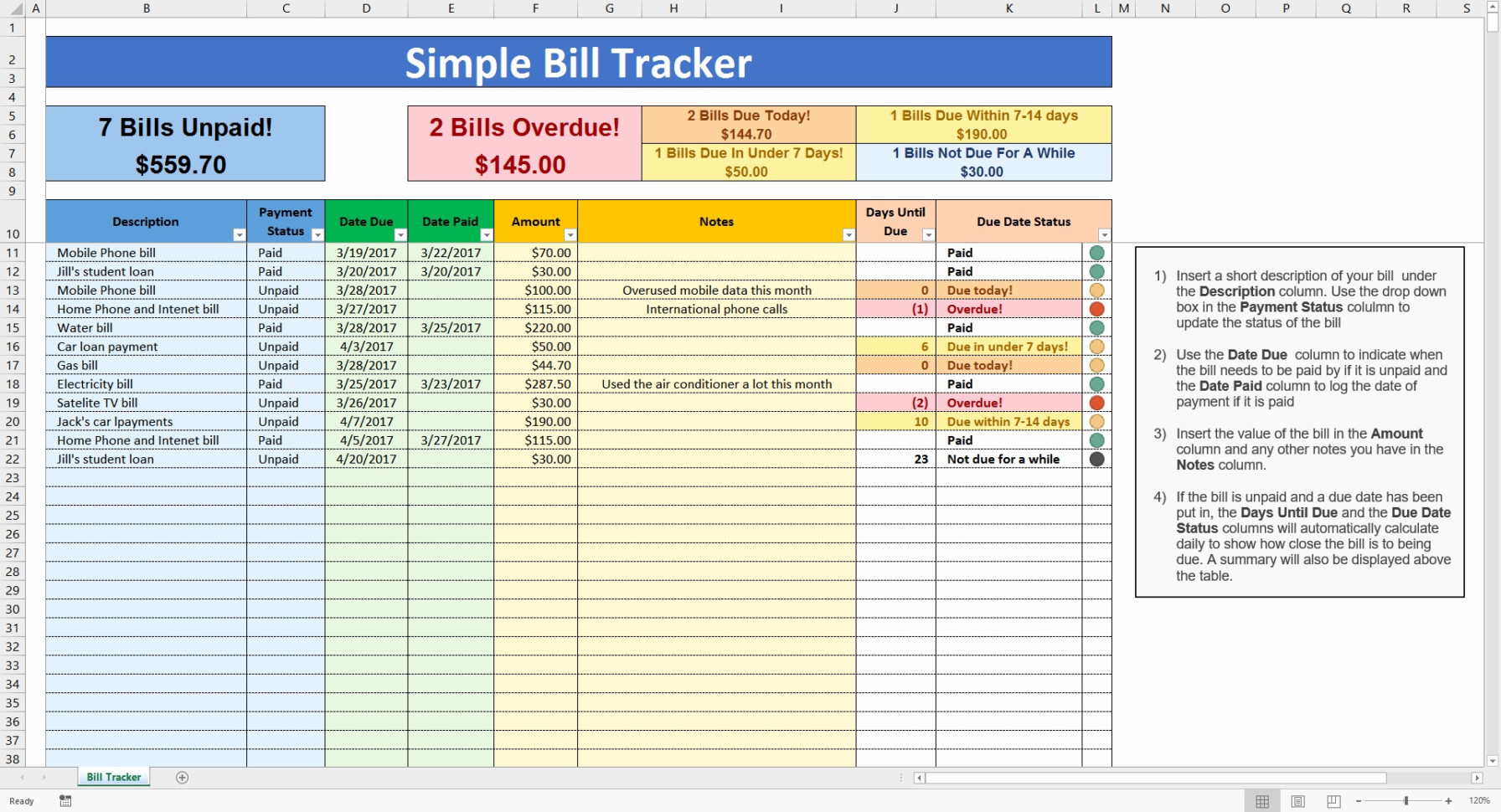

Medical Expense Spreadsheet Templates In Personal Budget Billadsheet

Medical Expense Spreadsheet Templates In Personal Budget Billadsheet

10 Attractive Fundraising Ideas For Medical Expenses 2023

Medical Expenses Icon Royalty Free Vector Image

Health Insurance Tax Benefit 4 Ways To Protect Your Savings By

Tax Benefit On Medical Expenses - You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to