Income Tax Rebate On Investment Web Tax on savings and investments detailed information From HM Revenue amp Customs and HM Treasury Get emails for this topic

Web 14 juin 2022 nbsp 0183 32 Under the current provisions they are allowed to invest 25 or Tk1 50 000 on which they will get a rebate of 15 As such the amount of their rebate or tax credit will Web 16 avr 2014 nbsp 0183 32 By Jun Merrett HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms

Income Tax Rebate On Investment

Income Tax Rebate On Investment

https://i.ytimg.com/vi/jhvGGPmV5_8/maxresdefault.jpg

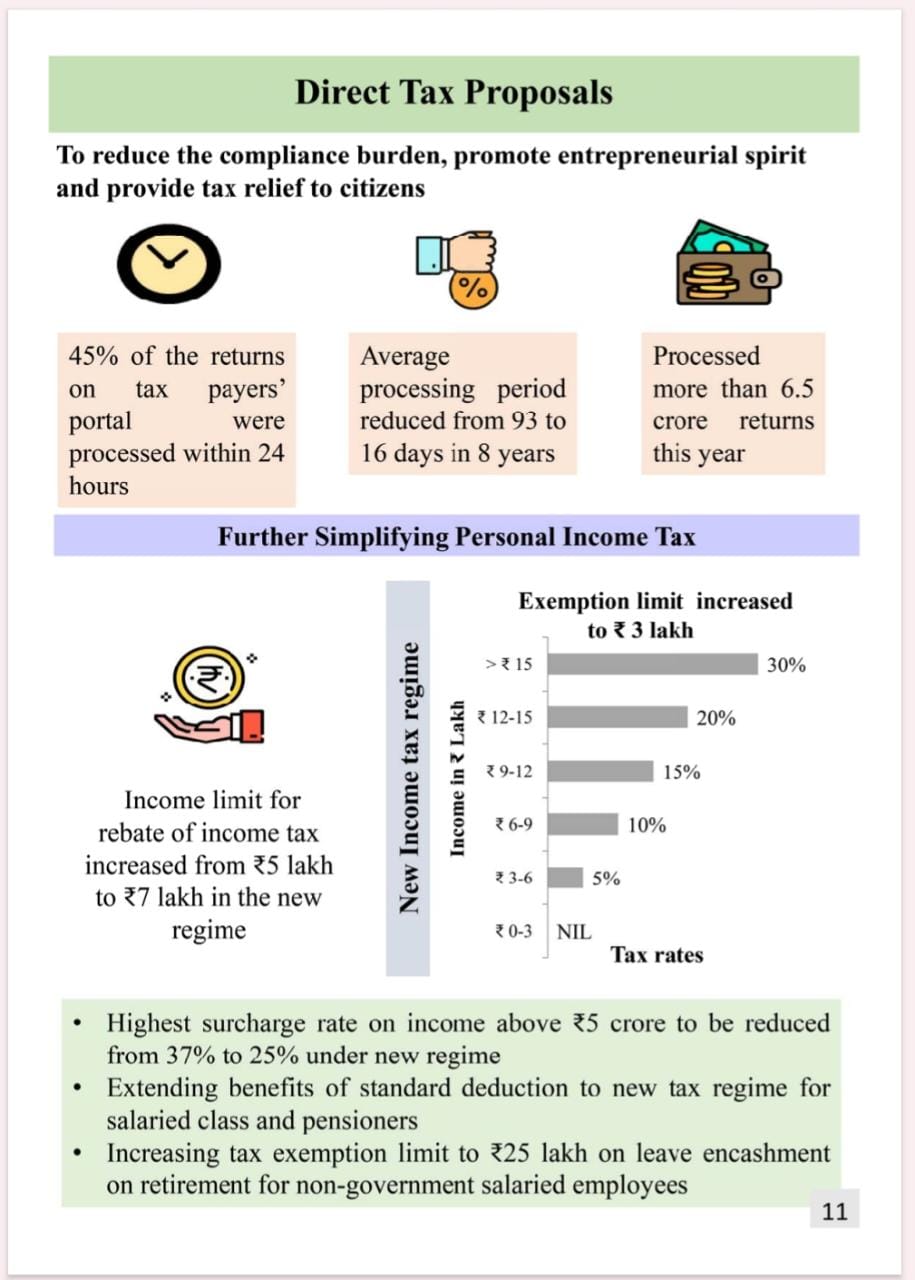

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://i1.wp.com/myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg?resize=321%2C543&ssl=1

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

https://i.ytimg.com/vi/jZcpVwGx4EE/maxresdefault.jpg

Web Must be a resident of India Your overall income after taking deductions into consideration is less than Rs 5 lakh The maximum amount of rebate that can be claimed is Rs 12 500 Web 11 juin 2022 nbsp 0183 32 Taxpayers having up to Tk15 lakh in annual taxable income are enjoying 15 rebate on their investments up to 25 of their annual taxable income while the rebate is 10 for taxpayers whose taxable

Web 11 juin 2021 nbsp 0183 32 The maximum ceiling on investment to claim a tax rebate was Tk 1 5 crore or 25 per cent of taxable income in the outgoing fiscal year The reduction is going to Web Capital gains Income from other sources 4 Tax Rate Assessment Year 2015 16 As per Finance Act 2015 a Other than Company For individuals other than female

Download Income Tax Rebate On Investment

More picture related to Income Tax Rebate On Investment

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

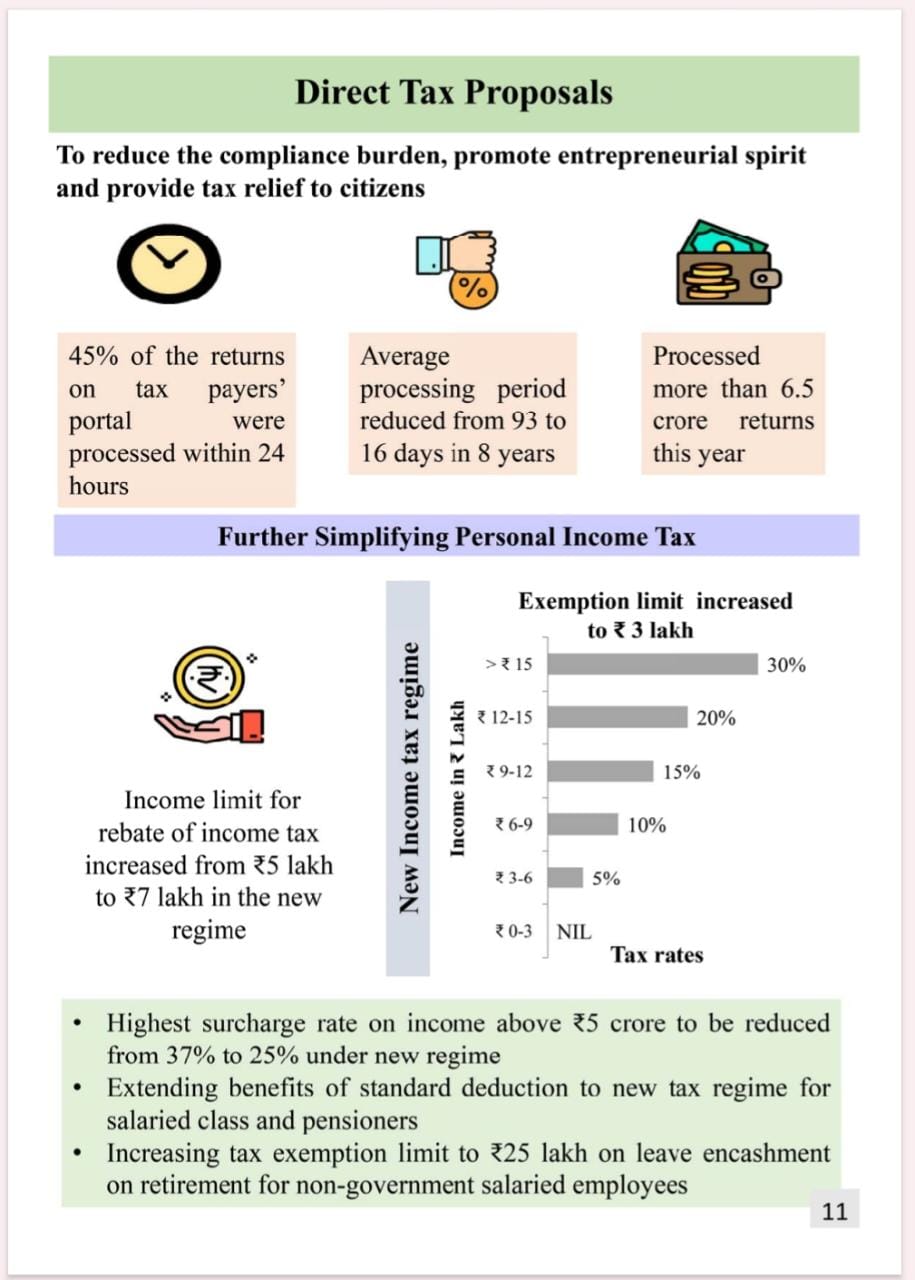

Know New Rebate Under Section 87A Budget 2023

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

Web 4 f 233 vr 2023 nbsp 0183 32 A tax Rebate is a benefit on income tax given by the government which means the total amount of salary you get in a year including bonuses and other benefits then a certain amount of annual Web 3 mars 2022 nbsp 0183 32 Investors have to pay tax when they earn money on their investments like shares or unit trusts The main types of investment income which have income tax

Web 10 oct 2021 nbsp 0183 32 If your annual income is less than Tk15 lakh you will get 15 tax exemption of total investment and donation Tax exemption at the rate of 10 will be available if it Web 9 sept 2023 nbsp 0183 32 Claim Tax Credit on the investment from your Tax Liability of 2023 2024 How To Avail Tax Credit Facility To claim your tax credit amount you just need to do

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

How You May Not Have To Pay Tax Even With Rs 9 5 Lakhs Income Yadnya

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2019/02/transcript-interim-budget-banner.png?fit=1080%2C614&ssl=1

https://www.gov.uk/topic/personal-tax/savings-investment-tax

Web Tax on savings and investments detailed information From HM Revenue amp Customs and HM Treasury Get emails for this topic

https://www.tbsnews.net/economy/budget/tax-rebate-investment-added...

Web 14 juin 2022 nbsp 0183 32 Under the current provisions they are allowed to invest 25 or Tk1 50 000 on which they will get a rebate of 15 As such the amount of their rebate or tax credit will

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Individual Income Tax Rebate

Illinois Tax Rebate Tracker Rebate2022

Standard Deduction For 2021 22 Standard Deduction 2021

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Income Tax Rebate Under Section 87A

Income Tax Rebate On Investment - Web 11 juin 2021 nbsp 0183 32 The maximum ceiling on investment to claim a tax rebate was Tk 1 5 crore or 25 per cent of taxable income in the outgoing fiscal year The reduction is going to