Tax Rebate On Interest Income Web 7 sept 2022 nbsp 0183 32 You pay taxes on the interest as if it were ordinary income that is at the same rate as your other income such as wages or self employment earnings So if

Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return From HM Revenue amp Customs Published Web 6 avr 2023 nbsp 0183 32 You may need to claim a repayment of tax if any of your savings income should only have been subject to the starting rate of tax for savings 0 in 2023 24 or should not have been taxed at all for

Tax Rebate On Interest Income

Tax Rebate On Interest Income

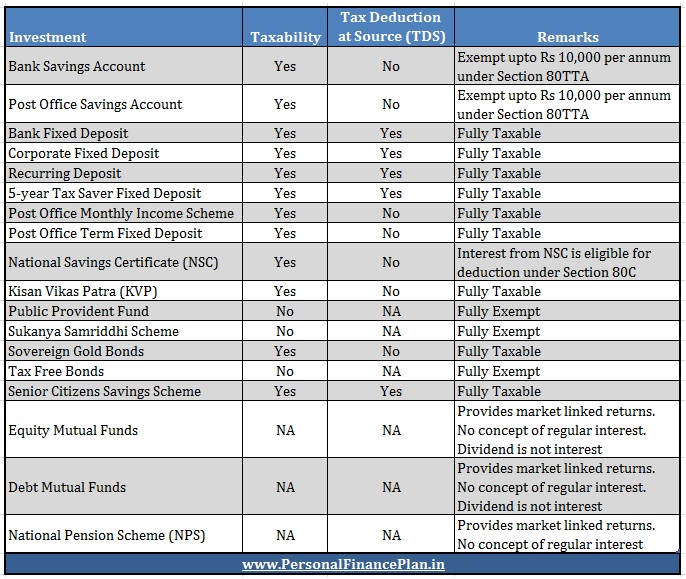

http://www.personalfinanceplan.in/wp-content/uploads/2017/04/20170420-Taxation-of-interest-income-tax.jpg

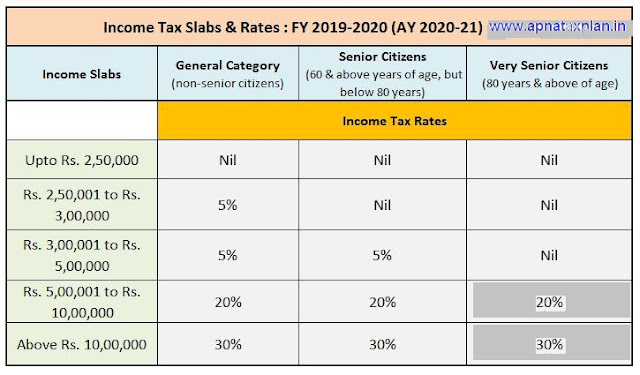

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to your income for the imputed rental value of your home If your taxable Web 22 f 233 vr 2023 nbsp 0183 32 Withholding Tax on Interest 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your Web 20 juil 2016 nbsp 0183 32 adjusted total income the income after losses and reliefs and excluding savings and dividends income that exceeds your personal allowance The tax

Download Tax Rebate On Interest Income

More picture related to Tax Rebate On Interest Income

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Web Answer 1 of 3 In saving account 10000 per annum is exempted u s 80 TTA In fixed deposits also 10000 per annum for TDS not to be deducted If you furnish declaration Web 28 mai 2022 nbsp 0183 32 Generally interest accrues on any unpaid tax from the due date of the return until the date of payment in full The interest rate is determined quarterly and is the

Web 9 d 233 c 2022 nbsp 0183 32 Once you hit the 1 500 of earned interest income for the year you can report all of your taxable interest on Schedule B of your 1040 federal tax return You still will Web 9 nov 2020 nbsp 0183 32 Interest Deduction A deduction for taxpayers who pay certain types of interest Interest deductions reduce the amount of income subject to tax The two main

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

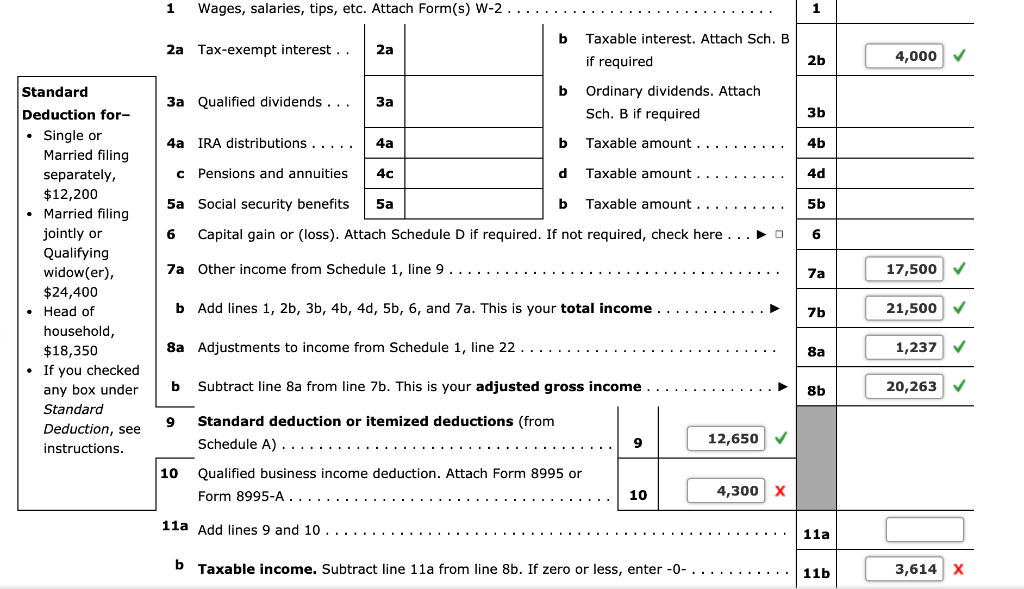

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/29e/29e60ea7-ac4f-41b4-b3e5-479b24bec3f3/phpYWR6IU

https://www.businessinsider.com/personal-finance/interest-income-taxes

Web 7 sept 2022 nbsp 0183 32 You pay taxes on the interest as if it were ordinary income that is at the same rate as your other income such as wages or self employment earnings So if

https://www.gov.uk/guidance/claim-a-refund-of-income-tax-deducted-from...

Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return From HM Revenue amp Customs Published

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Tax Rebate For Individual Deductions For Individuals reliefs

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Deductions List FY 2019 20

Tax Rebate On Interest Income - Web 22 f 233 vr 2023 nbsp 0183 32 Withholding Tax on Interest 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be