Income Tax Rebate On Two Housing Loan Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Web 9 janv 2021 nbsp 0183 32 09 Jan 2021 39 636 Views 41 comments From FY 19 20 onwards in the Finance Act 2019 government has allowed a major relief u s 23 and 24 of the Income Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Income Tax Rebate On Two Housing Loan

Income Tax Rebate On Two Housing Loan

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

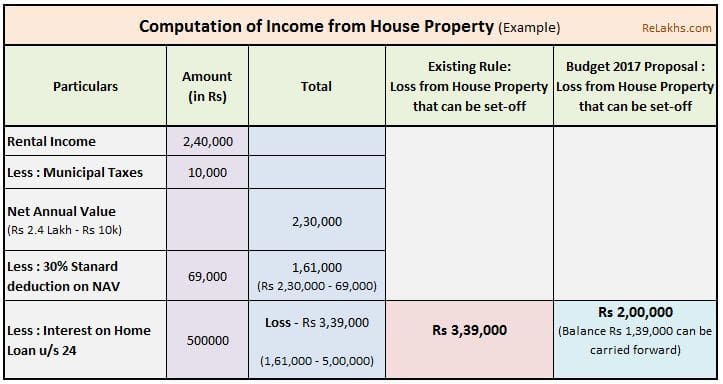

Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items Balwant

Web The income tax laws allow you to have two residential houses as self occupied So if you own and occupy upto two houses the maximum deduction with respect to interest payment is restricted to Rs 2 lakhs per Web 11 janv 2023 nbsp 0183 32 Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

Download Income Tax Rebate On Two Housing Loan

More picture related to Income Tax Rebate On Two Housing Loan

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web 20 mai 2016 nbsp 0183 32 If you are in a high tax bracket taking a second housing loan is always beneficial to save income tax You can claim unlimited interest as an income tax Web You can deduct a typical 30 percent interest on a home loan and municipal taxes from that You can deduct up to Rs 2 lakhs from your other sources of income Home Loan

Web Section 24 under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these Web 13 janv 2021 nbsp 0183 32 Under Section 24B of the Income Tax I T Act you can claim deduction for interest payable on a loan repair renovation or construction But if you own only one

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

https://www.icicibank.com/blogs/home-loan/ta…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

https://taxguru.in/income-tax/income-tax-benefits-deductions-second...

Web 9 janv 2021 nbsp 0183 32 09 Jan 2021 39 636 Views 41 comments From FY 19 20 onwards in the Finance Act 2019 government has allowed a major relief u s 23 and 24 of the Income

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Joint Home Loan Declaration Form For Income Tax Savings And Non

Illinois Tax Rebate Tracker Rebate2022

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

Home Loan Tax Benefits In India Important Facts

New Housing Tax Rebate Rebates Tax Canada

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate On Two Housing Loan - Web The income tax laws allow you to have two residential houses as self occupied So if you own and occupy upto two houses the maximum deduction with respect to interest payment is restricted to Rs 2 lakhs per