Income Tax Rebate On Travelling Allowance 213 rowsAllowance for travel expenses proper to be paid for business travel means reimbursement for tickets for travel seats or sleeping car berths and other comparable

Section 10 14 i of the Income Tax Act This section provides exemptions for expenses incurred due to your employer s business It includes traveling Leave Travel Allowance LTA or Leave Travel Concession LTC The income tax law also provides for an LTA LTC exemption to salaried employees

Income Tax Rebate On Travelling Allowance

Income Tax Rebate On Travelling Allowance

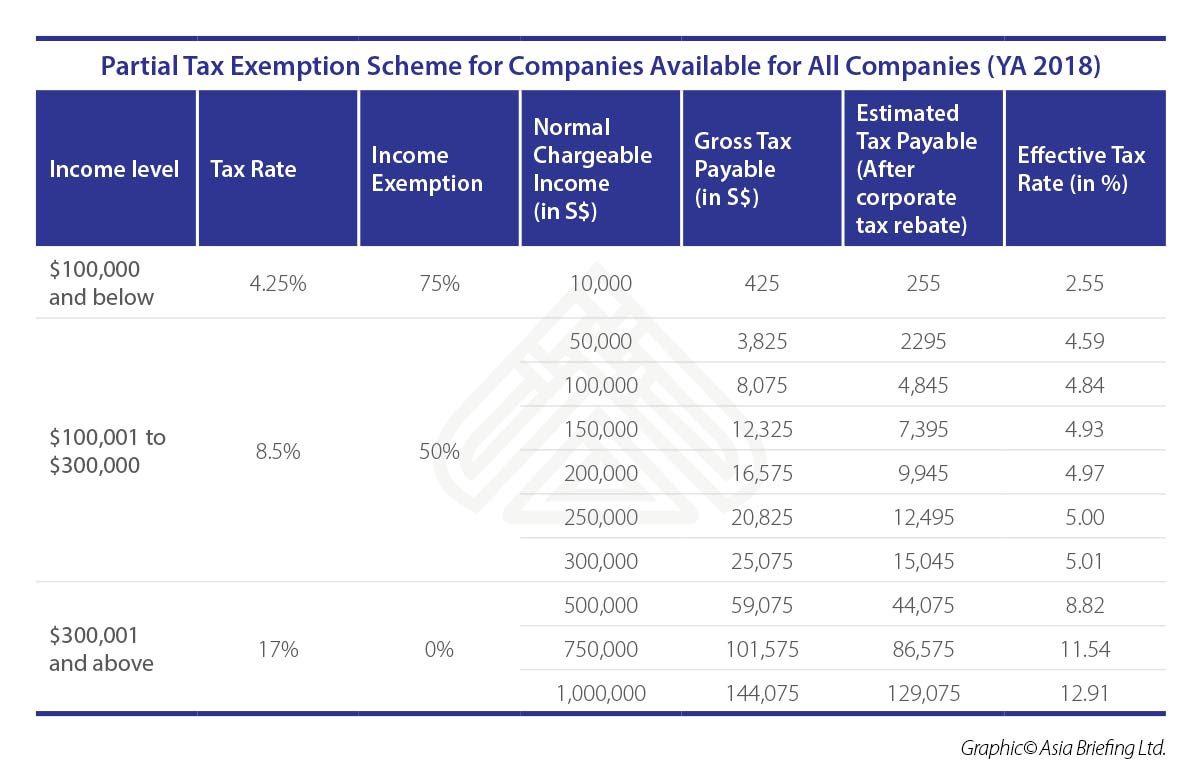

https://www.aseanbriefing.com/news/wp-content/uploads/2018/08/asb-Partial-Tax-Exemption-Scheme-for-Companies-Available-for-All-Companies-YA-2018-002.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

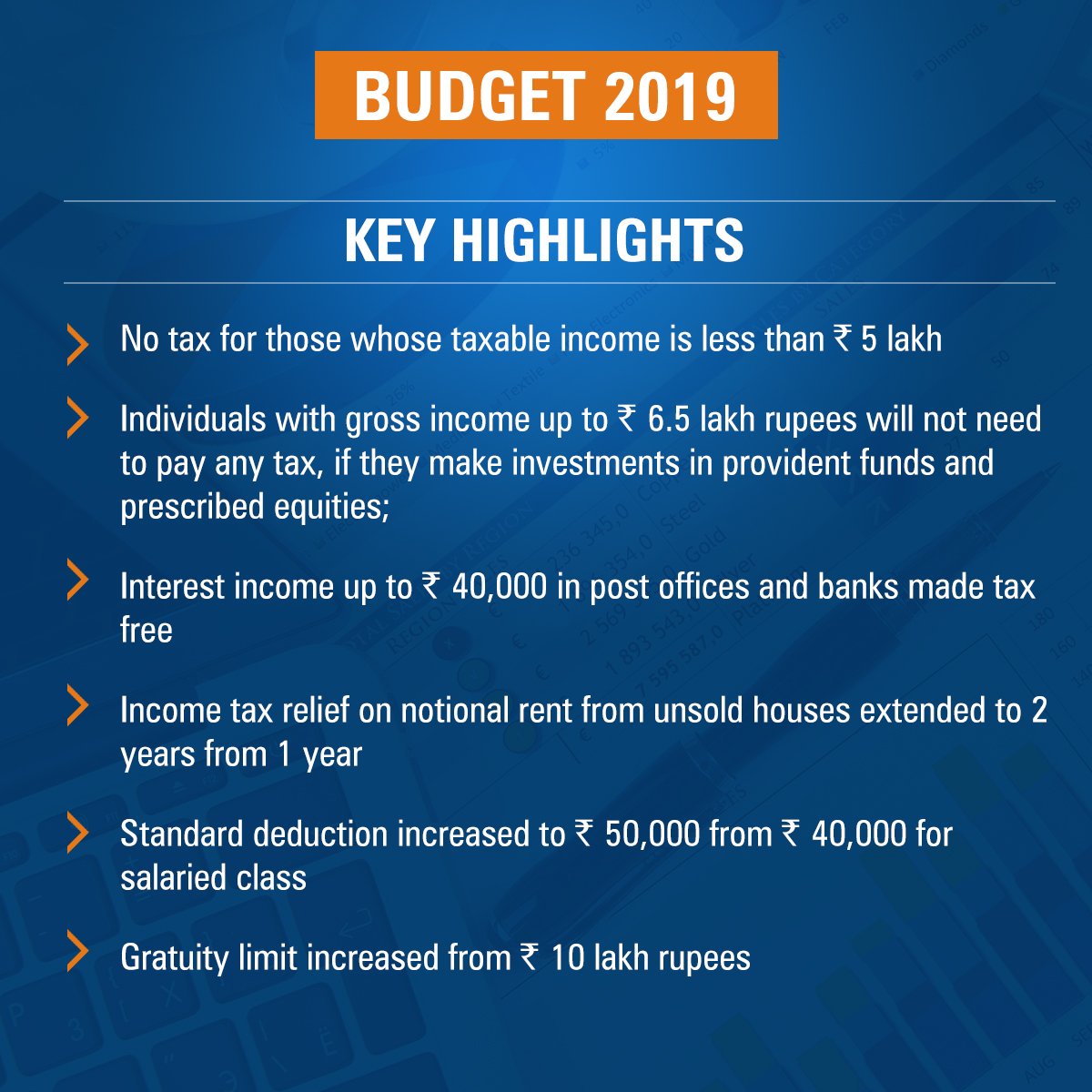

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

If you have to travel for your work you may be able to claim tax relief on the cost or money you ve spent on food or overnight expenses You cannot claim for travelling to and from The Leave Travel Allowance LTA Leave Travel Concession LTC amount computed above is allowed as an exemption for income tax purposes Your employer may pay you

In most cases tax relief is available for the full cost of business travelling expenses except where motoring expenses are paid to employees who use their own vehicles for Discover the ins and outs of Leave Travel Allowance LTA with our comprehensive guide on claiming rules exemptions and eligibility Learn how to optimize tax benefits while

Download Income Tax Rebate On Travelling Allowance

More picture related to Income Tax Rebate On Travelling Allowance

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

ICICIdirect On Twitter Income Tax Rebate Revised Interest Rates New

https://pbs.twimg.com/media/DykgM5RXQAAmbeJ.jpg:large

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

If your travel qualifies for tax relief then assuming your employer does not pay or reimburse the expenses you should be able to claim tax relief for your travel expenses If your travel allowance is shown as an allowance on your annual income statement or payment summary you must include the allowance as income in your tax return can

Find out about the special tax rules that give extra tax relief for travel by some employees who work abroad or come from abroad to work in the UK How to claim Transport Allowance while filing Income Tax Return Generally your employer takes care that you receive the benefit of tax exemption on transport

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

https://www.vero.fi/en/detailed-guidance/decisions/...

213 rowsAllowance for travel expenses proper to be paid for business travel means reimbursement for tickets for travel seats or sleeping car berths and other comparable

https://cleartax.in/s/section-10-of-income-tax-act

Section 10 14 i of the Income Tax Act This section provides exemptions for expenses incurred due to your employer s business It includes traveling

Hmrc Tax Return Self Assessment Form PrintableRebateForm

Deferred Tax And Temporary Differences The Footnotes Analyst

One time Direct Payments From 50 To 700 Still Going Out How You Can

Finance News Latest Financial News Finance News Today In Bangladesh

ICICIdirect On Twitter Income Tax Rebate Revised Interest Rates New

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

5 3

ITR Filing Income Tax Exemptions And Deductions That Home Loan

Income Tax Rebate On Travelling Allowance - In most cases tax relief is available for the full cost of business travelling expenses except where motoring expenses are paid to employees who use their own vehicles for