Income Tax Rebate On Medical Treatment Of Parents Verkko 3 marrask 2023 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner

Verkko 29 toukok 2023 nbsp 0183 32 Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table below Can be Verkko 29 kes 228 k 2018 nbsp 0183 32 1 Medical treatment of specified ailments under section 80DDB 2 Amount of deduction under section 80DDB 3 Points

Income Tax Rebate On Medical Treatment Of Parents

Income Tax Rebate On Medical Treatment Of Parents

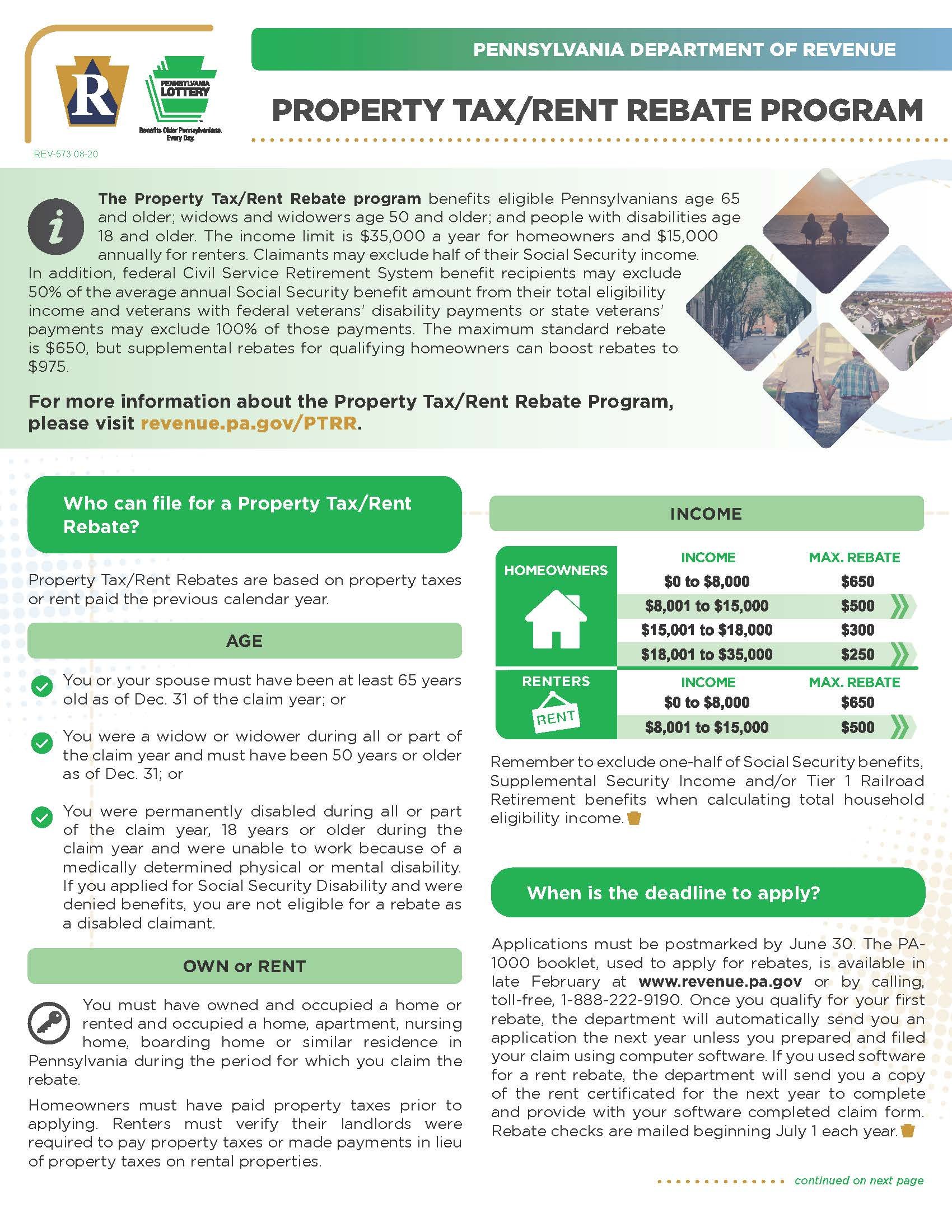

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

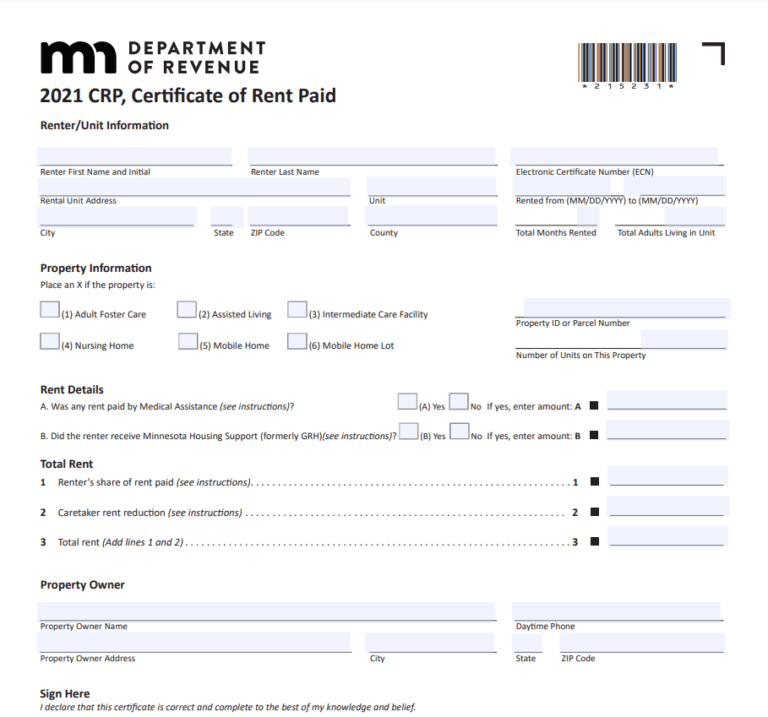

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

Verkko Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens must not Verkko 26 marrask 2020 nbsp 0183 32 Income tax deduction for payment of health insurance premium u s 80D explained Section 80D of the IT Act provides a deduction to the extent of 25 000

Verkko 27 jouluk 2021 nbsp 0183 32 As per the provisions of Section 80D of the Income Tax Act 1961 an individual is allowed an aggregate deduction of up to 50 000 per annum towards Verkko 30 hein 228 k 2023 nbsp 0183 32 The taxpayer has incurred expenses for medical treatment including nursing training amp rehabilitation of the differently abled dependant or the taxpayer may have deposited in a scheme of

Download Income Tax Rebate On Medical Treatment Of Parents

More picture related to Income Tax Rebate On Medical Treatment Of Parents

What Is The Tax Treatment For The Income Received By Medical

https://cdn1.npcdn.net/image/164981424173531e46613b1dfea515665bf14ccba9.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

How To Take The Benefit Of Income Tax Rebate U s 87A Quora

https://qph.cf2.quoracdn.net/main-qimg-018330878ef087944d0dea6361e945e5-lq

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Verkko 21 jouluk 2016 nbsp 0183 32 Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction Verkko 2 marrask 2015 nbsp 0183 32 Income Tax Rebate for Deduction in respect of medical treatment etc November 2 2015 Section 80DDB Income tax Act 1961 2015 Medical

Verkko 8 jouluk 2023 nbsp 0183 32 As per section 80D a taxpayer can claim tax deduction on premiums paid towards medical insurance for self spouse parents and dependent children Verkko 23 marrask 2023 nbsp 0183 32 There are several sections in the Income Tax Act to serve people with disabilities Section 80DD can be claimed by the taxpayer for the medical

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Divorce Enquiries Reach Record High I Talk To The Women Who Regret

https://cdn.mos.cms.futurecdn.net/kGMtVKie9fT4Cy3Cnvqshd-1920-80.jpg

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

Verkko 3 marrask 2023 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Verkko 29 toukok 2023 nbsp 0183 32 Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table below Can be

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

Income Tax Rebate Under Section 87A

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Option To Accelerate Claims On Renovation And Refurbishment Costs

Section 87A Income Tax Rebate

Section 87A Income Tax Rebate

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Deadline For Tax And Rent Relief Extended

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Income Tax Rebate On Medical Treatment Of Parents - Verkko Budget 2018 amended Section 80D of the Income tax Act which allows a deduction for medical expenditure incurred on senior citizens However senior citizens must not