Tax Rebate Per Child Web 3 mai 2023 nbsp 0183 32 61 par enfant poursuivant des 233 tudes secondaires du premier cycle coll 232 ge 153 par enfant poursuivant des 233 tudes secondaires du second cycle lyc 233 e 183

The child tax credit is available to taxpayers who have children under the age of 17 or in 2021 under the age of 18 Since 2018 the CTC is 2 000 per qualifying child It is available in full to single filers who make up to 200 000 and married couples filing jointly who make up to 400 000 Above these limits the CTC is phased out at the rate of 50 for each additional 1 000 earned W Web 14 avr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of 2 000 for each child under 17 on

Tax Rebate Per Child

Tax Rebate Per Child

https://www.cafca.org/wp-content/uploads/2022/06/CTCTR-English-791x1024.jpg

Are YOU Eligible For The CT Child Tax Rebate

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022-768x644.png

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

Web 9 mars 2021 nbsp 0183 32 Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1 400 as a refund But under the new rules they could Web 18 mai 2021 nbsp 0183 32 In this case eligible families qualify for up to 300 per month for each child younger than 6 and up to 250 for each child aged 6 to 17 So a family with three

Web 16 nov 2022 nbsp 0183 32 Les modes de gardes ouvrant droit 224 une r 233 duction d imp 244 t sont les suivants une assistante maternelle agr 233 233 e une cr 232 che collective une cr 232 che parentale Web 9 oct 2019 nbsp 0183 32 The maximum amount of the credit is 2 000 per qualifying child Taxpayers who are eligible to claim this credit must list the name and Social Security number for

Download Tax Rebate Per Child

More picture related to Tax Rebate Per Child

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

State Officials To Provide Update On State Child Tax Rebate

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/adx81n2rNGWllpIvRGOVdmKZAzs=/1200x675/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates

https://pbs.twimg.com/media/FUNcpk7XEAIy3dE?format=jpg&name=large

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

Web 24 janv 2023 nbsp 0183 32 The maximum tax credit per qualifying child you could receive for a child born last year went down to 2 000 from 3 600 for children five and under or 3 000 Web 17 ao 251 t 2023 nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or

Web 24 ao 251 t 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than Web 26 janv 2022 nbsp 0183 32 All eligible parents of qualifying children born or welcomed through adoption or foster care in 2021 are also encouraged to claim the child tax credit worth up to

30 Child Care Tax Rebate 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/child-care-tax-rebate-payment-dates-2022-2022-carrebate.jpg

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

https://www.impots.gouv.fr/particulier/deductions-liees-la-famille

Web 3 mai 2023 nbsp 0183 32 61 par enfant poursuivant des 233 tudes secondaires du premier cycle coll 232 ge 153 par enfant poursuivant des 233 tudes secondaires du second cycle lyc 233 e 183

https://en.wikipedia.org/wiki/Child_tax_credit

The child tax credit is available to taxpayers who have children under the age of 17 or in 2021 under the age of 18 Since 2018 the CTC is 2 000 per qualifying child It is available in full to single filers who make up to 200 000 and married couples filing jointly who make up to 400 000 Above these limits the CTC is phased out at the rate of 50 for each additional 1 000 earned W

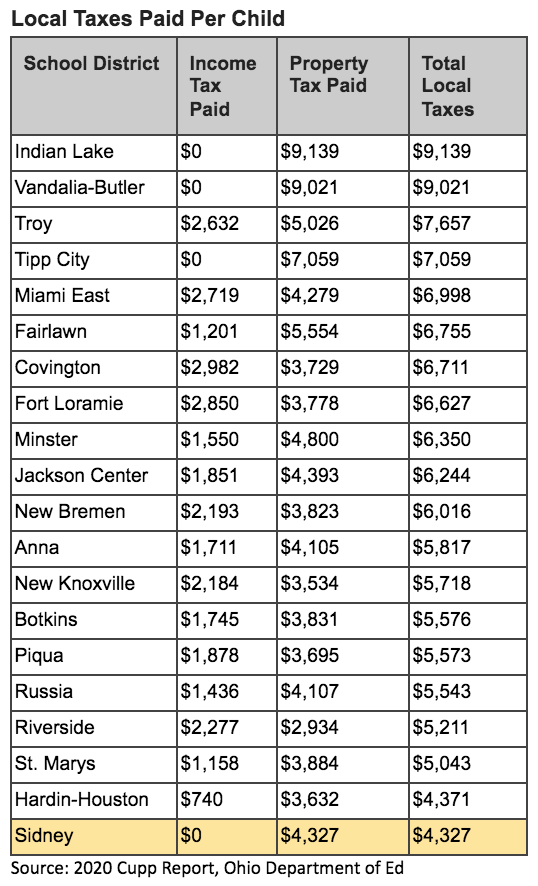

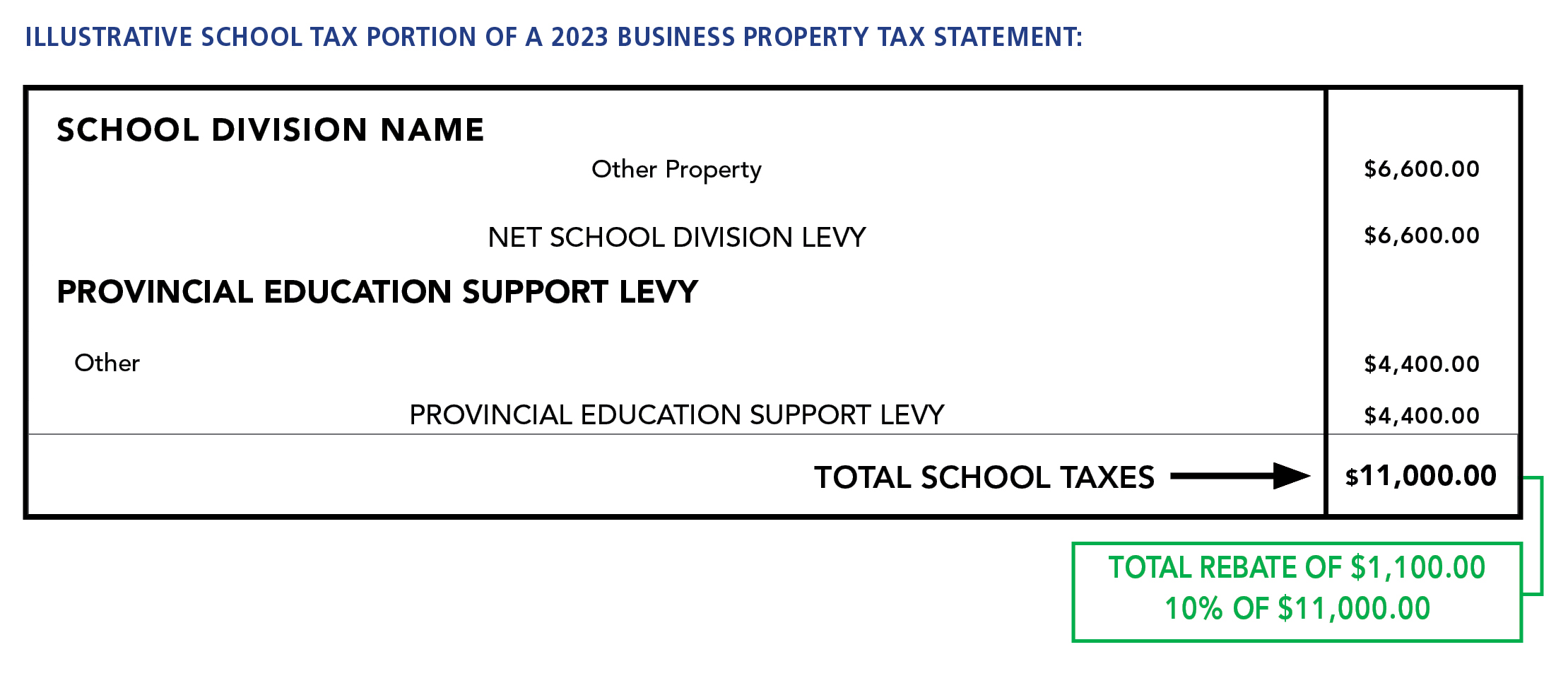

Community Sidney Schools Levy

30 Child Care Tax Rebate 2022 Carrebate

Weekly E Update

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

2022 Child Tax Rebate

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

Child Tax Rebate Program MUST APPLY BY 7 31 22 Borgida CPAs

/do0bihdskp9dy.cloudfront.net/07-07-2022/t_4b2a4f654eea40f384b59c1c647973cc_name_file_1280x720_2000_v3_1_.jpg)

VIDEO State Holds Webinar To Teach People How To Register For Child

Province Of Manitoba School Tax Rebate

Tax Rebate Per Child - Web 9 oct 2019 nbsp 0183 32 The maximum amount of the credit is 2 000 per qualifying child Taxpayers who are eligible to claim this credit must list the name and Social Security number for