Income Tax Rebate On Home Loan Pre Emi Web 31 ao 251 t 2023 nbsp 0183 32 In 2023 there s a special way to save on taxes if you re paying interest on a home loan before your house is built This is called pre eMI tax benefits Our guide will

Web 27 sept 2018 nbsp 0183 32 Tax Benefits on Pre EMI 2023 The final amount to be repaid every month is calculated in a way that it stays static over the entire repayment period EMI only starts Web 28 mars 2017 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Income Tax Rebate On Home Loan Pre Emi

Income Tax Rebate On Home Loan Pre Emi

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

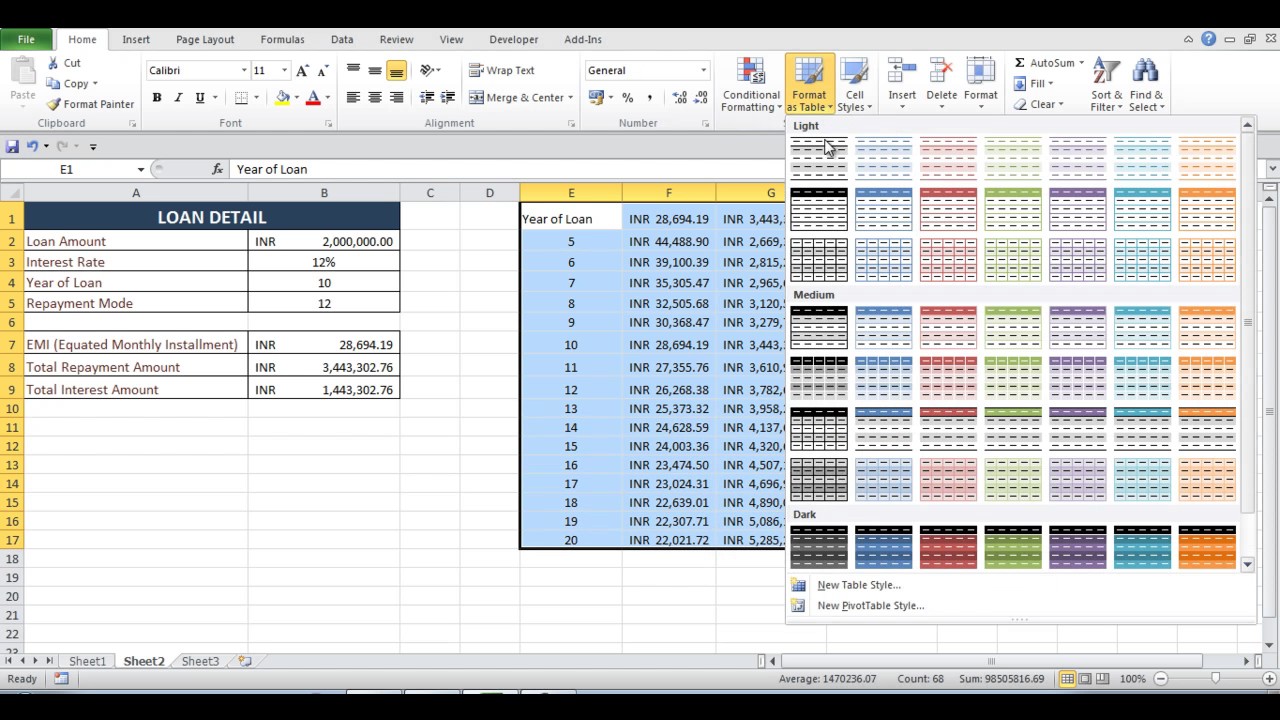

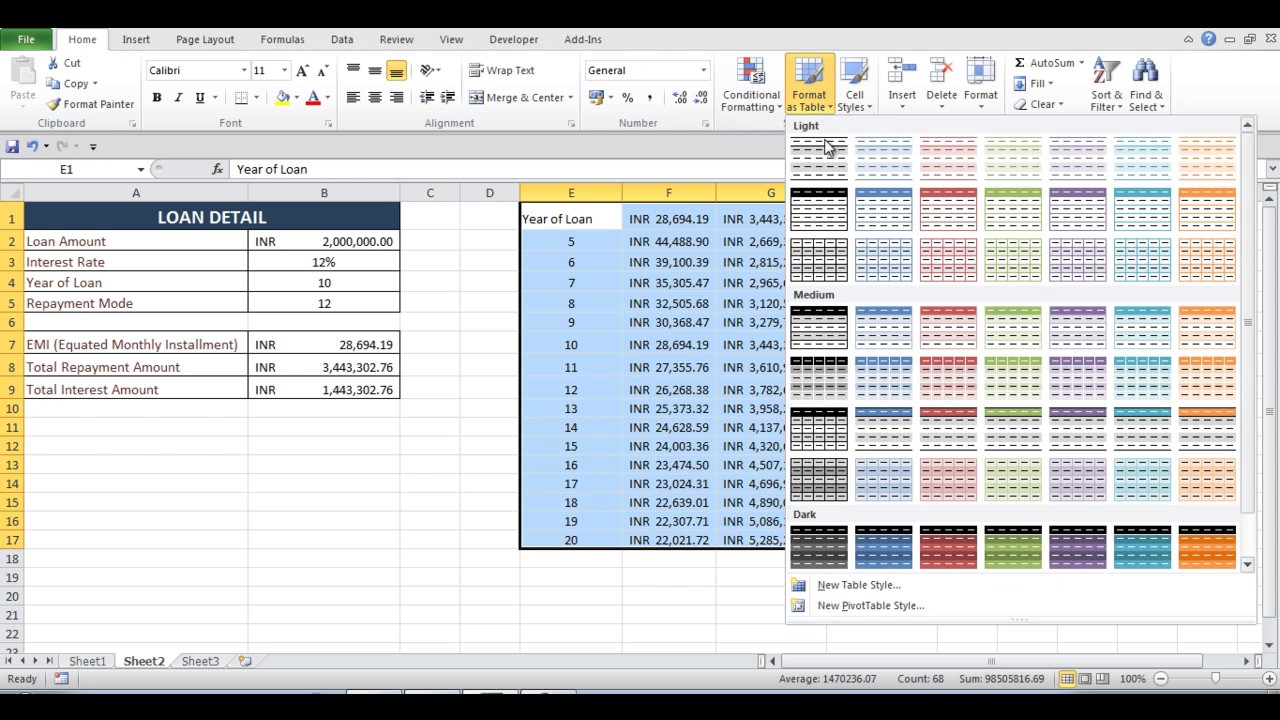

Pre Emi Calculator Home Loan Excel Homemade Ftempo

https://i.ytimg.com/vi/BBK9cFhAd_Y/maxresdefault.jpg

Should You Opt For EMI Or Pre EMI For Your Home Loan Home Loans

http://switchme.in/blog/wp-content/uploads/2015/01/pre-emi2.jpg

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web 2 ao 251 t 2021 nbsp 0183 32 This deduction is allowed under the overall umbrella limit of Rs 1 5 lakh of Section 80C There is no threshold limit for claiming principal repayment of home loans

Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only

Download Income Tax Rebate On Home Loan Pre Emi

More picture related to Income Tax Rebate On Home Loan Pre Emi

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Saving Taxes On Home Loan And Pre EMI Scheme

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/07/Meaning-Of-Pre-EMI-Scheme-On-A-Home-Loan.jpg

Home Loan EMI Calculator 2023 Free Excel Sheet Stable Investor

https://stableinvestor.com/wp-content/uploads/2020/11/Home-loan-EMI-interest-principal.png

Web For the FY 2018 19 total EMI payments are Rs 30 000 X 9 2 70 000 of which Rs 1 80 000 is paid towards principal repayment and Rs 90 000 is paid towards interest For the FY Web I have been claiming the Pre EMI rebate for past 3 years Aggregate of Pre EMI interest equally distributed in 5 years as well as deduction under Section 24 b and 80C in

Web 24 d 233 c 2021 nbsp 0183 32 Income tax rules on pre EMI rebate on home loan if property sold before 5 years Since the house is is being sold within five years from the end of the financial year Web 29 sept 2020 nbsp 0183 32 To avail income tax deductions on home loan repaid can lower the taxable amount by up to Rs 5 lacs which considerably reduces the income tax payable as per

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

https://3.bp.blogspot.com/-pZ5VeMeXKq4/WFdWf7wSr7I/AAAAAAAADsQ/bmB9t4Yn_b8XW1PA-J15RmXGXB7kd0dEwCLcB/s1600/One%2Bby%2BOne%2BForm%2B16%2B4.jpg

https://www.basichomeloan.com/blog/Home-Loans/pre-emi-interest-tax...

Web 31 ao 251 t 2023 nbsp 0183 32 In 2023 there s a special way to save on taxes if you re paying interest on a home loan before your house is built This is called pre eMI tax benefits Our guide will

https://www.bankbazaar.com/.../emi-calculator/tax-benefits-on-pre-emi.html

Web 27 sept 2018 nbsp 0183 32 Tax Benefits on Pre EMI 2023 The final amount to be repaid every month is calculated in a way that it stays static over the entire repayment period EMI only starts

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

The Pre EMI Guide To Home Loans By Aryan Landmark Issuu

Lic Home Loan Emi Calculator Wholesale Prices Save 65 Jlcatj gob mx

Lic Home Loan Emi Calculator Wholesale Prices Save 65 Jlcatj gob mx

Home Loan Pre EMI Full EMI Options Calculation Included Tamil

Latest Income Tax Rebate On Home Loan 2023

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Income Tax Rebate On Home Loan Pre Emi - Web Resident Indians are eligible for certain tax benefits on both principal and interest components of a loan under the Income Tax Act 1961 Under the current laws you are