Tax Rebate For Coronavirus Web We re offering tax help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus Child Tax Credit The 2021 Child Tax Credit is up to 3 600 for each qualifying child

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of Web 9 mars 2022 nbsp 0183 32 Bis repetita le Covid ayant encore contraint de nombreux salari 233 s 224 t 233 l 233 travailler en 2021 Bercy reconduit les mesures exceptionnelles pour le traitement fiscal des frais professionnels

Tax Rebate For Coronavirus

Tax Rebate For Coronavirus

https://files.taxfoundation.org/20201222180404/Covid-19-relief-package-FAQ-coronavirus-relief-bill-covid-relief-package-768x554.png

Coronavirus Statutory Sick Pay Rebate Scheme Set To Launch Scott Benton

https://www.scottbenton.org.uk/sites/www.scottbenton.org.uk/files/2020-05/Untitled-1.png

T20 0260 Combined Effect Of Recovery Rebates For Individuals In The

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0260_3.gif

Web 16 nov 2022 nbsp 0183 32 Coronavirus Recovery Rebate Credit and Economic Impact Payments Resources and Guidance Links to all materials and guidance issued by the IRS regarding coronavirus COVID 19 tax relief Recovery Rebate Credit and Economic Impact Payments organized by type for quick reference by the media and tax professionals Web The COVID related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave under the FFCRA You can get immediate access to the credit by reducing the employment tax deposits you are otherwise required to make

Web 24 sept 2022 nbsp 0183 32 For businesses that started during COVID there is up to 33 000 refund per employee The Employee Retention Credit tax refund program from the IRS is the last major COVID 19 financial relief Web 14 janv 2022 nbsp 0183 32 The IRS increased the standard deduction for tax year 2021 filings to keep up with inflation Married couples can now take 25 100 instead of 24 800 last year and 1 350 per spouse over 65

Download Tax Rebate For Coronavirus

More picture related to Tax Rebate For Coronavirus

Coronavirus SSP Rebate Scheme Set To Close On 17 March SKS Bailey Group

https://www.baileygroup.co.uk/wp-content/uploads/2022/03/BG-SSP-min.jpg

Coronavirus Tax Relief And Recovery Rebates What You Need To Know

https://www.unlv.edu/sites/default/files/styles/1200_width/public/releases/main-images/D70123_04.jpg?itok=iOenkSVy

T20 0262 Additional 2020 Recovery Rebates For Individuals In The

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0262_0.gif

Web 25 janv 2023 nbsp 0183 32 Watch our video to demystify the latest rules Millions of workers were able to claim tax relief on expenses they incurred from working from home during the Covid 19 pandemic but the rules have changed since then Some people will still be eligible to make a claim for 2022 23 and beyond but only in certain circumstances Web 26 janv 2021 nbsp 0183 32 Employers can access the ERC for the 1st and 2nd quarters of 2021 prior to filing their employment tax returns by reducing employment tax deposits Small employers i e employers with an average of 500 or fewer full time employees in 2019 may request advance payment of the credit subject to certain limits on Form 7200 Advance of

Web 12 janv 2023 nbsp 0183 32 COVID Tax Tip 2022 156 Most taxpayers who requested an extension to file their 2021 tax return must file by Oct 17 COVID Tax Tip 2022 149 File 2019 and 2020 tax returns by Sept 30 to receive COVID penalty relief COVID Tax Tip 2022 142 IRS Free File available through Oct 17 but taxpayers shouldn t wait to file 2021 returns Web This note provides guidance on tax policy reforms after economies have recovered from the COVID 19 crisis and fiscal consolidation becomes imperative The focus is on identifying tax measures that can boost revenue mobilization in a way that is

Impact Of COVID 19 On 2021 Commercial MLR Rebates AHIP

https://ahip.imgix.net/documents/AHIP_1P-MLR_Rebate_Explainer.pdf?auto=format%2Ccompress&bg=ffffff&crop=top&fit=crop&h=500&ixlib=php-2.1.1&page=1&w=500&s=6823a357f7d735f87a6313cb1f85b654

A COVID 19 Tax Rebate For Frontline Workers The McKell Institute

https://mckellinstitute.org.au/wp-content/uploads/2022/02/A-COVID-Tax-Rebate-for-Frontline-Workers.jpg

https://www.irs.gov/corona

Web We re offering tax help for individuals families businesses tax exempt organizations and others including health plans affected by coronavirus Child Tax Credit The 2021 Child Tax Credit is up to 3 600 for each qualifying child

https://www.irs.gov/coronavirus/economic-i…

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

Impact Of COVID 19 On 2021 Commercial MLR Rebates AHIP

COVID 19 Sick Pay Rebate Scheme Closed In September SKS Bailey Group

Coronavirus SSP Rebate Scheme To Close On 17 March 2022 Harvey

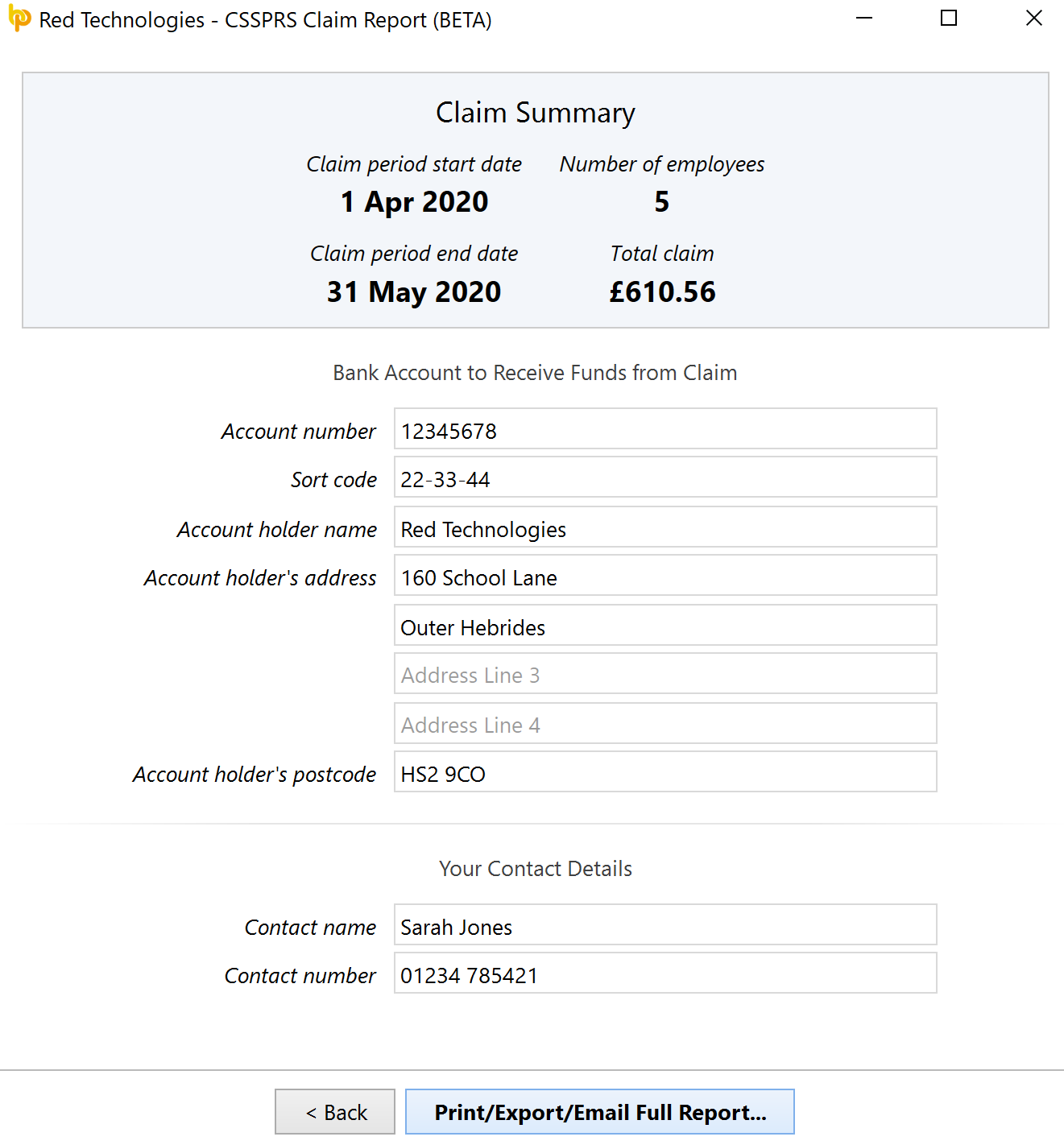

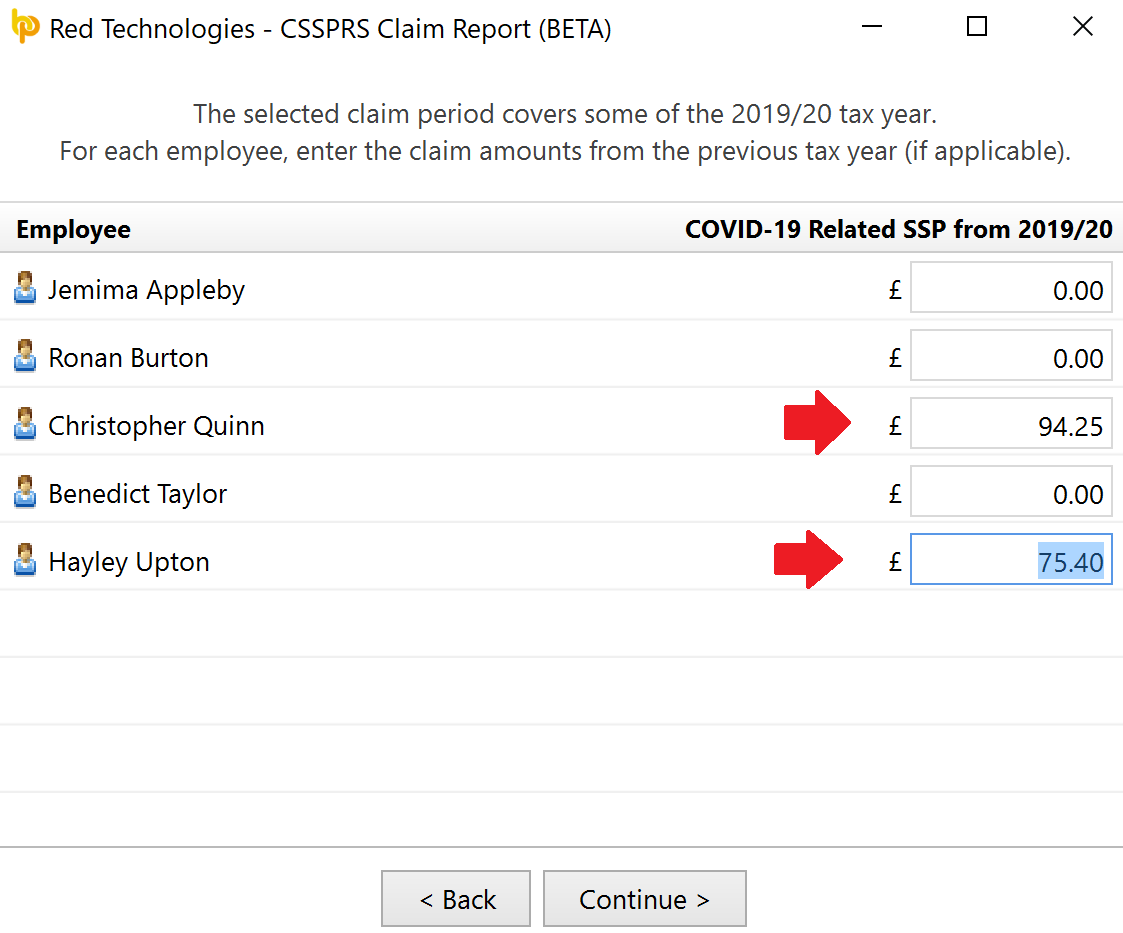

Coronavirus SSP Rebate Scheme Claim Report In BrightPay BrightPay

Can People Get A Larger COVID 19 Rebate By Waiting To File Their 2019

Can People Get A Larger COVID 19 Rebate By Waiting To File Their 2019

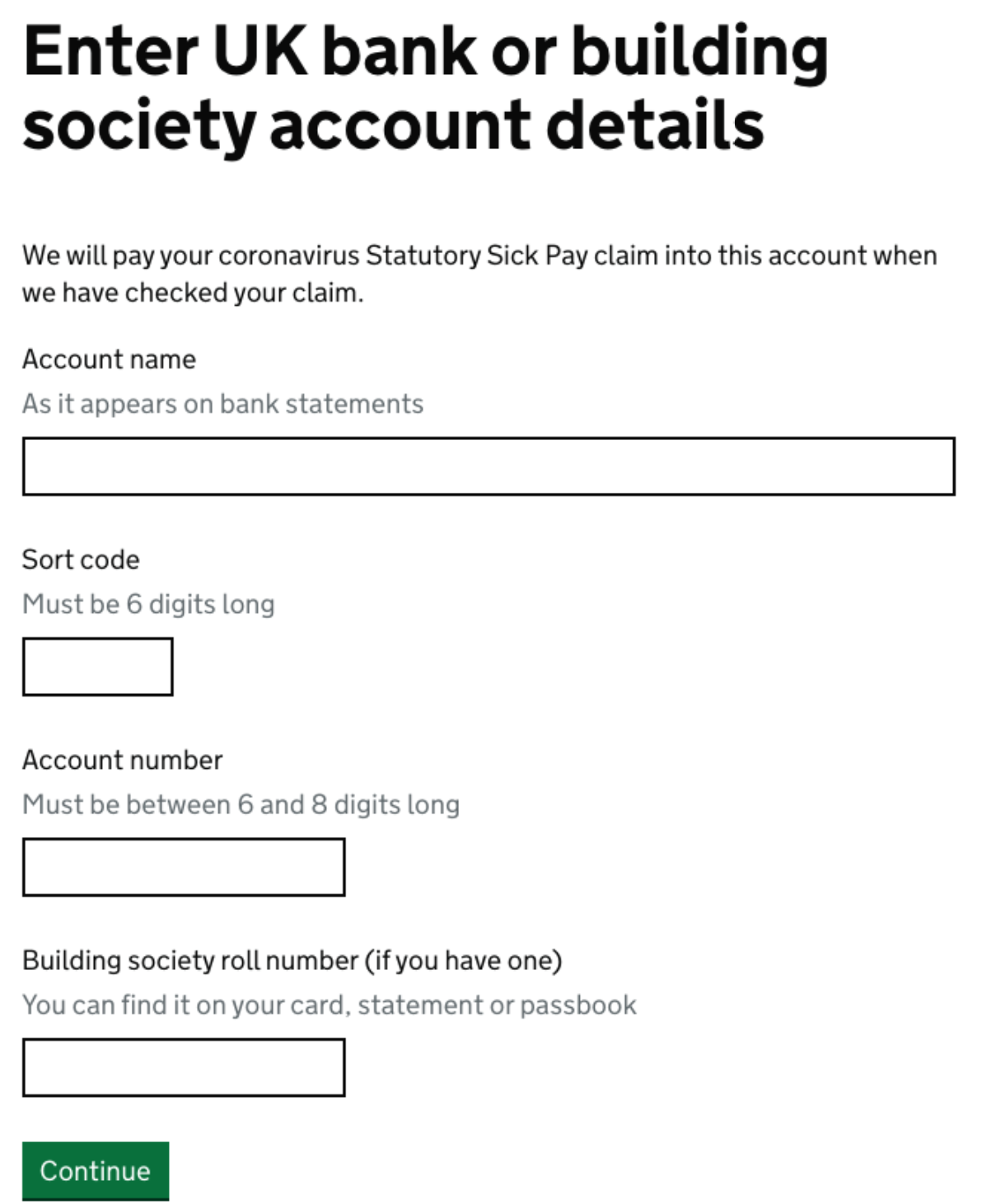

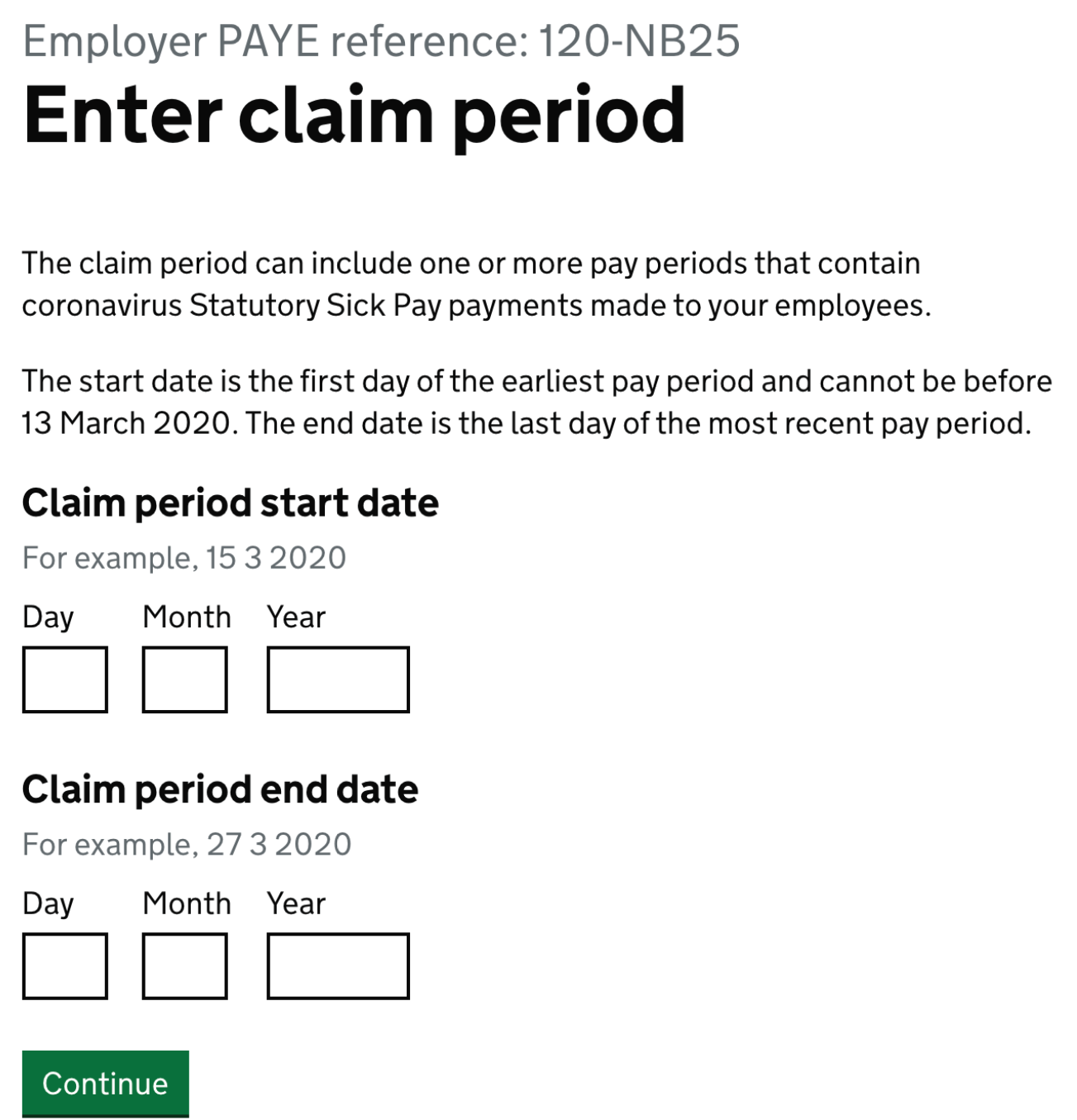

Coronavirus SSP Rebate Scheme Making A Claim Through HMRC BrightPay

Coronavirus SSP Rebate Scheme Making A Claim Through HMRC BrightPay

Coronavirus SSP Rebate Scheme Claim Report In BrightPay BrightPay

Tax Rebate For Coronavirus - Web The COVID related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and family leave under the FFCRA You can get immediate access to the credit by reducing the employment tax deposits you are otherwise required to make