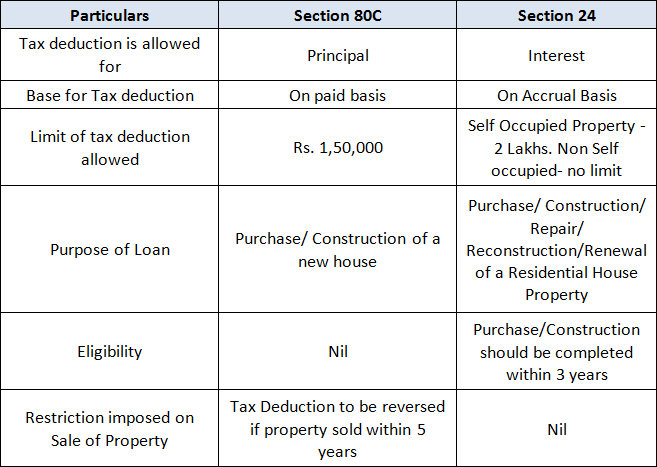

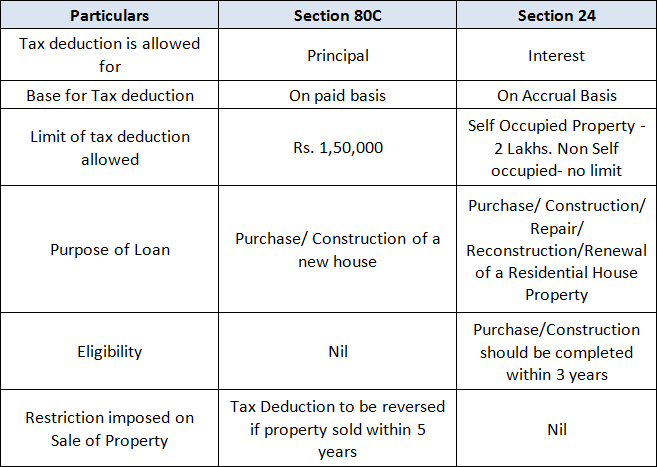

Income Tax Rebate On Interest Of Home Loan Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web 10 mars 2021 nbsp 0183 32 1 Deduction on repayment of principal amount of home loan The EMI paid by you has two components principal repayment

Income Tax Rebate On Interest Of Home Loan

Income Tax Rebate On Interest Of Home Loan

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Income Tax Benefits On Housing Loan Interest And Principal House Poster

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a deduction of up to Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Web 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income from house property 2 Deduction for principal amount of repayment can be claimed Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial

Download Income Tax Rebate On Interest Of Home Loan

More picture related to Income Tax Rebate On Interest Of Home Loan

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/line_Rebate-on-Home-Loan-for-Interest-Paid.png

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web Income tax rebate on home loan Tax deductions Tax deductions for a mortgage loan FY 2022 23 Repayment of a home loan s principal is tax deductible under Section 80C Web 31 mars 2019 nbsp 0183 32 The Indian Income Tax Act extends home loan tax benefits on the amount that you repay every month through your EMIs for your first home EMIs or equated monthly instalments are made up of two

Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh Web Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA On the interest payments for a home loan you can claim

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Form 12BB New Form To Claim Income Tax Benefits Rebate

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

INCOME TAX REBATE ON HOME LOAN

INCOME TAX REBATE ON HOME LOAN

Tax Rebate Under Section 87A Investor Guruji Tax Planning

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Home Loan Tax Benefits In India Important Facts

Income Tax Rebate On Interest Of Home Loan - Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a deduction of up to