Gst Rebate 2024 Eligibility criteria How to get the GST HST credit You need a social insurance number If you have a spouse or common law partner If you have children who are under 19 years of age If you turn 19 years of age before April 2024 How your GST HST credit is calculated Base year and payment period Benefits online calculator

What are the benefits Cash payouts of 350 to 700 in 2023 Cash payouts of 450 to 850 when fully enhanced in 2024 Payouts to be disbursed in August each year Who is eligible How to apply Where can I find help Scheme last updated 13 Feb 2023 The GST payment for January 2024 will be sent on January 5 2024 Eligible individuals can get up to 496 couples 650 and families with children an extra 171 based on their annual income

Gst Rebate 2024

Gst Rebate 2024

https://onecms-res.cloudinary.com/image/upload/s--Y7cXfOo3--/f_auto,q_auto/v1/mediacorp/cna/image/2022/02/18/gst-increase-help-final.png?itok=BEPcMY8x

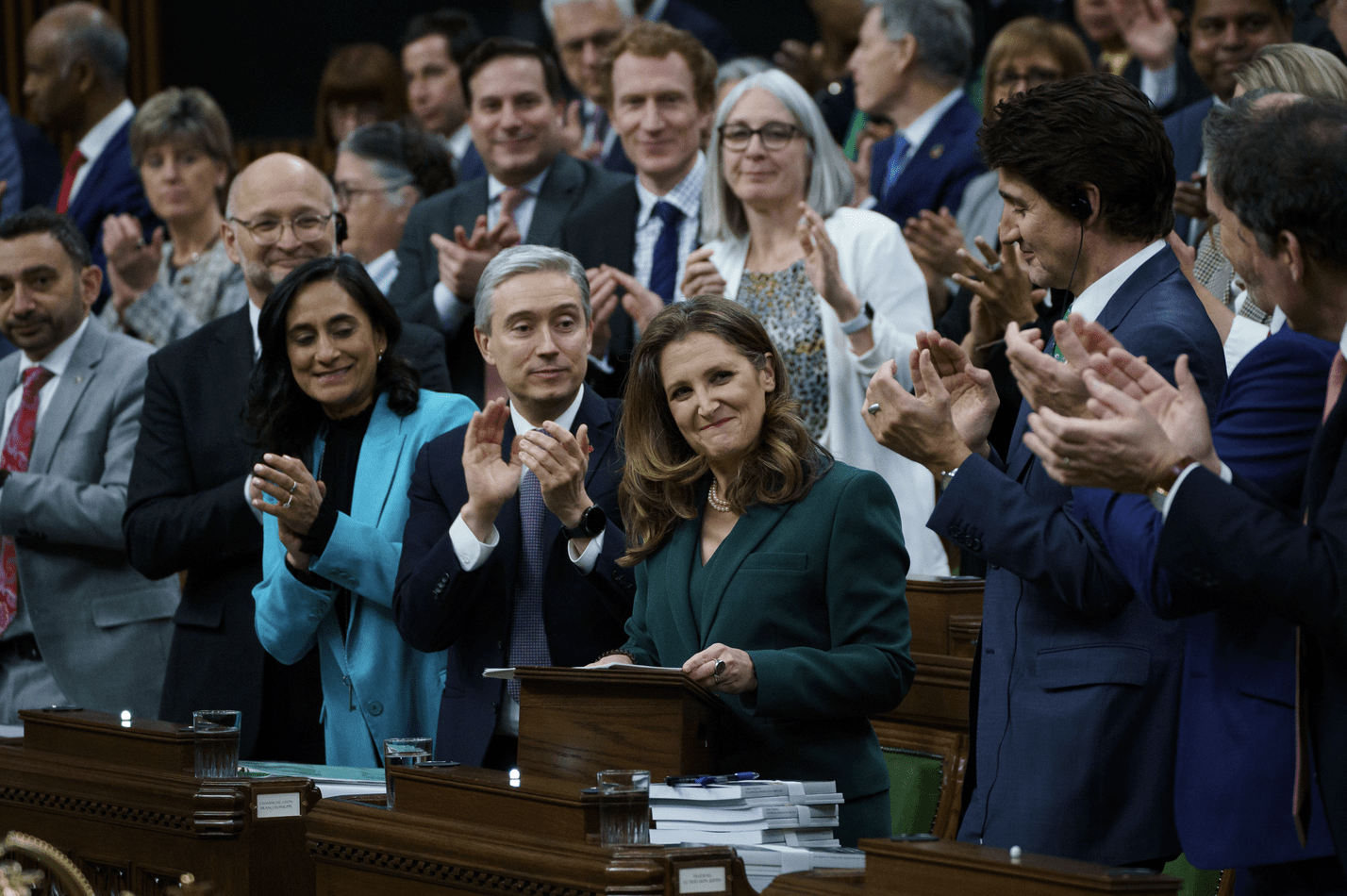

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

https://www.policymagazine.ca/wp-content/uploads/2023/03/Screen-Shot-2023-03-28-at-5.43.45-PM.png

Feds Temporary Boost To GST Rebate Will Help During High Inflation Period Economists Say

https://www.nationalobserver.com/sites/nationalobserver.com/files/styles/article_header_xl/public/img/2022/09/14/e28716eec22252892070e8135bdaa05d7d100a22f1922e7264620b1091a4cdbb.jpg?itok=NK8tVZen

GST credit When you ll receive the money January 5 2024 April 5 2024 July 5 2024 October 4 2024 The goods and services tax harmonized sales tax GST HST credit is a tax free How much will you receive via the GS HST tax credit in 2024 An individual is eligible to receive up to 496 in tax refunds Moreover the tax credit amount rises to 650 for married couples

Here are the GST HST rebate dates for the 2022 tax year July 5 2023 which you should ve received October 5 2023 January 5 2024 April 5 2024 If your overall GST HST credit for 2022 amounted to less than 50 per quarter the Canada Revenue Agency CRA would have provided you with a one time payment on July 5 How much will you receive via the GS HST tax credit in 2024 An individual is eligible to receive up to 496 in tax refunds Moreover the tax credit amount rises to 650 for married couples while for every child below the age of 19 the payout is raised by an additional 171 For the 2022 base year the GST HST tax credit will be distributed

Download Gst Rebate 2024

More picture related to Gst Rebate 2024

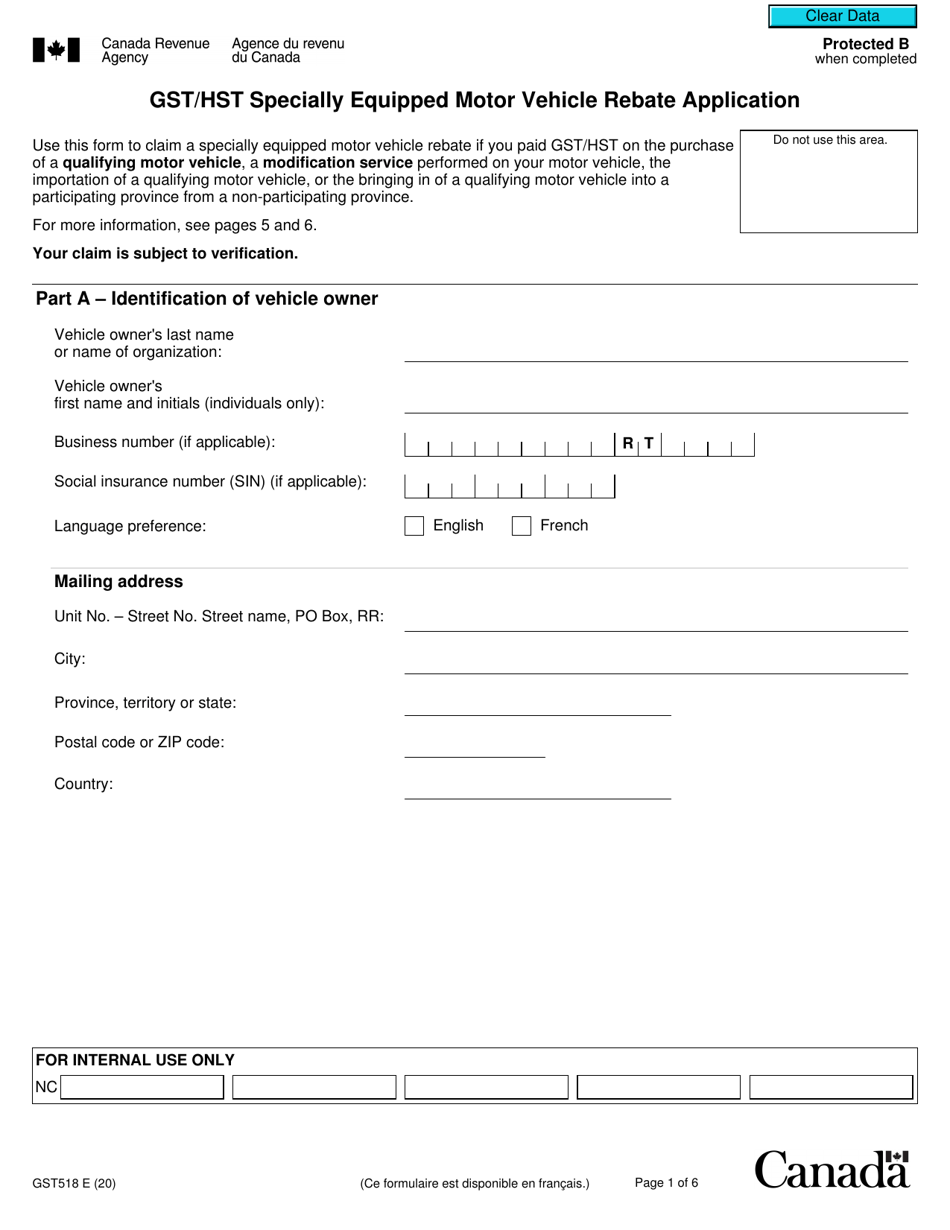

Form GST518 Download Fillable PDF Or Fill Online Gst Hst Specially Equipped Motor Vehicle Rebate

https://data.templateroller.com/pdf_docs_html/2191/21916/2191619/form-gst518-gst-hst-specially-equipped-motor-vehicle-rebate-application-canada_print_big.png

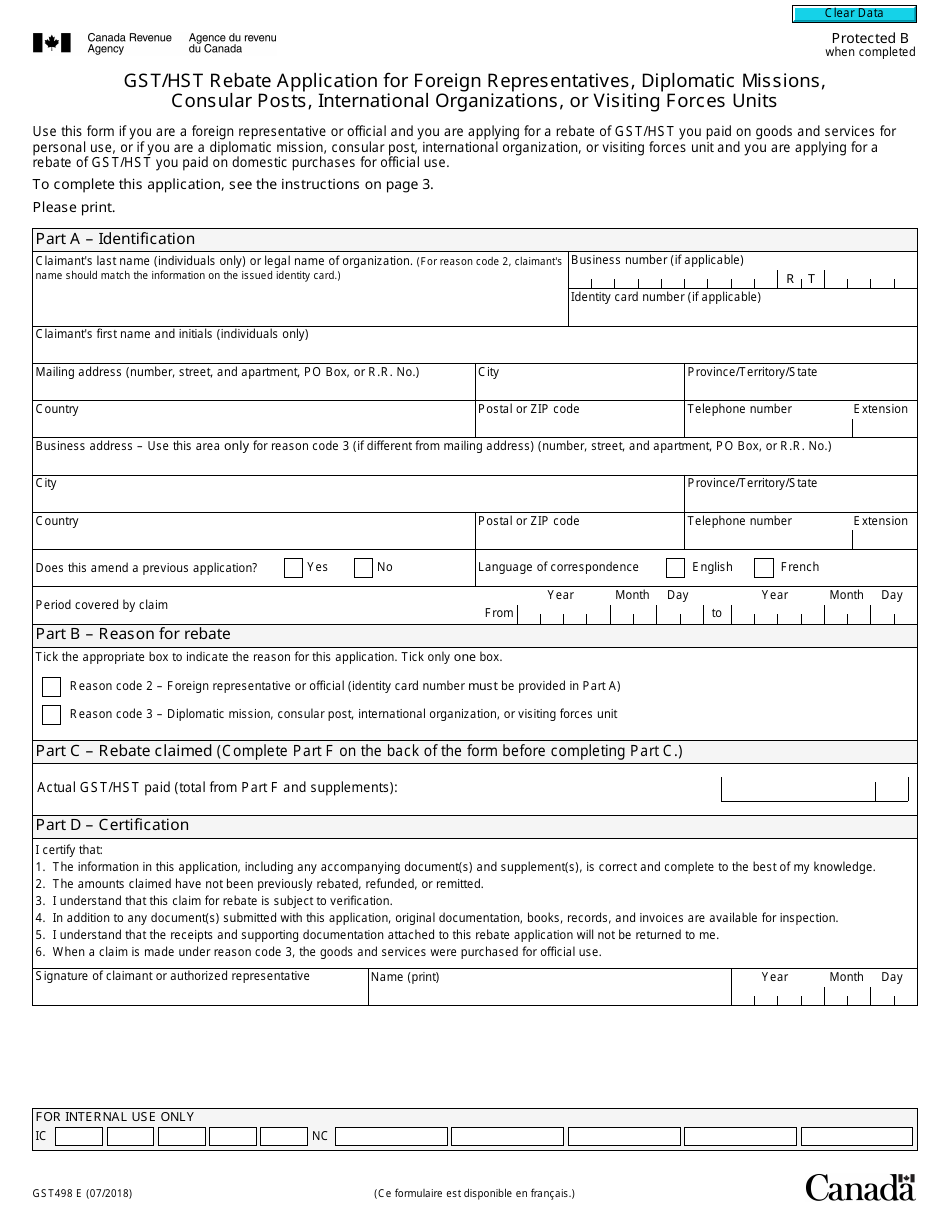

Hst Registration Fillable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1869/18693/1869368/form-gst498-gst-hst-rebate-application-for-foreign-representatives-diplomatic-missions-consular-posts-international-organizations-or-visiting-forces-units-canada_print_big.png

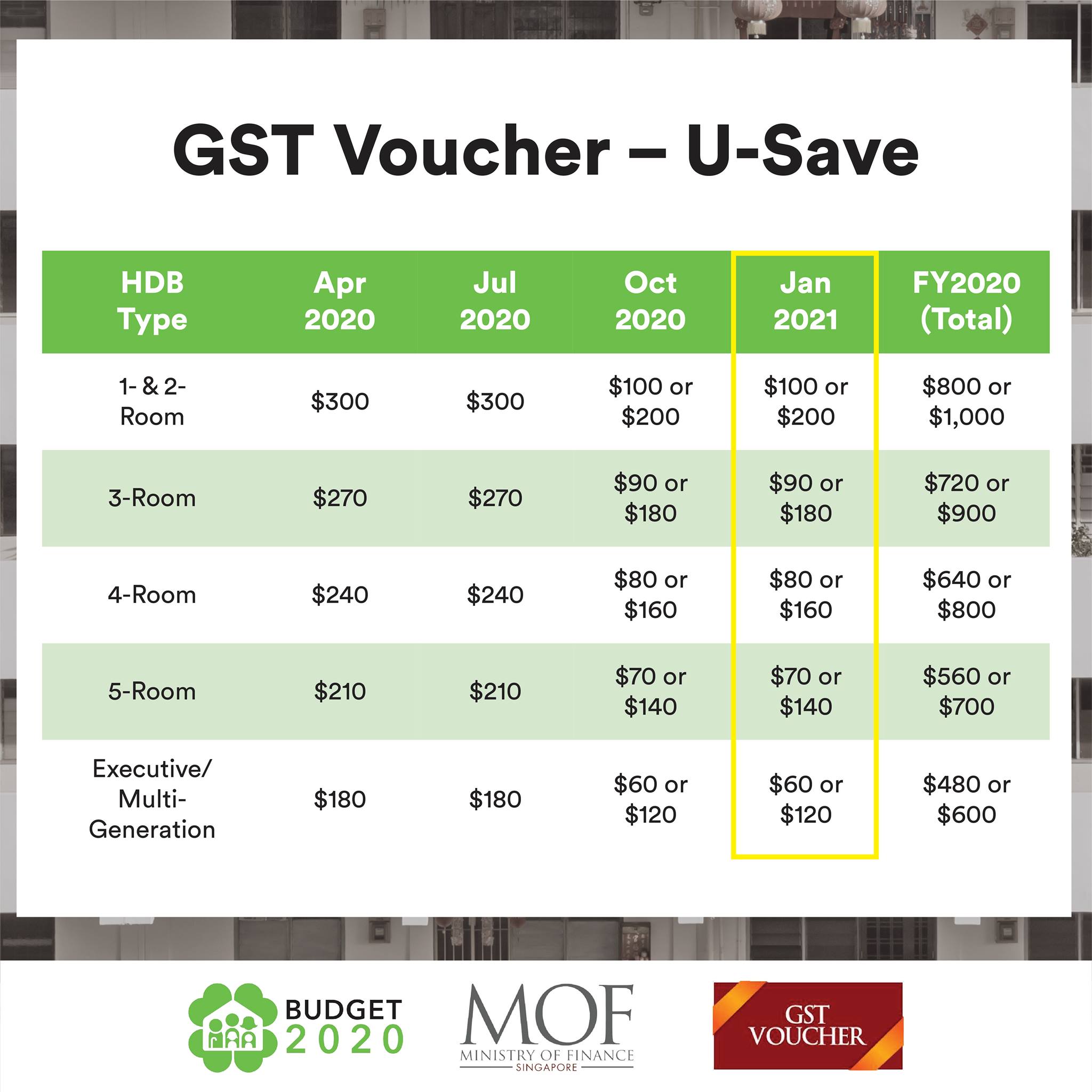

940 000 Households In S pore Will Receive Double Their Regular GST Voucher U Save Rebates For FY

https://static.mothership.sg/1/2021/01/133593294_3660223357349496_274809169011631261_o.jpg

The GST rebate is issued four times a year the 2023 payment dates are Jan 5 April 5 July 5 2023 and Oct 5 The Canada Revenue Agency has said some Canadians may be eligible for the July For the July 2023 to June 2024 payment period the standard Goods and Services Tax GST Credit amount increases with inflation How much you receive in total is based on your family size and income Single individuals 496 Couple 650 Each child under the age of 19 171

GST HST Refund Climate Action Incentive Payment Overview of the Canadian Pension Plan CPP and Old Age Security OAS The Canada Pension Plan CPP offers various benefits to eligible individuals There s an expected increase in the maximum CPP retirement pension starting in January 2024 25 Jan 2024 06 59 53 PM IST Budget 2024 Expectations Live Healthcare industry wants govt to reconsider GST levied on hospital room rents The healthcare industry anticipates a reconsideration

Double The Money Your GST Rebate Could Be Twice The Amount Tomorrow

https://www.victoriabuzz.com/wp-content/uploads/2019/06/adultingmoney-e1561581594509.jpg

GST HST New Housing Rebate And New Residential Rental Property Rebate SQI CPA Professional

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4210/gst-hst-credit.html

Eligibility criteria How to get the GST HST credit You need a social insurance number If you have a spouse or common law partner If you have children who are under 19 years of age If you turn 19 years of age before April 2024 How your GST HST credit is calculated Base year and payment period Benefits online calculator

https://supportgowhere.life.gov.sg/schemes/GSTV-CASH/gst-voucher-gstv-cash

What are the benefits Cash payouts of 350 to 700 in 2023 Cash payouts of 450 to 850 when fully enhanced in 2024 Payouts to be disbursed in August each year Who is eligible How to apply Where can I find help Scheme last updated 13 Feb 2023

GST Refund Declaration Form Printable Rebate Form

Double The Money Your GST Rebate Could Be Twice The Amount Tomorrow

MPs Unanimously Vote To Temporarily Double GST Rebate For Lower income Canadians

880 000 HDB Households To Get GST Voucher Rebate In Oct TODAY

880 000 HDB Households To Receive GST U Save Rebate Vouchers Of Up To 65 In April The Straits

Top 5 Questions About The GST HST Housing Rebate

Top 5 Questions About The GST HST Housing Rebate

Is GST Mandatory For Udyam Registration Compulsory Or Not

GST New Home Rebate Calculation And Examples YouTube

New Home HST GST Rebate By Nadene Milnes Issuu

Gst Rebate 2024 - How much will you receive via the GS HST tax credit in 2024 An individual is eligible to receive up to 496 in tax refunds Moreover the tax credit amount rises to 650 for married couples