Income Tax Rebate On Self Education In India Web 14 avr 2017 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as

Web 3 oct 2021 nbsp 0183 32 Let us discuss the benefits available under the income tax laws in India in connection with education Deduction under Section 80 Web 4 avr 2017 nbsp 0183 32 An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well If you have taken an

Income Tax Rebate On Self Education In India

Income Tax Rebate On Self Education In India

https://i.pinimg.com/originals/bc/2f/98/bc2f986a9acfd5fd5029064d973f680c.jpg

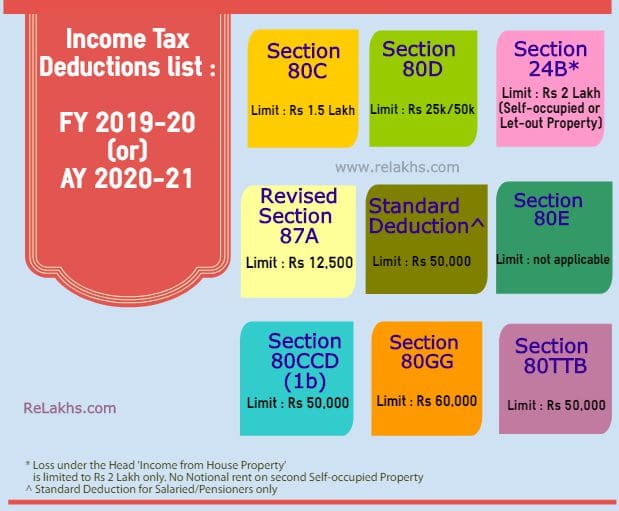

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Web To promote the importance of education amongst the citizen the Income Tax Department introduced various tax benefits or education fees deduction in income tax This helps Web 22 juil 2019 nbsp 0183 32 Deduction for Children Education amp Tuition Fees Tax Benefits Under Section 80C India s literacy rate is 77 70 2021 and 2022 To further promote

Web 10 sept 2018 nbsp 0183 32 Rs 80 000 under Section 80C of the ITA sums paid towards PPF LIP Balance Rs 70 000 for tuition fees 150 000 80 000 or vice versa In other words the Web 17 f 233 vr 2017 nbsp 0183 32 Synopsis When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax

Download Income Tax Rebate On Self Education In India

More picture related to Income Tax Rebate On Self Education In India

Education Tax Credit 2020 Income Limits TIEDUN

https://lh6.googleusercontent.com/proxy/m_W_bwTlWDpF5iljOjgXHPxlTVzu5eIfIbiPtzJfO1roD8DRoz-x1Uo5Z10u1SiKqgPru03YOGGlm8nmrbySkL03qqIipaiYmrKDe3YakCZYd46iCYMEBcqqr8IHxBSo=w1200-h630-p-k-no-nu

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

https://shabiba.eu-central-1.linodeobjects.com/2023/02/1675237419-1675237419-ominottsnayo-700x400.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the Web 25 f 233 vr 2021 nbsp 0183 32 Self Education Expenses The provisions of this Section 80C are only applicable when you are spending your income specifically on tuition fees of your child This means that as a parent you are not

Web This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Web Health amp Education Cess levied at the rate of 4 on the amount of Income tax plus surcharge NOTE For salaried persons including pensioners standard deduction of

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

https://i.ytimg.com/vi/jZcpVwGx4EE/maxresdefault.jpg

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as

https://www.livemint.com/money/personal-fina…

Web 3 oct 2021 nbsp 0183 32 Let us discuss the benefits available under the income tax laws in India in connection with education Deduction under Section 80

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Fortune India Business News Strategy Finance And Corporate Insight

INCOME TAX REBATE ON INVESTMENT

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate On Self Education In India - Web To promote the importance of education amongst the citizen the Income Tax Department introduced various tax benefits or education fees deduction in income tax This helps