Income Tax Rebate On Rd In Post Office A Post office Recurring Deposit RD account in the post office is eligible for tax exemptions under Section 80C Individuals can claim tax exemptions of up to Rs 1 5 lakh

To open an account Savings Bank SB Recurring Deposit RD Time Deposit TD Monthly Income Scheme MIS SB3 SB103 pay in slip and specimen signature slip for SB and TD An RD account in the post office falls under the tax exemptions umbrella as per Section 80C Individuals can claim up to Rs 1 5 Lakh as per annum tax exemption under this section

Income Tax Rebate On Rd In Post Office

Income Tax Rebate On Rd In Post Office

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

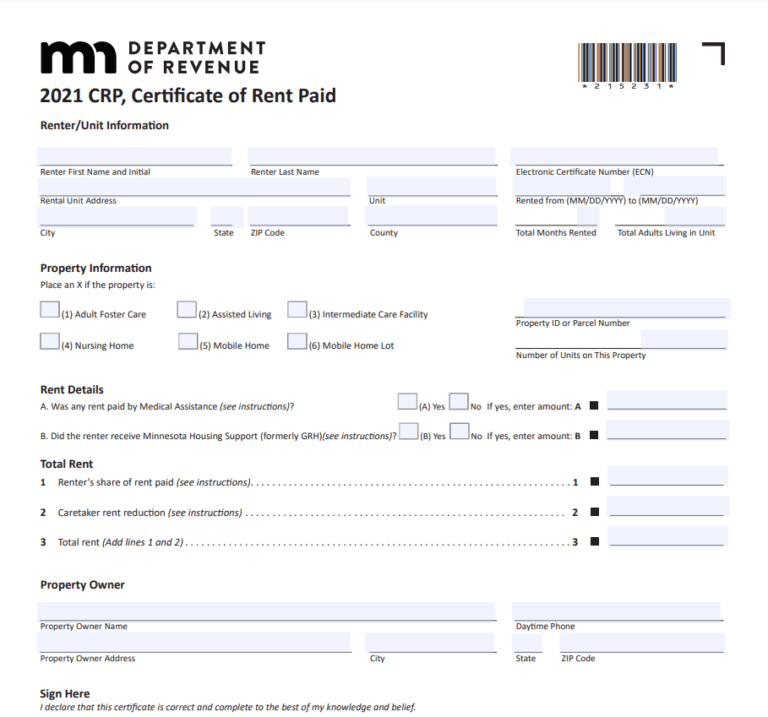

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

The Post Office RD Calculator deals with a simple calculation that considers the principal amount tenure and prevailing interest rate to figure out the maturity amount and premium Post office tax saving scheme comprises different plans like Public Provident Fund Sukanya Samriddhi Account National Savings Certificate Senior Citizen Savings Scheme SCSS

Interest earned on post office RD and NSC is eligible for exemption under Section 80C within the overall limit of Rs 1 5 lakh in the years Under Section 80TTA you can claim a Features Benefits of Post Office Monthly Income Scheme Capital protection Your money is safe until maturity as this is a government backed scheme Tenure The lock in period for Post Office MIS is 5 years You can withdraw

Download Income Tax Rebate On Rd In Post Office

More picture related to Income Tax Rebate On Rd In Post Office

How To Take The Benefit Of Income Tax Rebate U s 87A Quora

https://qph.cf2.quoracdn.net/main-qimg-018330878ef087944d0dea6361e945e5-lq

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

The Post Office RD scheme can be exempted from tax deduction under Section 80C of the Income Tax Act and an individual can claim up to Rs 1 5 lakh per annum however the interest Also this scheme offers no tax rebate and the interest is fully taxable After one year depositors can withdrawal up to 50 per cent of the balance Along with interest at the prescribed

Tax Benefits of Post Office Recurring Deposit RD The interest income from investing in Post Office Recurring Deposit is taxable income The interest income will be The current interest rate of a post office RD is 6 5 There is no Section 80C tax exemption on recurring deposit investments done with the post office The interest is added to

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

https://tax2win.in/guide/5-year-post-office-recurring-deposit

A Post office Recurring Deposit RD account in the post office is eligible for tax exemptions under Section 80C Individuals can claim tax exemptions of up to Rs 1 5 lakh

https://www.indiapost.gov.in/Financial/Pages/...

To open an account Savings Bank SB Recurring Deposit RD Time Deposit TD Monthly Income Scheme MIS SB3 SB103 pay in slip and specimen signature slip for SB and TD

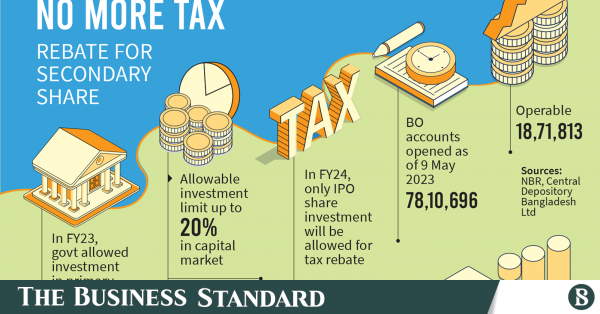

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

Income Tax Rebate Under Section 87A Union Budget 2023 YouTube

Income Tax Rebate Under Section 87A Union Budget 2023 YouTube

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Old Tax Regime Vs New Tax Regime Which Is Better For You As Per Budget

Option To Accelerate Claims On Renovation And Refurbishment Costs

Income Tax Rebate On Rd In Post Office - Post office tax saving scheme comprises different plans like Public Provident Fund Sukanya Samriddhi Account National Savings Certificate Senior Citizen Savings Scheme SCSS