Tax Return On Medical Expenses For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring

Tax Return On Medical Expenses

Tax Return On Medical Expenses

http://ramsaycpa.com/blog/wp-content/uploads/2017/10/10_03_17_80407780_ITB_560x292.jpg

How To Get The Most Out Of Your Medical Expenses Elite Tax

http://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

Guide Tax Back On Medical Expenses Irish Tax Rebates

https://www.irishtaxrebates.ie/img/xmedical-expenses-hero.png.pagespeed.ic.-qC5BvXHlN.png

You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return You were The medical expenses tax offset was available from the 2015 16 to 2018 19 income years The offset is not available from 1 July 2019 You could claim the medical

Luckily you can recoup some of those costs when you file your taxes by taking a deduction for medical expenses To do so the expenses in question must meet the qualifications outlined by the IRS This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in

Download Tax Return On Medical Expenses

More picture related to Tax Return On Medical Expenses

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Medical Expenses You Can Claim Back From Tax Momentum Multiply Blog

https://blog.multiply.co.za/wp-content/uploads/2019/07/save-on-medical-expenses.jpg

133 rowsHow to claim eligible medical expenses on your tax return You can claim eligible medical expenses on line 33099 or line 33199 of your tax return Step 5 Federal tax According to IRS Publication 502 you can only classify services or items as medical expenses if they alleviate or prevent a physical or mental disability or illness

If you incurred substantial medical expenses not covered by insurance you might be able to claim them as deductions on your tax return These costs include How To Claim Medical Expenses on Your Taxes To claim qualifying medical expenses on your tax return you ll need to complete Schedule A and file it with

Don t Get Caught Up In A Tax Return Scam Acclaim Federal Credit Union

https://www.acclaimfcu.org/wp-content/uploads/2022/01/Dont-Get-Caught-up-in-a-Tax-Return-Scam-scaled-1-1536x1153.jpg

Medical Expense Deduction How To Claim A Tax Deduction For Medical

https://www.bankrate.com/2020/02/20184340/Medical-expense-deduction-how-to-claim-medical-expenses-on-your-taxes.jpeg

https://www.nerdwallet.com/article/taxes/me…

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

https://www.thebalancemoney.com/medical-e…

You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

The Top Four Reasons To File Your Personal Tax Return On Time SCARROW

Don t Get Caught Up In A Tax Return Scam Acclaim Federal Credit Union

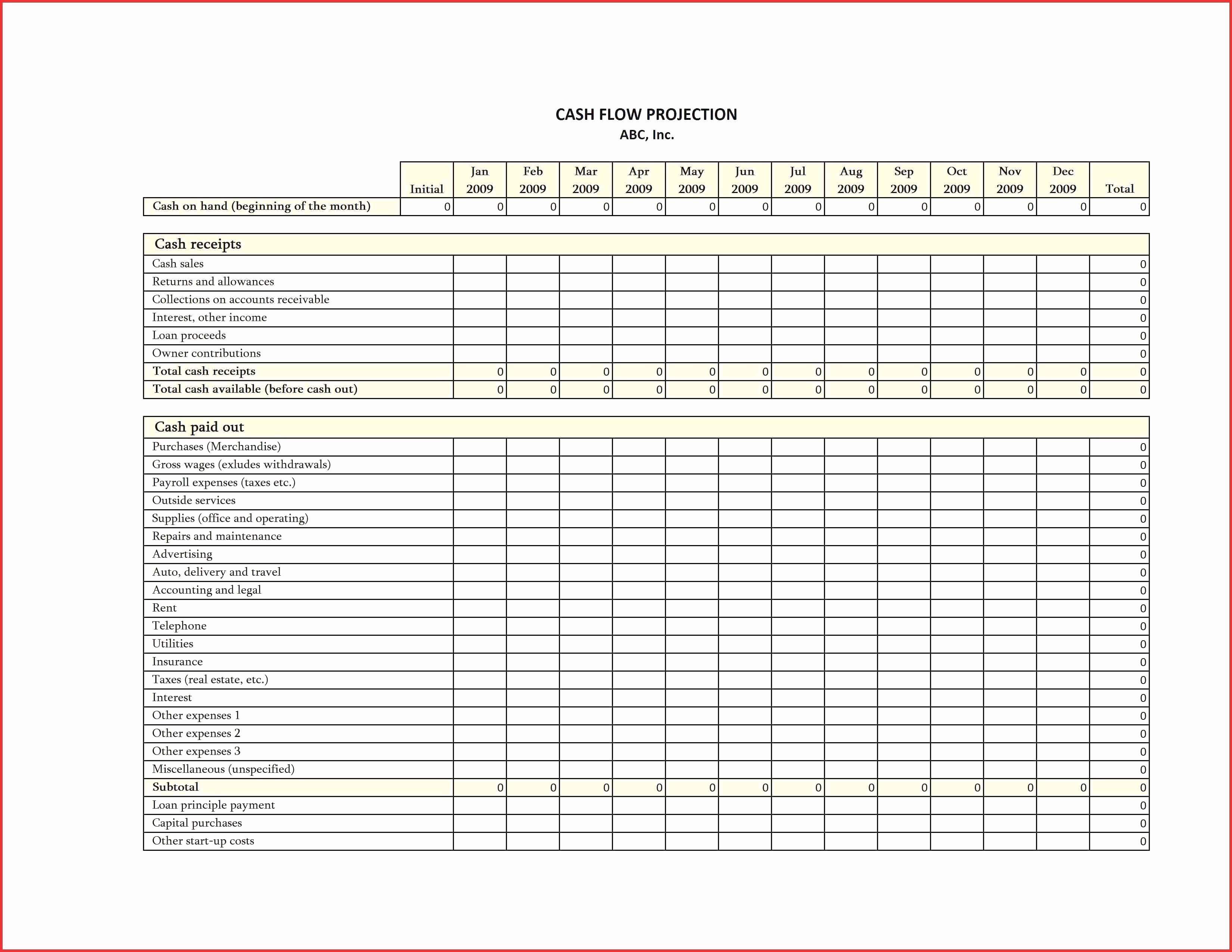

Tax Expenses Template

How To Claim Medical Expenses On Your Tax Return

How To Fill Out Your Tax Return Like A Pro The New York Times

Qualified Business Income Deduction And The Self Employed The CPA Journal

Qualified Business Income Deduction And The Self Employed The CPA Journal

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

What Kind Of Medical Finance Expenses Are Tax Deductible Medical

Medical Expenses And Taxes What Can You Claim Filing Taxes

Tax Return On Medical Expenses - Fortunately we re here to help you understand medical expense tax deductions and how they can help you reduce your taxable income In this guide we ll