Income Tax Rebate On Rent Paid Web 10 janv 2021 nbsp 0183 32 Section 80GG of the Income Tax Act also allows deduction on the rent paid by a person This can be claimed by self employed people as well as employees who do not receive any HRA from their employers

Web you pay rent you re on a low income or claiming benefits you have savings of less than 163 16 000 you re over State Pension age If you or your partner are under State Pension Web 14 oct 2019 nbsp 0183 32 Income tax benefits on rent paid The income tax laws provide for certain tax benefits on rent paid depending on whether the tax payer is self employed or a salaried person The law also requires you to

Income Tax Rebate On Rent Paid

Income Tax Rebate On Rent Paid

https://www.pdffiller.com/preview/585/571/585571881/large.png

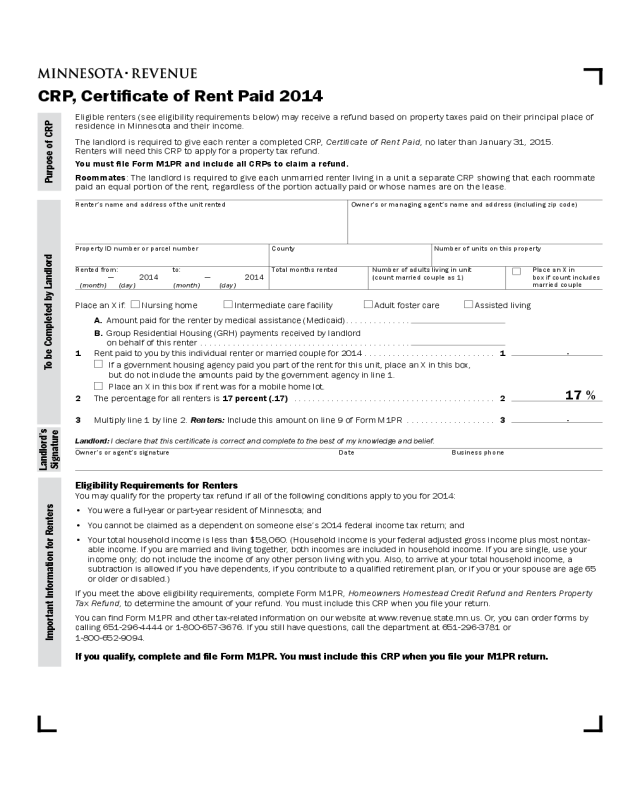

Form For Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/rent-rebate-form-1-free-templates-in-pdf-word-excel-download-15.png?fit=768%2C1024&ssl=1

Rent Rebate Tax Form Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021.jpg

Web 15 oct 2020 nbsp 0183 32 Most salaried individuals who stay in rented accommodations are eligible to claim tax deduction on rent paid out of Web 21 nov 2021 nbsp 0183 32 Condition to claim the Deduction 1 Individual HUF Only Individual or HUF are eligible to claim these deductions 2 No HRA to be received during the year To

Web 11 f 233 vr 2021 nbsp 0183 32 The rebate is applicable on registered leases as from the basis year 2020 where the tax on such lease is being paid at the rate of 15 In the event that a lease Web 19 oct 2015 nbsp 0183 32 If you do not usually send a tax return you need to register for Self Assessment by 5 October following the tax year you had rental income If you do not

Download Income Tax Rebate On Rent Paid

More picture related to Income Tax Rebate On Rent Paid

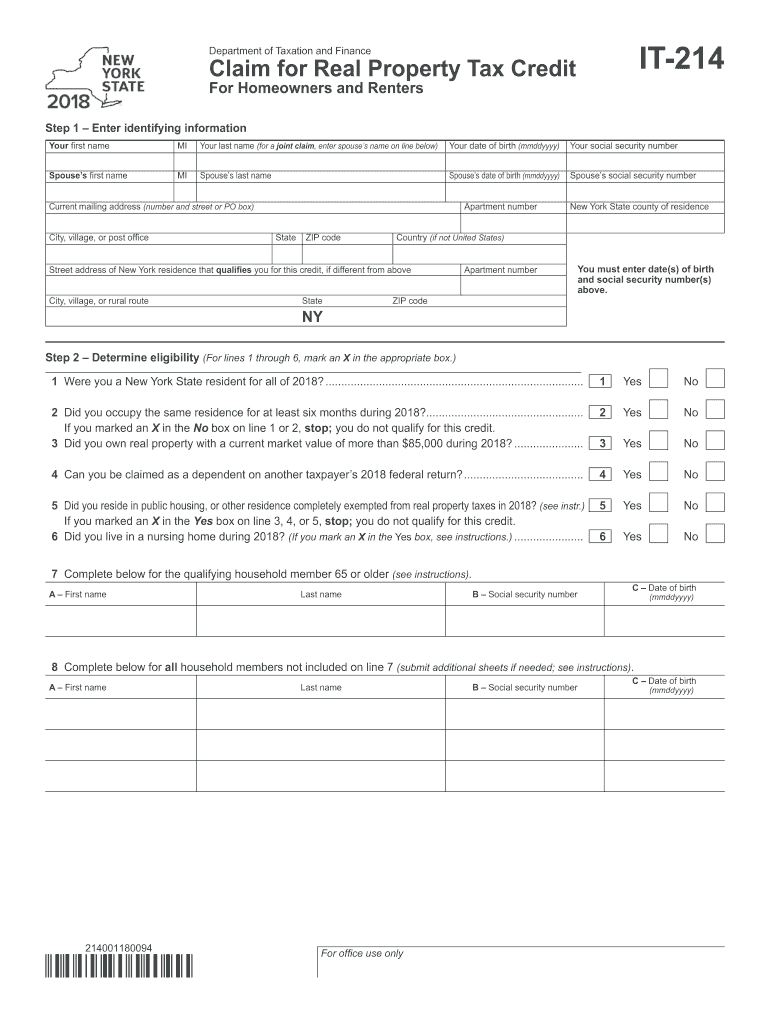

2021 Rent Rebate Form Fillable Printable PDF Forms Handypdf

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/free-7-sample-rent-rebate-forms-in-pdf-22.jpg?fit=585%2C430&ssl=1

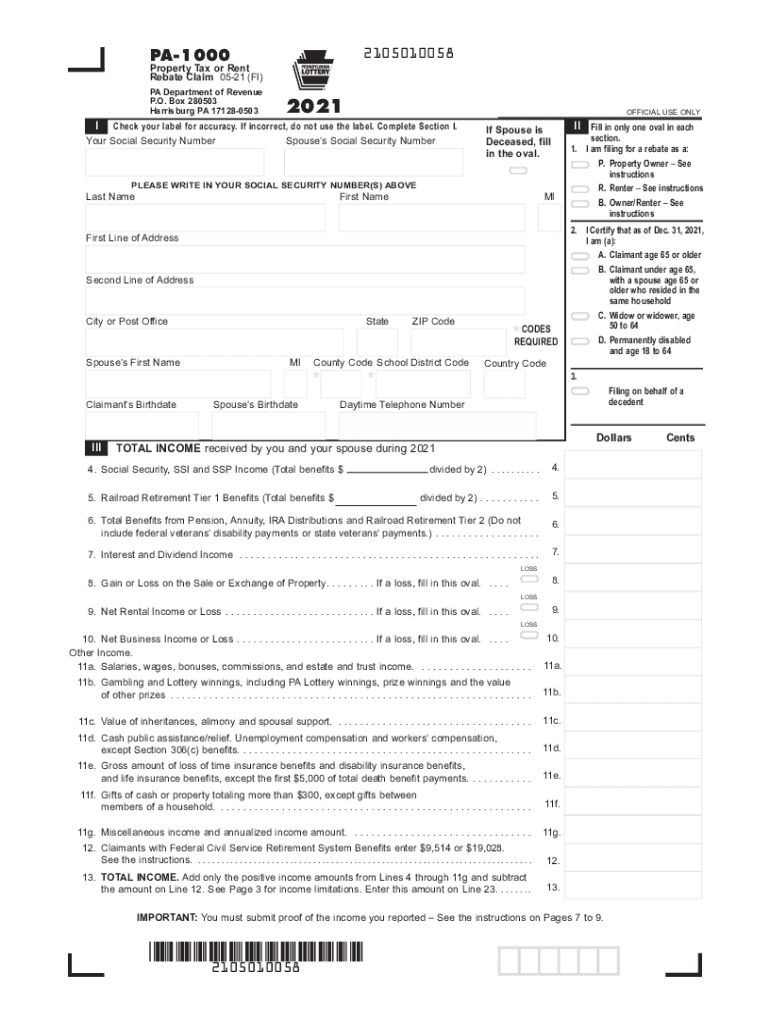

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

Pa Renters Rebate Status RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/pa-1000-2014-property-tax-or-rent-rebate-claim-free-download-1.png?fit=728%2C943&ssl=1

Web 27 f 233 vr 2023 nbsp 0183 32 Condition 1 Monthly rental limit of Rs 5000 every month i e 60 000 per annum Condition 2 Rent paid i e 1 5 lakhs minus 50 000 10 of annual income 1 lakh Condition 3 25 of the total annual Web 26 juin 2018 nbsp 0183 32 1 Rent paid minus 10 percent the adjusted total income 2 Rs 2 000 per month Rs 5000 wef F Y 2016 17 3 25 percent of the adjusted total income

Web 7 f 233 vr 2020 nbsp 0183 32 Amount of Deduction under Section 80GG Under Section 80GG the taxpayer can claim a deduction that is the lowest of the following three amounts Rs 5000 per month Budget 2016 increased the limit of Web 26 juil 2023 nbsp 0183 32 Tax on rental income and applicable deductions While income tax laws prescribe certain taxes on a person who receives any rent from a property which he has let out the tax payer is also allowed to

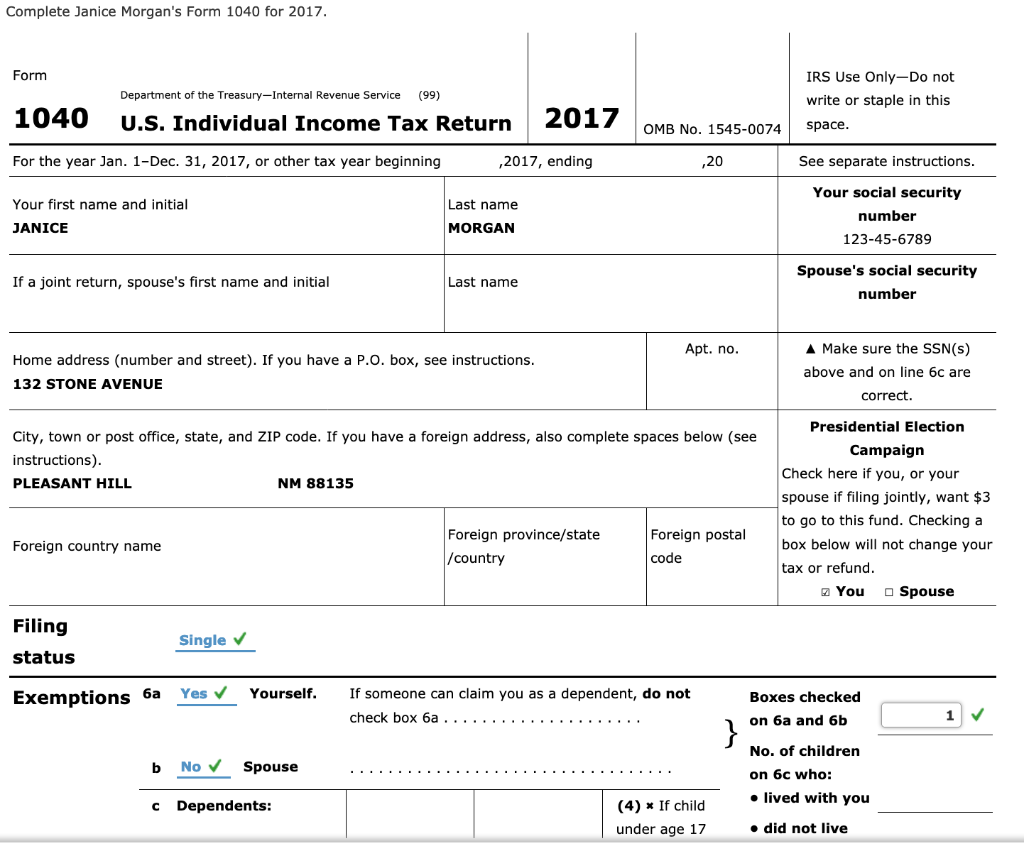

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

2019 Rent Rebate Form Missouri Justgoing 2020

https://handypdf.com/resources/formfile/images/10000/crp-certificate-of-rent-paid-2014-minnesota-page1.png

https://housing.com/news/income-tax-benefit…

Web 10 janv 2021 nbsp 0183 32 Section 80GG of the Income Tax Act also allows deduction on the rent paid by a person This can be claimed by self employed people as well as employees who do not receive any HRA from their employers

https://www.ageuk.org.uk/information-advice/money-legal/benefits...

Web you pay rent you re on a low income or claiming benefits you have savings of less than 163 16 000 you re over State Pension age If you or your partner are under State Pension

It 214 Rental Rebate Forms Fill Out And Sign Printable PDF Template

Solved Janice Morgan Age 24 Is Single And Has No Chegg

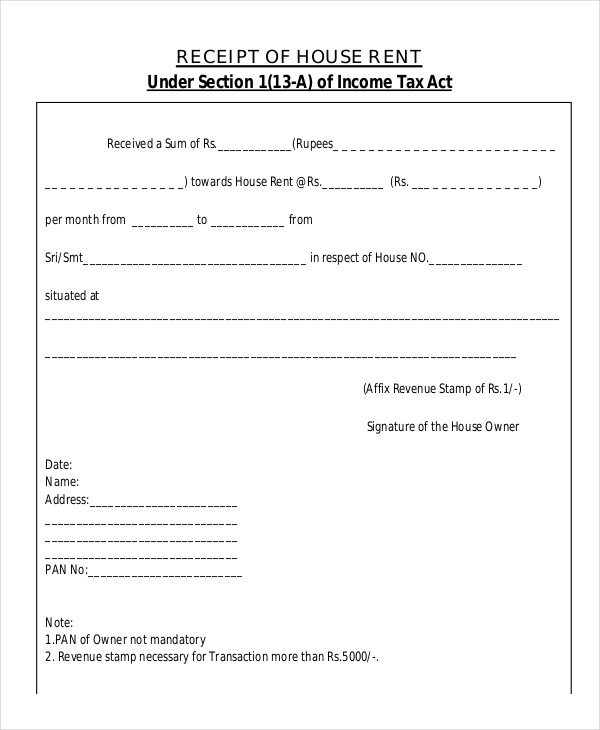

Original Rent Tax Receipt Template Superb Receipt Templates

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Property Tax Rent Rebate Program Maximizing Savings And Support For

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Military Journal Nm State Rebate 2022 According To The Department

Income Tax Rebate On Rent Paid - Web 19 oct 2015 nbsp 0183 32 If you do not usually send a tax return you need to register for Self Assessment by 5 October following the tax year you had rental income If you do not