Income Tax Rebate Sections Web 27 d 233 c 2022 nbsp 0183 32 The income tax law allows employees to claim tax free reimbursement of expenses incurred on mobile and internet This reimbursement is on the bill amount paid or amount provided in the

Web 6 f 233 vr 2023 nbsp 0183 32 If the net taxable income is less than or equal to the limits the individual is eligible to claim a rebate under section 87A If the net taxable income exceeds Rs 5 lakhs or Rs 7 lakhs then the individual is not Web Section 24 under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these

Income Tax Rebate Sections

Income Tax Rebate Sections

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?w=1303&ssl=1

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Download Income Tax Rebate Sections

More picture related to Income Tax Rebate Sections

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Tds Slab Rate For Ay 2019 20

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Web 3 sept 2022 nbsp 0183 32 The Inflation Reduction Act which President Biden signed into law Aug 16 offers tax credits and rebates to consumers who buy clean vehicles and appliances or take other steps to reduce their Web Il y a 1 jour nbsp 0183 32 Lower income buyers could get up to 12 000 California is eliminating its popular electric car rebate program which often runs out of money and has long

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web 27 juil 2023 nbsp 0183 32 These are not eligible for tax rebate under Section 87A This income will be taxed at a flat rate of 30 per cent along with cess and surcharge if applicable said Ankit

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Union Budget 2017 18 Proposed Tax Slabs For FY 2017 18 Taxing Tax

http://taxingtax.com/wp-content/uploads/2017/02/Capture6.png

https://www.etmoney.com/learn/income-tax/t…

Web 27 d 233 c 2022 nbsp 0183 32 The income tax law allows employees to claim tax free reimbursement of expenses incurred on mobile and internet This reimbursement is on the bill amount paid or amount provided in the

https://scripbox.com/tax/tax-rebate

Web 6 f 233 vr 2023 nbsp 0183 32 If the net taxable income is less than or equal to the limits the individual is eligible to claim a rebate under section 87A If the net taxable income exceeds Rs 5 lakhs or Rs 7 lakhs then the individual is not

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Tax Rebate For Individual Deductions For Individuals reliefs

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Are Investment Expenses Tax Deductible In 2019 Antique Wooden World

Are Investment Expenses Tax Deductible In 2019 Antique Wooden World

Rebate Of Income Tax Under Section 87A YouTube

Income Tax Rebate Of Section 87A Up To Rs 5000 For F Y 2016 17 With

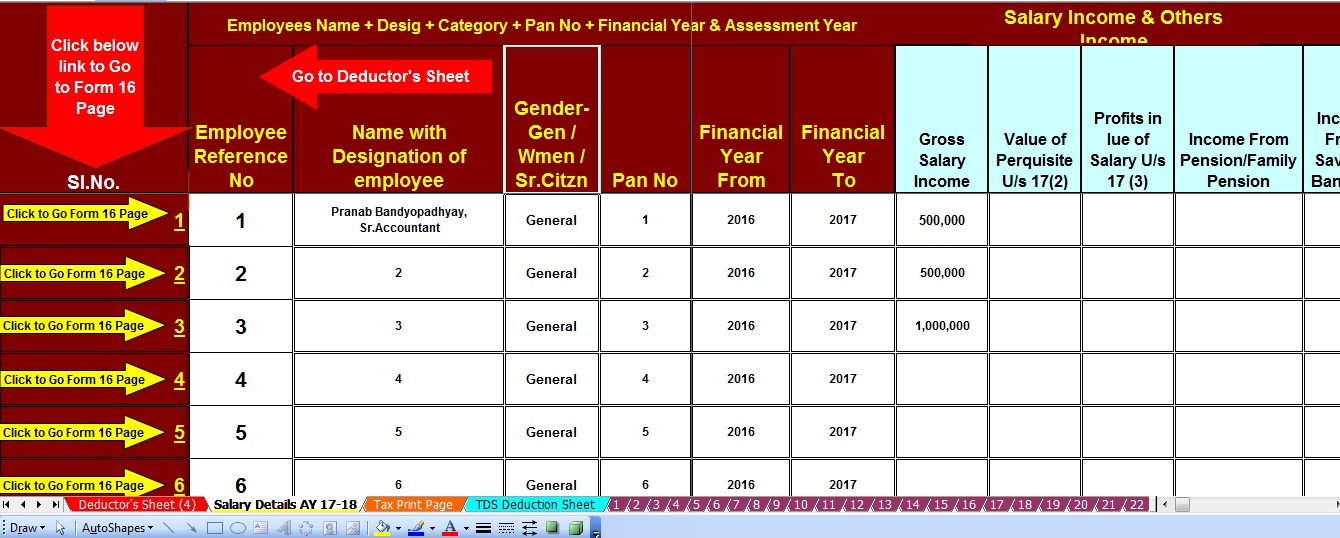

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Income Tax Rebate Sections - Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax