Tax Return Claim Medical Expenses You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible spending account FSA or health reimbursement account HRA withdrawals to cover qualified medical expenses

You can deduct qualified medical expenses if you choose to itemize deductions Learn what medical expenses qualify and how to claim them on your tax return ANCHOR ON THIS you can deduct 100 of your medical costs if you know the IRS rules set up your business accordingly and keep a proper records If you know the IRS rules you can deduct your child s braces and call it a business expense If you have questions or need help setting up a section 105 plan contact us Jim Flauaus EA

Tax Return Claim Medical Expenses

Tax Return Claim Medical Expenses

https://www.dmtax.ca/wp-content/uploads/2022/12/medical-expenses.jpg

How To Get The Most Out Of Your Medical Expenses Elite Tax

https://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

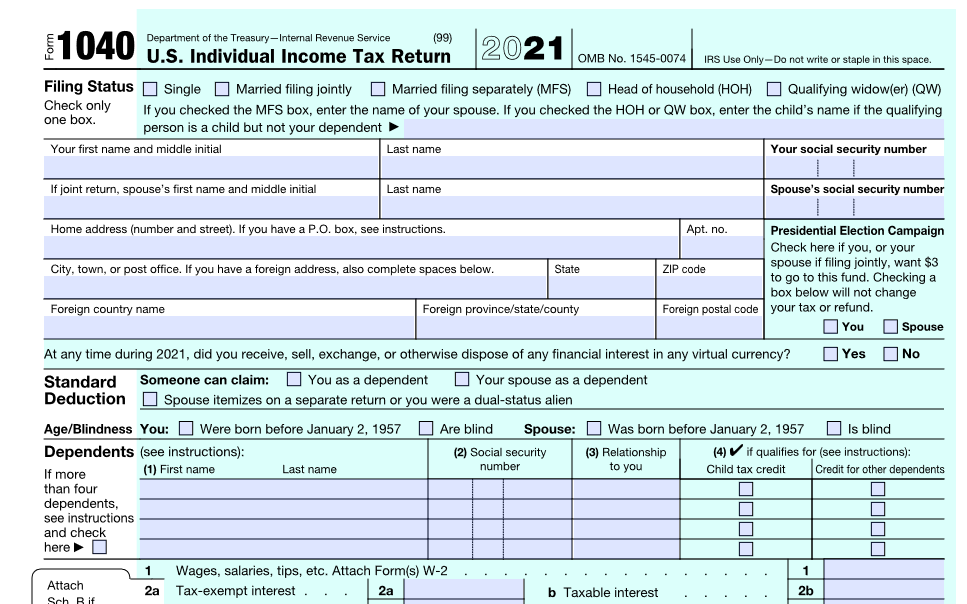

Claim Medical Expenses On Your Tax Return Krankheitskosten

https://assets.wunder.tax/v1/67072/1200,/sp,bdebd02a7b58330bc73df22c1b378384307ca8faeda64644b16ea59e18af05b5/claim-medical-expenses-on-your-tax-return-krankheitskosten

You should consider deducting medical expenses if you spend a lot of money on healthcare Learn more about deductible medical expenses at H R Block When can I deduct medical expenses for tax purposes Medical expenses are considered an extraordinary burden This means that you can claim your special expenses in your income tax return if they exceed a certain amount Where the

To deduct medical expenses on your tax return you need to itemize deductions rather than claim the standard deduction But many Americans don t itemize thanks to the annual growth of the standard deduction You need to have more in itemized deductions than the standard deduction to make itemizing worthwhile LIMITED TIME You may be able to claim them on your income tax and benefit return Why claim medical expenses You can reduce the amount of federal tax you pay by claiming a non refundable tax credit on a wide variety of medical expenses including hospital services nursing home fees and medical supplies

Download Tax Return Claim Medical Expenses

More picture related to Tax Return Claim Medical Expenses

What Medical Expenses Can I Claim On My Canadian Tax Return 27F

https://www.27fchileanway.cl/wp-content/uploads/2023/05/what-medical-expenses-can-i-claim-on-my-canadian-tax-return.png

Medical Expense Deduction How To Claim A Tax Deduction For Medical

https://www.bankrate.com/2020/02/20184340/Medical-expense-deduction-how-to-claim-medical-expenses-on-your-taxes.jpeg

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

The IRS provides a full list of qualified medical and dental expenses that anyone can deduct including self employed individuals if they meet certain requirements For example you have to itemize deductions to If your adjusted gross income AGI for the 2022 tax year was 50 000 you d need more than 3 750 50 000 x 7 5 in itemized medical expenses A costly year of medical expenses such as dentures surgery hearing aids and a

Yes medical expenses are still tax deductible in 2024 You can deduct the cost of medical and dental care for yourself your spouse and your dependents This deduction is available if you itemize The amount of the deduction is limited to the amount by which your unreimbursed medical expenses exceed 7 5 of your adjusted gross You can only claim eligible medical expenses if they have not already been claimed the year prior or were incurred in the 12 month period you are claiming for Medical Expenses You Can Deduct On Your Income Tax Return What medical expenses are tax deductible in Canada

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

How To Claim A Dependent On Your Tax Return SDG Accountants

https://sdgaccountant.com/wp-content/uploads/2021/07/How-to-Claim-a-Dependent-on-Your-Tax-Return.jpg

https://www.kempercpa.com/news/the-irs-clarifies...

You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible spending account FSA or health reimbursement account HRA withdrawals to cover qualified medical expenses

https://www.goodrx.com/insurance/taxes/are-medical...

You can deduct qualified medical expenses if you choose to itemize deductions Learn what medical expenses qualify and how to claim them on your tax return

How To Claim Medical Expenses On Your Tax Return

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

Can I Claim Medical Expenses On My Taxes TMD Accounting

You May Be Able To Claim Medical Expenses On Your Tax Return Greater

Squeezing Under The Medical Deduction Threshold CPA Practice Advisor

Medical Expenses You Can Claim Back From Tax Multiply Blog

Medical Expenses You Can Claim Back From Tax Multiply Blog

Can You Claim Medical Expenses On Your Tax Return Tax Walls

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

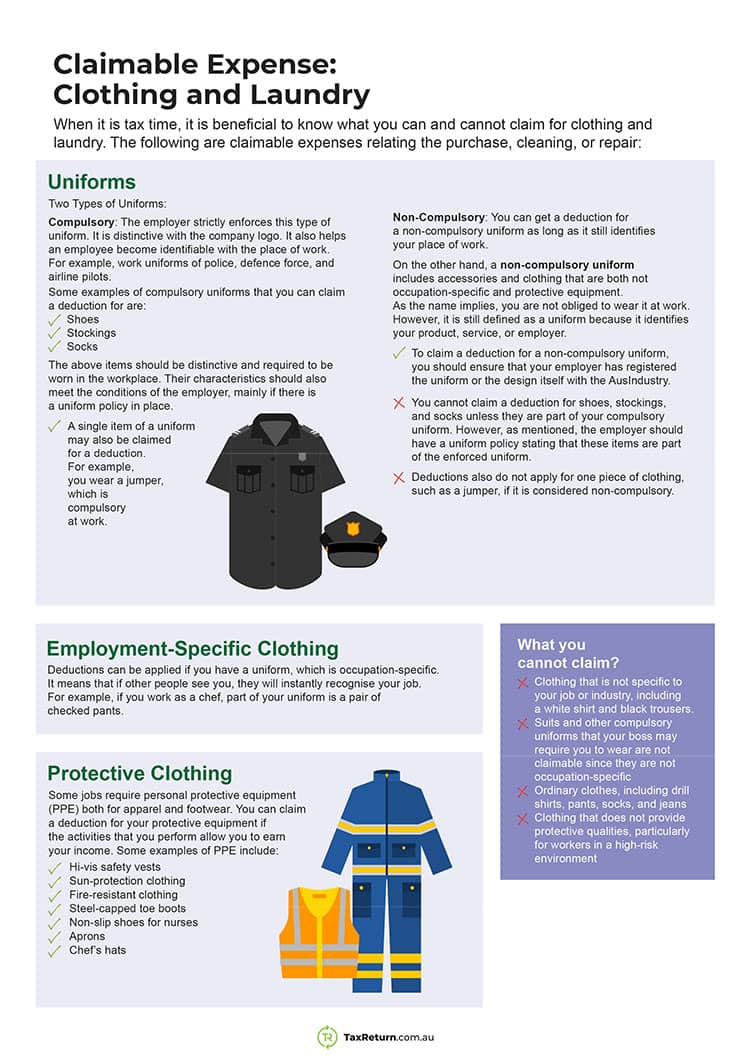

Claimable Expenses What You Can Claim On Your Tax Return

Tax Return Claim Medical Expenses - Key Takeaways Eligible medical expenses must be recognized by a licensed healthcare provider Expenses incurred are deductible up to 2 479 or 3 of your net income Canada covers most medical expenses either as deductibles or under universal healthcare Many non eligible expenses have exceptions in certain situations