Rebate Income Tax India Standard Web 14 f 233 vr 2023 nbsp 0183 32 The new income tax slabs slabs are Rs 3 lakh 6 lakh with 5 tax rate Rs 6 lakh 9 lakh with 10 etc But why is it being said that there is no income tax upto Rs

Web 1 f 233 vr 2023 nbsp 0183 32 A rebate under section 87A has been enhanced under the new tax regime from current income level of Rs 5 lakh to Rs 7 lakh Thus individuals opting for new Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5

Rebate Income Tax India Standard

Rebate Income Tax India Standard

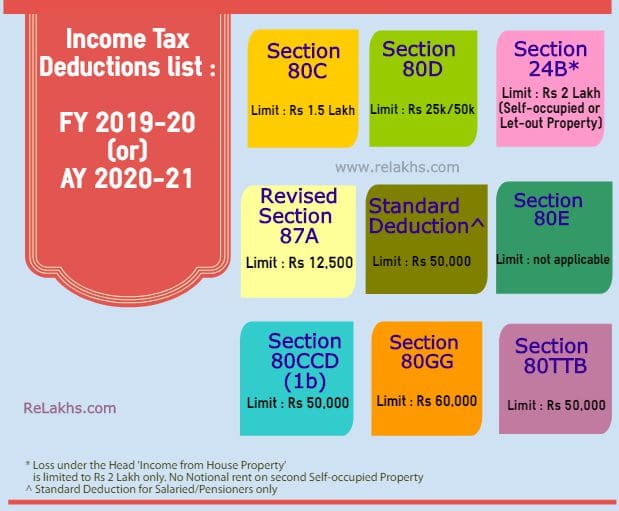

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

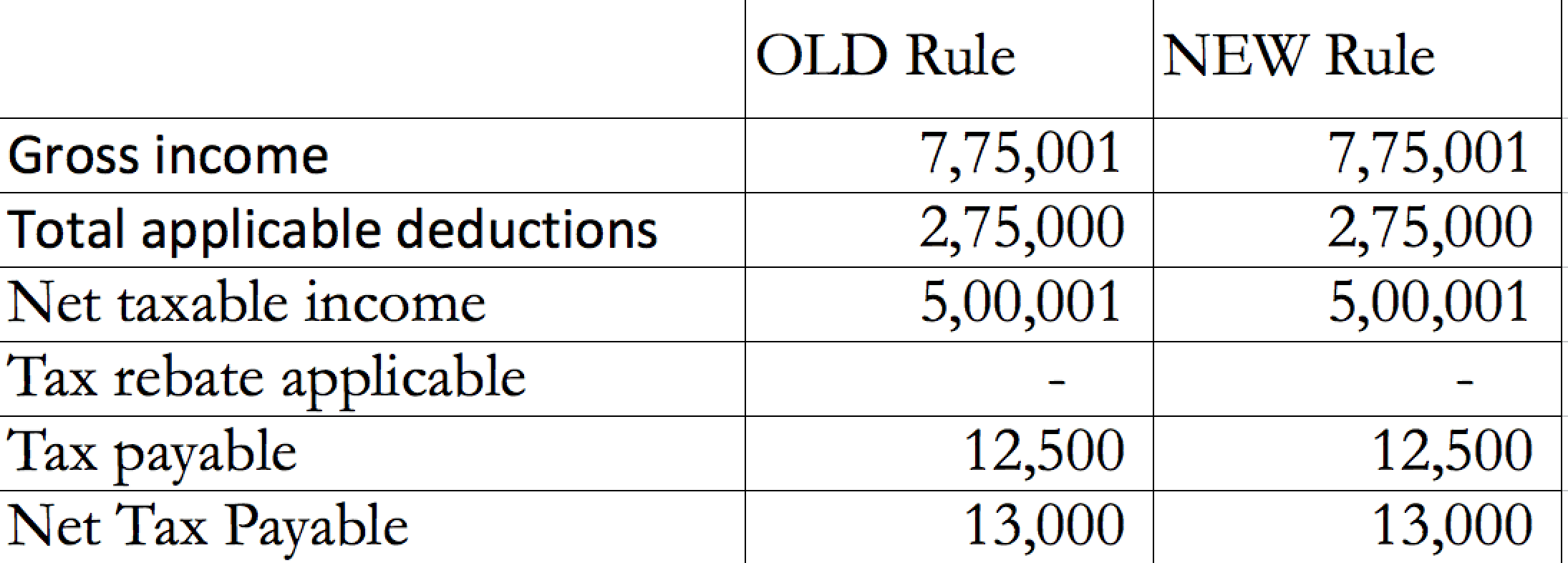

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Incometax Individual Income Taxes Urban Institute This Service

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202002/new_income_tax_slabs-1200x1149.jpg?RA2r0ErOqnEHAPszFYqp_R3A8vlGK5kS

Web Rebate of income tax in case of certain individuals 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees Web 1 f 233 vr 2023 nbsp 0183 32 The new income tax slabs under the new tax regime are Rs 0 3 lakh Nil Rs 3 6 lakh 5 per cent Rs 6 9 lakh 10 per cent Rs 9 12 lakh 15 per cent Rs 12 15 lakh 20 per cent Over Rs 15 lakh 30 per cent

Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5 Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Download Rebate Income Tax India Standard

More picture related to Rebate Income Tax India Standard

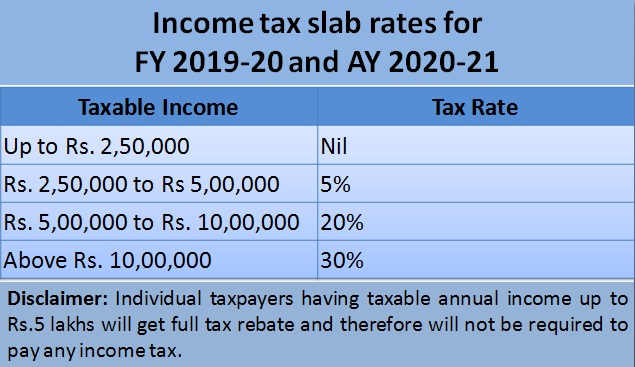

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

2018 Standard Deduction Chart

https://www.relakhs.com/wp-content/uploads/2018/04/Impact-of-Standard-Deduction-Rs-40000-on-income-tax-calculation-tax-liability-tax-savings-benefit-additional-tax.jpg

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

Web 2 f 233 vr 2023 nbsp 0183 32 A Standard Deduction of Rs 52 500 will be allowed as a deduction in new tax regime The highest surcharge levied has been reduced significantly from 37 to 25 in Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Web 21 f 233 vr 2023 nbsp 0183 32 The income tax law allows an employee to claim a tax free reimbursement of expenses incurred An employee can claim reimbursement of the actual bill amount Web 2 f 233 vr 2023 nbsp 0183 32 It is proposed that in the new tax regime the income eligible for rebate to be increased from Rs 500 000 to Rs 700 000 and the maximum surcharge to be reduced

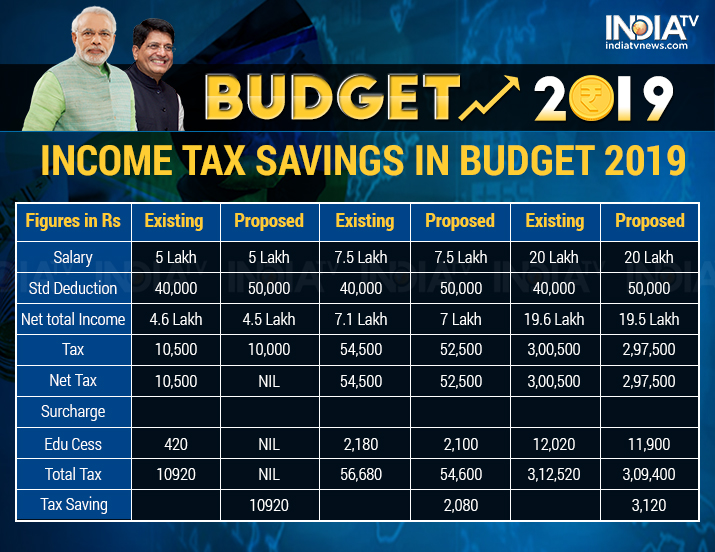

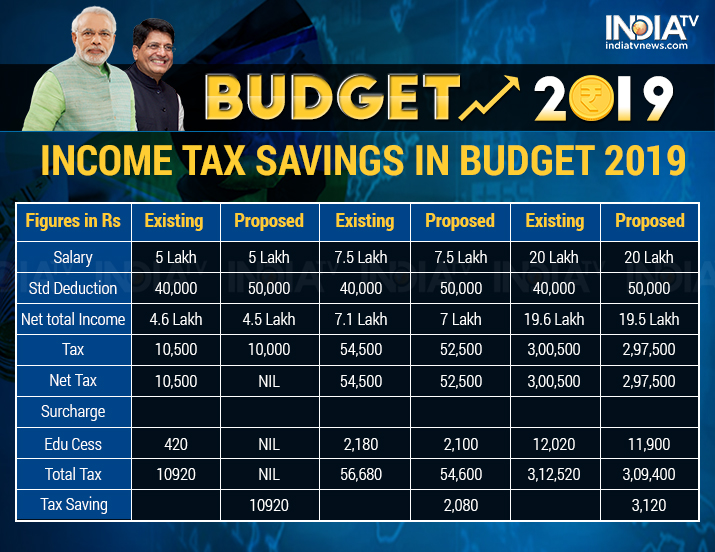

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2019/02/income-tax-savings-in-budget-2019-1549027494.jpg

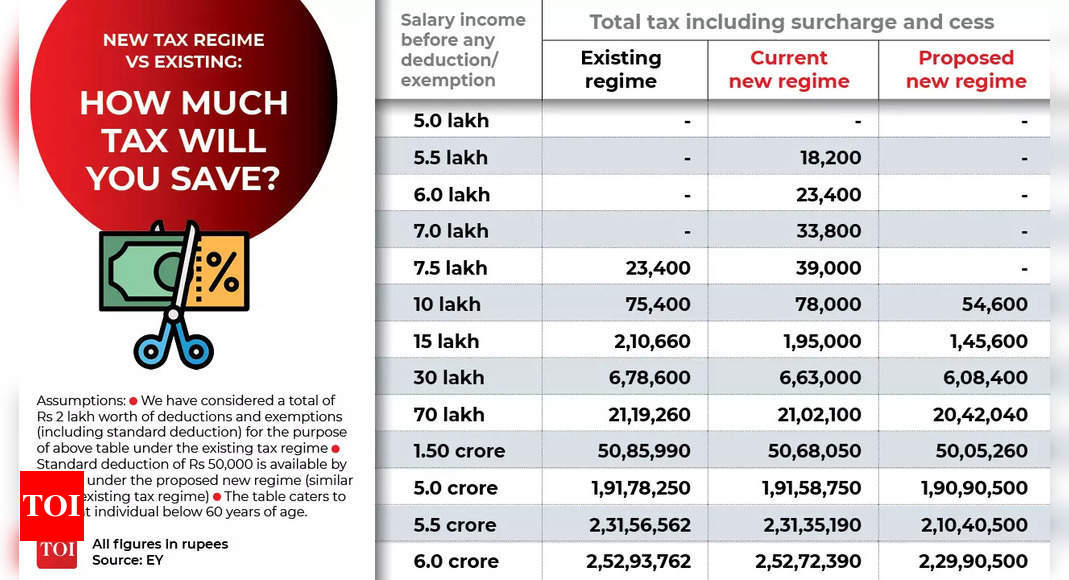

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

https://static.toiimg.com/thumb/msid-97531244,width-1070,height-580,imgsize-103792,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

Web 14 f 233 vr 2023 nbsp 0183 32 The new income tax slabs slabs are Rs 3 lakh 6 lakh with 5 tax rate Rs 6 lakh 9 lakh with 10 etc But why is it being said that there is no income tax upto Rs

https://economictimes.indiatimes.com/news/economy/policy/standard...

Web 1 f 233 vr 2023 nbsp 0183 32 A rebate under section 87A has been enhanced under the new tax regime from current income level of Rs 5 lakh to Rs 7 lakh Thus individuals opting for new

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

Daily current affairs

Income Tax Slab 2019 Salaried Individuals Can Rejoice As Government

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

ALL ABOUT REBATE 87A EXEMPTION OF TAX UP TO 5 LAKH SIMPLE TAX INDIA

Rebate Income Tax India Standard - Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount