Income Tax Rebate Section Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less See the Claiming the Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

Income Tax Rebate Section

Income Tax Rebate Section

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

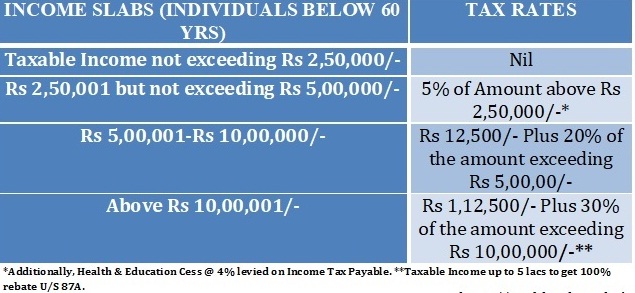

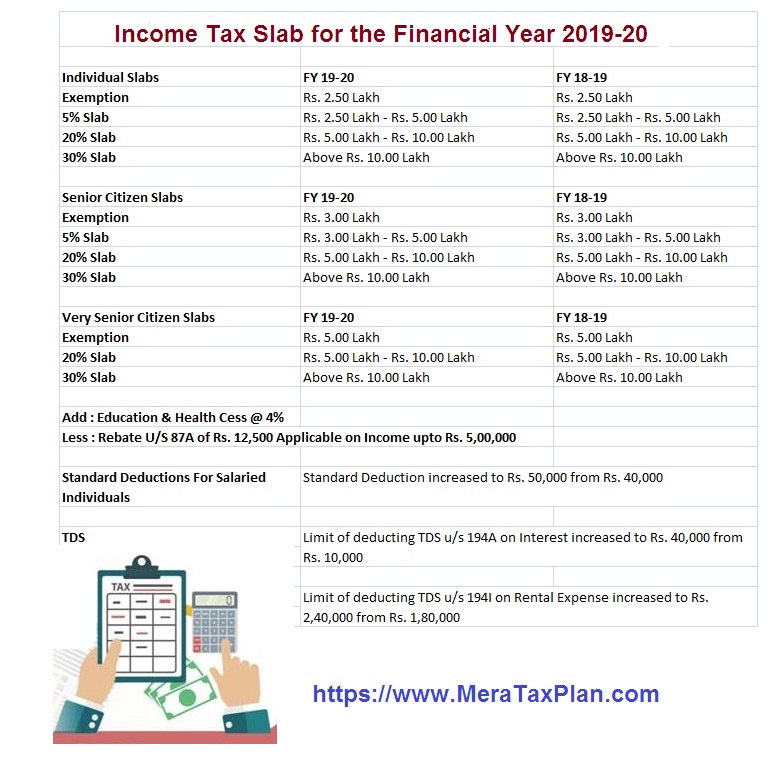

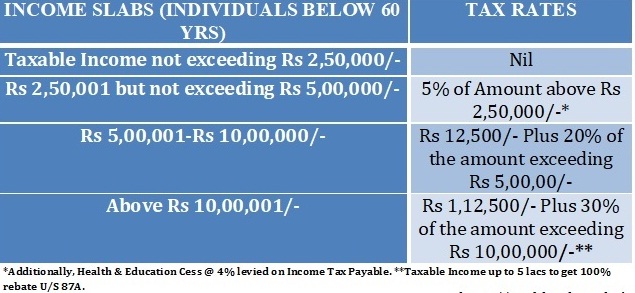

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

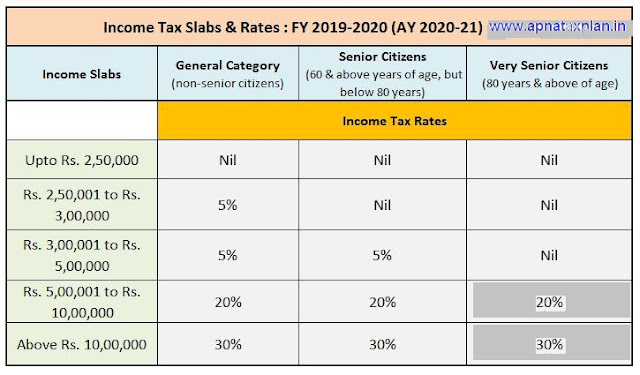

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?w=1303&ssl=1

Web Here are the eligibility criteria to claim income tax rebate under Section 87A of the Income Tax Act Must be a resident of India Your overall income after taking deductions into Web But the widely popular section of the income tax act that taxpayers throng to each year to save and invest is Section 80C Taxpayers can claim a maximum tax deduction of Rs

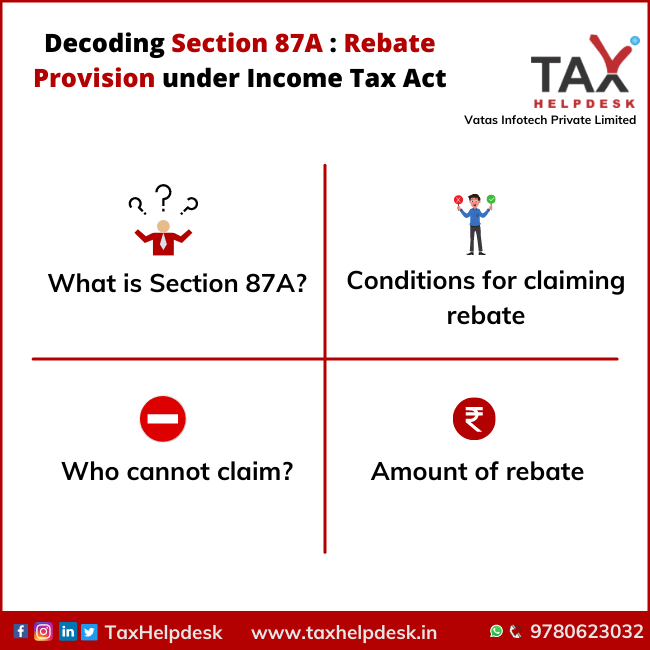

Web 6 f 233 vr 2023 nbsp 0183 32 Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will Web 15 mai 2023 nbsp 0183 32 Section 87A of the Income Tax offers a rebate to specific taxpayers that can help them lower their income tax liability A rebate is offered when the taxpayer s total

Download Income Tax Rebate Section

More picture related to Income Tax Rebate Section

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/TvlWdoFkYts/maxresdefault.jpg

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Web 3 janv 2022 nbsp 0183 32 On 31 December 2021 the Minister in the exercise of the powers conferred by subsection 6D 4 of the Income Tax Act 1967 Act 53 gazetted the Income Tax Web 6 sept 2023 nbsp 0183 32 Section 87A of the income tax act 1961 was launched to give relief to the taxpayers who fall under the 10 percent tax slab If a person whose total net income

Web 3 ao 251 t 2023 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed Web You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been

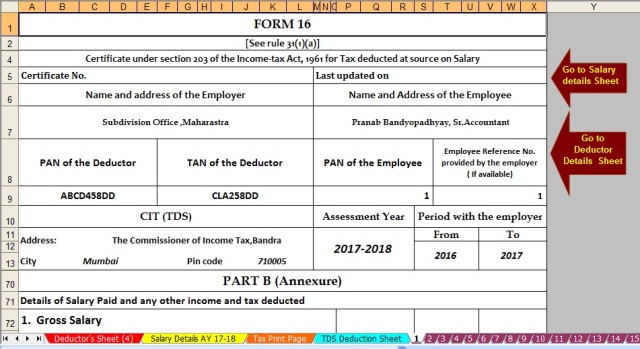

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

https://1.bp.blogspot.com/-6tNn2hi5BU4/Xgq0_3mhp7I/AAAAAAAALX0/o1GLWnLdwv4U83jdi5vB-0Dok4eOztfawCNcBGAsYHQ/s1600/Picture%2Bfor%2BTax%2BSlab%2Bf.y.%2B2019-20.jpg

Tds Slab Rate For Ay 2019 20

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less See the Claiming the

Income Tax Rebate Under Section 87A

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Hike Rs 5000 Under Section 87A With Automated

Tax Rebate For Individual Deductions For Individuals reliefs

Tax Rebate For Individual Deductions For Individuals reliefs

Income Tax Return TaxHelpdesk

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Income Tax Rebate Under Section 87A

Income Tax Rebate Section - Web 26 avr 2022 nbsp 0183 32 Eligibility Criteria for Claiming Tax Rebate Under Section 87A Tax rebate under Section 87A is available for both old and new tax regimes for Financial Year 2021