Income Tax Rebate On Interest On House Building Advance Web 5 juil 2021 nbsp 0183 32 2 5 rebate is applicable on HBA loan if the conditions related to the sanction of the advance and recovery of the entire amount are fulfilled completely 0 5 interest

Web 4 ao 251 t 2021 nbsp 0183 32 Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was completed So you get some Web 1 avr 1999 nbsp 0183 32 Claiming Exemption for House Building Loan Repayment and Interest on Housing Loan in Income Tax Conditions for Claim of Deduction of Interest on Borrowed

Income Tax Rebate On Interest On House Building Advance

Income Tax Rebate On Interest On House Building Advance

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

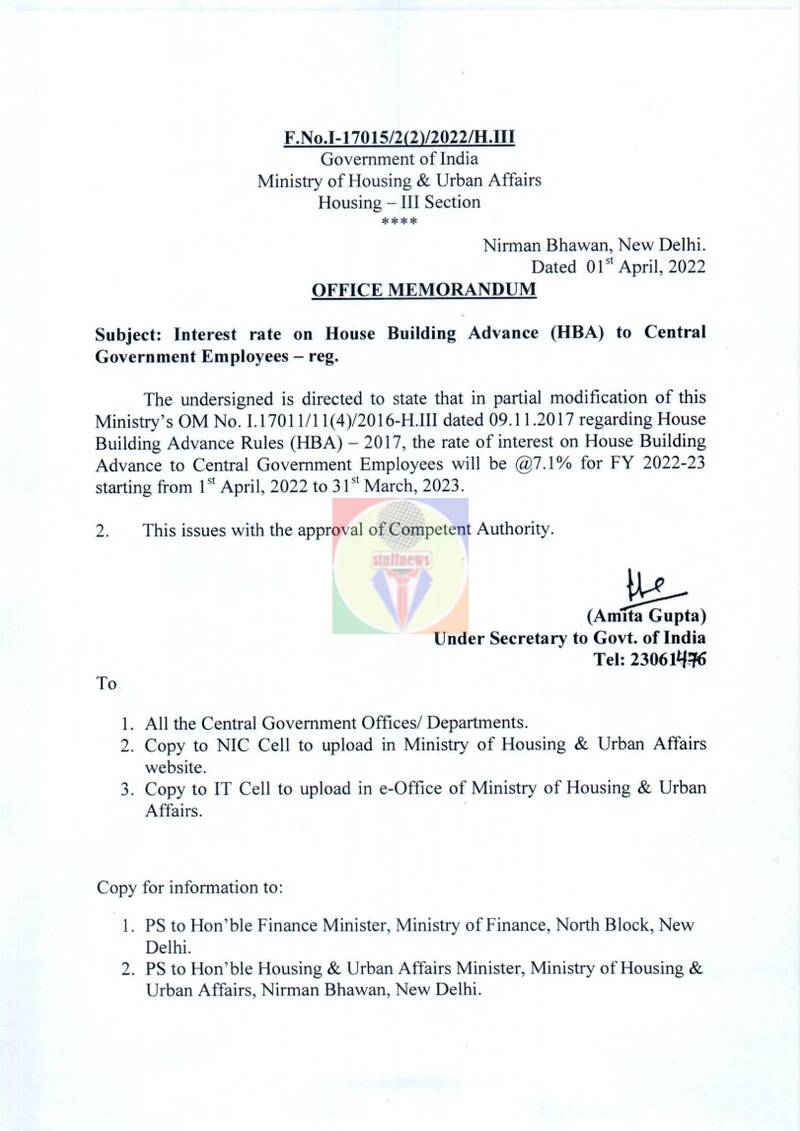

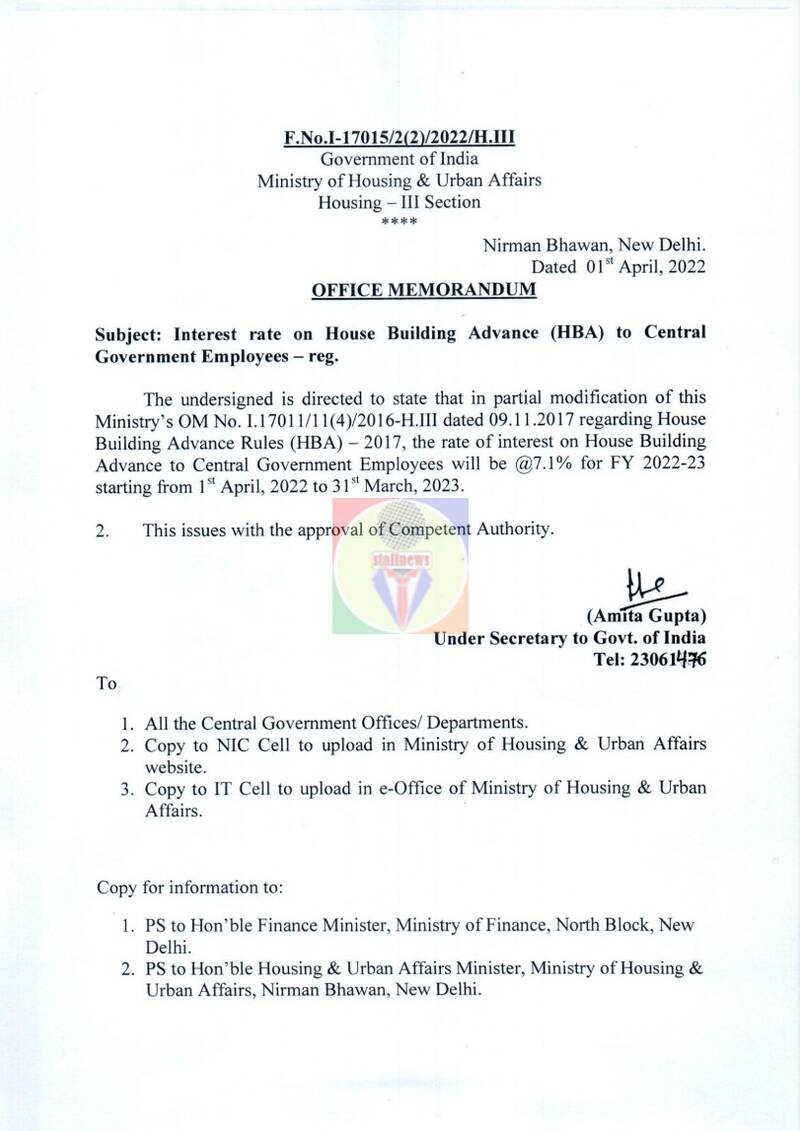

Interest Rate On House Building Advance HBA For FY 2022 23 Starting

https://www.staffnews.in/wp-content/uploads/2022/04/interest-rate-on-house-building-advance-hba-for-fy-2022-23.jpg

Rate Of Interest On House Building Advance HBA During 01 04 2023 Till

https://www.staffnews.in/wp-content/uploads/2023/05/interest-rate-on-house-building-advance-hba-550x303.jpg

Web You can claim up to Rs 150 000 or the actual interest repaid whichever is lower You can claim thisinterest only when Web 12 juin 2013 nbsp 0183 32 Your taxable income is 5 50 000 Principal Repayment for the same year 1 20 000 and interest payable is 1 70 000 Principal Repayment for the same year

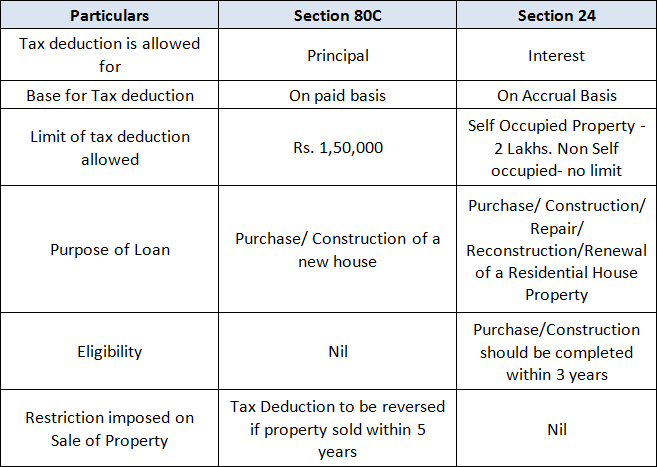

Web 24 avr 2017 nbsp 0183 32 A tax deduction up to 2 Lakhs on the interest payments made in a year and up to 1 5 Lakhs towards the principal amount made under Section 80C of the Income Tax Act However it is important to Web Under rule 6 of the House Building Rules advances granted to Central Government servants carry interest which runs from the date of advance The following table gives

Download Income Tax Rebate On Interest On House Building Advance

More picture related to Income Tax Rebate On Interest On House Building Advance

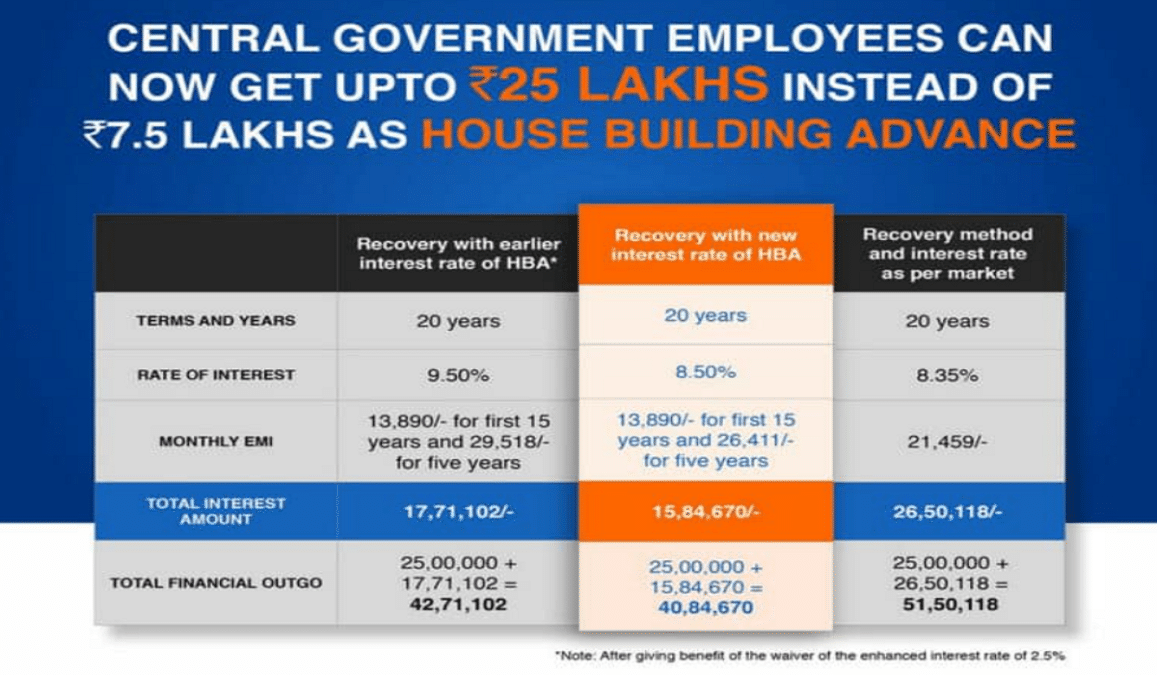

House Building Advance Scheme 2021 For Central Government Employees

https://sarkariyojana.com/wp-content/uploads/2017/11/house-building-advance-scheme-interest-rate-1157x675.png

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

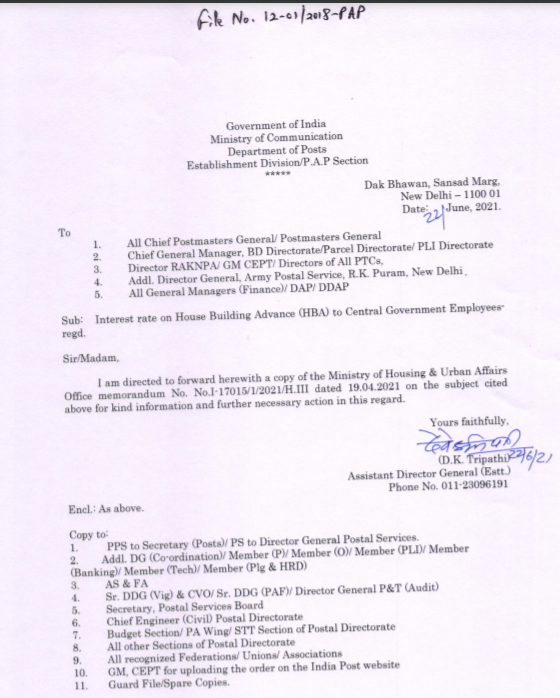

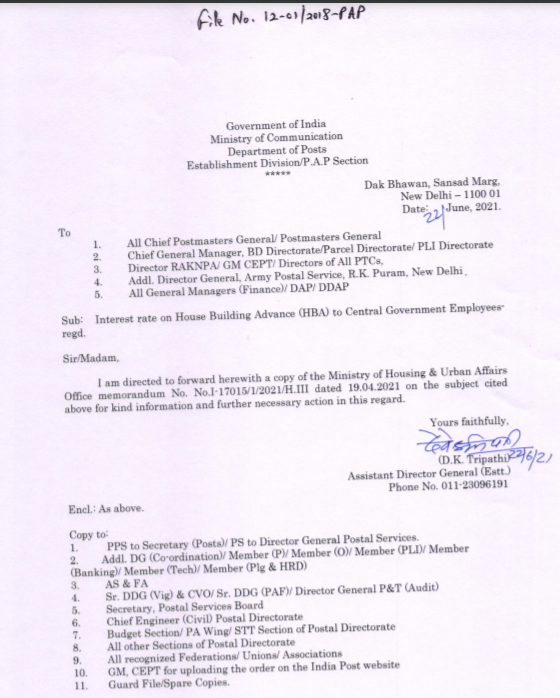

Rates Of Interest On House Building Advance India Post

https://www.yumpu.com/en/image/facebook/17500402.jpg

Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a deduction of up to Rs Web 18 juil 2018 nbsp 0183 32 In this article we will discuss the tax benefits which one can avail under the Income Tax Act 1961 on Purchase of House property Including the Expenses on

Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can Web 7 janv 2022 nbsp 0183 32 With effect from the financial year in which the construction is completed the taxpayer can claim for both the interest paid during such year as well as the instalment

Interest Rate On House Building Advance HBA To Central Government

https://1.bp.blogspot.com/-KP3q5SYKpEg/YNIYUzgZjCI/AAAAAAAAT88/sMwuRZGsAKAEZeoZr2myrg4NA4SVKaEgACLcBGAsYHQ/s698/Interest1.png

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

https://www.bankbazaar.com/tax/7th-cpc-house-building-advance.html

Web 5 juil 2021 nbsp 0183 32 2 5 rebate is applicable on HBA loan if the conditions related to the sanction of the advance and recovery of the entire amount are fulfilled completely 0 5 interest

https://stableinvestor.com/2021/08/deduction-loan-interest-under...

Web 4 ao 251 t 2021 nbsp 0183 32 Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was completed So you get some

Income Tax Rebate Under Section 87A

Interest Rate On House Building Advance HBA To Central Government

Retirement Income Tax Rebate Calculator Greater Good SA

Latest Income Tax Rebate On Home Loan 2023

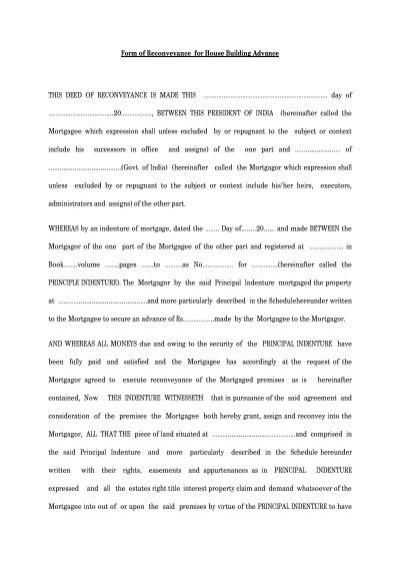

Download Form Of Reconveyance For House Building Advance

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Income Tax Rebate On Interest On House Building Advance - Web 23 juin 2021 nbsp 0183 32 The Central Government employees who wish to construct their own home can avail the House Building Advance HBA The HBA availed from 1st October 2020